Lithium Ionic drills 2.45% Li2O over 9.1m and 1.61% Li2O over 11.9m at Bandeira, Minas Gerais, Brazil

Lithium Ionic Corp. (TSXV: LTH) (OTCQX: LTHCF) (FSE: H3N) reports additional results from the ongoing drilling program at the Bandeira Project, located in northern Minas Gerais State, Brazil. The Company is rapidly advancing Bandeira, situated within the emerging “Lithium Valley”, where two lithium producers currently operate.

These results form part of a large 50,000-metre drill program underway for H2 2023, which is focused on expanding and upgrading existing mineral resource estimates to support a Feasibility Study planned for completion in early 2024, as well as grow the known mineralization at other prospective regional targets.

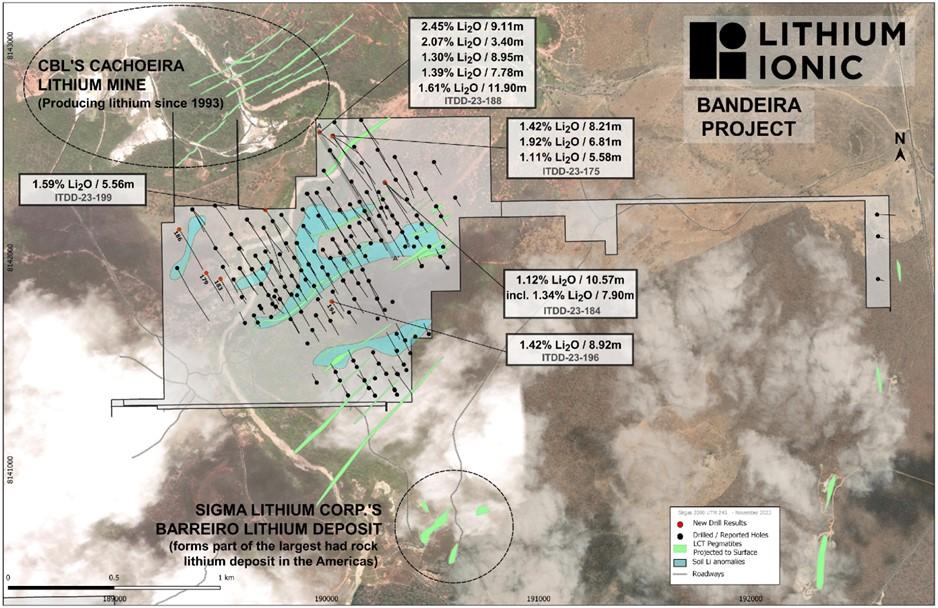

Bandeira Drill Intercept Highlights (See Table 1 and Figure 1):

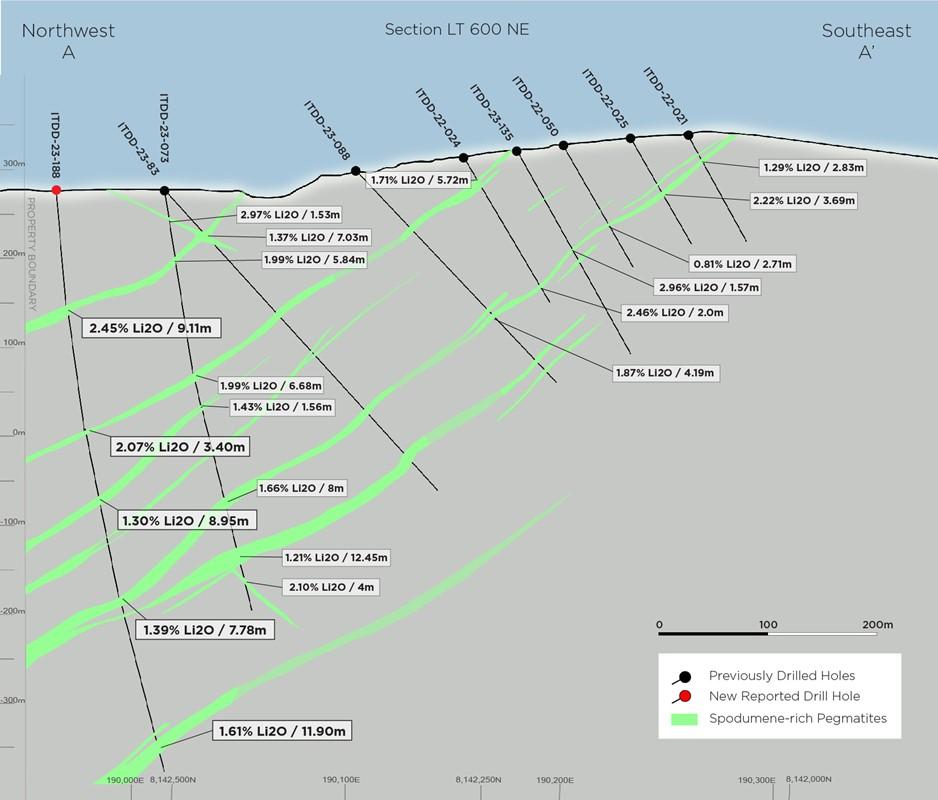

- 2.45% Li2O over 9.1m, 1.61% Li2O over 11.9m, 1.30% Li2O over 9.0m as well as 1.39% Li2O over 7.8m (hole ITDD-23-188) (See Figure 2 cross section)

- 1.92% Li2O over 6.9m and 1.42% Li2O over 8.2m (hole ITDD-23-175)

- 1.42% Li2O over 8.9m (hole ITDD-23-196)

- 1.12% Li2O over 10.6m, incl. 1.34% Li2O over 7.9m (hole ITDD-23-184)

- 1.59% Li2O over 5.6m (hole ITDD-23-199)

Blake Hylands, P.Geo., Chief Executive Officer of Lithium Ionic, commented, “These latest drill results continue to bolster our efforts to expand and enhance the Bandeira project for our upcoming Feasibility Study. The growth trajectory of this deposit since we began drilling it in April 2022 is a testament to its significance within our large portfolio of properties in this belt and will continue to be a key driver of our success. Bandeira represents just a fraction of our land holdings, and our team strongly believes that our success at this property could be replicated at our other properties in the region with the same effort.”

The Company began drilling Bandeira in April 2022, reporting an initial mineral resource estimate in June 2023. In October 2023, an updated MRE at Bandeira showcased a near-doubling of the MRE, which formed the basis of a Preliminary Economic Assessment. This study supported a long-life and low-cost spodumene concentrate mining project with a post-tax Net Present Value 8% of US$1.6 billion (~C$2.2 billion) and an Internal Rate of Return of 121% (see press release dated October 19, 2023).

The Company is currently undertaking an independent NI 43-101 compliant Feasibility Study (“FS”), including an updated MRE, expected to be completed in early 2024.

The Bandeira Project is located in the same district where Companhia Brasileira de Litio’s Cachoeira mine has been producing lithium for +30 years, and recent producer Sigma Lithium operates the Grota do Cirillo project, which hosts the largest hard rock lithium deposit in the Americas (See Figure 1).

The Company is rapidly advancing Bandeira towards a production decision, while it continues to explore and define regional targets. Permitting activities are progressing well, in parallel with the advancement of project engineering. NEO Agroambiental Ltda is completing the RCA (Environmental Control Report) and PCA (Environmental Control Plan) to support the application of a Concomitant Environmental and Installation License (“LAC”, or Licença Ambiental Concomitante) for the Bandeira operation, which is expected to be submitted by the end of the year. The LAC is an accelerated permitting scenario available to projects such as Bandeira, whose mine infrastructure covers a small footprint where deforestation is not required. The LAC replaces the first two steps of the environmental licensing process: the Preliminary License (LP – Licença Prévia) and the Installation License (LI – Licença de Instalação); which precede the final Operating License (LO – Licença de Operação).

Figure 1. Bandeira Drill Collars and Traces with Intercept Highlights

Figure 2. Section_LT600NE Drill Results

Table 1. Bandeira Drill Results

| Hole ID | Az | Dip | From | To | Metres | Li2O (%) |

| ITDD-23-175 | 150 | -73 | 323.64 | 325.56 | 1.92 | 1.85 |

| and | 383.34 | 385.19 | 1.85 | 1.02 | ||

| and | 399.28 | 407.49 | 8.21 | 1.42 | ||

| and | 485.38 | 492.19 | 6.81 | 1.92 | ||

| and | 524.36 | 529.94 | 5.58 | 1.11 | ||

| ITDD-23-179 | 150 | -50 | nsv | |||

| ITDD-23-183 | 150 | -68 | 177.37 | 179.59 | 2.22 | 2.08 |

| ITDD-23-184 | 150 | -85 | 156.12 | 159.73 | 3.61 | 1.03 |

| and | 200.00 | 210.57 | 10.57 | 1.12 | ||

| including | 202.67 | 210.57 | 7.90 | 1.34 | ||

| and | 339.45 | 341.69 | 2.24 | 1.87 | ||

| and | 348.01 | 349.42 | 1.41 | 1.94 | ||

| ITDD-23-186 | 150 | -60 | nsv | |||

| ITDD-23-188 | 0 | -90 | 130.48 | 139.59 | 9.11 | 2.45 |

| and | 272.46 | 275.86 | 3.40 | 2.07 | ||

| and | 347.55 | 356.50 | 8.95 | 1.30 | ||

| and | 463.82 | 471.60 | 7.78 | 1.39 | ||

| and | 631.34 | 643.24 | 11.90 | 1.61 | ||

| ITDD-23-194 | 150 | -50 | 117.31 | 119.50 | 2.19 | 1.83 |

| and | 125.97 | 128.18 | 2.21 | 1.51 | ||

| ITDD-23-196 | 0 | -90 | 110.73 | 113.82 | 3.09 | 0.93 |

| and | 137.13 | 146.05 | 8.92 | 1.42 | ||

| ITDD-23-199 | 150 | -83 | 49.26 | 50.43 | 1.17 | 3.29 |

| and | 127.38 | 129.42 | 2.04 | 2.03 | ||

| and | 270.33 | 272.10 | 1.77 | 0.93 | ||

| and | 278.35 | 279.67 | 1.32 | 1.36 | ||

| and | 288.91 | 294.47 | 5.56 | 1.59 | ||

| and | 408.52 | 413.16 | 4.64 | 0.74 | ||

*Assays pending for holes ITDD-23-190 to ITDD-23-193, ITDD-23-195, ITDD-23-197 and ITDD-23-198

Stock Option Grant

Lithium Ionic’s Board of Directors has approved the grant of 1,460,000 incentive stock options to various directors, officers, and consultants of the Company pursuant to its stock option plan. The options may be exercised at a price of $1.44 per option for a period of five years from the date of grant. The grant of options remains subject to the approval of the TSX Venture Exchange.

About Lithium Ionic Corp.

Lithium Ionic is a Canadian mining company exploring and developing its lithium properties in Brazil. Its Itinga and Salinas group of properties cover 14,182 hectares in the northeastern part of Minas Gerais state, a mining-friendly jurisdiction that is quickly emerging as a world-class hard-rock lithium district. Its Feasibility-stage Bandeira Project is situated in the same region as CBL’s Cachoeira lithium mine, which has produced lithium for +30 years, as well as Sigma Lithium Corp.’s Grota do Cirilo project, which hosts the largest hard-rock lithium deposit in the Americas.

Quality Assurance and Control

During the drill program, assay samples were taken from NQ core and sawed in half. One-half was sent for assaying at SGS Laboratory, a certified independent commercial laboratory, and the other half was retained for results, cross checks, and future reference. A strict QA/QC program was applied to all samples. Every sample was processed with Drying, crushing from 75% to 3 mm, homogenization, quartering in Jones, spraying 250 to 300 g of sample in steel mill 95% to 150. SGS laboratory carried out multi-element analysis for ICP90A analysis.

Qualified Persons

The technical information in this news release has been prepared by Carlos Costa, Vice President Exploration of Lithium Ionic and Blake Hylands, CEO and director of Lithium Ionic, and both are “qualified persons” as defined in NI 43-101.

MORE or "UNCATEGORIZED"

Bonterra Announces Closing of Upsized Brokered Private Placement for Proceeds of $10.5M

Bonterra Resources Inc. (TSX-V: BTR) (OTCQX: BONXF) (FSE: 9BR2) i... READ MORE

ESGold Expands Montauban Mine Building to 4,000 sq. ft. Ahead of Key Operational Milestones

Increased facility footprint reflects advanced construction progr... READ MORE

ARIS MINING COMPLETES INSTALLATION AND COMMISSIONING OF SECOND MILL AT SEGOVIA, ON TIME AND ON BUDGET

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces the... READ MORE

Zodiac Gold Expands Arthington Discovery with Broad Gold Intercepts

Zodiac Gold Inc. (TSXV: ZAU) a West-African gold exploration co... READ MORE

Appia Announces Final Closing of Its Non-Brokered Private Placement

Appia Rare Earths & Uranium Corp. (CSE: API) (OTCQB: APAAF) (... READ MORE