Lundin Mining Announces Initial Mineral Resource at Filo Del Sol Demonstrating One of the World’s Largest Copper, Gold, and Silver Resources

Lundin Mining Corporation (TSX: LUN) (Nasdaq Stockholm: LUMI) is pleased to announce that Vicuña Corp. has completed an initial Mineral Resource estimate for the Filo del Sol sulphide deposit, an update to the Mineral Resource estimate for the Filo del Sol oxide deposit and an update to the Mineral Resource estimate for the Josemaria deposit (collectively referred to as the “Vicuña Mineral Resource”). Mineral Resource estimate figures reported herein are on a 100% basis and all values presented are in United States dollars unless stated otherwise.

Vicuña Corp. is a 50/50 joint arrangement between Lundin Mining and BHP and holds the Filo del Sol project and the Josemaria project. The Joint Arrangement creates a long-term strategic alliance between the two companies to develop an emerging world class copper, gold, and silver district. The proximity of the Filo del Sol and Josemaria projects allows for greater economies of scale, shared infrastructure and increased optionality for staged expansions to support a globally ranked mining complex.

Vicuña Mineral Resource Highlights

- One of the world’s largest copper, gold, and silver resources: Ranks in the top 10 for Mineral Resources of the largest producing copper mines in the world1.

- Contained copper of 13 million tonnes Measured and Indicated and 25 Mt Inferred.

- Contained gold of 32 million ounces M&I and 49 Moz Inferred.

- Contained silver of 659 Moz M&I and 808 Moz Inferred.

- Generational discovery: The largest greenfield copper discovery in the last 30 years1.

- High-grade core: The Filo del Sol and Josemaria deposits have significant high-grade mineralization that could provide the initial years of mining.

- Filo del Sol high-grade core: 606 Mt (M&I) at 1.14% CuEq2 (0.74% Cu) for contained metal of 4.5 Mt copper, 9.6 Moz gold and 259 Moz silver.

- Near surface Josemaria high-grade core: 196 Mt (M&I) at 0.73% CuEq3 (0.50% Cu) for contained metal of 978 kt copper, 2.4 Moz gold and 11 Moz silver.

- Copper oxide mineralization at surface: Lower capital intensity heap leach oxide cap at Filo del Sol of 434 Mt (M&I) at 0.34% copper (1.5 Mt), 0.28 g/t gold (3.9 Moz) and 2.5 g/t silver (35 Moz).

- Filo del Sol high-grade oxides: 181 Mt (M&I) at 1.05% CuEq4 (0.50% Cu) for contained metal of 911 kt copper, 2.3 Moz gold and 230 Moz silver.

- Clear potential for expansion: Drilling at Filo del Sol bottomed in mineralization and is open at depth, while drilling at the Flamenco zone approximately 2 km to the south has intercepted mineralization beyond the limits of the current resource pit shell.

- Significant increase in Lundin Mining’s attributable copper Mineral Resource base5:

- 29% increase in M&I contained copper Mineral Resources.

- 650% increase in Inferred contained copper Mineral Resources.

Jack Lundin, President and CEO, commented “Filo del Sol has been one of the most significant greenfield discoveries in the last 30 years and an amazing journey for all those that have been involved. Congratulations to the Filo team for such a remarkable discovery and advancing the deposit to where it is today. The initial Mineral Resource has highlighted the potential for one of the highest grade undeveloped open pit copper projects in the world and one of the largest gold and silver resources globally. Filo del Sol and the Vicuña district are poised to develop into a world class deposit that will support a globally ranked mining complex.

“Highlighted in this release is not only the size and scale of Vicuña but also the high-grade core of the deposits. At Filo del Sol there is over 600 Mt at 1.14% CuEq and at Josemaria almost 200 Mt at 0.73% CuEq. We see the potential for Vicuña to be not only a significant copper producer but also one of the world’s largest gold and silver mines as well, with contained gold of 32 Moz M&I and 49 Moz Inferred along with contained silver of 659 Moz M&I and 808 Moz Inferred, a truly unique asset. Big deposits tend to get bigger and we see clear expansion potential to grow the resource.

“The Mineral Resource is a key milestone and will form the basis for the integrated technical report that will outline a combined project, this report is on schedule for completion in the first quarter of 2026. We look forward to advancing Vicuña with our partner and together, aim to generate long-term value for our stakeholders.”

|

Footnote: |

|

| 1. | Based on rankings from S&P Global, including the Filo del Sol and Josemaria deposits. |

| 2. | Filo del Sol copper equivalent assumes average metallurgical recoveries of 78% for copper, 62% for gold and 62% for silver, and metal prices of $4.43/lb Cu, $2,185/oz Au and $28.80/oz Ag. The CuEq formula is: CuEq= Cu% + (0.59 * Au g/t) + (0.008 * Ag g/t). |

| 3. | Josemaria high-grade core copper equivalent (CuEq) assumes metallurgical recoveries of 84% for copper, 67% for gold and 63% for silver, and metal prices of $4.43/lb Cu, $2,185/oz Au and $28.80/oz Ag. The CuEq formula is: CuEq= Cu% + (0.58 * Au g/t) + (0.007 * Ag g/t). |

| 4. | Filo del Sol oxide copper equivalent (CuEq) assumes average metallurgical recoveries of 78% for copper, 62% for gold and 62% for silver, and metal prices of $4.43/lb Cu, $2,185/oz Au and $28.80/oz Ag. The CuEq formula is: CuEq= Cu% + (0.59 * Au g/t) + (0.008 * Ag g/t). |

| 5. | Lundin Mining owns an 80% ownership in Candelaria; 70% in Caserones and 100% of Chapada and Eagle. |

Vicuña Mineral Resource Statement (100% basis)

The table below summarizes the Mineral Resource estimates for Filo del Sol and Josemaria deposits effective as of April 15, 2025 on a 100% basis. Additional important information is included in the notes following this news release. Table totals may not summate correctly due to rounding. Further information is available on the Company’s SEDAR+ profile at www.sedarplus.ca and on the Company’s website at www.lundinmining.com.

Table 1. Vicuña Mineral Resource Estimate

| 100% basis | |||||||||||

| Type | Category | Tonnes (Mt) | Cu (%) | Au (g/t) | Ag (g/t) | Cu (kt) | Au (Moz) | Ag (Moz) | |||

| Filo del Sol Sulphide | Measured | – | – | – | – | – | – | – | |||

| Indicated | 1,192 | 0.54 | 0.39 | 8.1 | 6,452 | 14.8 | 311 | ||||

| M&I | 1,192 | 0.54 | 0.39 | 8.1 | 6,452 | 14.8 | 311 | ||||

| Inferred | 6,080 | 0.37 | 0.20 | 3.2 | 22,643 | 38.9 | 631 | ||||

| Filo del Sol Copper Oxide | Measured | – | – | – | – | – | – | – | |||

| Indicated | 434 | 0.34 | 0.28 | 2.5 | 1,483 | 3.9 | 35 | ||||

| M&I | 434 | 0.34 | 0.28 | 2.5 | 1,483 | 3.9 | 35 | ||||

| Inferred | 331 | 0.25 | 0.21 | 2.1 | 838 | 2.3 | 22 | ||||

| Filo del Sol Gold Oxide | Measured | – | – | – | – | – | – | – | |||

| Indicated | 288 | – | 0.29 | 3.1 | – | 2.7 | 29 | ||||

| M&I | 288 | – | 0.29 | 3.1 | – | 2.7 | 29 | ||||

| Inferred | 673 | – | 0.21 | 3.3 | – | 4.5 | 72 | ||||

| Filo del Sol Silver Oxide | Measured | – | – | – | – | – | – | – | |||

| Indicated | 77 | 0.34 | 0.37 | 90.7 | 259 | 0.9 | 225 | ||||

| M&I | 77 | 0.34 | 0.37 | 90.7 | 259 | 0.9 | 225 | ||||

| Inferred | 72 | 0.10 | 0.17 | 26.1 | 71 | 0.4 | 60 | ||||

| Josemaria | Measured | 654 | 0.33 | 0.25 | 1.2 | 2,148 | 5.2 | 25 | |||

| Indicated | 992 | 0.25 | 0.14 | 1.1 | 2,475 | 4.6 | 34 | ||||

| M&I | 1,646 | 0.28 | 0.19 | 1.1 | 4,623 | 9.8 | 59 | ||||

| Inferred | 736 | 0.22 | 0.11 | 1.0 | 1,587 | 2.6 | 23 | ||||

| Vicuña District | Measured | 654 | 0.33 | 0.25 | 1.2 | 2,148 | 5.2 | 25 | |||

| Indicated | 2,984 | 0.36 | 0.28 | 6.6 | 10,669 | 27.0 | 634 | ||||

| M&I | 3,638 | 0.35 | 0.27 | 5.6 | 12,817 | 32.2 | 659 | ||||

| Inferred | 7,895 | 0.32 | 0.19 | 3.2 | 25,139 | 48.7 | 808 | ||||

|

Notes: |

|||||||||||

| a. | Mineral Resources have an effective date of April 15, 2025. | ||||||||||

| b. | The Qualified Persons are Mr. Luke Evans of SLR Consulting (Canada) Ltd. (Filo del Sol) and Mr. Sean Horan of Resource Modeling Solutions Ltd. (Josemaria). | ||||||||||

| c. | Reported within a conceptual pit shell using; Prices of $4.43/lb. copper, $2,185/oz gold, and $28.80/oz silver; Filo del Sol sulphide recovery: 78% copper, 62% gold, and 62% silver with NSR cutoff value of $10.39/t; Copper oxide and silver oxide recovery: 67% copper, 63% gold, and 78% silver with NSR cutoff of value $15.59/t; Gold oxide recovery: 73% gold; 63% silver with NSR cut-off of $10.23/t; Josemaria recovery: 82% copper, 60% gold, and 56% silver with NSR cutoff of $7.30/t. | ||||||||||

| d. | NSR values in $/t units account for metal prices, metallurgical recoveries, and off-site sales terms, and can be compared to unit operating costs as a basis for inclusion in Mineral Resources. | ||||||||||

| e. | All figures are rounded to reflect the accuracy of the estimate and totals may not sum due to rounding. | ||||||||||

High-Grade Mineralization

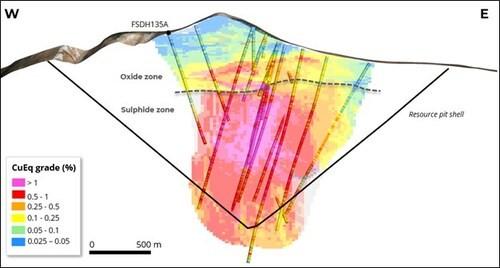

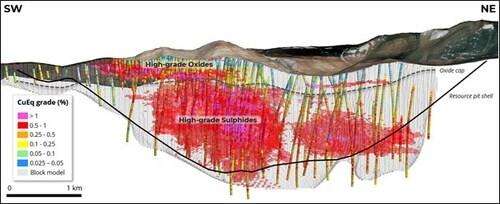

Filo del Sol and Josemaria deposits have near surface high-grade mineralization that contains significant amounts of M&I copper (6.4 Mt), gold (14.3 Moz) and silver (500 Moz) that could provide the feed for the initial years of mine life.

- Filo del Sol high-grade core: 606 Mt (M&I) at 1.14% CuEq (0.74% Cu) for contained metal of 4.5 Mt copper, 9.6 Moz gold and 259 Moz silver.

- Additional near surface Filo del Sol high-grade oxides: 181 Mt (M&I) at 1.05% CuEq (0.50% Cu) for contained metal of 911 kt copper, 2.3 Moz gold and 230 Moz silver.

- Near surface Josemaria high-grade: 196 Mt (M&I) at 0.73% CuEq (0.50% Cu) for contained metal of 978 kt copper, 2.4 Moz gold and 11 Moz silver.

Table 2. Filo del Sol high-grade core at a cut-off of 0.75% CuEq.

| 100% basis, 0.75% CuEq cut-off | |||||||||

| Category | Tonnes (Mt) | CuEq % | Cu (%) | Au (g/t) | Ag (g/t) | Cu (kt) | Au (Moz) | Ag (Moz) | |

| Measured | – | – | – | – | – | – | – | – | |

| Indicated | 606 | 1.14 | 0.74 | 0.49 | 13.3 | 4,503 | 9.6 | 259 | |

| M&I | 606 | 1.14 | 0.74 | 0.49 | 13.3 | 4,503 | 9.6 | 259 | |

| Inferred | 861 | 0.90 | 0.66 | 0.35 | 4.8 | 5,662 | 9.6 | 132 | |

Table 3. Filo del Sol high-grade oxide core at a cut-off of 0.60% CuEq.

| 100% basis, 0.60% CuEq cut-off | |||||||||

| Category | Tonnes (Mt) | CuEq % | Cu (%) | Au (g/t) | Ag (g/t) | Cu (kt) | Au (Moz) | Ag (Moz) | |

| Measured | – | – | – | – | – | – | – | – | |

| Indicated | 181 | 1.05 | 0.50 | 0.39 | 39.6 | 911 | 2.3 | 230 | |

| M&I | 181 | 1.05 | 0.50 | 0.39 | 39.6 | 911 | 2.3 | 230 | |

| Inferred | 29 | 0.76 | 0.43 | 0.32 | 18.5 | 124 | 0.3 | 17 | |

Table 4. Josemaria high-grade core at a cut-off of 0.60% CuEq.

| 100% basis, 0.60% CuEq cut-off | |||||||||

| Category | Tonnes (Mt) | CuEq % | Cu (%) | Au (g/t) | Ag (g/t) | Cu (kt) | Au (Moz) | Ag (Moz) | |

| Measured | 161 | 0.74 | 0.50 | 0.39 | 1.7 | 807 | 2.0 | 9.0 | |

| Indicated | 35 | 0.68 | 0.49 | 0.31 | 1.7 | 171 | 0.4 | 2.0 | |

| M&I | 196 | 0.73 | 0.50 | 0.38 | 1.7 | 978 | 2.4 | 11 | |

| Inferred | 5 | 0.66 | 0.46 | 0.32 | 2.2 | 24 | 0.1 | 0.0 | |

Potential for Resource Expansion

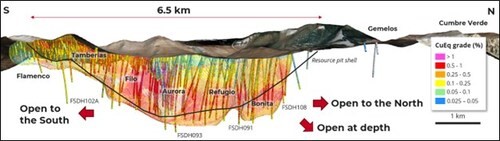

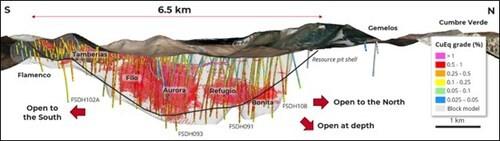

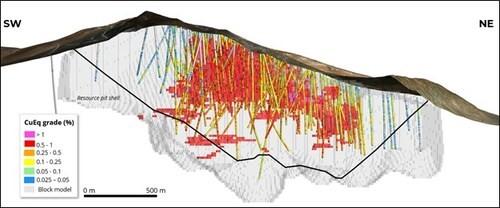

Filo del Sol Mineral Resource has been defined over a total area of 10 square km, with an approximate strike length of 6.5 km and a width of 1.5 km. Mineralization remains open at depth with several drill holes ending in mineralization.

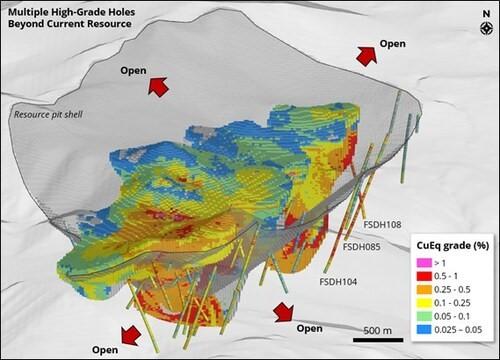

Limited drilling on the east and west edges of the pit have intercepted mineralization providing an opportunity to extend the width of the deposit which could convert material now classified as waste into the Mineral Resource (see Figure 6 below). Recent drilling along the eastern margin of the deposit in drill hole FSDH104 encounted breccia that included 592.0 m (744 m to 1336 m) of 0.41% Cu, 0.13 g/t Au and 3.7 g/t Ag (see News Release of Filo Corp. dated April 22, 2024). Drill hole FSDH085 intercepted 879.0 m (320 m to 1199 m) of 0.32% Cu, 0.13 g/t Au and 6.0 g/t Ag (see News Release of Filo Corp. dated July 11, 2023).

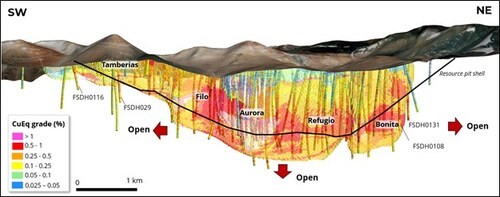

Along strike, previous drilling has intersected mineralization to the north at the Bonita Zone, where drill hole FSDH108 returned 955 m (216 m to 1172 m) of 0.36% Cu and 0.15 g/t Au (see News Release of Filo Corp. dated April 22, 2024) which is beyond the limits of the current resource. In the southern portion of the deposit, additional porphyry potential remains open at depth. Historic drilling concentrated on shallower oxide potential; however, multiple drill holes have intersected gold-rich porphryry mineralization which is currently outside of the current resource, including FSDH116 which returned 610 m (22 m to 6332 m) of 0.15% Cu and 0.39 g/t Au (see News Release of Filo Corp. dated November 21, 2024).

About the Vicuña Project

The Filo del Sol deposit is an advanced-stage copper exploration project located along the border of the San Juan Province in Argentina and the Atacama Region of Chile. Drilling has continued to extend the strike length of mineralization to over 6 km, with multiple reported high grade copper drill intercepts.

The Josemaria project, is an advanced stage copper project, located approximately 10 km from Filo del Sol in San Juan Province, Argentina. A feasibility study for the Josemaria project with an effective date of September 28, 2020 was completed in November 2020 (the “2020 Josemaria Feasibility Study”) and an Environmental Social Impact Assessment was approved by the Mining Authority of San Juan, Argentina in April 2022. The Josemaria project features favourable topography for the placement of infrastructure for the district, with expansion potential. The Vicuña Mineral Resource estimate and the corresponding Vicuña Technical Report (defined below) supersede the 2020 Josemaria Feasibility Study (including declassifying the Mineral Reserves previously declared therein).

Geology and Mineral Resource Estimation

Regional and Deposit Geology

The Vicuña project area of the central Andes encompasses the crest of the ridge along the Chile-Argentina border and the area eastward into Argentina at approximately 28.5° S between the Maricunga belt to the north and the El Indio belt to the south. Regional mineralization in the area is typically related to porphyry and epithermal systems developed during the Late Oligocene to Miocene compressive stages of Andean arc development. The two major deposits thus far discovered on the Vicuña project the porphyry-epithermal copper-gold (-silver) systems of Filo del Sol and Josemaria.

The Filo del Sol alignment is an approximately 8 km long, north to northeast trending series of prospects of mid-Miocene porphyry copper-gold and related epithermal mineralization. The Filo del Sol deposit lies along the alignment as an elongate 5.4 km long domain of contiguous mineralization across three zones: An older, more deeply eroded porphyry copper–gold mineralized domain in the Tamberías area, a slightly younger, partly blind to the surface porphyry copper–gold mineralized intrusions in the Aurora zone in the central domain, and deeper mineralization along a northeast trend in the Bonita area in the north. The domains together represent the mineralization around a large hydrothermal breccia centre cored by porphyry intrusions. Extreme telescoping in the Aurora zone led to the overprinting of the copper–gold mineralized porphyry domain by high-sulphidation copper–gold–silver epithermal mineralization within a large area of advanced argillic alteration.

The Josemaria deposit area is characterized by a Late Oligocene porphyry copper-gold system, emplaced along a north-trending structrual corridor, to the east of Filo del Sol. The system includes disseminated porphyry style mineralization that also saw extreme telescoping and overprinting of the porphyry domain by advanced argillic alteration and related high-sulphidation mineralization. The reconstituted copper mineralization was upgraded in these telecoped domains, which were then additionally enriched through supergene processes when the high-grade part of the system was exposed to surface in modern times.

Mineral Resource Estimation

The Vicuña Mineral Resource estimate was prepared using commercial mine software and geostatistical software.

The Mineral Resource estimates for Filo del Sol and Josemaria deposits are based on 200,486 m of drilling in 400 drill holes and 106,504 m in 243 drill holes, respectively. The holes were assayed on a nominal 2-metre basis. Assays were composited (8 m for Filo del Sol and 4 m for Josemaria) and top-cut (Filo del Sol only) prior to interpolation. The deposits were segregated into multiple estimation domains based on the geological models of lithology, alteration and mineralization style. Density was assigned by using an average per estimation domain for Filo del Sol and simulated for Josemaria, based on the results of specific-gravity samples taken from the drill core. The geological database was closed on April 9, 2025 for Filo del Sol and December 31, 2022 for Josemaria.

Metal grades were interpolated using top-cut Ordinary Kriging for Filo del Sol and conditional simulation for Josemaria. Search ellipse anisotropy and orientation were guided by variography and geology. Mineral Resources are classified under the categories of Measured, Indicated, and Inferred according to the Canadian Institute of Mining, Metallurgy and Petroleum’s “Definition Standards for Mineral Resources and Reserves”. Blocks were coded with the average distance to the nearest three holes and the Mineral Resource classification was based primarily on drill hole spacing with consideration for the continuity of mineralization. Final classification shapes were smoothed by post-processing.

Metallurgical testing demonstrates that oxide mineralization at Filo del Sol is amenable to heap leach operations to produce copper cathode and gold/silver doré. Hypogene mineralization at Josemaria and Filo del Sol are considered amenable to conventional milling and flotation to produce copper concentrates. Gold and silver are expected to reach payable levels in the copper concentrate for both projects. At Josemaria, average flotation recoveries of 82%, 60% and 56% are expected for copper, gold and silver, respectively. At Filo del Sol, flotation recoveries vary by lithology. In the Filo del Sol concentrator, overall average recoveries of 78%, 62% and 62% are expected for copper, gold and silver, respectively. In the Filo del Sol heap leach, recoveries of 67%, 63% and 78% are expected for copper, gold and silver, respectively. Recovery estimates consider metallurgical testwork completed up to January 13, 2025.

This Mineral Resource estimate is also based upon the reasonable prospect of eventual economic extraction based on an optimized pit, using estimates of reasonable operating costs and price assumptions. The pit optimization results are used solely for testing the “reasonable prospects for eventual economic extraction” and do not represent an attempt to estimate Mineral Reserves. Conceptual pits for both deposits were generated using Lundin Mining’s long-term metal prices, with 15% added: $4.43/lb. Cu, $2,185/oz. Au, and $28.80/oz. Ag. Maximum pit slope angle is 40 degrees for Filo del Sol and 45 degrees for Josemaria. An average mining cost of $2.08/t with incremental costs of $0.045/t/bench are used. Average processing costs are estimated at $5.02/t at Josemaria and range from $4.61 to $11.87/t at Filo. G&A cost estimates for project deposits range from $1.35/t to $2.28/t, depending on processing destination.

Filo del Sol copper equivalent (CuEq) assumes average metallurgical recoveries of 78% for copper, 62% for gold and 62% for silver based on similar deposits, and metal prices of $4.43/lb Cu, $2,185/oz Au and $28.80/oz Ag. The CuEq formula is: CuEq= Cu% + (0.59 * Au g/t) + (0.008 * Ag g/t).

Josemaria high-grade core copper equivalent (CuEq) assumes metallurgical recoveries of 84% for copper, 67% for gold and 63% for silver based on similar deposits, and metal prices of $4.43/lb Cu, $2,185/oz Au and $28.80/oz Ag. The CuEq formula is: CuEq= Cu% + (0.58 * Au g/t) + (0.007 * Ag g/t).

Qualified Person Statements and Related Disclosure

In accordance with applicable Canadian securities laws, all Mineral Resource estimates disclosed or referenced in this news release have been prepared in accordance with the disclosure standards of Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators (“NI 43-101”) and have been classified in accordance with CIM’s “Definition Standards for Mineral Resources and Reserves”. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There is no guarantee that all or any part of the Mineral Resource will be converted into Mineral Reserves. In addition, “Inferred Resources” have a great amount of uncertainty as to their existence, and economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian securities rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, or economic studies, except for a Preliminary Assessment as defined under NI 43-101. Investors are cautioned not to assume that part or all of an Inferred Mineral Resource exists or is economically or legally mineable.

Mineral Resource estimates are shown on a 100% basis.

Mineral Resources have been estimated using metal prices of $4.43/lb copper, $2,185/oz gold, and $28.80/oz silver. Reference herein to $ or USD is to United States dollars, CLP is to Chilean pesos, ARS is to Argentine pesos Exchange rates used were USD/CLP 850 and USD/ARS 1,000 for Mineral Resource estimates.

A technical report in support of the Vicuña Mineral Resource estimate will be filed within 45 days under Lundin Mining’s profile on SEDAR+ at www.sedarplus.ca. The Vicuña Mineral Resource estimate, effective April 15, 2025, and the corresponding Vicuña Technical Report supersede the 2020 Josemaria Feasibility Study (including declassifying the Mineral Reserves previously declared in the 2020 Josemaria Feasibility Study) and the Filo del Sol updated pre-feasibility study dated March 17, 2023 with an effective date of February 28, 2023.

The Mineral Resource estimate for Filo del Sol was prepared under the supervision of and verified and approved by Mr. Luke Evans, P.Eng., SLR Consulting (Canada) Ltd. The Mineral Resource estimate for Josemaria was prepared under the supervision of and verified and approved by Mr. Sean Horan, P.Geo. of Resource Modeling Solutions Ltd. Drilling and sampling procedures were verified by Mr. Evans and Mr. Paul Daigle, P.Geo. of AGP Mining Consultants Inc. for Filo del Sol and Josemaria, respectively. Recovery and other metallurgical assumptions were reviewed, verified and approved by Mr. Jeff Austin, P.Eng. of International Metallurgical and Environmental Inc. Each of the aforementioned persons is a Qualified Person as defined under NI 43-101 and is independent of Lundin Mining.

Other scientific and technical information in this news release not set out in the Vicuña Technical Report was reviewed, verified and approved by Cole Mooney, P.Geo., Director, Resource Geology, Lundin Mining, who is a Qualified Person as defined under NI 43-101.

The Qualified Persons have reviewed and verified the sampling and analytical procedures, results of the QAQC program, database, domain interpretation, estimation parameters and validation of the block model and are of the opinion that Vicuña and their consultants have adopted a generally prudent and acceptable approach to their estimates. There was no limitation on the verification process. The Qualified Persons are not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the Mineral Resource estimate.

About Lundin Mining

Lundin Mining is a diversified base metals mining company with operations or projects in Argentina, Brazil, Chile, and the United States of America, primarily producing copper, gold and nickel.

Figure 1. Longitudinal section through Filo del Sol Mineral Resource block model. Filo del Sol Mineral Resource has been defined over a total area of 10 square kilometres (“km”), with an approximate surface area of 6.5 km by 1.5 km. (CNW Group/Lundin Mining Corporation)

Figure 2. Cross section of the Filo del Sol deposit. Highlighting the high-grade core and the shallow near surface high-grade oxide zone. (CNW Group/Lundin Mining Corporation)

Figure 3. Filo del Sol high-grade core at a cut-off of 0.75% CuEq. Longitudinal section through Filo del Sol Mineral Resource block model. A large zone of high-grade mineralization is present within the deposit. Mineralization remains open in multiple locations, particularly at depth and along the east and west edges of the deposit. Grey shaded area represents the limits of M&I and Inferred classification in the block model. (CNW Group/Lundin Mining Corporation)

Figure 4. Filo del Sol high-grade oxide at a cut-off of 0.60% CuEq. Longitudinal section through Filo del Sol Mineral Resource block model. The Filo del Sol deposit includes a high-grade near surface oxide zone. (CNW Group/Lundin Mining Corporation)

Figure 5. Josemaria high-grade core at a cut-off of 0.60% CuEq. Longitudinal section through Josemaria Mineral Resource block model. The high-grade core extends to the surface of the deposit. (CNW Group/Lundin Mining Corporation)

Figure 6. Filo del Sol deposit. Limited drilling on the east and west edges of the pit have intersected mineralization and provides an opportunity to extend the width of the deposit which could convert material currently classified as waste into the resource. (CNW Group/Lundin Mining Corporation)

Figure 7. Longitudinal section view of exploration opportunities. Along strike, previous drilling has intersected mineralization to the north at the Bonita zone and to the south at the Tamberías zone. (CNW Group/Lundin Mining Corporation)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE