Luminex’s Camp Drilling at Condor North Indicates Thicker, Higher Grades Emerging at Depth; 5.2 Metres of 15.1 g/t Au Eq

Highlights Include:

- CC22-39 – 5.2m grading 14.61 g/t gold, 37.4 g/t silver for a gold equivalent of 15.06 g/t

- CC22-40 – 5.0m grading 8.92 g/t gold, 36.0 g/t silver for a gold equivalent of 9.35 g/t

- CC22-41 – 9.8m grading 3.40 g/t gold, 30.5 g/t silver for a gold equivalent of 3.76 g/t

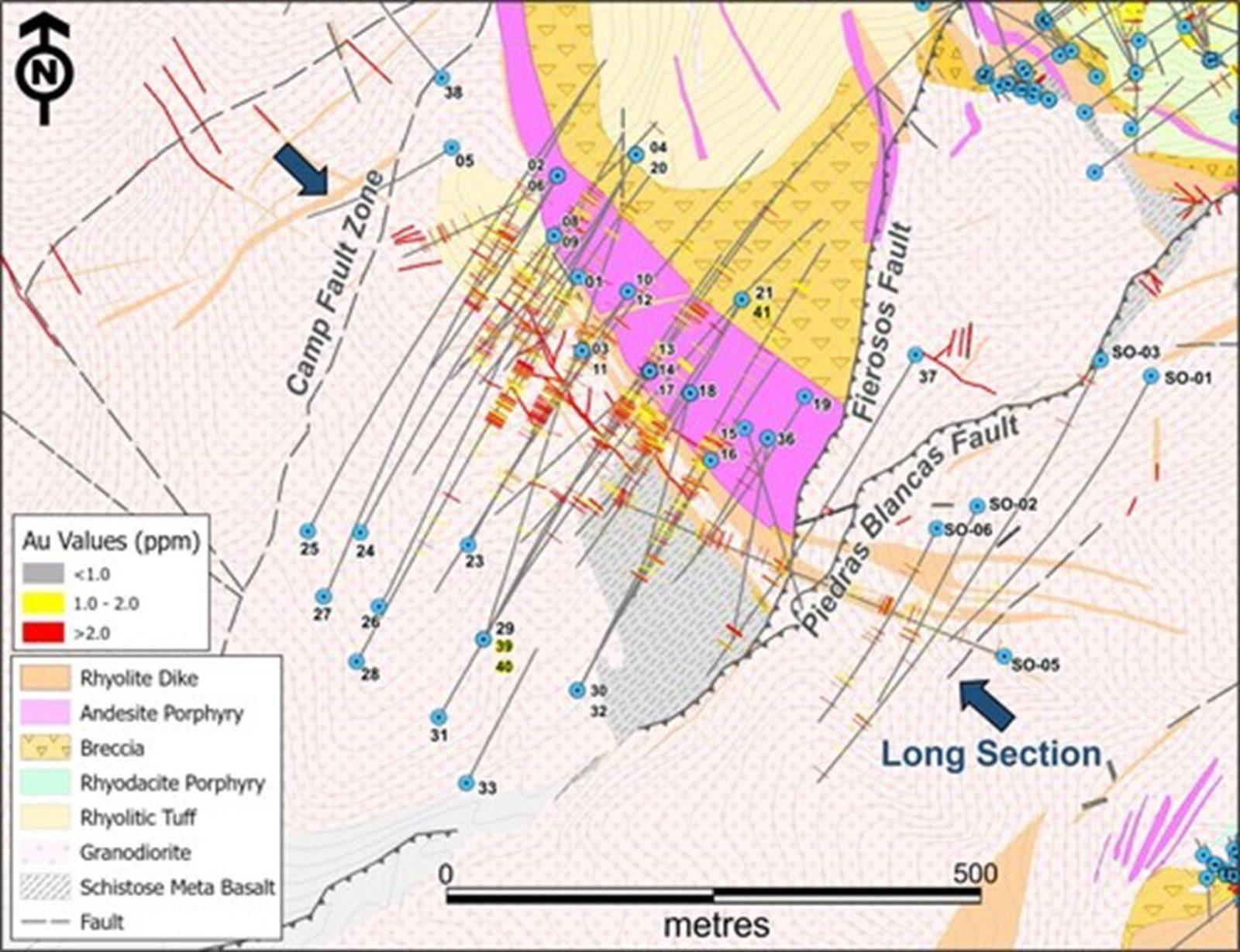

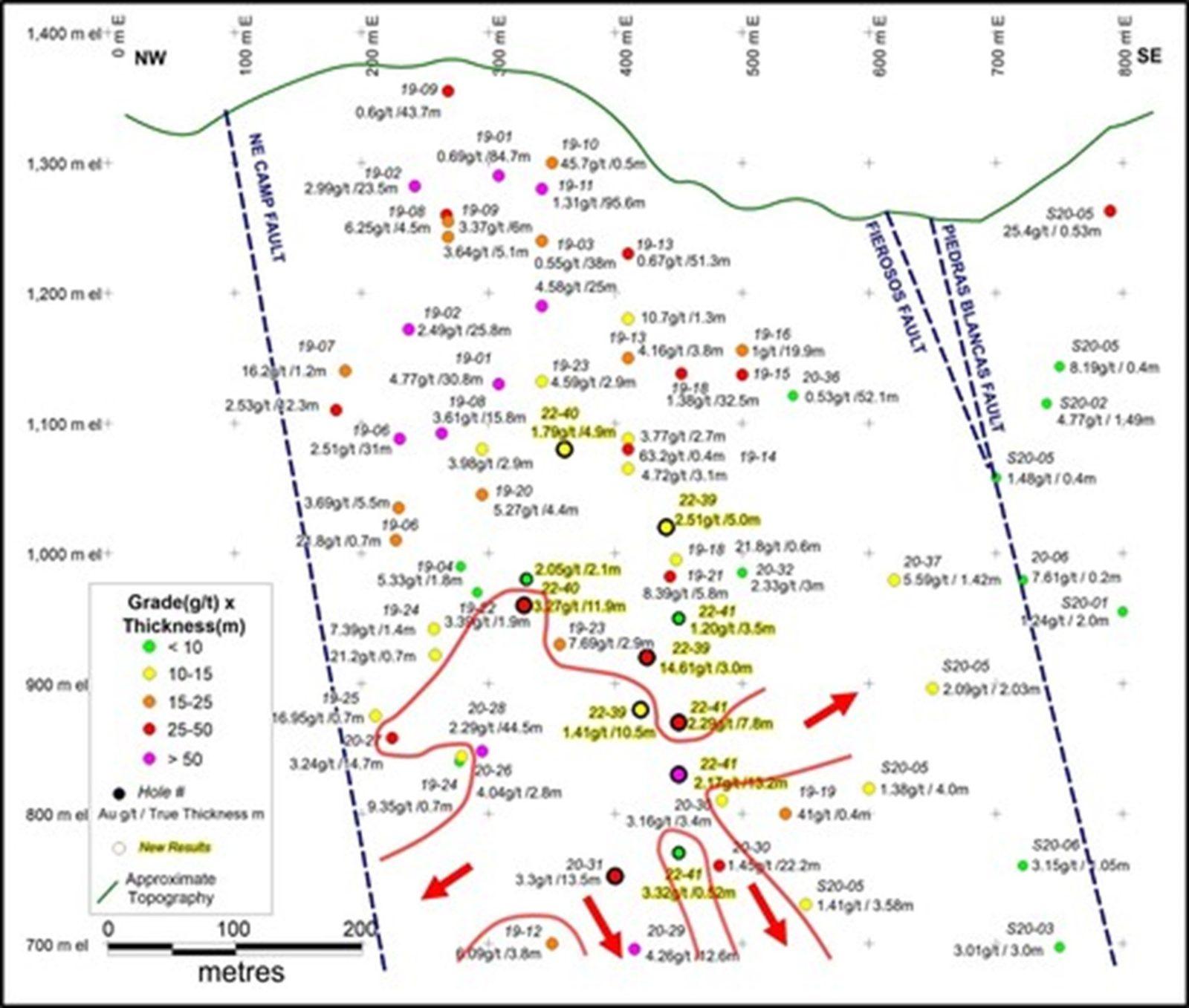

Luminex Resources Corp. (TSX-V: LR) (OTCQX: LUMIF) is pleased to announce results from three holes drilled at the Camp deposit, part of the Condor North project area. Drill holes CC22-39, CC22-40 and CC22-41 have enabled the Company to delineate a thicker part of the Camp deposit. The three holes were drilled to infill an area of more widely spaced holes in the lower-central part of the deposit, which formed as composite sheets of mineralized material that dip steeply to the north. This thicker part of the deposit has been defined by intercepts measuring above 10 metres true thickness horizontally, using a 1.0 g/t gold cut-off grade. It comprises an irregular area measuring approximately 200 metres by 200 metres and remains open to expansion to the southeast, northwest and to depth (see Figure 1). Luminex expects these holes to add to the Camp mineral resource.

Luminex is continuing to drill infill and step out holes on the Camp deposit, as well as step out holes at the emerging, nearby Cuyes West and Ruiz structures with two active rigs at Condor North.

Table 1. Drill intercepts for Camp deposit holes.

| Hole | Azimuth / Dip / Length | From

(m) |

To

(m) |

Interval (m) |

True

Thickness (m) |

Au

(g/t) |

Ag

(g/t) |

Au Eq

(g/t) |

| CC22-39 | 30° /

-52° / 753.3m |

185.0 | 187.0 | 2.0 | 1.00 | 2.92 | 8.1 | 3.02 |

| And | 240.0 | 242.0 | 2.0 | 1.00 | 4.08 | 28.8 | 4.42 | |

| And | 248.0 | 256.0 | 8.0 | 5.00 | 2.51 | 10.1 | 2.63 | |

| And | 312.0 | 313.0 | 1.0 | 0.60 | 5.32 | 35.9 | 5.75 | |

| And | 345.0 | 347.0 | 2.0 | 1.00 | 1.44 | 6.3 | 1.52 | |

| And | 355.0 | 356.0 | 1.0 | 0.50 | 3.28 | 2.3 | 3.31 | |

| And | 381.8 | 387.0 | 5.2 | 3.00 | 14.61 | 37.4 | 15.06 | |

| And | 393.0 | 397.0 | 4.0 | 2.20 | 2.00 | 21.5 | 2.25 | |

| And | 403.0 | 420.0 | 17.0 | 10.50 | 1.41 | 15.7 | 1.60 | |

| And | 492.0 | 500.0 | 8.0 | 4.65 | 1.51 | 10.2 | 1.63 | |

| And | 560.0 | 562.0 | 2.0 | 1.20 | 2.13 | 13.8 | 2.30 | |

| CC22-40 | 22° /

-38° / 528.2m |

194.0 | 202.0 | 8.0 | 4.90 | 1.79 | 7.9 | 1.88 |

| Incl | 194.0 | 196.0 | 2.0 | 1.40 | 5.22 | 11.7 | 5.36 | |

| And | 259.7 | 260.0 | 0.3 | 0.25 | 3.62 | 63.8 | 4.39 | |

| And | 307.0 | 308.0 | 1.0 | 0.70 | 2.80 | 36.9 | 3.24 | |

| And | 335.0 | 336.0 | 1.0 | 0.70 | 11.80 | 25.3 | 12.10 | |

| And | 350.0 | 351.0 | 1.0 | 0.70 | 5.48 | 15.6 | 5.67 | |

| And | 364.0 | 367.0 | 3.0 | 2.10 | 2.05 | 14.9 | 2.23 | |

| And | 377.0 | 394.0 | 17.0 | 11.90 | 3.07 | 25.8 | 3.38 | |

| Incl | 384.0 | 389.0 | 5.0 | 3.50 | 8.92 | 36.0 | 9.35 | |

| And | 448.8 | 450.0 | 1.2 | 0.90 | 3.78 | 15.8 | 3.97 | |

| CC22-41 | 210° /

-70° / 720.0m |

419.7 | 431.0 | 11.3 | 3.50 | 1.20 | 8.2 | 1.29 |

| And | 437.0 | 458.6 | 21.6 | 7.80 | 2.29 | 25.3 | 2.59 | |

| Incl | 437.0 | 442.0 | 5.0 | 1.80 | 4.84 | 19.4 | 5.07 | |

| Incl | 453.0 | 455.3 | 2.3 | 0.83 | 5.45 | 21.1 | 5.70 | |

| And | 465.0 | 506.8 | 41.8 | 13.20 | 2.17 | 25.5 | 2.47 | |

| Incl | 475.0 | 477.0 | 2.0 | 0.60 | 4.94 | 33.3 | 5.34 | |

| Incl | 490.0 | 494.0 | 4.0 | 1.26 | 3.34 | 35.3 | 3.76 | |

| Incl | 497.0 | 506.8 | 9.8 | 3.10 | 3.40 | 30.5 | 3.76 | |

| And | 558.5 | 560.2 | 1.7 | 0.52 | 3.32 | 15.9 | 3.51 | |

| Note: Intervals, except those marked with an asterisk (*), are calculated using a lower limit of 1.00 g/t Au with a maximum inclusion of up to five continuous metres below cut-off and the highest gold value used in the reported weighted averages is 82.4 g/t Au. AuEq values assume $1,500 gold and $18.00 silver (AuEq= Au g/t + (Ag g/t *0.012). Equivalent values assume 100% recovery of all quoted metals. | ||||||||

Hole CC22-41 intersected the thickest zone of gold mineralisation, 41.8m grading 2.17 g/t gold, 25.5 g/t silver for a gold equivalent of 2.47 g/t, including 9.8m grading 3.40 g/t gold, 30.5 g/t silver for a gold equivalent of 3.76 g/t. The true thicknesses of these intercepts are interpreted to approximately 31% of the core length.

Holes CC22-39 and CC22-40 also contained notable intervals such as 5.2m grading 14.61 g/t gold, 37.4 g/t silver for a gold equivalent of 15.06 g/t in hole CC22-39 and 5.0m grading 8.92 g/t gold, 36.0 g/t silver for a gold equivalent of 9.35 g/t in hole CC22-40. The true thicknesses of these intervals are estimated to be 57% and 70% of the core length respectively.

Quality Assurance

All Luminex sample assay results have been independently monitored through a quality control / quality assurance protocol which includes the insertion of blind standards, blanks as well as pulp and reject duplicate samples. Logging and sampling are completed at Luminex’s core handling facility located at the Condor property. Drill core is diamond sawn on site and half drill-core samples are securely transported to ALS Laboratories’ sample preparation facility in Quito, Ecuador. Sample pulps are sent to ALS’s lab in Lima, Peru for analysis where gold content is determined by fire assay of a 50-gram charge with ICP finish.

Silver and other elements are also determined by ICP methods. Over-limit samples assaying greater than 10 g/t gold and 100 g/t silver are re-analyzed by ALS using fire assay with a gravimetric finish. Luminex is not aware of any drilling, sampling, recovery or other factors that could materially affect the accuracy or reliability of the data referred to herein. ALS Laboratories is independent of Luminex.

Qualified Persons

Leo Hathaway, P. Geo, Senior Vice President Exploration of Luminex and the Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed, verified and approved the scientific and technical information concerning the Condor Project in this news release and has verified the data underlying that scientific and technical information.

About Luminex Resources

Luminex Resources Corp. is a Vancouver, Canada based precious and base metals exploration and development company focused on gold and copper projects in Ecuador. Luminex’s inferred and indicated mineral resources are located at the Condor Gold-Copper project in Zamora-Chinchipe Province, southeast Ecuador. Luminex also holds a large and highly prospective land package in Ecuador, including the Pegasus and Orquideas projects, which are being co-developed with Anglo American and JOGMEC respectively.

Figure 1. Geological plan map of Camp deposit showing location of vertical longitudinal sections displayed in Figure 2. (CNW Group/Luminex Resources Corp.)

Figure 2. Longitudinal vertical sections of the Camp deposit showing newly delineated, >10m thick zone in red outline. (CNW Group/Luminex Resources Corp.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE