Luca Mining Confirms New High-Grade Gold Zones with Significant Mining widths at the Tahuehueto Gold Mine

Luca Mining Corp. (TSX-V: LUCA) (OTCQX: LUCMF) (Frankfurt: Z68) is issuing this news release as a result of a review by British Columbia Securities Commission to clarify its disclosure. The Company is updating from its May 21, 2024 news release and announces that mining activity has confirmed high grade gold mineralization over significant widths at the Tahuehueto Gold Mine in Durango, Mexico. The mineralization occurs in shoots branching off the main Creston vein at Underground Level 23. Creston is one is one of two main structures currently being mined. Regular geological mapping, as part of mining activities, and channel sampling at this level confirmed the presence of breccia ore shoots up to 20 meters wide. Internally assayed channel samples1 taken as part of the ore control process have indicated higher-than-average grades.

Level 23 Geology

The underground mine development at Tahuehueto has been advancing since early 2022 and most recently has included developing access, dewatering and mining the first stopes of Level 23, currently the lowest level in the mine. Two mineralized splays have been exposed on the hangingwall and footwall sides of the Creston fault, and mineralized breccia in between with economic widths up to 20m. In this zone there are two types of mineralization; the first is represented by northeast-trending veins of structurally controlled hydrothermal breccias carrying zinc and lead sulphides, hosted in highly altered andesitic rocks with greater contents of gold and copper as a result of higher temperature and deep-seated mineralization. The second type consists of high-grade gold and silver mineralization, superimposed over the lodes and breccias of base metals sulphides formed in previous stages of mineralization.

The block model developed for the pre-feasibility study (refer to Technical Report Preliminary Feasibility Study, 2022) identified maximum vein widths in this area of 8.4m in the hangingwall and 6.5m in the footwall vein splays on Level 23 respectively. Actual vein widths are very comparable, with up to 4.9m in the footwall and 9.5m in the hangingwall, though detailed vein geometries vary. The footwall vein has been exposed 160 meters along strike and shows excellent continuity. Figure 2 shows production channel sampling of the southwest extent of the mineralized vein-breccia zone. Previous diamond drilling indicated that this area extends laterally 200 meters by 230 vertical meters, and the area remains open at depth and to the NE and SW. Based on the field mapping and ore control results, these targets will be included within an upcoming exploration program.

Channel Sampling

Where it is feasible and safe to do so, channel samples are taken in the back and face of excavations in mineralized zones across all lithologies approximately every 1.2 meters. Some areas may not be correctly sampled due to limitations in equipment and local ground conditions. Each sample weighs approximately 2.5 kgs and are sent to the mine laboratory for preparation and analysis by fire assay and atomic absorption methods.

Summary statistics of the channel sample assays from level 23 are included below:

| Summary Statistics Channel Samples Level 23 | |||||

| Au | Ag | Cu | Pb | Zn | |

| g/t | g/t | % | % | % | |

| Max | 65.04 | 267.00 | 4.41 | 11.29 | 14.19 |

| Min | 0.00 | 0.05 | 0.00 | 0.01 | 0.03 |

| Average | 3.30 | 27.17 | 0.22 | 0.78 | 1.39 |

| Count | 494 | ||||

Control and duplicate samples are inserted with the regular samples and include blanks and standards. Control samples account for approximately 6% of the total number of samples analyzed. The QP has verified the data including site visits and analysis of the control sample data. The QP also notes that none of the samples have been verified by an outside laboratory and are indicative only.

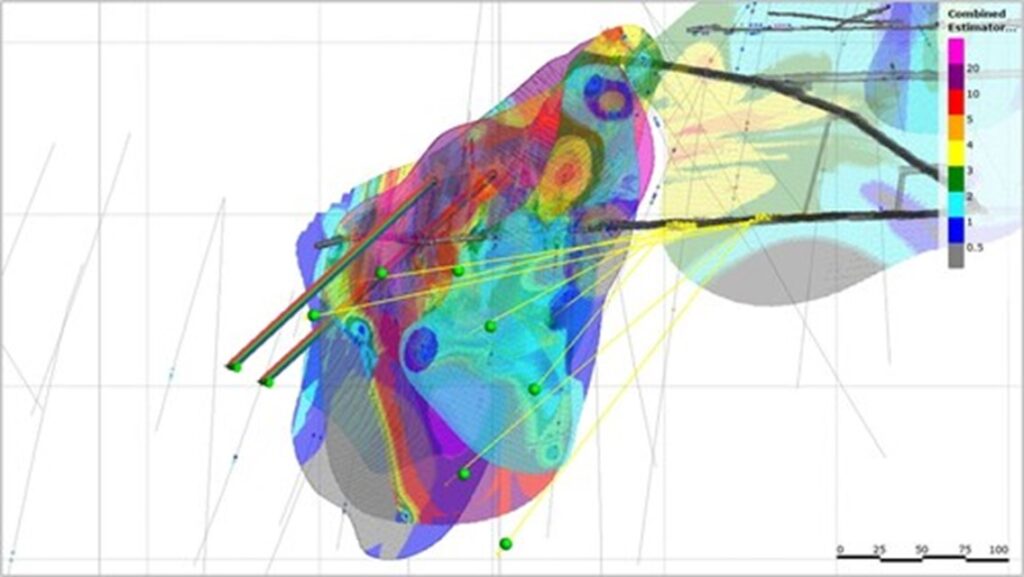

Figures 3 and 4 show long-sections of the Lever 23 area and illustrate the block model interpretations of mineralisation on these structures, together with limits to the existing drilling.

About Luca Mining Corp.

Luca Mining is a diversified Canadian mining company with two 100%-owned producing mines in Mexico. The Company produces gold, copper, zinc, silver and lead from these mines that each have considerable development and resource upside.

The Campo Morado mine, is an underground operation located in Guerrero State, a prolific mining region in Mexico. It produces copper-zinc-lead concentrates with precious metals credits. It is currently undergoing an optimisation program which is already generating significant improvements in recoveries and grades, efficiencies, and cashflows.

The Tahuehueto Gold, Silver Mine is a new underground operation in Durango State, Mexico, within the Sierra Madre Mineral Belt which hosts numerous producing and historic mines along its trend. The Company is commissioning its mill capacity to 1,000 tonnes per day, and key test work and production ramp-up is underway, to increase production by 2H 2024.

The Company expects its operations to start generating positive cash flows in 2024. Luca Mining is focused on growth with the aim of maximizing shareholder returns.

Figure 1: General Plan View – North Mine Area (CNW Group/Luca Mining Corp.)

Figure 2 –Partial Level 23 map showing channel samples of SW extents of mineralized vein-breccia zone (CNW Group/Luca Mining Corp.)

Figure 3: Long-Section – Lower Mine (Looking West) (CNW Group/Luca Mining Corp.)

Figure 4: Zoomed-In Long-Section – Level 23 (Looking West) (CNW Group/Luca Mining Corp.)

MORE or "UNCATEGORIZED"

Ascot Announces Closing of C$34 Million Bought Deal Financing

Ascot Resources Ltd. (TSX: AOT) (OTCQX: AOTVF) is pleased to anno... READ MORE

RUA GOLD Closes C$8 Million Brokered Offering and Announces Commencement of Trading on the TSX Venture Exchange

Highlights Closing the fully subscribed brokered offering for C$8... READ MORE

Mosaic Acquires 100% of the Amanda Project

Mosaic Minerals Corporation (CSE: MOC) announces that it has sign... READ MORE

First Phosphate Confirms Significant High-Quality Igneous Phosphate Deposit at Its Bégin-Lamarche Project in the Saguenay-Lac-St-Jean Region, Quebec au Canada

First Phosphate Corp. (CSE: PHOS) (OTC: FRSPF) (FSE: KD0) is ple... READ MORE

PROSPECT RIDGE ANNOUNCES FINAL CLOSING OF ITS OVERSUBSCRIBED PRIVATE PLACEMENT

Prospect Ridge Resources Corp. (CSE: PRR) (OTC: PRRSF) (FRA: OE... READ MORE