Lundin Gold Achieves a New High of Contained Gold Ounces in Mineral Reserves and Mineral Resources at Fruta del Norte

Lundin Gold Inc. (TSX: LUG) (Nasdaq Stockholm: LUG) (OTCQX: LUGDF) today reports its updated estimates of Mineral Reserves and Mineral Resources as at December 31, 2024 for its Fruta del Norte gold mine in Ecuador. The tables of the updated estimates of Mineral Reserves and Resources can be found at the end of this release. PDF Version

Highlights

- Based on contained gold ounces, the 2024 estimates are the highest ever published at FDN for Mineral Reserves and Resources.

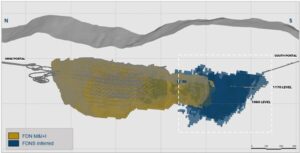

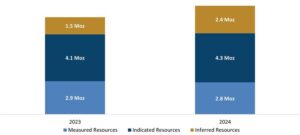

- Inferred Resources increased by 59% to 2.36 million ounces of contained gold from 13.95 metric tonnes with an average grade of 5.27 grams per tonne net of conversion of 0.65 Moz to Measured and Indicated.

- FDN South was the lead contributor to the Inferred Resource growth increasing contained ounces from 0.73 Moz in 2023 to 2.09 Moz from 12.35 Mt with an average grade of 5.25 g/t.

- Measured and Indicated Mineral Resources increased to 7.06 Moz of contained gold from 30.62 Mt with an average grade of 7.17 g/t.

- Proven and Probable Mineral Reserves increased to 5.54 Moz of contained gold from 22.06 Mt with an average grade of 7.81 g/t, after 2024 mining depletion of 0.54 Moz.

Ron Hochstein, President and CEO, commented, “I am extremely pleased to announce our year-end 2024 Mineral Reserve and Resource estimate, marking another year of significant growth for FDN. This latest update represents the largest Reserve and Resource statement in the Company’s history based on contained gold ounces. In addition to increasing our Mineral Reserves after mining depletion, our 2024 near-mine exploration success at FDN and mainly FDNS has resulted in notable additions to our Inferred Resources, growing them by 1.7 Moz through the drill bit. With continued conversion and exploration programs planned for 2025, I am very excited about the potential for further growth, including our plans to publish an initial resource for Bonza Surlater this year.”

Inferred Mineral Resources Update

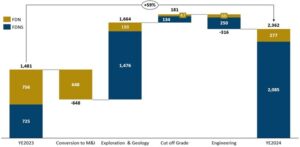

The 2024 near mine exploration drilling program was successful at finding new ounces with the main contribution coming from FDNS. Inferred Resources increased by 59% to 2.36 Moz of contained gold from 13.95 Mt with an average grade of 5.27 g/t net of conversion of 0.65 Moz to Measured and Indicated. FDNS contributed 2.09 Moz to the Inferred Resource from 12.35 Mt with an average grade of 5.25 g/t with most of this Mineral Resource showing grades above 7 g/t as illustrated in Table 1 below. A more conservative resource model was developed by applying cut-off grades and mining parameters to Inferred Resources, which resulted in engineering reductions but increased the accuracy of future conversion potential. The FDNS Inferred Resource will be a focus of the 2025 conversion drilling program.

Figure 1: 2023 Inferred Resources Contained Ounces Compared to 2024 Inferred Resources (represented in thousand ounces) (CNW Group/Lundin Gold Inc.)

Figure 2: New Zones of Inferred Resources at FDNS from 2024 Near Mine Exploration Drilling Program (CNW Group/Lundin Gold Inc.)

Table 1: FDNS Inferred Resources Cut-off Grade Sensitivity, as at December 31, 20241

| Cut-off Grade g/t | Tonnage

kt |

Grade

(g/t Au) |

Contained Metal

(k oz Au) |

| 3.0 | 12,347 | 5.25 | 2,085 |

| 4.0 | 8,498 | 6.07 | 1,659 |

| 4.5 | 6,748 | 6.54 | 1,419 |

| 5.0 | 5,113 | 7.11 | 1,169 |

| 5.5 | 3,636 | 7.86 | 919 |

| 6.0 | 2,656 | 8.64 | 737 |

| Notes: | |||

| (1) | FDNS Inferred Mineral Resource Statement used the cut-off grade of 3.0 g/t. All other cut-off grades to highlight sensitivity are provided for information only. | ||

Measured and Indicated Mineral Resources Update

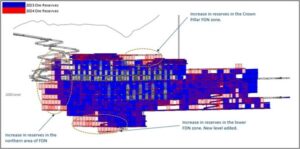

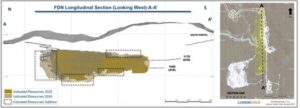

The 2024 conversion drilling campaign was successful at reclassifying Inferred Resources to Indicated in areas immediately beyond the current Reserve boundary. The new areas of Indicated Resources are illustrated in Figure 3, and include extensions to the north, at depth, and to the south of the FDN deposit.

Figure 3: New Zones of Indicated Resources from 2024 Conversion Drilling (CNW Group/Lundin Gold Inc.)

Figure 4: 2023 Mineral Resources Compared to 2024 Mineral Resources[1],[2] (CNW Group/Lundin Gold Inc.)

| Notes: | |

| (1) | Measured and Indicated Mineral Resources are reported inclusive of Mineral Reserves. |

| (2) | For information on the Lundin Gold’s estimates of Mineral Resources as at December 31, 2023, see Lundin Gold’s Annual Information Form dated March 26, 2024 under the Company’s profile on SEDAR+ at www.sedarplus.ca. |

Mineral Reserves Update

Proven and Probable Mineral Reserves increased to 5.54 Moz of contained gold from 22.06 Mt with an average grade of 7.81 g/t after 2024 mining depletion of 0.54 Moz. The addition of 2.03 Mt was achieved at a grade of 8.01 g/t which is higher than the average 2023 Mineral Reserve grade of 7.89 g/t and was offset by 2024 mining depletion of 1.67 Mt at 10.01 g/t.

Increases to the Reserve estimate are primarily due to successful conversion drilling, modifications to the mine design, and some changes to technical parameters. Mine design modifications include replacement of drift and fill with longhole stoping and improvements in mining dilution and recovery estimates. Technical parameter modifications include minor changes in cut-off grade estimates. The assumed gold price was increased to $1,500/oz from $1,400/oz from the year prior.

Mineral Resource and Reserve Summary

The tables below summarize the Mineral Resource and Mineral Reserve estimates for FDN effective as of December 31, 2024. Additional information on Mineral Resource and Mineral Reserve estimates for Fruta del Norte is contained in the “Amended NI 43-101 Technical Report Fruta del Norte Mine Ecuador” dated March 29, 2023 (the “FDN Technical Report”) which is available under the Company’s profile on SEDAR+ at www.sedarplus.ca. Except as set out in this release, major assumptions, parameters and risks associated with the Company’s 2024 Mineral Resource and Mineral Reserve estimates are listed in the FDN Technical Report.

Table 2: Mineral Resources, as at December 31, 2024

| Mineral Resources (1)(2)(3)(4)(5)(6)(7)(8) | ||||||

| Category | Tonnage

Kt |

Grade

(g/t Au) |

Grade

(g/t Ag) |

Contained Metal |

||

(k oz Au)Contained

Metal

(k oz Ag)FDNMeasured8,6459.9311.432,7603,176Indicated21,9746.0810.884,2987,689M & I30,6187.1711.047,05810,865Inferred1,6035.388.11277418FDNSMeasured—–Indicated—–M & I–––––Inferred12,3475.2512.712,0855,045TotalMeasured8,6459.9311.432,7603,176Indicated21,9746.0810.884,2987,689M & I30,6187.1711.047,05810,865Inferred13,9505,2712.182,3625,463Notes:(1)2014 CIM Definition Standards were followed for the classification of Mineral Resources.(2)The Qualified Person for the estimate is Felipe Machado de Araújo, MAusIMM (CP), Senior Geologist, SRK Consultores do Brasil Ltda.(3)Measured and Indicated Mineral Resources are reported inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.(4)Inferred Mineral Resources are considered too speculative geologically to have economic considerations applied to them to enable them to be categorized as Mineral Reserves. (5)Mineral Resources are reported at a cut-off grade of 3 g/t Au, which is calculated using a long-term gold price of US$1,800/oz.(6)Mineral Resources were depleted by mining to December 31, 2024, and use drill hole data available as of December 1, 2024.(7)Figures may not add due to rounding.(8)Additional information on Mineral Resource and Mineral Reserve estimates for Fruta del Norte is contained in the FDN Technical Report which is available under the Company’s profile on SEDAR+. Except as set out herein, the assumptions, parameters and risks associated with the Company’s Mineral Resource and Mineral Reserve estimates set out herein are as set out in the FDN Technical Report.

Table 3: Mineral Reserves, as at December 31, 2024

| Mineral Reserves (1)(2)(3)(4)(5)(6)(7)(8) | |||||||

| Category | Tonnage

kt |

Grade

(g/t Au) |

Grade

(g/t Ag) |

Contained Metal |

|||

(k oz Au)Contained

Metal

(k oz Ag)

FDNProven7,2719.3810.672,1922,494

Probable14,7867.0411.573,3465,502

Total22,0567.8111.285,5387,996

Notes: (1)2014 CIM Definitions Standards on Mineral Resources and Reserves have been followed.(2)The Mineral Reserves estimate has an effective date of December 31, 2024.(3)Ore Mined (Depletion) totals are for Reserve depletion only. Some material mined and processed in 2024 was non-Reserve material.(4)Mineral Reserves were estimated using key inputs listed in the table below:

| Key Input | December 31, 2023 | December 31, 2024 | Unit |

| Gold Price | 1,400 | 1,500 | $/oz |

| Transverse Stoping Mining Cost | 53 | 52 | $/t |

| Process, Surface Ops, G&A Cost | 72 | 72 | $/t |

| Surface Royalties, Sustaining Capital, Closure Costs | 8 | 8 | $/t |

| Taxes | 2 | 2 | $/t |

| Dilution Factor | 8 | 8 | percent |

| Concentrate Transport & Treatment | 50 | 43 | $/oz |

| Payable Gold Concentrate | 97 | 97 | percent |

| Royalty | 79 | 85 | $/oz |

| Gold Metallurgical Recovery | 91.2 | 91.2 | percent |

| Gold Cut-off Grade

Longhole Stoping* Drift and Fill |

4.0

5.3 |

3.7

n/a |

g/t

g/t |

| *Longhole stoping is inclusive of both longitudinal and transverse methods. | |||

| (5) | Silver was not considered in the calculation of the cut-off grade but is recovered and contributes to the revenue stream. | ||

| (6) | Tonnages are rounded to the nearest 1,000 t, gold and silver grades are rounded to two decimal places, and costs are rounded to the nearest dollar. Tonnage and grade measurements are in metric units; contained gold and silver are reported as thousands of troy ounces. | ||

| (7) | Figures may not add due to rounding. | ||

| (8) | The Qualified Person for the year end 2023 and 2024 estimates is Terry Smith P.Eng., Lundin Gold’s Chief Operating Officer. | ||

Qualified Persons

In this news release, the Qualified Person for the Mineral Resource estimate is Felipe Machado de Araújo, MAusIMM (CP), Senior Geologist, SRK Consultores do Brasil Ltda and the Qualified Person for the Mineral Reserve estimate is Terry Smith P.Eng, Lundin Gold’s Chief Operating Officer, both of whom are Qualified Persons in accordance with the requirements of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

The technical information contained in this news release has been reviewed and approved by Terry Smith, P. Eng., Lundin Gold’sChief Operating Officer, and Andre Oliviera, P. Geo., Lundin Gold’s Vice President, Exploration, both of whom are Qualified Persons in accordance with the requirements of NI 43-101.

For information on Lundin Gold’s QAQC and data verification procedures, please refer to Lundin Gold’s Annual Information Form dated March 26, 2024, filed under the Company’s profile on SEDAR+ (www.sedarplus.ca).

About Lundin Gold

Lundin Gold, headquartered in Vancouver, Canada, owns the Fruta del Norte gold mine in southeast Ecuador. Fruta del Norte is among the highest-grade operating gold mines in the world.

The Company’s board and management team have extensive expertise and are dedicated to operating Fruta del Norte responsibly. The Company operates with transparency and in accordance with international best practices. Lundin Gold is committed to delivering value to its shareholders through operational excellence and growth, while simultaneously providing economic and social benefits to impacted communities, fostering a healthy and safe workplace and minimizing the environmental impact. Furthermore, Lundin Gold is focused on continued exploration on its extensive and highly prospective land package to identify and develop new resource opportunities to ensure long-term sustainability and growth for the Company and its stakeholders.

MORE or "UNCATEGORIZED"

Great Pacific Gold Announces Closing of Upsized $16.9 Million Private Placement Financing Led by Canaccord Genuity Corp

Great Pacific Gold Corp. (TSX-V: GPAC) (OTCQX: FSXLF) (FSE: V3H)... READ MORE

Ridgeline Minerals Provides Assay Results and Drill Program Updates for the Big Blue and Atlas Projects

Big Blue highlights: 0.6 meters grading 0.7% Cu, 3,194 g/t Ag and... READ MORE

Goldshore Intersects 42.7m of 1.09 g/t Au at the Eastern QES Zone of the Moss Deposit

Goldshore Resources Inc. (TSX-V: GSHR) (OTCQB: GSHRF) (FSE: 8X00)... READ MORE

Dios Sells K2 to Azimut

Dios Exploration Inc. (TSX-V: DOS) is pleased to report it has e... READ MORE

Northisle Announces Near Surface Intercepts and Higher-Grade Intercepts at Depth at West Goodspeed on its North Island Project

Highlights: Recent drilling at West Goodspeed supports the presen... READ MORE