Magna Mining Acquires Producing Copper Mine in Sudbury from KGHM International Ltd.

Acquisition Includes a Portfolio of Critical Mineral Exploration and Development Assets in the Sudbury Basin Mining District

Magna Mining Inc. (TSX-V: NICU) (OTCQB: MGMNF) (FSE: 8YD) is pleased to announce that it has entered into a definitive share purchase agreement dated September 11th 2024 with a subsidiary of KGHM International Ltd. to acquire a portfolio of base metals assets located in the Sudbury Basin. Magna will acquire the producing McCreedy West copper mine, the past-producing Levack mine, Podolsky mine and Kirkwood mine as well as the Falconbridge Footwall (81.41%), Northwest Foy (81.41%), North Range and Rand exploration assets (together, the “Sale Assets”).

Transaction Highlights

- Purchase Price: C$5.3 million in cash and $2.0 million of Magna common shares on the closing of the Transaction and C$2.0 million in cash on December 31, 2026, plus future contingent payments of up to C$24.0 million.

- Funding: Magna is negotiating a commitment letter for a C$10 million three-year Term Loan facility and a C$10 million Letter of Credit facility with Fédération des caisses Desjardins du Québec (“FCDQ”), a subsidiary of Desjardins Group.

- Acquisition Properties: (see Figure 1)

- McCreedy West Mine: Currently an operating mine which had 2023 production of 317,660 tonnes at grades of 1.59% copper, 0.23% nickel, 0.01% cobalt, 1.03 g/t platinum, 1.34 g/t palladium, 0.41 g/t gold and 14.05 g/t silver.

- Levack Mine: On care and maintenance since 2019 with current activities underground to maintain the ramp, shaft and pumping infrastructure. Shaft access extends to the 2650 Level and ramp access to the 5400 Level. Near surface high grade nickel and copper zones to be evaluated for mine restart.

- Podolsky Mine: On care and maintenance since 2013 with both ramp access from surface and shaft access to the 2450 Level. Near surface mining potential in the copper rich North Zone as well as potential to develop the Nickel Ramp deposit.

- An extensive exploration property portfolio in the Sudbury Basin; This includes the past-producing Kirkwood Mine and the Falconbridge Footwall, Northwest Foy, North Range and Rand exploration properties.

CEO Jason Jessup stated “Upon closing this acquisition, Magna will immediately become a copper and nickel mining company with an extensive portfolio of development and exploration assets in the premier critical mineral mining district in Canada. We are not only acquiring a producing mine. Along with the mine properties there is a dedicated team of management, technical, administrative and safety professionals, miners and maintenance personnel. The talented people and safety culture are a key consideration in making this acquisition and we believe it will have many synergies with our Crean Hill Project. We believe that there is significant mineral resource potential remaining and the Sale Assets have exceptional exploration potential. The Sale Assets are non-core to their owners and due to this, we believe, have not been allocated the capital needed to realize their full potential. We plan to re-invest most of the profits that may be generated from McCreedy West back into additional capital development and exploration focused on expanding resources, increasing production and making new discoveries. This acquisition creates a clear pathway to realizing our stated goal of having three or more producing mines within 3 to 5 years.”

Commenting on the proposed financing structure for the Transaction, Mr. Paul Fowler, SVP of Magna added “Magna intends to finance the purchase price using debt facilities that we are negotiating with FCDQ. Successful execution of these facilities would mean that Magna is less dependent on raising external equity capital to close the Transaction, which would be consistent with our stated objective of growing our company in a highly capital efficient fashion. This acquisition accelerates Magna’s timeline to becoming a significant critical minerals producer alongside two major mining companies in the Sudbury mining camp.”

Figure 1: Location of Sale Assets, Magna Mining Existing Properties, and Key Sudbury Infrastructure

Property Descriptions

The property portfolio includes the operating McCreedy West Mine, three past producing mines (Levack, Podolsky and Kirkwood), as well as four exploration properties (Falconbridge Footwall, Northwest Foy, North Range and Rand) (Figure 1). Magna believes that the current and past producing properties have significant mineral resource potential remaining, as well as high priority, near mine exploration potential.

McCreedy West Mine

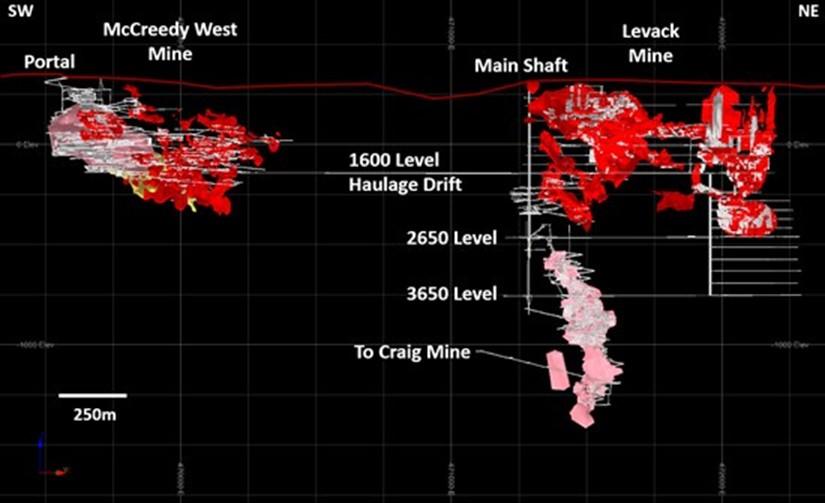

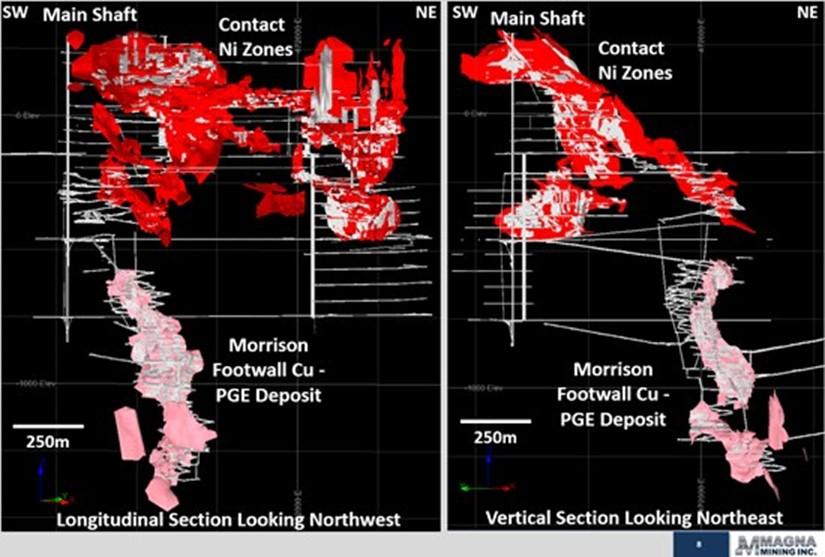

McCreedy West and Levack are adjacent properties, located on the north range of the Sudbury Igneous Complex, and host both contact nickel-copper mineralization, as well as high grade copper-PGE footwall deposits. The McCreedy West Mine operates via ramp access from surface, and the Levack Mine primary access is via the Main Shaft, however the two mines are connected underground on the 1600 Level haulage drift (Figure 2).

Figure 2: McCreedy West and Levack Mines Underground Infrastructure

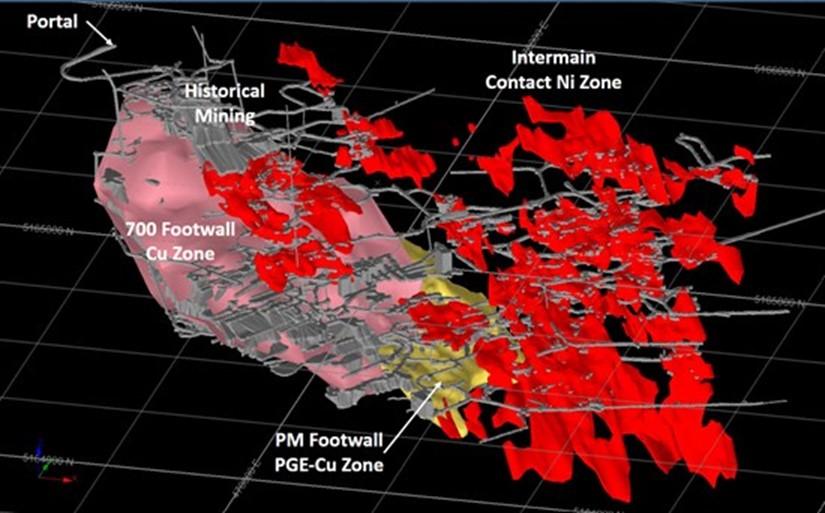

Figure 3: McCreedy West Mineralized Zones

History

McCreedy West mine was initially developed and mined by Inco Ltd. between 1970-1998, and produced approximately 15.8 million tons of ore, grading 1.7% Cu, 1.4 % Ni, and 1.5 g/t Pt+Pd+Au during this period. In 2002 the property was acquired by FNX Mining Company Inc., and the mine was re-opened in 2003, and is currently operated by KGHM. From 2003-2023 the mine has produced more than 6.3 million tonnes from three areas at McCreedy West. Production during this period consists of the 3.0 million tonnes grading 0.3% Cu and 1.4% Ni from the contact nickel zones, and 3.3 million tonnes grading 1.4 % Cu, 0.3% Ni and 4.2 g/t Pt+Pd+Au from the 700 Footwall Cu Zone and the PM Footwall PGE-Cu Zone combined. McCreedy West total production in 2023 was 317,660 tonnes at grades of 1.59% copper, 0.23% nickel, 0.01% cobalt, 1.03 g/t platinum, 1.34 g/t palladium, 0.41 g/t gold and 14.05 g/t silver and is summarized in Table 1.

Table 1: McCreedy West 2023 Production

| Zone | Tonnes | Ni (%) |

Cu (%) |

Co (%) |

Pt (gpt) |

Pd (gpt) |

Au (gpt) |

Ag (gpt) |

| 700 | 252,008 | 0.24 | 1.80 | 0.01 | 0.86 | 1.06 | 0.38 | 15.81 |

| PM | 65,652 | 0.19 | 0.79 | 0.01 | 1.71 | 2.40 | 0.55 | 7.30 |

| Total | 317,660 | 0.23 | 1.59 | 0.01 | 1.03 | 1.34 | 0.41 | 14.05 |

Current Mineral Resource Estimate

A mineral resource has been estimated for the McCreedy West Mine by SGS Geological Services and is summarized in Table 2 and Table 3, and sensitivity to cut-off grade is illustrated in Table 4. Mineral resources are stated for three areas at McCreedy West Mine, and include the Intermain Contact Ni Zone, the 700 Footwall Cu Zone, and the PM Footwall PGE-Cu Zone (Figure 3).

Table 2: McCreedy West Underground Mineral Resource Estimate, December 31, 2023

| Cut-off Grade NiEq (%) |

Tonnes | Ni % | Cu % | Co % | Pt g/t | Pd g/t | Au g/t | Ag g/t | NiEq % |

| Indicated | |||||||||

| 1.10 | 9,345,000 | 0.89 | 1.30 | 0.024 | 0.96 | 1.10 | 0.45 | 5.28 | 2.02 |

| Inferred | |||||||||

| 1.10 | 123,000 | 1.60 | 0.75 | 0.047 | 0.21 | 0.23 | 0.05 | 0.55 | 2.12 |

The underground base case cut-off grade of 1.10% NiEq considers metal prices of $8.50/lb Ni, $3.75/lb Cu, $17.00/lb Co, $950/oz Pt, $1100/oz Pd and $1,950/oz Au, metal recoveries of 78% for Ni, 95.5% for Cu, 56% for Co, 69.2% for Pt, 68% for Pd and 67.7% for Au (Ag is not considered), a mining cost of US$80.00/t rock and processing, treatment and refining, transportation and G&A cost of US$42.50/t mineralized material. See notes on McCreedy West Mine Mineral Resource Estimate at the end of this news release.

Table 3: McCreedy West Mineral Resource Estimate by Zone, December 31, 2023

700 Zone

| Cut-off Grade NiEq (%) |

Tonnes | Ni % | Cu % | Co % | Pt g/t | Pd g/t | Au g/t | Ag g/t | NiEq % |

| Indicated | |||||||||

| 1.10 | 5,230,000 | 0.70 | 1.92 | 0.014 | 1.08 | 1.17 | 0.57 | 6.48 | 2.16 |

| Inferred | |||||||||

| 1.10 | 63,000 | 1.63 | 1.23 | 0.040 | 0.40 | 0.43 | 0.10 | 0.82 | 2.43 |

PM Zone

| Cut-off Grade NiEq (%) |

Tonnes | Ni % | Cu % | Co % | Pt g/t | Pd g/t | Au g/t | Ag g/t | NiEq % |

| Indicated | |||||||||

| 1.10 | 1,438,000 | 0.27 | 0.95 | 0.002 | 2.27 | 2.84 | 0.82 | 10.43 | 1.87 |

Intermain Zone

| Cut-off Grade NiEq (%) |

Tonnes | Ni % | Cu % | Co % | Pt g/t | Pd g/t | Au g/t | Ag g/t | NiEq % |

| Indicated | |||||||||

| 1.10 | 2,677,000 | 1.59 | 0.27 | 0.055 | 0.01 | 0.02 | 0.00 | 0.15 | 1.83 |

| Inferred | |||||||||

| 1.10 | 61,000 | 1.58 | 0.24 | 0.054 | 0.01 | 0.02 | 0.01 | 0.27 | 1.80 |

See notes on McCreedy West Mine Mineral Resource Estimate at the end of this news release.

Table 4: McCreedy West Mineral Resource Estimate, at Various NiEq Cut-off Grades, December 31, 2023

| Cut-off Grade NiEq (%) |

Tonnes | Ni % | Cu % | Co % | Pt g/t | Pd g/t | Au g/t | Ag g/t | NiEq % |

| Indicated | |||||||||

| 0.80 | 14,039,000 | 0.72 | 1.07 | 0.020 | 0.81 | 0.92 | 0.37 | 4.81 | 1.66 |

| 1.00 | 10,690,000 | 0.83 | 1.22 | 0.023 | 0.91 | 1.04 | 0.42 | 5.12 | 1.90 |

| 1.10 | 9,345,000 | 0.89 | 1.30 | 0.024 | 0.96 | 1.10 | 0.45 | 5.28 | 2.02 |

| 1.20 | 8,209,000 | 0.94 | 1.38 | 0.025 | 1.00 | 1.16 | 0.47 | 5.43 | 2.14 |

| 1.30 | 7,223,000 | 1.00 | 1.46 | 0.026 | 1.05 | 1.21 | 0.50 | 5.59 | 2.27 |

| Inferred | |||||||||

| 0.80 | 192,000 | 1.28 | 0.56 | 0.041 | 0.18 | 0.20 | 0.05 | 0.59 | 1.69 |

| 1.00 | 137,000 | 1.52 | 0.70 | 0.045 | 0.20 | 0.22 | 0.05 | 0.54 | 2.01 |

| 1.10 | 123,000 | 1.60 | 0.75 | 0.047 | 0.21 | 0.23 | 0.05 | 0.55 | 2.12 |

| 1.20 | 109,000 | 1.70 | 0.80 | 0.049 | 0.22 | 0.23 | 0.05 | 0.55 | 2.25 |

| 1.30 | 96,000 | 1.80 | 0.85 | 0.051 | 0.23 | 0.22 | 0.05 | 0.51 | 2.38 |

- Underground mineral resources are reported at a base case cut-off grade of 1.10% NiEq. Values in this table reported above and below the base case cut-off grades should not be misconstrued with a Mineral Resource Statement. The values are only presented to show the sensitivity of the block model estimate to the base case cut-off grade.

- All values are rounded to reflect the relative accuracy of the estimate and numbers may not add due to rounding.

The technical report in support of the above noted mineral resource estimates will be filed by Magna Mining within 45 days of this press release.

Exploration Potential

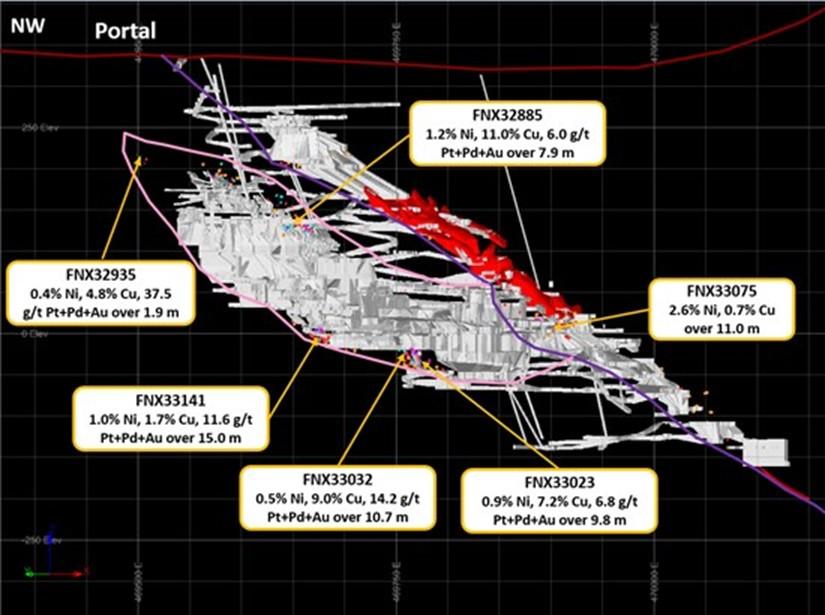

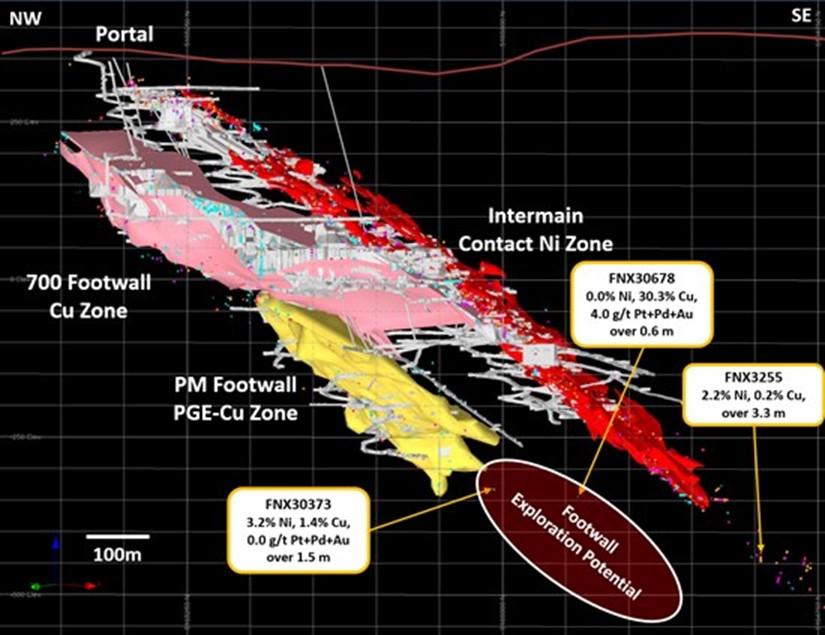

Significant exploration potential exists at McCreedy West mine, both for discovery of new footwall deposits, and expansion of the known resources currently being mined. Figure 4 highlights some of the recent 2023 and 2024 diamond drilling results within the remnants of the main deposit and 700 FW Zone and provides support for the high grade potential of these areas. The footwall breccia between the McCreedy West and Levack mines remains under explored and has the potential to host a new footwall Cu-PGE deposit. Significant intersections in this area that warrant follow-up include 30.3 % Cu and 4.0 g/t Pt+Pd+Au over 0.6 metres in drillhole FNX30678 (Figure 5). Drillhole FNX3255, intersecting 2.2% Ni over 3.3 metres, demonstrates the potential to extend the Intermain contact Ni deposit down-dip with continued infill diamond drilling (Figure 5).

Figure 4: McCreedy West Mine Vertical Section Looking Southeast Showing Recent Drilling Highlights

Figure 5: McCreedy West Mine Vertical Section Looking Northeast Showing Footwall and Contact Exploration Potential

Levack Mine

The Levack Mine is adjacent to and connected to the McCreedy West mine with underground development (Figure 2 and Figure 6). The Levack Mine was originally developed by the Mond Nickel Company and operated between 1915-1929 when the surface plants were destroyed by fire. The mine was re-opened in 1937 by Inco Ltd. and historical records for the Levack Mine during the period between 1937-1997, indicate the mine produced approximately 60.0 million tons of minerals, grading 1.3% Cu, 2.0 % Ni, and 1.5 g/t Pt+Pd+Au. FNX Mining Inc. commenced exploration activities at the Levack property in April 2002 and continued until March 2006, when production was commenced. Commercial production was achieved in January 2007 from the contact nickel zones, producing 411,000 tonnes grading 0.5% Cu and 1.3% Ni, before stopping nickel mining at the end of 2008 due to low metal prices. The Morrison Footwall deposit was discovered in 2005 and produced 2.0 million tonnes grading 7.1% Cu 1.4% Ni and 8.1 g/t Pt+Pd+Au 2009 to 2018. As of 2022, Levack serves as a secondary egress to the Craig Mine (owned by a third party), including the Onaping Depth Project, and McCreedy West Mine and provides dewatering infrastructure from both McCreedy West and Levack.

Figure 6: Levack Mine Mineralized Zones and Underground Infrastructure

Historical Resource Estimate

A mineral resource estimate (MRE) at Levack Mine has been completed internally by KGHM International and is summarized in Table 5. The MRE for the Levack Mine is considered historical in nature. Although the resource estimate has been prepared and disclosed in compliance with all current disclosure requirements for mineral resources set out in the National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and the classification of the historical resource as a Measured, Indicated and Inferred resource is consistent with current 2014 CIM Definition Standards – For Mineral Resources and Mineral Reserves, a qualified person has not done sufficient work to classify the historical resource estimate as a current mineral resource and Magna is not treating the historical resource estimate as a current mineral resource.

Table 5: Levack Mine Historical Resource Estimate, December 31, 2022

| Property | Deposit Type | Tonnes | Ni (%) |

Cu (%) |

Co (%) |

Pt (gpt) |

Pd (gpt) |

Au (gpt) |

Ag (gpt) |

| Measured and Indicated | |||||||||

| Levack | Contact | 4,112,000 | 2.12 | 1.14 | 0.07 | ||||

| Levack | Footwall | 546,000 | 0.78 | 0.64 | 0.02 | 0.64 | 0.81 | 0.10 | 1.97 |

| Morrison | Footwall | 721,000 | 0.94 | 4.20 | 0.01 | 1.50 | 2.93 | 0.70 | 12.84 |

| Total | 5,379,000 | 1.82 | 1.50 | 0.05 | 0.27 | 0.47 | 0.10 | 1.92 | |

| Inferred | |||||||||

| Levack | Contact | 938,000 | 2.16 | 0.81 | 0.07 | ||||

| Levack | Footwall | 767,000 | 0.69 | 1.62 | 0.01 | 1.22 | 1.67 | 0.37 | 5.10 |

| Morrison | Footwall | 122,000 | 0.96 | 2.53 | 0.01 | 1.43 | 1.90 | 0.84 | 13.88 |

| Total | 1,827,000 | 1.46 | 1.26 | 0.04 | 0.61 | 0.83 | 0.21 | 3.07 | |

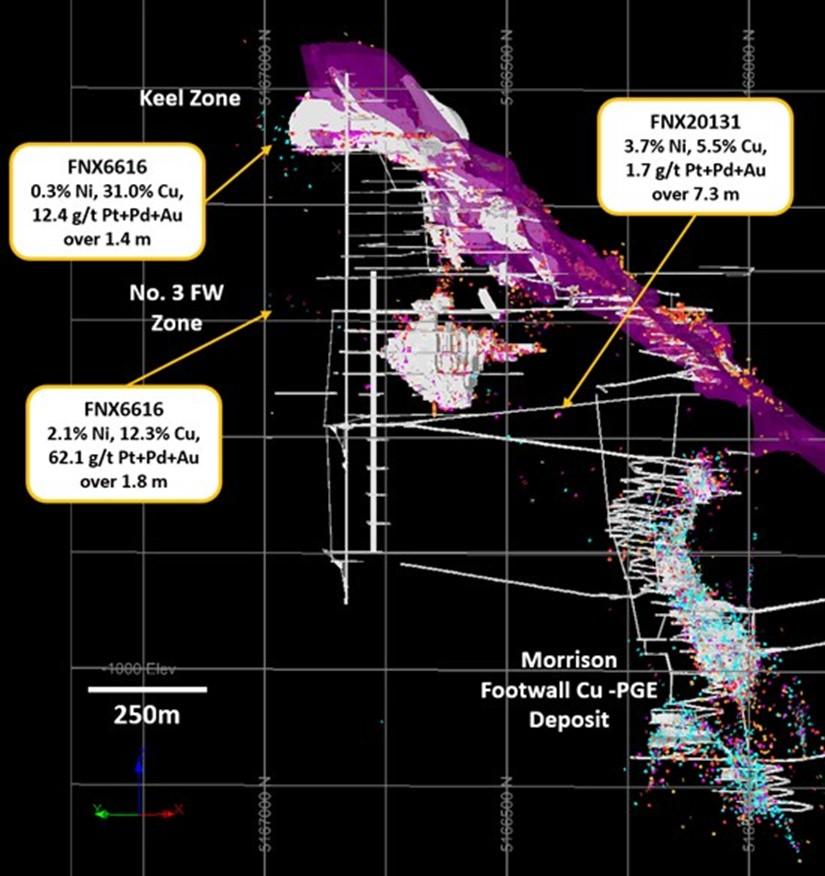

Exploration Potential

The footwall environment at Levack has high potential for discovery of Cu-PGE footwall deposits as demonstrated by the discovery of the Morrison Footwall deposit in 2005. Additional areas of known footwall mineralization include the Keel Zone and No. 3 Footwall Zone, which is the equivalent to known mineralization found on the east side of the Fecunis fault which separates the No.3 and No.4 contact deposits. Figure 7 illustrates some historical high-grade diamond drillhole intersections in these areas. Additionally, the footwall breccia between the McCreedy West PM Zone and the Levack Morrison Deposit remains relatively underexplored.

Figure 7: Levack Mine Vertical Section Looking Northeast Highlighting Footwall Exploration Potential

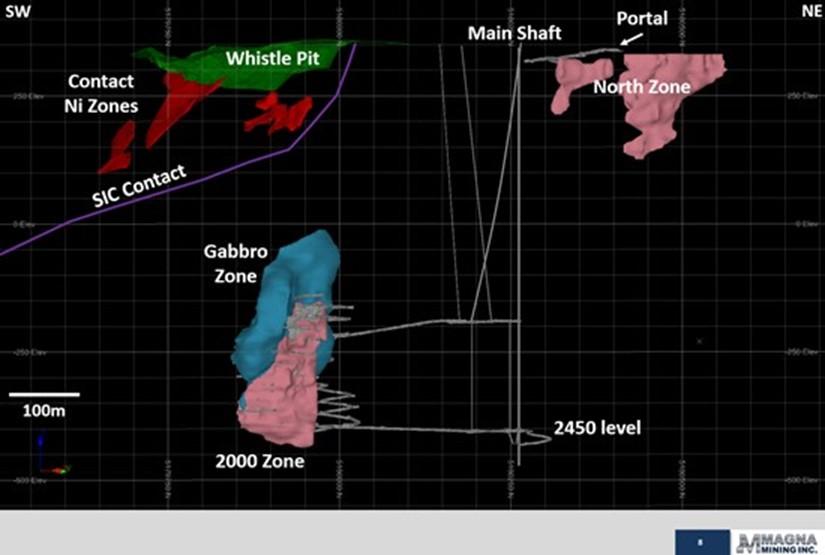

Podolsky Mine

The Podolsky Mine property is located on the east range of the SIC and consists of the historically mined Whistle open pit nickel contact deposit as well as the shaft accessed 2000 Zone offset hosted footwall deposit, that was developed and mined by FNX Mining Inc. from 2007-2013 (Figure 8). The Whistle open pit was developed and mined by Inco in the late 1980’s and 1990’s, and produced 5.7 million tons grading 0.33% Cu, 0.95% Ni and 0.034% Co. Production from the 2000 Zone and Gabbro Zones totaled 1.75 million tonnes grading 3.9% Cu, 0.3 % Ni and 3.9 g/t Pt+Pd+Au. The North Zone offset hosted Cu-PGE deposit remains undeveloped, and significant exploration potential exists for additional offset hosted Cu-PGE deposits within the footwall and offset environments.

Figure 8: Podolsky Mine Mineralized Zones and Underground Infrastructure

Historical Resource Estimate

An MRE for the Podolsky Mine has been completed internally by KGHM International and is summarized in Table 6. The MRE for the Podolsky Mine is considered historical in nature. Although the resource estimate has been prepared and disclosed in compliance with all current disclosure requirements for mineral resources set out in the NI 43-101 and the classification of the historical resource as a Measured, Indicated and Inferred resource is consistent with current 2014 CIM Definition Standards – For Mineral Resources and Mineral Reserves, a qualified person has not done sufficient work to classify the historical resource estimate as a current mineral resource and Magna is not treating the historical resource estimate as a current mineral resource.

Table 6: Podolsky Mine Historical Resource Estimate, December 31, 2022

| Property | Deposit Type |

Tonnes | Ni (%) |

Cu (%) |

Co (%) |

Pt (gpt) |

Pd (gpt) |

Au (gpt) |

Ag (gpt) |

| Measured and Indicated | |||||||||

| Podolsky | Contact | 6,058,000 | 0.75 | 0.21 | |||||

| Podolsky | Footwall | 1,099,000 | 0.27 | 2.35 | 0.00 | 1.01 | 1.01 | 0.42 | 13.56 |

| Total | 7,157,000 | 0.68 | 0.54 | 0.00 | 0.16 | 0.15 | 0.06 | 2.08 | |

| Inferred | |||||||||

| Podolsky | Footwall | 526,000 | 0.23 | 1.98 | 0.00 | 0.65 | 0.76 | 0.34 | 8.91 |

| Total | 526,000 | 0.23 | 1.98 | 0.00 | 0.65 | 0.76 | 0.34 | 8.91 | |

Exploration Properties

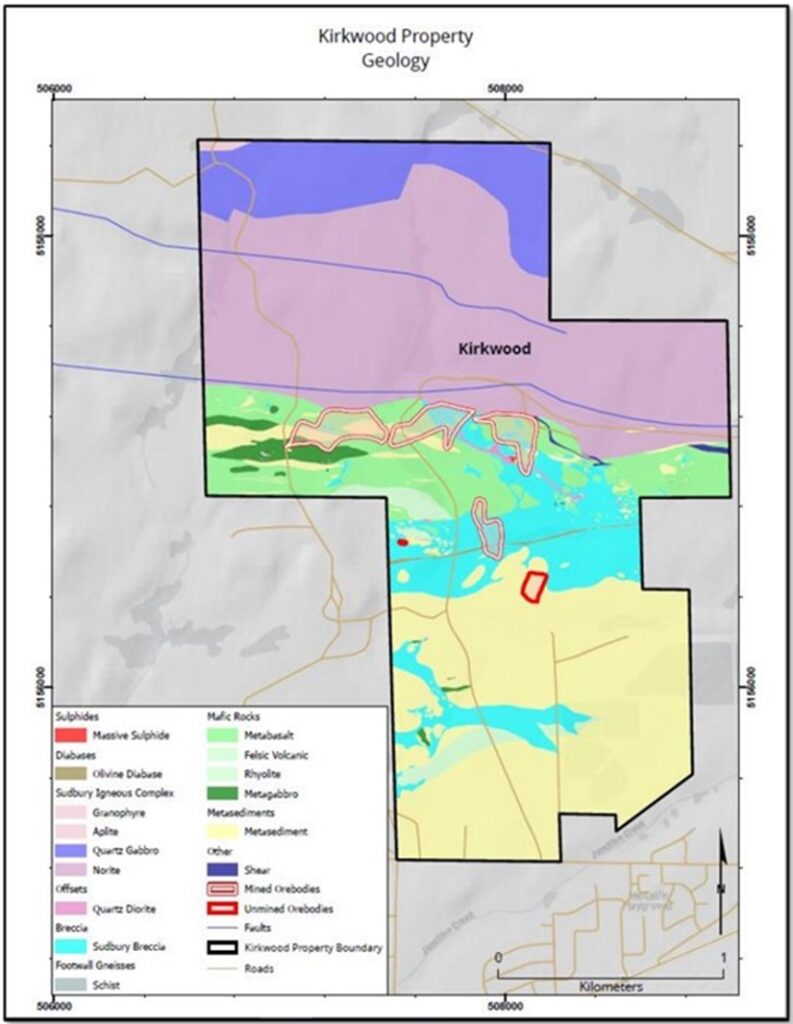

Kirkwood

The Kirkwood Property is located to the west of Vale’s currently producing Garson Mine (Figure 1 and Figure 8). Copper and nickel were discovered on the property in 1892 and initial production from 1914-1916. The resulting production was 71,600 tons grading 1.53% Cu and 2.81% Ni. The mine was closed and flooded in 1916. In 1969 a new shaft was developed and a total of 2,488,000 tons of 0.99% Cu and 0.87% Ni was produced from the Main and East orebodies between 1969 and 1976. A total of 134,000 tons of ore grading 0.96% Cu and 0.53% Ni was produced from a small open pit between 1970 and 1972. The total historical production from the Kirkwood property was 2,695,000 tons grading 1.00% Cu and 0.90% Ni.

The Kirkwood property covers a portion of the South Range Breccia belt, which is host to Vale’s nearby Frood-Stobie mine, and in 2005 FNX Mining Inc. discovered the Segway Footwall Zone within this footwall Sudbury breccia unit. Drilling by FNX intersected a narrow high-grade Cu-Ni-PGE sulphide lens extending to a depth of 75 m below surface (including an intersection grading: 5.4% Cu, 0.8% Ni, and 16.7 g/t TPM over 7.8 m. The remainder of the footwall breccias on the Kirkwood property are not well explored.

Historical Resource Estimate

An MRE for the Kirkwood Mine has been completed internally by KGHM International and is summarized in Table 7. The MRE for the Kirkwood Mine is considered historical in nature. Although the resource estimate has been prepared and disclosed in compliance with all current disclosure requirements for mineral resources or reserves set out in the NI 43-101 and the classification of the historical resource as a Measured, Indicated and Inferred resource is consistent with current 2014 CIM Definition Standards – For Mineral Resources and Mineral Reserves, a qualified person has not done sufficient work to classify the historical resource estimate as a current mineral resource and Magna is not treating the historical resource estimate as a current mineral resource.

Table 7: Kirkwood Mine Historical Resource Estimate, December 31, 2022

| Property | Deposit Type |

Tonnes | Ni (%) |

Cu (%) |

Co (%) |

Pt (gpt) |

Pd (gpt) |

Au (gpt) |

Ag (gpt) |

| Measured and Indicated | |||||||||

| Kirkwood | Contact | 565,000 | 1.17 | 0.49 | |||||

| Total | 565,000 | 1.17 | 0.49 | ||||||

| Inferred | |||||||||

| Kirkwood | Contact | 1,589,000 | 1.27 | 0.97 | |||||

| Total | 1,589,000 | 1.27 | 0.97 | ||||||

Figure 9: Kirkwood Mine Surface Geology

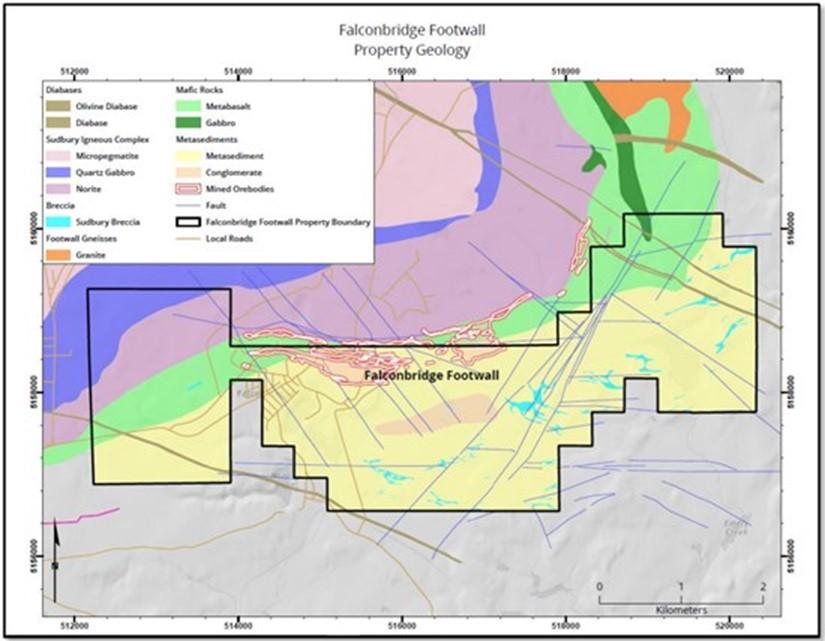

Falconbridge Footwall

The Falconbridge Footwall Property is located at the southeast corner of the Sudbury Basin and contains over eight kilometres of SIC footwall environment (Figure 1 and Figure 10). Like many SIC footwall environments proximal to large nickel contact deposits, this area has historically been considered a strong candidate for hosting high grade Cu-Ni-PGE footwall deposits, such as those mined at other South Range locations including Garson, Frood, Creighton and Vermilion mines. The steeply south dipping SIC contact that is located north (and east) of the property boundary (at surface), eventually cuts onto the property at approximately 1 km depth. The Falconbridge deposit was brought into production in 1929, followed by the East Deposit that was subsequently explored by drifts driven from the Falconbridge Mine. Later, a production shaft was sunk at the East Deposit and production commenced in 1951.The Falconbridge Mine was shut down in 1983 due to a collapse from unstable ground conditions after production of 33,065,837 tonnes grading 1.58% nickel and 0.89% copper. The Falconbridge No. 1 Surface Pit and East Mine were closed in 1990 after production of 8,722,583 tonnes grading 1.15% nickel and 0.76% copper.

The property is owned under a joint-venture agreement between Aurora Platinum Corp (KGHM with 81.41%) and Falconbridge Limited (Glencore with 18.59%).

Figure 10: Falconbridge Footwall Property Surface Geology

North Range Properties

Three exploration properties (Northwest Foy, Rand and North Range) are located in the north range footwall environment of the SIC which could host footwall deposits similar to the Wallbridge Mining Broken Hammer deposit. Broken Hammer was a Cu-Ni-PGE footwall deposit that consisted of massive chalcopyrite veins and low-sulfide, high-PGE mineralization. The 2013 Reserve for the Broken Hammer Deposit was 194,000 tonnes at 0.95% Cu, 0.1% Ni, 2.14 g/t Pt, 1.95 g/t Pd, 0.63 g/t Au and 6.68 g/t Ag. Sudbury breccia within the north range properties has the potential to host similar mineralization. The Northwest Foy property is owned under a joint-venture agreement between Aurora Platinum Corp (KGHM with 81.41%) and Falconbridge Limited (Glencore with 18.59%).

Table 8: Summary of Historical Mineral Resource Estimates, December 31, 2022

| Property | Deposit Type | Tonnes | Ni (%) |

Cu (%) |

Co (%) |

Pt (gpt) |

Pd (gpt) |

Au (gpt) |

Ag (gpt) |

| Measured and Indicated | |||||||||

| Levack | Contact | 4,112,000 | 2.12 | 1.14 | 0.07 | ||||

| Levack | Footwall | 546,000 | 0.78 | 0.64 | 0.02 | 0.64 | 0.81 | 0.10 | 1.97 |

| Morrison | Footwall | 721,000 | 0.94 | 4.20 | 0.01 | 1.50 | 2.93 | 0.70 | 12.84 |

| Podolsky | Contact | 6,058,000 | 0.75 | 0.21 | |||||

| Podolsky | Footwall | 1,099,000 | 0.27 | 2.35 | 0.00 | 1.01 | 1.01 | 0.42 | 13.56 |

| Kirkwood | Contact | 565,000 | 1.17 | 0.49 | |||||

| Total | 13,101,000 | 1.17 | 0.93 | 0.02 | 0.19 | 0.28 | 0.08 | 1.93 | |

| Inferred | |||||||||

| Levack | Contact | 938,000 | 2.16 | 0.81 | 0.07 | ||||

| Levack | Footwall | 767,000 | 0.69 | 1.62 | 0.01 | 1.22 | 1.67 | 0.37 | 5.10 |

| Morrison | Footwall | 122,000 | 0.96 | 2.53 | 0.01 | 1.43 | 1.90 | 0.84 | 13.88 |

| Podolsky | Footwall | 526,000 | 0.23 | 1.98 | 0.00 | 0.65 | 0.76 | 0.34 | 8.91 |

| Kirkwood | Contact | 1,589,000 | 1.27 | 0.97 | |||||

| Total | 3,942,000 | 1.22 | 1.24 | 0.02 | 0.37 | 0.49 | 0.14 | 2.61 | |

Although the resource estimate has been prepared and disclosed in compliance with all current disclosure requirements for mineral resources set out in the NI 43-101 and the classification of the historical resource as a Measured, Indicated and Inferred resource is consistent with current 2014 CIM Definition Standards – For Mineral Resources and Mineral Reserves, a qualified person has not done sufficient work to classify the historical resource estimate as a current mineral resource and Magna is not treating the historical resource estimate as a current mineral resource.

Transaction Summary

The Transaction will be completed pursuant to the Agreement and is structured as a share purchase transaction whereby Magna will acquire all of the outstanding shares of Project Nikolas Company Inc. from FNX Mining Inc., a subsidiary of KGHM. The purchase price is comprised of:

- C$5.3 million cash payable at closing;

- C$2.0 million of Magna common shares issuable at closing;

- A deferred payment of C$2.0 million in cash payable on December 31, 2026; and

- Contingent payments on satisfaction of certain future milestones totalling up to C$24 million.

Magna will assume certain liabilities of PNCI, including C$9.9 million of reclamation liabilities.

In addition, FNX Mining will retain a 4.0% net smelter returns royalty on New Discoveries on certain exploration properties that are part of the Sale Assets. Magna has the right to buy-back 3% of these royalties (for a remaining 1% NSR residual) at any time for various cash considerations.

The Transaction is subject to satisfaction of customary closing conditions including the receipt of all required third party consents and regulatory approvals, including the approval of the TSX Venture Exchange. The Transaction is expected to close by the end the fourth quarter of 2024 or the first quarter of 2025.

In connection with the Transaction, Magna is negotiating a commitment letter received from FCDQ for a credit facility in the aggregate amount of up to C$20 million, which comprises a term loan facility of up to C$10 million and a C$10 million Letter of Credit facility (together the “Debt Financing”). Disbursement of funds under the Debt Financing will be subject to confirmatory due diligence, final documentation and other customary closing conditions including entering into definitive documentation, Desjardins being satisfied with its due diligence review in its sole discretion and the receipt of all required third party consents and regulatory approvals. Upon entering into the definitive agreement in respect of the Debt Financing, the Company will issue a further news release disclosing the material terms of the Debt Financing.

Advisors and Counsel

Magna has engaged Desjardins Capital Markets as its financial advisor and Bennett Jones LLP as its legal advisor in connection with the Transaction.

Qualified Person

The technical information in this press release has been reviewed and approved by David King, M.Sc., P.Geo. Mr. King is the Senior Vice President, Exploration and Geoscience for Magna Mining Inc. and is a qualified person under Canadian National Instrument 43-101.

The McCreedy West mineral resource was estimated by Allan Armitage, Ph.D., P. Geo. of SGS Geological Services and is an independent Qualified Person as defined by NI 43-101.

McCreedy West Property Mineral Resource Estimate Notes:

- The effective date of the McCreedy West Property Mineral Resource Estimate (MRE) is December 31, 2023. This is the close out date for the final mineral resource models and mine out models (as-builts).

- The mineral resource was estimated by Allan Armitage, Ph.D., P. Geo. of SGS Geological Services and is an independent Qualified Person as defined by NI 43-101. Armitage conducted two site visits to the McCreedy Property Mine on two occasions, on August 22-23, 2023 (surface tour) and July 24, 2024 (included an underground tour).

- The classification of the current MRE into Indicated and Inferred mineral resources is consistent with current 2014 CIM Definition Standards – For Mineral Resources and Mineral Reserves.

- All figures are rounded to reflect the relative accuracy of the estimate and numbers may not add due to rounding.

- The mineral resource is presented undiluted and in situ, constrained by 3D grade control resource models, and are considered to have reasonable prospects for eventual economic extraction. The mineral resource is exclusive of mined out material.

- Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that most Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- The McCreedy West mineral resource estimate is based on a validated drill hole database which includes data from 7,587 surface and underground diamond drill holes completed between 1970 and March 2024. The drilling totals 2,381,333 ft (725,830 m). The resource database totals 264,268 assay intervals representing 1,103 460 ft (336,335 m) of data.

- The mineral resource estimate is based on 3 three-dimensional (“3D”) resource models representing the 700 Footwall Vein Complex (700 Complex Zone), the PM Zone and the Intermain Zone. 3D models of mined out areas were used to exclude mined out material from the current MRE. The 3D models and as-builts are based on drill data and mining to December 31, 2023. The 2024 drilling and 2024 production are not considered in the current MRE.

- Grades for Ni, Cu, Co, Pt, Pd, Ag and Au are estimated for each mineralization domain using ~5.0 ft (1.52 m) capped composites assigned to that domain. To generate grade within the blocks, the inverse distance squared (ID2) interpolation method was used for all domains.

- Average density values were assigned to each domain based on a database of 45,525 samples.

- Based on the size, shape, and orientation of the deposits, it is envisioned that the deposits may be mined using both bulk and selective mining methods including Longhole Stoping and Mechanized Cut and Fill (MCAF) (mining methods that have long been utilized in the Sudbury region). The MRE is reported at a base case cut-off grade of 1.10% NiEq. The mineral resource grade blocks are quantified above the base case cut-off grade and within the constraining mineralized wireframes (considered mineable shapes).

- The underground base case cut-off grade of 1.10% NiEq considers metal prices of $8.50/lb Ni, $3.75/lb Cu, $17.00/lb Co, $950/oz Pt, $1100/oz Pd and $1,950/oz Au, metal recoveries of 78% for Ni, 95.5% for Cu, 56% for Co, 69.2% for Pt, 68% for Pd and 67.7% for Au (Ag is not considered), a mining cost of US$80.00/t rock and processing, treatment and refining, transportation and G&A cost of US$42.50/t mineralized material.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

About Magna Mining Inc.

Magna Mining is an exploration and development company focused on nickel, copper and PGM projects in the Sudbury Region of Ontario, Canada. The Company’s flagship assets are the past producing Shakespeare and Crean Hill Mines. The Shakespeare Mine is a feasibility stage project which has major permits for the construction of a 4,500 tonne per day open pit mine, processing plant and tailings storage facility and is surrounded by a contiguous 180km2 prospective land package. Crean Hill is a past producing nickel, copper and PGM mine with a technical report dated July 2023.

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE