Lion Copper and Gold Announces Pre-Feasibility Study Results for Brownfield Yerington Copper Project and Maiden Mineral Reserve

Base Case $4.30/lb copper, Post-Tax NPV (7%) $694 million and 14.6% IRR with payback at 6.7 years

Advancing Clear Path to Near-Term Production of U.S. Refined Copper Cathode

Lion Copper and Gold Corp. (CSE: LEO) (OTCQB: LCGMF) is pleased to announce the results of the Pre-Feasibility Study (PFS) for its wholly-owned Yerington Copper Project, located in Lyon County, Nevada. The PFS, completed pursuant to the provisions of National Instrument 43-101 – Standards of Disclosure for Mineral Projects, demonstrates and confirms the Project’s potential as a significant refined copper cathode producer in the United States in the heart of the Yerington Copper District. The PFS was prepared by Samuel Engineering Inc., with input from independent Qualified Persons (QPs), and was fully funded by the Company’s strategic partner, Nuton LLC, a Rio Tinto venture.

In this news release, all dollar amounts are in United States dollars (“$”) and imperial units are utilized.

Highlights

Sizeable and scalable open pit heap leach project

- Average annual production of 120 million pounds of refined copper cathode over a 12-year mine life, with a peak of 151 million pounds in Years 5-7.

- Proven and Probable Reserves of 506.5 million tons at 0.21% CuT, containing 2.14 billion pounds of copper.

- Excluding reserves, an additional Measured & Indicated Resource of 293.3 million tons at 0.18% CuT, containing 989 million pounds of copper and an additional Inferred Resource of 158.1 million tons at 0.14% CuT, containing 443.4 million pounds of copper.

- Strong copper recovery performance with an average of 67.4% LOM copper recovery from low-cost heap leaching – 73.2% copper recovery from sulfides using Nuton leach technology and 60% from oxides in a conventional heap leach.

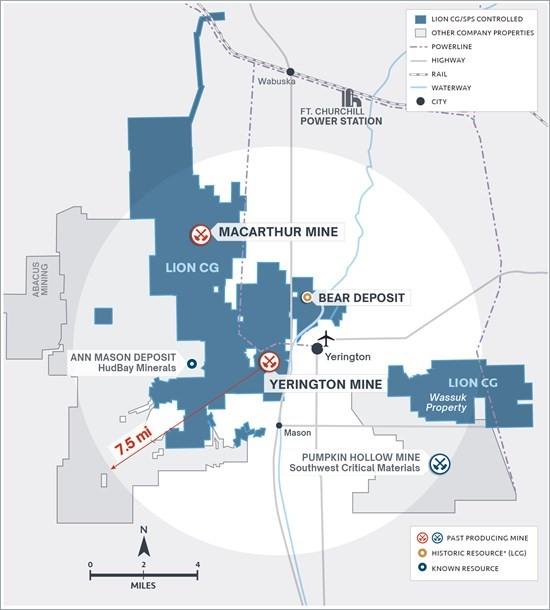

- Extensive land holdings include patented and unpatented mining claims as well as private land adjacent to other significant copper deposits.

- The Project plans to spend approximately $70M to treat 43,000 acre-feet of Yerington Pit Lake water and release this water to the environment for multiple beneficial stakeholder uses in the Mason Valley.

- Benefits of the Project include utilizing disturbed land for mine infrastructure, zero discharge of water from copper processing operations, lower carbon intensity, and efficiently delivering copper cathode directly into U.S. supply chains.

John Banning, CEO of the Company, states, “With growing domestic demand for refined copper, we are pleased to announce the completion of the Pre-Feasibility Study for our Yerington Copper Project, a brownfield asset in Nevada, planned to produce 120 million pounds of refined copper cathode annually over a 12-year mine life. This PFS showcases Lion Copper and Gold’s strategic advantage in the Yerington Copper District, bolstered by secured water rights, the Bear Deposit’s significant potential, strategic land control, and proximity to major neighboring copper projects, positioning us to deliver significant shareholder value and strengthen North America’s critical minerals supply chain.”

Economics

- Base Case $4.30/lb copper, Post-Tax NPV (7%) $694 million and 14.6% IRR with payback at 6.7 years.

- Initial Capital: $724 million, including mine development, heap leach pads, SX/EW plant, acid plant and related infrastructure.

- Base Case NPV-to-Initial Capital Ratio of 0.96.

- Operating Costs: Cash cost (C1)1 of $1.92 per pound of copper.

- All-in Sustaining Costs (AISC)1 of $2.67 per pound of copper.

- Base Case Capital Intensity* of $12,044/tpa.

* Initial capital expenditures divided by average annual copper production for mine life

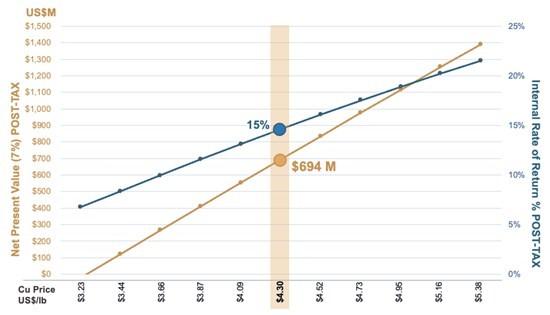

Copper Price Sensitivity

| Sensitivity | Copper Price | Pre-Tax | Post-Tax | ||||

| (%) /item | Cu/lb | NPV(7%) | IRR | Payback | NPV(7%) | IRR | Payback |

| $M | % | Years | $M | % | Years | ||

| -25% | $3.23 | $111 | 8% | 8.9 | ($21) | 7% | N/A |

| -20% | $3.44 | $284 | 10% | 8.2 | $122 | 8% | 8.6 |

| -15% | $3.66 | $457 | 12% | 7.6 | $266 | 10% | 7.9 |

| -10% | $3.87 | $629 | 14% | 7.1 | $410 | 12% | 7.4 |

| -5% | $4.09 | $802 | 15% | 6.7 | $553 | 13% | 7.0 |

| Base Case | $4.30 | $975 | 17% | 6.4 | $694 | 15% | 6.7 |

| 5% | $4.52 | $1,148 | 19% | 6.1 | $836 | 16% | 6.4 |

| 10% | $4.73 | $1,321 | 20% | 5.8 | $976 | 18% | 6.1 |

| 15% | $4.95 | $1,494 | 22% | 5.5 | $1,116 | 19% | 5.9 |

| 20% | $5.16 | $1,667 | 23% | 5.3 | $1,254 | 20% | 5.6 |

| 25% | $5.38 | $1,840 | 25% | 5.0 | $1,390 | 22% | 5.4 |

Figure 1. Copper Price Sensitivity After Tax

Significantly Derisked Project at PFS level with Resource Upside Potential

- Strong reserve and resource confidence with 60% of the resources in Proven and Probable and 88% Measured and Indicated categories with over 125 miles (660,000 ft) of drilling in 1,662 drill holes across the Yerington and MacArthur deposits.

- +10 years of extensive metallurgical testwork and modelling completed including over 50 column tests thoroughly assessing performance characteristics across numerous composites and configurations to optimize reliable metallurgical outcomes.

- 6,014 acre-feet/year of secured water rights permitted for mining use for the life of the project.

- Regional infrastructure is in place to support a major mine, with rail, power, highway, airport and proximity to skilled workforce.

- Clear path to permitting with strong eligibility potential for Fast-41 streamlined permitting process.

Strategically Important U.S. Copper Production

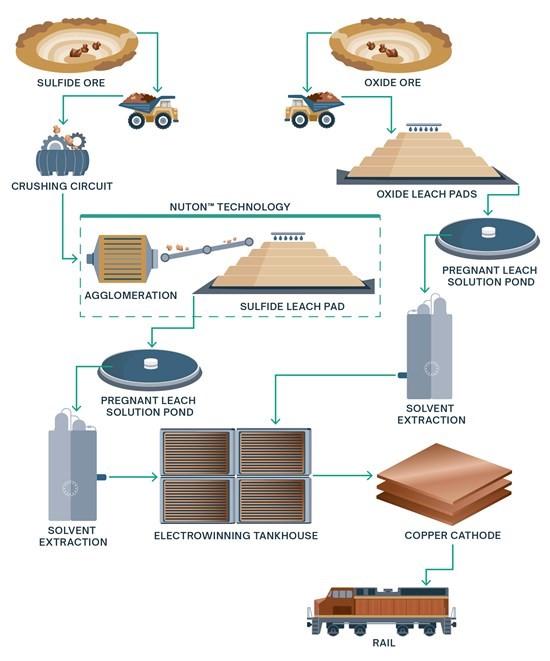

- Heap leach operation with solvent extraction-electrowinning (SX/EW), enhanced by Nuton’s proprietary sulfide leaching technology, achieving a project average of 73.2% copper recovery from sulfide ore.

- Run of mine (ROM) oxide ore heap leached with recoveries at the project of 60%.

- On-site production of refined cathode copper for use in U.S. supply chains.

Project Overview

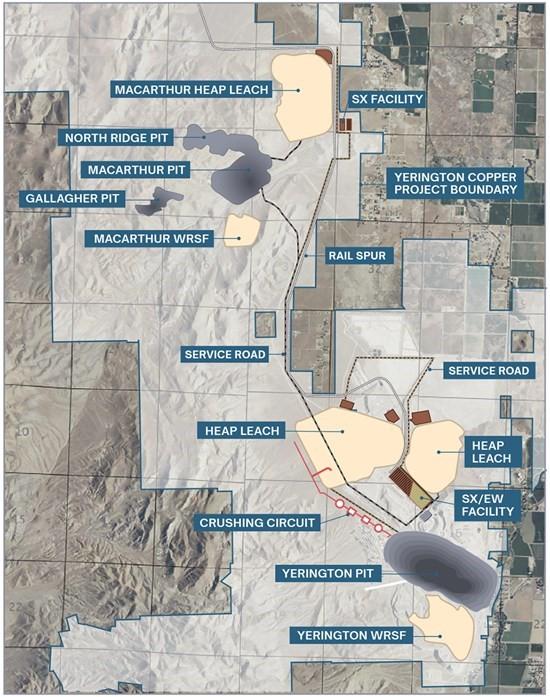

The Yerington Copper Project integrates the Yerington and MacArthur deposits, located in Nevada’s Yerington Copper District, a historic mining region with excellent infrastructure (rail, power, U.S. Highway 95A). The Project benefits from 100% Lion Copper and Gold owned water rights of 6,014 acre-feet/year permitted for mining use for the life of the project and de-risked permitting and mine development. The PFS envisions conventional open-pit mines feeding a heap leach operation, producing LME Grade A copper cathode via SX/EW, with Nuton’s technology enhancing sulfide recoveries. The Project plans to create approximately 400 direct jobs during construction and up to 250 permanent jobs during operations, contributing significantly to the local and state economies.

The Project offers significant environmental benefits compared to traditional copper production. Benefits of the Project include utilizing previously disturbed project facilities area suitable for new mine infrastructure, using pit water for multiple beneficial uses in Mason Valley, zero discharge of water from copper processing operations, lower carbon intensity, and efficiently delivering refined copper cathode directly into U.S. supply chains. These environmental benefits are an important part of the Project being a partner in the Mason Valley to foster growth and diversity in the local economy together with the local stakeholders.

The Project is approximately 70 miles by road from Reno, Nevada, 50 miles south of Tahoe-Reno Industrial Center, and 10 miles from the nearest rail spur of Wabuska. The Project includes both the historic Yerington and MacArthur open pit mines with shared mineral processing infrastructure for operational efficiency. The Project is bordered on the east by the town of Yerington, Nevada, which provides access via a network of paved and gravel roads that were used during previous mining operations.

Figure 2. Yerington Copper Project Overview

Base Case Economics – Based on $4.30/lb Copper Price

| Parameter | Unit | Pre-tax | Post-tax |

| Net Revenue | $USM | 2,914 | 2,315 |

| NPV (7%) (LOM) | $USM | $975 | $694 |

| IRR (LOM) | % | 16.9% | 14.6% |

| Payback | Years | 6.4 | 6.7 |

| Cash Costs1 | $US/lb payable | $1.92 | |

| AISC1 | $US/lb payable | $2.67 | |

| Copper – Payable | Mlbs | 1,443 | |

| Mine Life | Years | 12 | |

| Average Annual Production LOM | Mlbs | 120 | |

| LOM Production | tons | 721,352 | |

1 Total cash cost and AISC are non-GAAP measures and include royalties payable. See reference below regarding non-IFRS measures.

NPV Sensitivities

The sensitivity analysis provides a range of results for the Project when key parameters are varied from their base-case values. The NPV estimate is most sensitive to the copper price.

The PFS uses a base case copper price of $4.30/lb, using the COMEX two-year trailing average copper prices. Project sensitivities were completed on the copper price with a range of $3.25/lb through $5.38/lb:

- At $3.23/lb: NPV(7%) -$21M IRR 7% (Post-Tax).

- At $5.38/lb: NPV(7%) $1.4B, IRR 22% (Post-Tax).

Capital and Operating Costs

The initial capital, expensed over the first 3 years of the Project, amounts to $724 million. The sustaining capital over the remainder of LOM amounts to $1,008 million. A breakdown of capital is presented in the tables below.

| Operating Costs | $USM | $/t Feed | $/lb payable |

| Open Pit Mining | 1,698 | 3.35 | 1.18 |

| Processing | 947 | 1.87 | 0.66 |

| G&A | 124 | 0.24 | 0.09 |

| Total | 2,769 | 5.47 | 1.92 |

| Capital Costs | ||

| Initial Capital | $USM | 724 |

| Sustaining Capital | $USM | 1,008 |

| Total Capital | $USM | 1,732 |

| $/lb payable | 1.20 | |

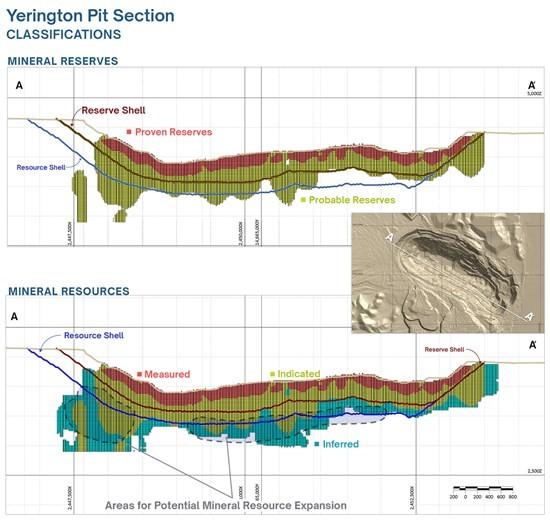

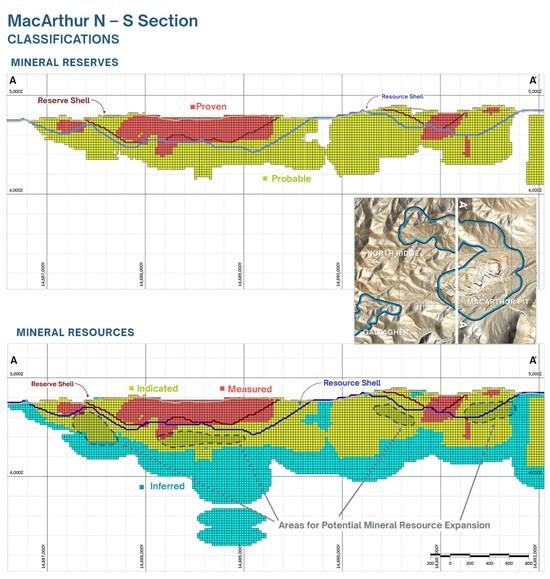

Reserves and Resources

The PFS includes the first Mineral Reserve estimate for the Yerington Copper Project. The PFS is based on the Mineral Reserves only and the reserve estimate is based on pit designs using a copper price of $3.90/lb, with cut-off grades ranging from 0.03 to 0.07% CuT for oxide material and 0.09% CuT for sulfide material.

Mineral Reserves

| Pit Area | Proven | Probable | Total | ||||||

| Ore Type | Tons (kt) | Grade (Cu%) | Copper Mlbs | Tons (kt) | Grade (Cu%) | Copper Mlbs | Tons (kt) | Grade (Cu%) | Copper Mlbs |

| Yerington Pit/VLT | |||||||||

| Oxide | 34,295 | 0.22 | 148.3 | 73,681 | 0.13 | 193.1 | 107,976 | 0.16 | 341.5 |

| Sulfide | 81,037 | 0.30 | 481.1 | 152,761 | 0.24 | 732.3 | 233,798 | 0.26 | 1,213.3 |

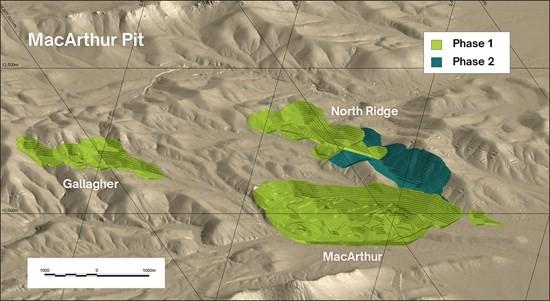

| MacArthur Area | |||||||||

| Oxide | 110,224 | 0.19 | 411.7 | 54,553 | 0.16 | 173.5 | 164,777 | 0.18 | 585.2 |

| Sulfide | – | – | – | – | – | ||||

| Total Oxide | 144,519 | 0.19 | 560.0 | 128,234 | 0.14 | 366.7 | 272,753 | 0.17 | 926.7 |

| Total Sulfide | 81,037 | 0.30 | 481.1 | 152,761 | 0.24 | 732.3 | 233,798 | 0.26 | 1,213.3 |

| Total Reserve |

225,556 | 0.23 | 1,041.1 | 280,995 | 0.20 | 1,099.0 | 506,551 | 0.21 | 2,140.0 |

Note: This Mineral Reserve estimate has an effective date of May 31, 2025, and is based on the mineral resource estimates for Yerington and VLT dated March 17, 2025 by AGP Mining Consultants Inc. and MacArthur Area Pits dated March 17, 2025 by Independent Mining Consultants Inc. The Mineral Reserve estimate was completed under the supervision of Gordon Zurowski, P.Eng. of AGP, who is a Qualified Person as defined under NI 43-101. Mineral Reserves are stated within the final pit designs based on a $3.90/lb copper price.

- The copper cutoff grades used were:

Yerington Pit – 0.05% copper (oxide ROM), 0.09% copper (sulfide)

Vat Leach Tailings (VLT) Pit – 0.03% copper (oxide ROM)

MacArthur – 0.05% copper (oxide ROM)

Gallagher Pit – 0.07% copper (oxide ROM)

North Ridge Pit – 0.06% copper (oxide ROM)

- Open pit mining costs varied by area and elevation with waste of $2.53/t, oxide material at $2.49/t and sulfide at $2.22/t. Incremental costs of $0.027/25ft bench were applied below the 4225 foot elevation for waste and oxide and 0.024/t for sulfide material below the 4225 foot elevation.

- Processing costs were based on the use of an acid plant at site with crushing for sulfide material. The processing costs by pit area were:

Yerington Pit – $2.00/t ore (oxide ROM), $4.44/t (sulfide)

VLT Pit – $1.34/t ore (oxide ROM)

MacArthur – $1.67/t ore (oxide ROM)

Gallagher Pit – $2.14/t ore (oxide ROM)

North Ridge Pit – $1.73/t ore (oxide ROM)

G&A costs were $0.49/t ore.

- Process copper recoveries varied by material and area and were as follows:

Yerington Pit – 70% (oxide ROM), 74% (sulfide)

VLT Pit – 75% (oxide ROM)

MacArthur – 55% (oxide ROM)

Gallagher Pit – 54% (oxide ROM)

North Ridge Pit – 55% (oxide ROM)

Mineral Resources (Inclusive of Mineral Reserves)

| Pit Area | Measured | Indicated | Measured + Indicated | ||||||

| Resource Type |

Tons (kt) | Grade (Cu%) | Copper Mlbs | Tons (kt) |

Grade (Cu%) | Copper Mlbs | Tons (kt) |

Grade (Cu%) | Copper Mlbs |

| Yerington Pit/VLT | |||||||||

| Oxide | 37,531 | 0.21 | 157.6 | 96,556 | 0.13 | 257.9 | 134,087 | 0.16 | 417.0 |

| Sulfide | 84,163 | 0.30 | 505.0 | 263,230 | 0.22 | 1,158.2 | 347,393 | 0.24 | 1,663.2 |

| MacArthur Area | |||||||||

| Oxide | 163,333 | 0.18 | 577.8 | 155,086 | 0.15 | 471.6 | 318,419 | 0.17 | 1,049.4 |

| Sulfide | – | – | – | – | – | – | – | – | – |

| Total | |||||||||

| Oxide Total | 200,864 | 0.19 | 735.4 | 251,642 | 0.15 | 729.4 | 452,506 | 0.16 | 1,464.9 |

| Sulfide Total | 84,163 | 0.30 | 505.0 | 263,230 | 0.22 | 1,158.2 | 347,393 | 0.24 | 1,663.2 |

| Total | 285,027 | 0.22 | 1,240.4 | 514,872 | 0.18 | 1,887.6 | 799,899 | 0.20 | 3,129.0 |

| Pit Area | Inferred | ||

| Resource Type | Tons (kt) | Grade (Cu %) | Copper Mlbs |

| Yerington Pit/VLT | |||

| Oxide | 67,338 | 0.11 | 145.8 |

| Sulfide | 67,576 | 0.17 | 229.8 |

| MacArthur Area | |||

| Oxide | 23,169 | 0.15 | 67.9 |

| Sulfide | – | – | – |

| Total | |||

| Oxide Total | 90,507 | 0.12 | 213.6 |

| Sulfide Total | 67,576 | 0.17 | 229.8 |

| Total | 158,083 | 0.14 | 443.4 |

Notes:

- Mineral Resources are reported in situ for the Yerington Pit and MacArthur Pit area and the effective date is March 17, 2025. Mineral Resources for the VLT are surficial and the effective date is March 17, 2025. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resource estimate will be converted into Mineral Reserves. The Mineral Resource Estimate of Yerington and the VLT was performed by Mr. Tim Maunula, P. Geo of T. Maunula & Associates Consulting and the MacArthur Area Pits by Mr. Herb Welhener, MMSA-QPM, Vice President of Independent Mining Consultants Inc. Both responsible parties are both Qualified Persons under 43-101 standards. All figures are rounded to reflect the relative accuracy of the estimates and totals may not add correctly.

- Mineral Resources of the Yerington pit area are reported within a conceptual pit shell that used the following input parameters: a variable break-even economic cut-off grade of 0.04 % TCu and 0.08% TCu, for oxide and sulfide material respectively, based on assumptions of a net copper price of US$4.22 per pound (after smelting, refining, transportation, and royalty charges), 70% recovery in oxide material, 74% recovery in sulfide material, base mining costs of $2.49/st for oxide and $2.22/st for sulfide, and processing plus G&A costs of $2.00/st for oxide and $4.44/st for sulfide.

- Mineral Resources of the VLT are reported within a conceptual pit shell that used the following input parameters: a break-even cut-off grade of 0.03 % TCu based on assumptions of a net copper price of US$4.22 per pound (after smelting, refining, transportation and royalty charges) and 75% recovery in oxide material.

- Mineral Resources of the MacArthur Pit area are reported within a conceptual pit shell that used the following input parameters: a break-even cut-off grade of 0.05 % for the MacArthur pit, 0.07 % TCu for the Gallagher pit, and 0.06 % TCu for the North Ridge pit. Metal price of $4.22 per pound (after smelting, refining, transportation, and royalty charges); process costs between $1.67 and $2.14/st; and base mining costs for heap tonnage of $2.49/st and $2.53/st for waste,

- Recovery of Total Copper in redox zones of leach cap, overburden, oxide and mixed: MacArthur domain 55%, North Ridge domain 53%, Gallagher domain 54%.

Figure 3. Yerington Pit Long Section

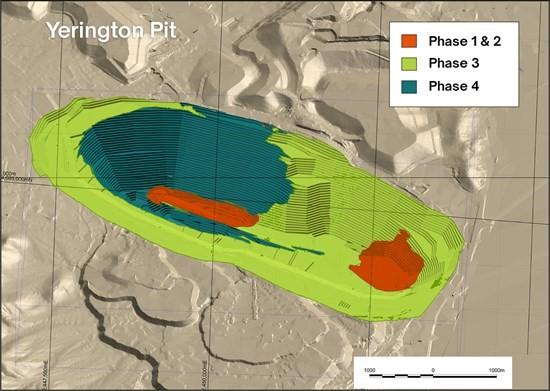

Figure 4. Yerington Pit Mine Phases

Figure 5. MacArthur Pit North-South Section

Figure 6. MacArthur Pit Mine Phases

Metallurgy

Nuton™ Technology will be utilized for copper recovery in the form of bioleaching for the Yerington Sulfide Ore. Nuton technology will utilize microorganism assisted acid leach system to extract the copper from the Yerington Sulfide Ore that has been crushed and stacked onto a heap leach pad. Pyrite and Nuton additives will be added to the process at the agglomeration stage to enhance the extraction process. This innovative approach has been demonstrated via extensive column testing, lab testing and modelling to enhance the overall copper recovery for the sulfide ore, offering a lower cost and more water efficient sulfide copper recovery process compared to conventional milling and floatation.

Lion Copper and Gold in partnership with Nuton™ completed extensive column and laboratory testing on the Yerington sulfide material to optimize recoveries from deploying the Nuton sulfide leaching technology. Over 40 test columns were leached by Nuton at their own laboratory to develop both recovery models and fine tune process design criteria. The forthcoming PFS Technical Report will provide additional testwork details and associated results.

Process Description Summary

Copper will be extracted through a heap leach process, followed by SX/EW. Ore will originate from multiple sources which will be stacked and processed on three separate leach pads with two SX circuits. The sulfide and oxide ore from the Yerington open pit will be distributed onto separate heap leach pads but will share an SX circuit. The MacArthur open pits will have one heap leach pad and one SX circuit. There will be a single EW facility for the project co-located with the Yerington SX system.

The Yerington Oxide Heap Leach Facility (HLF) will be ROM truck dumped with a peak placement rate of 83,000 short tons per day (tpd) of new oxide ore and residual stockpiled ore. The crushing, conveying, agglomeration and ore stacking at the Yerington Sulfide HLF is designed for 114,000 tpd to process the peak sulfide ore placement rate of 94,000 tpd. The MacArthur HLF will also be ROM truck dump with a peak placement rate of 142,000 tpd.

The Yerington solvent extraction (SX) systems will handle up to 30,000 gallons per minute (gpm) of pregnant leach solution (PLS). MacArthur’s SX system will be designed to process up to 22,000 gpm of PLS. The shared electrowinning (EW) circuit will process electrolyte from both Yerington and MacArthur with the ability to produce up to 90,000 tons per year of refined copper cathode.

The planned mine life is 12 years, with SX/EW to be in operation for 14 years with the acid plants to be in operation for their life cycle of 19 years. Sulfuric acid production that exceeds project requirements will be sold into the domestic market. The combined copper recovery is expected to be 67.4%.

Figure 7. Yerington Copper Project Copper Cathode Production Simplified Flowsheet

Project Development

Lion Copper and Gold anticipates securing all required permits and authorizations needed to construct and operate the Project within reasonable and normal timeframes. Preliminary permitting schedule estimates that the completion of baseline studies, acquisition of requisite state permits, and the National Environmental Policy Act (NEPA) process necessary for project authorization could be completed in as little as 2.5 years. Furthermore, the Project’s permitting schedule may benefit from the Executive Order (EO) 14241 titled Immediate Measures to Increase American Mineral Production issued in March 2025 to streamline permitting processes for mining projects, particularly those focused on critical minerals.

Figure 8: Development Timeline

Future Opportunities

The Yerington Copper Project covers an extensive strategic land package, including the Bear Deposit and numerous other underexplored targets. While Lion Copper and Gold’s Project is compelling on its own, it creates the potential to act as a catalyst to consolidate with adjacent copper projects.

- Large and scalable processing facility to service and create synergies with several adjacent deposits, projects and operations.

- Utilize and expand on the existing resource base and project infrastructure to extend the life of the Project.

Figure 9. Yerington Area, Including Bear Deposit, Pumpkin Hollow Mine, and Ann Mason Deposit

Qualified Persons

For the purposes of Canadian National Instrument 43-101, the independent Qualified Persons responsible for preparing the scientific and technical information disclosed in this news release announcing the Study are Michael McGlynn (Samuel Engineering Inc.), Gordon Zurowski (AGP Mining Consultants) Steve Pozder (Samuel Engineering Inc.), John Rupp (Piteau Associates), Tim Maunula (T. Maunula & Associates Consulting), Herb Welhener (Independent Mining Consultants), Marie-Hélène Paré (GSI Environmental) and Adrien Butler (NewFields). The Qualified Persons named herein have reviewed and approved the information in this news release relevant to the portion of the scientific and technical information for which they are responsible.

Other disclosures of a technical or scientific nature included in this news release have been reviewed, verified, and approved by Todd Bonsall, Douglas Stiles, Steven Dischler and John Banning who are Qualified Persons as defined by Canadian National Instrument 43-101 and are employees of Lion Copper and Gold.

A Technical Report in the form required under Canadian National Instrument 43-101 will be filed within 45 days of this news release and will be available on Lion Copper and Gold’s website and on its SEDAR profile.

About Lion

Lion Copper and Gold Corp. is advancing its flagship copper project in Yerington, Nevada through an Option to Earn-in Agreement with Nuton LLC, a Rio Tinto Venture.

About Nuton

Nuton is an innovative venture that aims to help grow Rio Tinto’s copper business. At the core of Nuton is a portfolio of proprietary copper leaching technologies and capability. Nuton has the potential to economically unlock copper from hard-to-leach ores, including primary sulfides and, in doing so, increase domestic production of critical minerals to support the energy transition. Nuton technologies can achieve market-leading recovery rates and boost copper production in new, ongoing and historical operations, increasing resource utilization and maximizing value.

With significantly lower energy and water needs than conventional concentrating and smelting, and the ability to produce copper cathode at the mine site, Nuton offers a reliable source of domestically produced copper, with a short mine-to-metal supply chain and the ambition to set industry-leading ESG credentials.

One of the key differentiators of Nuton is the ambition to produce the world’s lightest environmental footprint copper while having at least one Positive Impact at each of its deployment sites, across its five pillars: water, energy, land, materials and society.

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE