Lion One Reports Preliminary Gold Results, Announces C$16.3M in Quarterly Revenue

Lion One Metals Limited (TSX-V: LIO) (OTCQX: LOMLF) is pleased to provide an operations update and to report preliminary quarterly gold production from the Tuvatu Gold Mine in Fiji for the quarter ending June 30th, 2025.

Highlights of Operations:

- Record mill utilization of 96%

- Record mill throughput of 33,726 tonnes

- Record capital development of 489 m

- Record operating development of 1,014 m

- Shrink stope development complete, production beginning

- Sustained increase in gold recoveries

Preliminary Quarterly Production Results:

- 3,577 oz of gold sold

- 3,214 oz of gold recovered

- 81.6% recovery

- 3.6 g/t gold average head grade

- Total revenue of C$16,300,821

Lion One Metals sold approximately 3,577 oz of gold and 1,233 oz of silver during the three-month period ending June 30th, 2025. The average sale price for the quarter was C$4,541 per ounce of gold sold. Total revenue for the quarter was C$16,300,821, which represents a 24% increase in revenue compared to the previous quarter (C$13,173,024), and a 77% increase in revenue compared to the same quarter last year (C$9,187,046). Gold revenue for the quarter was enhanced by higher gold prices, increased recoveries, and higher mill throughput, as well as the sale of additional gold recovered from the gold in circuit. Average head grade for the quarter was low due to the delayed completion of the mine ventilation project, which caused a delay in mine development in lower levels of the mine. This limited the Company’s flexibility and opportunity to mine high grade material during the quarter as mine development recovered from the delay.

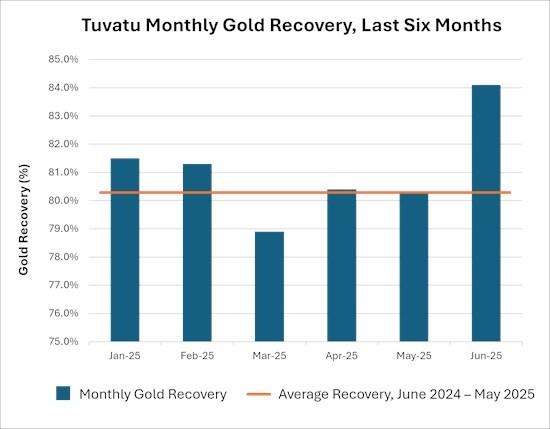

Mill performance for the quarter was very strong, achieving record quarterly mill utilization of 96%. This resulted in a record 33,726 tonnes of mineralized material being processed through the mill, for an average throughput of approximately 371 tonnes per day for the quarter. With minimal down time for maintenance and repairs, the processing team was able to focus on debottlenecking efforts and improved carbon management, which in turn resulted in a sustained increase in gold recoveries at the end of the quarter. Gold recovery for the month of June was 84.1%, compared to an average of 80.3% over the previous 12 months at Tuvatu (Figure 1). With construction of the flotation circuit underway, gold recoveries are anticipated to increase to over 90% by the end of 2025 (see release dated March 20, 2025).

Figure 1. Tuvatu Monthly Recovery, Last Six Months. Gold recoveries increased from a 12-month average of 80.3% to 84.1% in June 2025 because of debottlenecking efforts and improved carbon management at the mill.

Mine development achieved record levels during the quarter with a total of 1,503 m of underground development completed. The arrival of new mining equipment during the quarter, as well as the completion of the mine ventilation project in early April enabled the mining team to increase the rate of underground development and to open more levels of the mine. The top three months of development at Tuvatu were all achieved during this past quarter, with a new record monthly development of 545 m achieved in May 2025. The average monthly mine development at Tuvatu for the 12 months preceding this quarter was 340.5 m (Figure 2). More new mining equipment is scheduled to arrive on site and undergo commissioning in July and August, which is expected to further increase the rate of development at Tuvatu. Notably, the development of the Company’s first shrinkage stope is now complete, with production scheduled for July, August, and September. Drilling in the shrinkage stope has returned high grade intervals, such as 142.66 g/t Au over 2.2 m, 489.52 g/t Au over 0.4 m, 168.95 g/t Au over 0.5 m, and 156.55 g/t Au over 0.6 m (see news releases dated March 25, 2025 and May 12, 2025).

Lion One CEO Ian Berzins stated: “With the Tuvatu gold mine still in the pilot plant stage of development, we have made great progress this quarter in laying the foundations for future success at Tuvatu. We have increased gold recoveries on the mill side and we have increased the rate of underground development on the mine side, both of which we expect to continue to improve moving forward. With production from the shrink stope coming online in July we anticipate this upcoming quarter to achieve even stronger results.”

Figure 2. Tuvatu Monthly Mine Development, Last Six Months. Record Capital and Operating Development was achieved during the quarter ending June 30th 2025. This was a result of the arrival of new mining equipment during the quarter as well as the completion of the mine ventilation project in early April 2025. Record mine development of 545 m was achieved in May 2025. This compares to average monthly mine development of 340.5 m during the preceding 12 months from April 2024 to March 2025.

Qualified Persons Statement

In accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43- 101”), William J. Witte, P.Eng., Principal Advisor to the Company, is the Qualified Person for the Company and has reviewed and approved the technical and scientific content of this news release.

Lion One Laboratories / QAQC

Lion One adheres to rigorous QAQC procedures above and beyond basic regulatory guidelines in conducting its drilling, sampling, testing, and analyses. The Company operates its own geochemical assay laboratory and its own fleet of diamond drill rigs using PQ, HQ and NQ sized drill rods.

Diamond drill core samples are logged by Lion One personnel on site. Exploration diamond drill core is split by Lion One personnel on site, with half core samples sent for analysis and the other half core remaining on site. Grade control diamond drill core is whole core assayed. Core samples are delivered to the Lion One Laboratory for preparation and analysis. All samples are pulverized at the Lion One lab to 85% passing through 75 microns and gold analysis is carried out using fire assay with an AA finish. Samples that return grades greater than 10.00 g/t Au are re-analyzed by gravimetric method, which is considered more accurate for very high-grade samples.

Duplicates of 5% of samples with grades above 0.5 g/t Au are delivered to ALS Global Laboratories in Australia for check assay determinations using the same methods (Au-AA26 and Au-GRA22 where applicable). ALS also analyses 33 pathfinder elements by HF-HNO3-HClO4 acid digestion, HCl leach and ICP-AES (method ME-ICP61). The Lion One lab can test a range of up to 71 elements through Inductively Coupled Plasma Optical Emission Spectrometry (ICP-OES) but currently focuses on a suite of 26 important pathfinder elements with an aqua regia digest and ICP-OES finish.

About Lion One Metals Limited

Lion One Metals is an emerging Canadian gold producer headquartered in North Vancouver BC, with new operations established in late 2023 at its 100% owned Tuvatu Alkaline Gold Project in Fiji. The Tuvatu project comprises the high-grade Tuvatu Alkaline Gold Deposit, the Underground Gold Mine, the Pilot Plant, and the Assay Lab. The Company also has an extensive exploration license covering the entire Navilawa Caldera, which is host to multiple mineralized zones and highly prospective exploration targets.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE