LUCA ANNOUNCES US$4.5 MILLION OF NET EARNINGS IN Q1 2025

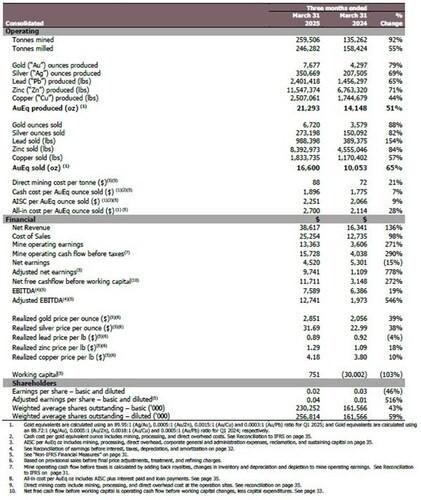

Luca Mining Corp. (TSX-V: LUCA) (OTCQX: LUCMF) (Frankfurt: Z68) is pleased to report an exceptional first quarter of 2025 with $4.5 million in net earnings, $7.6 million in EBITDA and $11.7 million in free cash flow before working capital items. All amounts are in U.S. dollars unless otherwise indicated.

Highlights from the first quarter are as follows:

- In health and safety, the Company reported a TRIFR (total recordable injuries frequency rate) of 0.87, improvement over the prior year and achieved 1,000,000 hours of no lost time incidents at Campo Morado in the first quarter of 2025.

- Record revenues, up 117% from the same quarter in the previous year to over $47.4 million.

- Positive EBITDA of $7.6 million and adjusted EBITDA of $12.7 million.

- Positive free cashflow before working capital items increased significantly to $11.7 million.

- Record consolidated gold equivalent production of 21,293 ounces, a 51% increase compared to Q1 2024, supported by higher throughput and improved head grades at both Campo Morado and Tahuehueto.

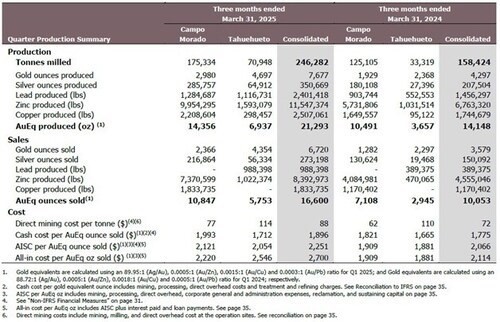

- Strong throughput growth, with a 55% increase in tonnes milled year-over-year to 246,282 tonnes, Campo Morado processed 175,334 tonnes (+40%), while Tahuehueto more than doubled to 70,948 tonnes.

- Gold production reached 7,677 ounces, up 79% from Q1 2024, alongside increases of 69% in silver and 71% in zinc, reflecting higher grades and volumes at both mines.

- Lead and copper production increased 65% and 44%, respectively, year over year, supporting broader metal output diversification and revenue growth.

- Campo Morado sustained a near 2,000 tpd processing rate, supported by over 1,800 meters of mine development and improved haulage capacity with new trucks and ramp access.

- Tahuehueto gold equivalent production increased 90%, reaching 6,937 ounces, despite underground development delays, highlighting operational resilience and plant stability.

- All-in sustaining cost per AuEq ounce sold remained controlled at $2,251, up just 9% from the prior year despite inflationary pressures and ramp-up expenses.

- Since January 1, 2025, the Company has paid down $8.4 million against its debt facilities, resulting in a current debt balance of $8.5 million. Luca’s total cash and cash equivalents balance (including silver bullion on hand) is currently $24.6 million.

Dan Barnholden, CEO, commented, “Our Q1 results are the product of a solid operational foundation laid over the course of 2024. Going forward, I expect our financial and operational results to demonstrate our commitment to continuous improvement at both of our mines. We have set the table for a transformational year and our results, announced today, are indicative of what Luca is capable of.”

The consolidated financial and operating results for the three months ended March 31, 2025, are summarized below.

Operating metrics for the Campo Morado and Tahuehueto mines for the first quarter period ended March 31, 2025, are summarized below.

Exploration Continues to Yield Promising Results for Resource Expansion

Drilling is underway at both the Campo Morado and Tahuehueto mines with the objective to delineate additional near mine resources to add to the mine plan. The Company is also planning to drill farther afield to test the district scale potential of its properties.

Campo Morado

Drillhole CMUG-25-012 drilled 3.8 metres (“m”) of 12.54 g/t AuEq (3.8m of 5.4 g/t Au, 288 g/t Ag, 0.8% Cu, 2.2% Pb and 6.4% Zn) within a wider 15.8m of 4.87 g/t AuEq (2.2 g/t Au, 109 g/t Ag, 0.3% Cu. 0.8% Pb and 2.4% Zn) representing the discovery of a new mineralized zone within the G9 Deposit (See Company News Release Dated May 12, 2025).

Nineteen underground drillholes have been completed to date as part of a 5,000m Phase 1 program targeting near-mine resource expansion. Untapped high-grade mineral potential close to existing mine workings continues to be identified in under drilled zones – results to inform updated mineral resource and mine plans.

In addition, surface drilling is underway to test property-wide targets including Reforma and El Rey – first exploration at these deposits since 2010. Campo Morado hosts a large cluster of polymetallic massive sulphide deposits containing gold, silver, zinc, copper, and lead mineralization within a highly prospective land package totaling over 121 square kilometres within the Sierra Madre del Sur mineral belt.

Tahuehueto

At Tahuehueto, a new high-grade breccia mineralized shoot was discovered within the El Creston vein system located approximately 60m below the active mine workings of Level 23. The discovery drill hole returned 9.4m of 5.21 g/t AuEq within a larger 13.9m zone of 3.90 g/t AuEq (See Company News Release dated May 5, 2025).

An additional new high-grade breccia mineralized shoot was discovered at an untested area of the Creston FW Vein north of the current underground workings, with three new drill holes returning results including: 4.8m of 5.62 g/t AuEq, 6.9m of 4.10 g/t AuEq and 5.1m of 5.62 g/t AuEq, including 2.4m of 9.37 g/t AuEq.

Twenty-three underground drillholes have been completed to date including over 550m of a planned 5,000m Phase 2 underground drilling program targeting near-mine resource expansion. Additional mineral potential was identified in underexplored zones and the results will inform updated mineral resource and near and medium term Tahuehueto mine plans.

Surface drilling has begun at the Santiago deposit which is one of 18 identified mineralized veins on the Tahuehueto Property and has been prioritized for additional exploration for its favourable geology, shallow setting and historic mineral resource.

The Company intends to carry on and expand its exploration efforts based upon the successful initial drilling results at Campo Morado and Tahuehueto. Multiple, untested priority targets exist at both projects.

Cash Generation

As planned, the Company has been steadily reducing its debt and since January 1, 2025, the Company has paid down $8.4 million against its debt facilities, resulting in a current debt balance of $8.5 million. Luca’s total cash and cash equivalents balance (including silver bullion on hand) is currently $24.6 million and growing, as strong cash flow from operations continues and further warrant exercises are expected.

Luca is in a unique position to benefit from the continuing strong commodity demand cycle with its diversified metal production profile. Along with its strong and growing cash balance, debt elimination in 2026, and expanding production levels, the Company is set for another quarter and beyond of exceptional performance.

Inclusion in Solactive Index Fund

Luca has met the inclusion criteria and has been added to the Solactive Global Copper Miners Total Return Index, with an inclusion date of May 1, 2025. This index is tracked by the Global X Copper Miners ETF (COPX). Further information is available on the respective websites for Solactive and Global X.

Proactive and Successful Health and Safety Record

The Company is proud of its outstanding health and safety record, having recently celebrated a major milestone of one million hours without a Lost Time Incident at Campo Morado.

This achievement underscores the Company’s unwavering commitment to safety and operational excellence and is a testament to the dedication, professionalism and teamwork of our operations team. Their commitment to high safety standards, clear communication and collaboration made this possible.

Maintaining a safe and efficient work environment is a key pillar of the Company’s sustainability and operational strategy. Luca continually invests in comprehensive safety training, rigorous protocols and advanced monitoring systems to protect the health and well-being of the Company’s workforce at both the Campo Morado and Tahuehueto mines.

As a conscientious mining entity, Luca recognizes the paramount importance of the Health and Safety of our employees and the significance of Environmental, Social, and Governance considerations in all aspects of its operations. Our four key pillars of responsible and sustainable mining operations are 1) Health and Safety, 2) Environmental Stewardship, 3) People, Community and Culture and 4) Governance & Ethics.

About Luca Mining Corp.

Luca Mining Corp. is a Canadian mining company with two wholly owned mines located in the prolific Sierra Madre mineral belt in Mexico. These mines produce gold, copper, zinc, silver, and lead and generate strong cash flow. Both mines have considerable development and resource upside as well as tremendous exploration potential.

The Company’s Campo Morado Mine hosts VMS-style, polymetallic mineralization within a large land package comprising 121 sq km. It is an underground operation, producing gold, silver, copper, zinc, and lead. The mine is located in Guerrero State.

The Tahuehueto Mine is a large property of over 75 sq km in Durango State. The project hosts epithermal gold and silver vein-style mineralization. Tahuehueto is a newly constructed underground mining operation producing primarily gold and silver. The Company has successfully commissioned its mill and is now in commercial production.

Quarterly Revenue by Location (CNW Group/Luca Mining Corp.)

Table 1 (CNW Group/Luca Mining Corp.)

Table 2 (CNW Group/Luca Mining Corp.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE