Lahontan Gold Corp (TSX-V:LG) (OTCQB:LGCXF) is pleased to announce results from the first four reverse-circulation rotary drill holes from the Company’s 2023 7,000 metre Phase Three drilling campaign exploring the Calvada pit area of the Company’s 19 km2 Santa Fe Mine Project in Nevada’s Walker Lane. Past mining, historic drilling, and the Company’s previously completed Phase One and Phase Two drilling programs had outlined significant oxide domain gold and silver resources (Canadian NI 43-101 compliant) west of the Calvada open pit that remain open along strike and down-dip*. The four drill holes reported herein, totaling 883 metres, targeted these potential extensions to gold and silver resources. Highlights include:

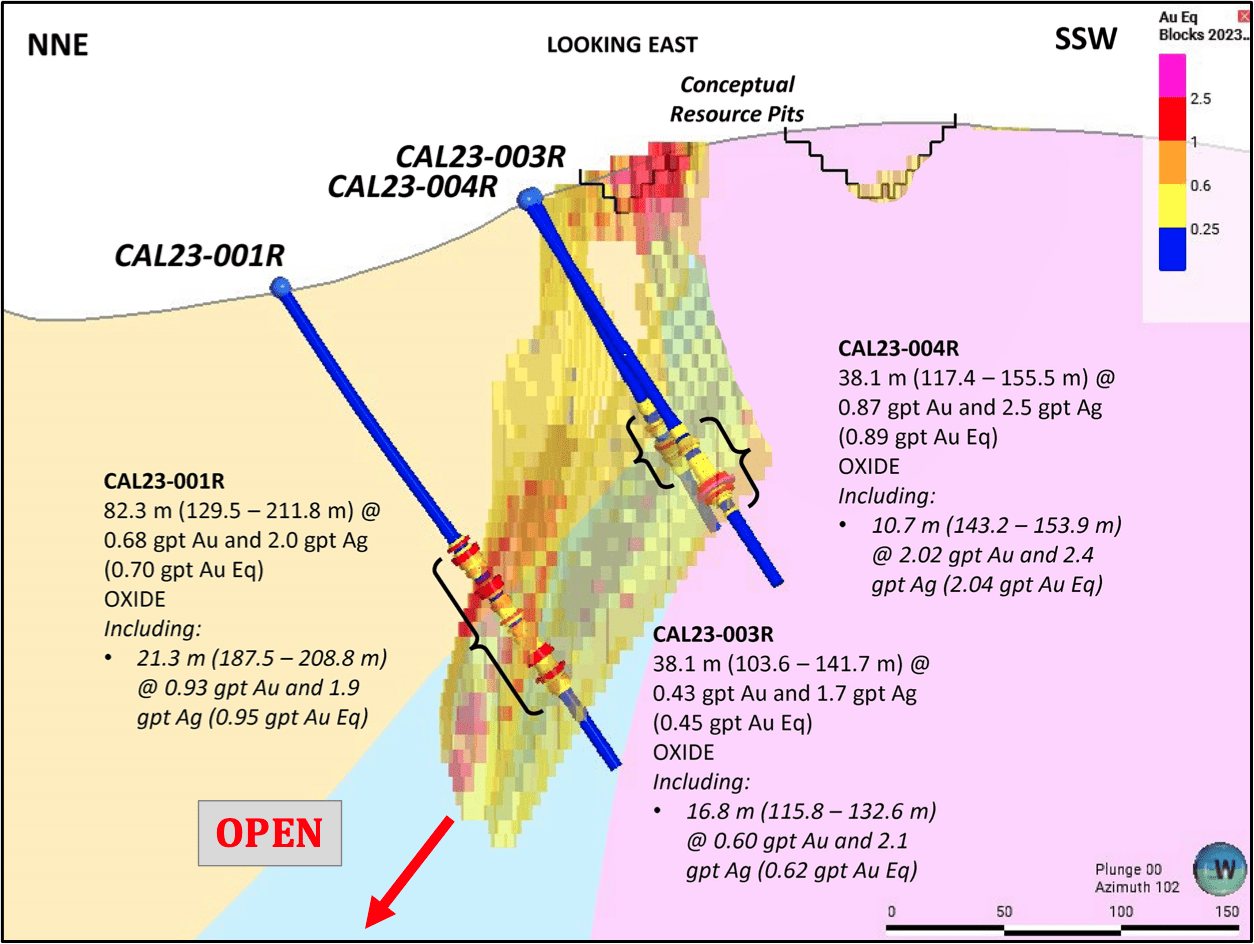

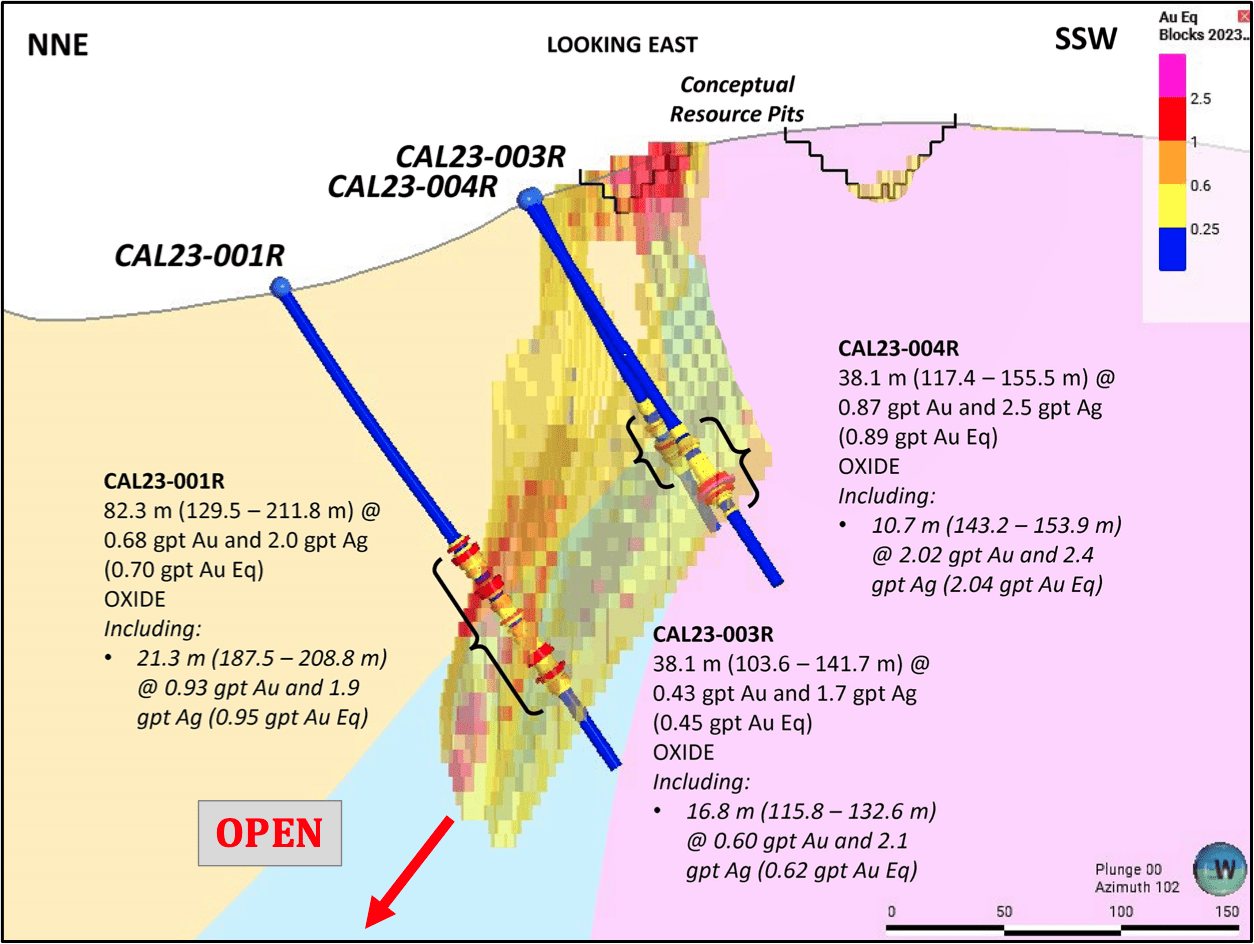

- 38.1 metres grading 0.87 g/t Au and 2.5 g/t Ag (0.89 gpt Au Eq)of oxide metallurgical domain mineralization in drill hole CAL23-004R including 10.6 metres grading 2.02 g/t Au and 2.4 g/t Ag (2.04 gpt Au Eq). This drill hole, coupled with earlier Lahontan drill results, shows that oxide gold and silver mineralization extends in a westerly direction from the Calvada pit along the Calvada Fault, a key target area for resource expansion. (Please see location map, cross section, and table below).

- 82.3 metres grading 0.68 g/t Au and 2.0 g/t (0.70 gpt Au Eq) of oxide metallurgical domain mineralization in drill hole CAL23-001R, including 21.3 metres grading 0.93 gpt Au and 1.9 gpt Ag (0.95 gpt Ag). This thick intercept should help expand the scale of the conceptual pit shell used to constrain mineral resources in future resource estimates. This intercept also contains a higher-grade interval which may be indicative of the margin of a “feeder” structure. Oxide gold and silver mineralization remain open below CAL23-001R generating yet another target for resource expansion at the Santa Fe Mine (Please see cross section below).

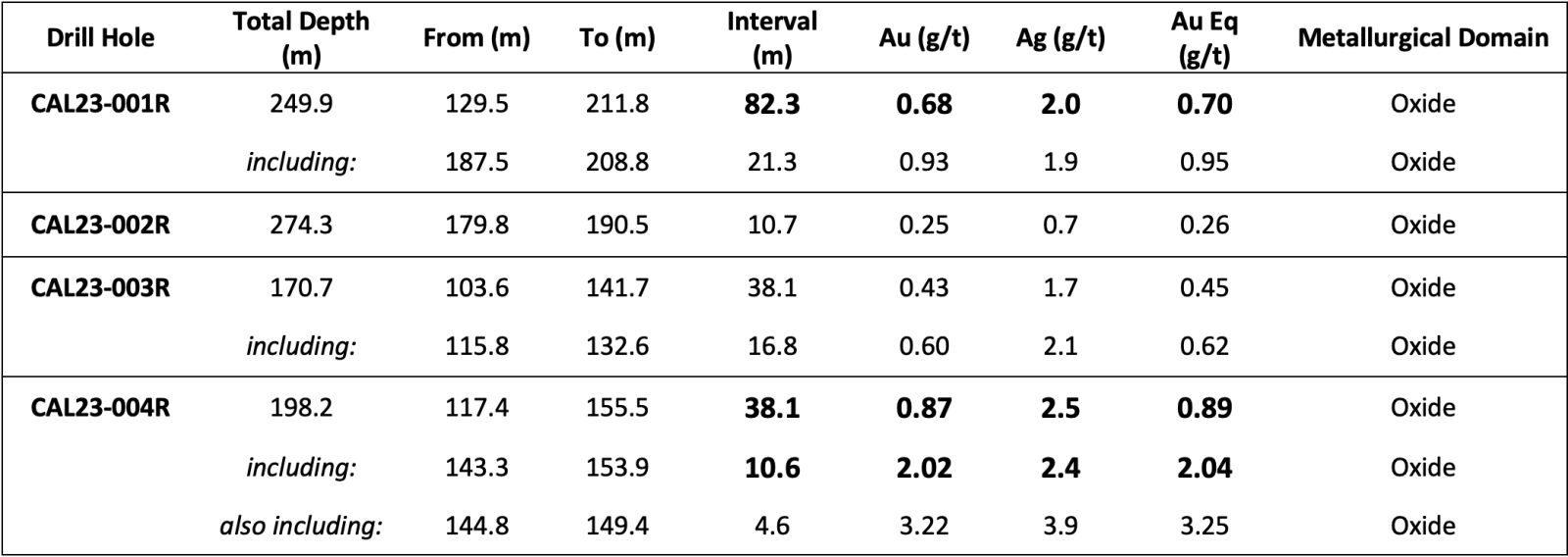

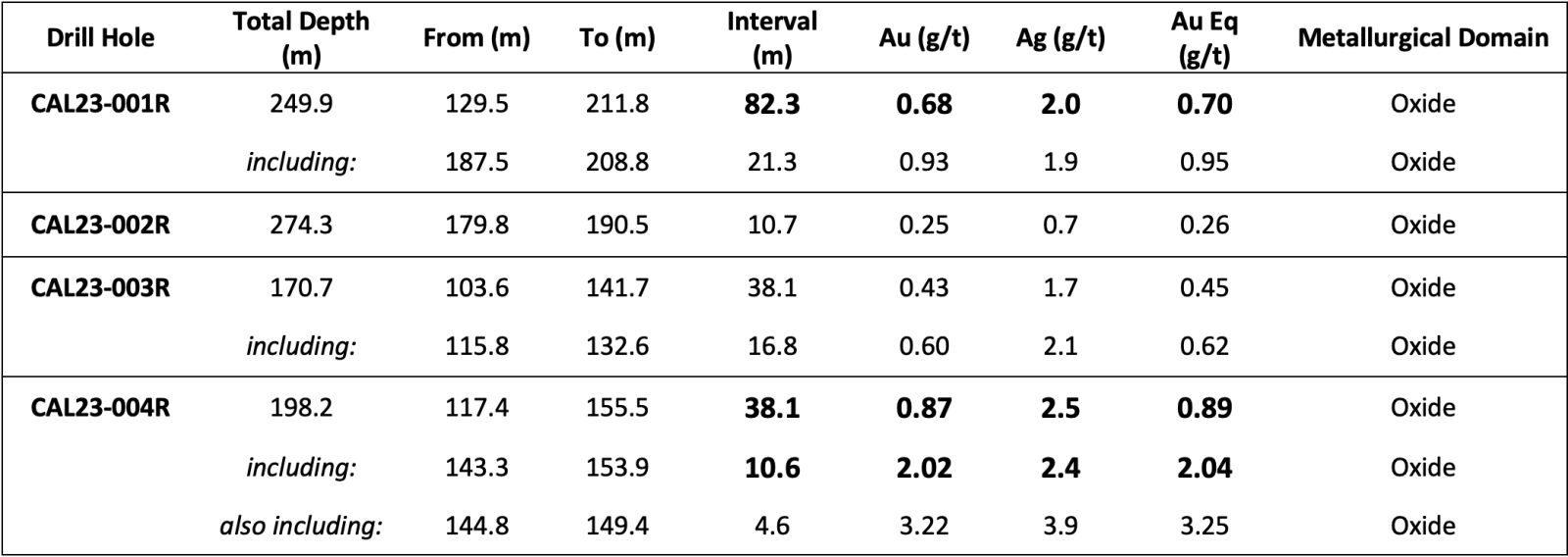

| Notes: Au Eq equals Au (g/t) + ((Ag g/t/75)*0.66). Ag grade for calculating Au Eq is adjusted to consider historic metallurgical recovery as described in the Santa Fe Project Technical Report*. True thickness of the intercepts is estimated to be 80-90% of the drilled interval. Numbers may not total precisely due to rounding. |

|

| Kimberly Ann, Lahontan Founder, CEO, President, and Director commented: “These initial drill results confirm the presence of extensive oxide domain gold and silver mineralization west of the Calvada open pit. Modeling of this area during preparation of our Mineral Resource Estimate (“MRE”) outlined multiple areas where new resources could be defined with in-fill and step-out drilling. These drill results confirm this interpretation of the resource model and open new areas for additional drilling. In addition, the high gold and silver grades seen in drill hole CAL23-004R (4.6 metres grading 3.25 g/t Au Eq) suggests that we may have identified an important “feeder” zone for gold mineralization in the Slab-Calvada complex.” |

|

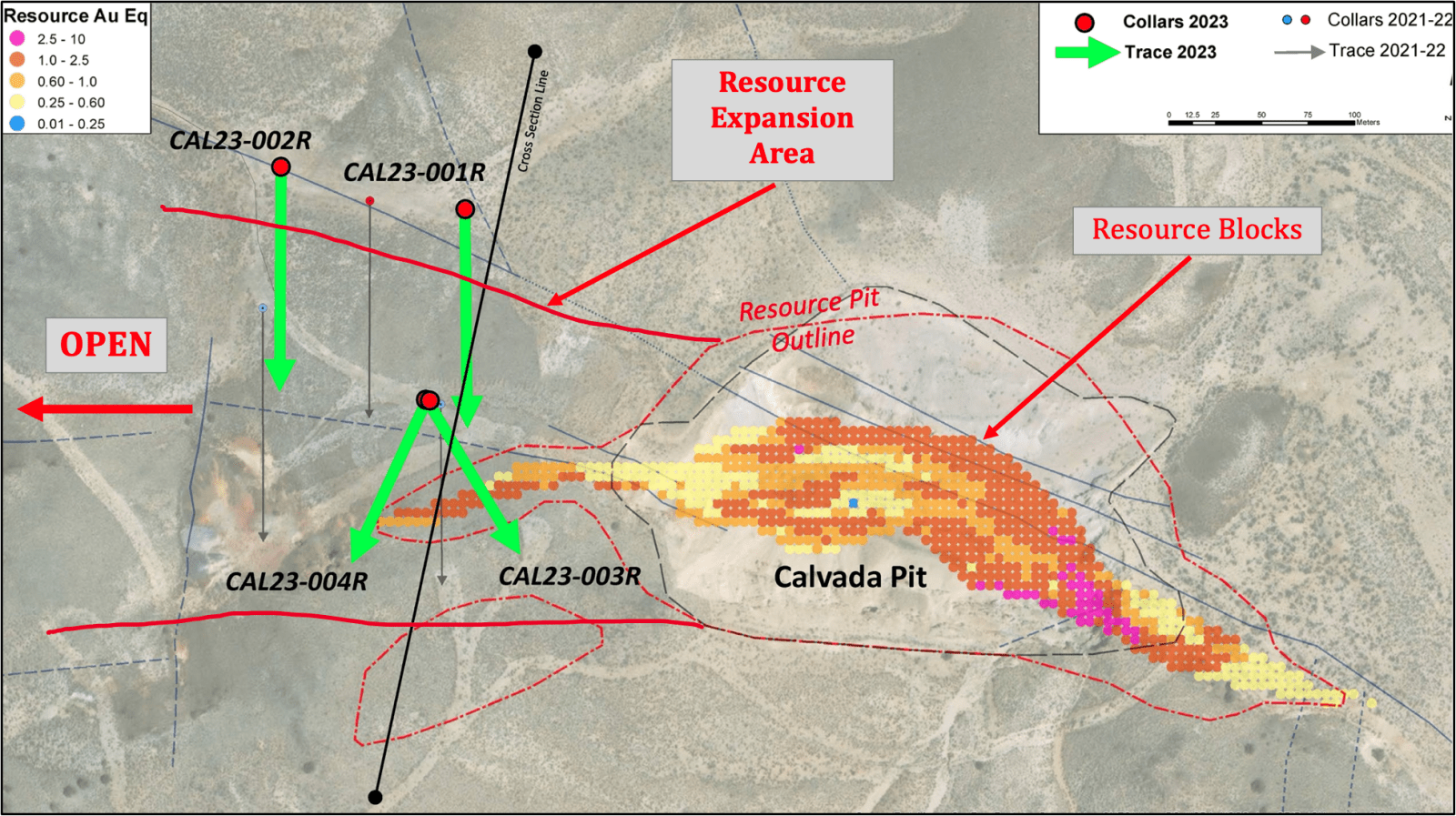

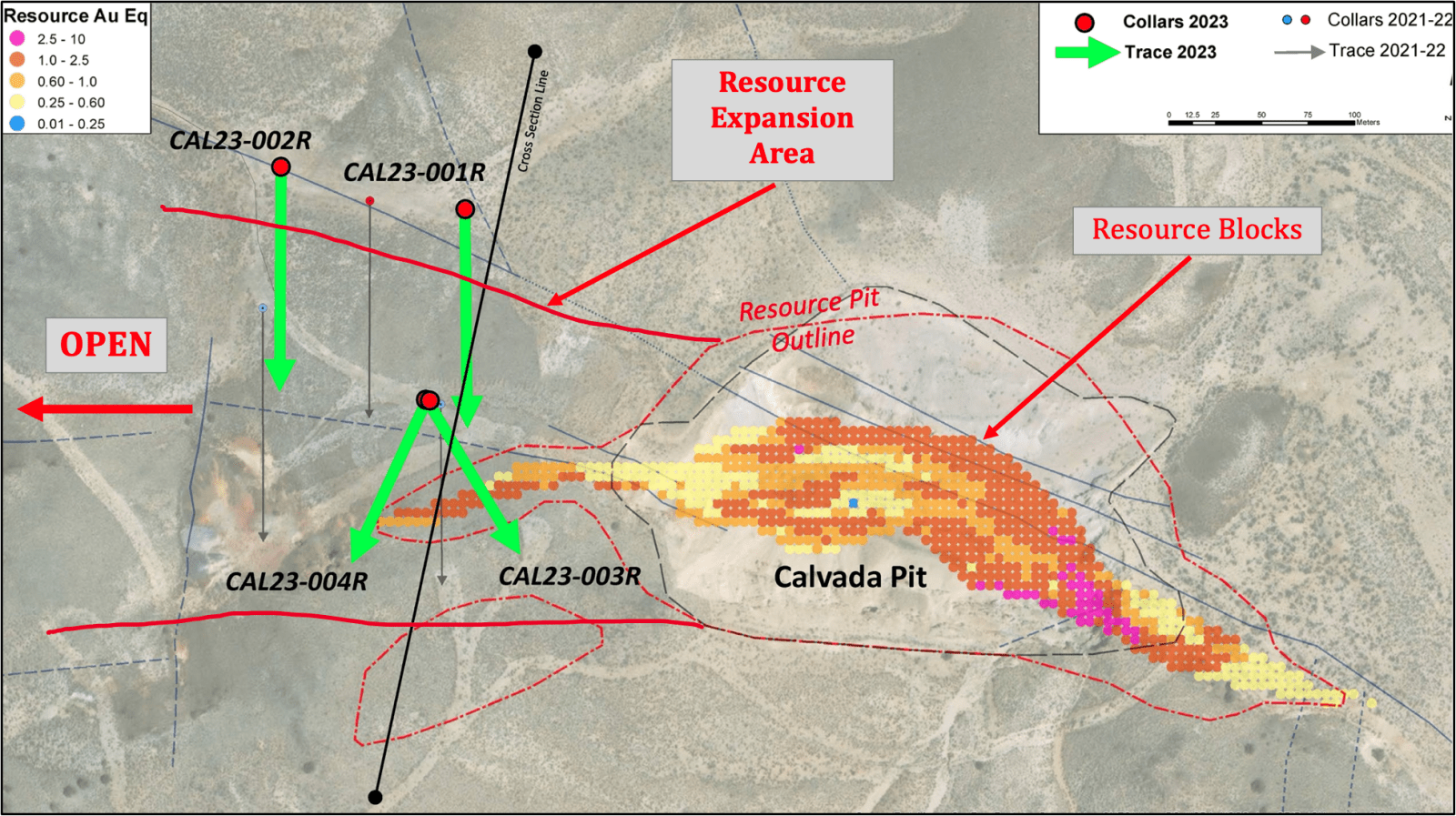

Plan view of the Calvada pit area, Santa Fe Mine, Nevada. The outline of the Calvada pit is shown in black with MRE conceptual pit shell shown in dashed red. Resource blocks are color-coded for Au Eq grade in g/t. The four drill holes reported herein are shown with heavy green drill hole traces, the line of the cross section (below) is also shown.

| Cross section through Calvada pit area drill holes. These new zones of deeper oxide Au and Ag mineralization have the potential to “pull-down” the conceptual pit shells used to constrain resource estimation when the resource is updated following completion of the Phase Three drilling campaign. |

|

| The plan view and cross section of the Calvada pit area (above) highlights the resource expansion potential of the current drilling campaign. All four drill holes intercepted significant oxide gold and silver mineralization, expanding the footprint of the Calvada resource to the west. Mineralization remains open to the west, east and at depth and will be the subject of additional drilling during 2023. |

|

| QA/QC Protocols:

Lahontan conducts an industry standard QA/QC program for its core and RC drilling programs. The QA/QC program consisted of the insertion of coarse blanks and Certified Reference Materials (CRM) into the sample stream at random intervals. The targeted rate of insertion was one QA/QC sample for every 16 to 20 samples. Coarse blanks were inserted at a rate of one coarse blank for every 65 samples or approximately 1.5% of the total samples. CRM’s were inserted at a rate of one CRM for every 20 samples or approximately 5% of the total samples.

The standards utilized include three gold CRM’s and one blank CRM that were purchased from Shea Clark Smith Laboratories (MEG) of Reno, Nevada. Expected gold values are 0.188 g/t, 1.107 g/t, 10.188 g/t, and -0.005 g/t, respectively. The coarse blank material comprised of commercially available landscape gravel with an expected gold value of -0.005 g/t.

As part of the RC drilling QA/QC process, duplicate samples were collected of every 20th sample interval at the drill rig to evaluate sampling methodology. Samples were collected from the reject splitter on the drill rig cyclone splitter. Samples were collected at each 95- to 100-foot (28.96 – 30.48m) mark and labeled with a “D” suffix on the sample bag. No duplicates were submitted for core.

All drill samples were sent to American Assay Laboratories (AAL) in Sparks, Nevada, USA for analyses. Delivery to the lab was either by a Lahontan Gold employee or by an AAL driver. Analyses for all RC and core samples consisted of Au analysis using 30-gram fire assay with ICP finish, along with a 36-element geochemistry analysis performed on each sample utilizing two acid digestion ICP-AES method. Tellurium analyses were performed on select drill holes utilizing ICP-MS method. Cyanide leach analyses, using a tumble time of 2 hours and analyzed with ICP-AES method, were performed on select drill holes for Au and Ag recovery. AAL inserts their own blanks, standards and conducts duplicate analyses to ensure proper sample preparation and equipment calibration. We have all results reported in grams per tonne (g/t). |

|

| About Lahontan Gold Corp.

Lahontan Gold Corp. is a Canadian mineral exploration company that holds, through its US subsidiaries, four top-tier gold and silver exploration properties in the Walker Lane of mining friendly Nevada. Lahontan’s flagship property, the 19 km2 Santa Fe Mine, had past production of 345,000 ounces of gold and 711,000 ounces of silver between 1988 and 1995 from open pit mines utilizing heap-leach processing (Nevada Bureau of Mines and Geology, 1995). The Santa Fe Mine has Canadian National Instrument 43-101 compliant Indicated Mineral Resources of 1,112,000 oz Au Eq (grading 1.14 g/t Au Eq) and an Inferred Mineral Resource of 544,000 oz Au Eq (grading 1.00 g/t Au Eq), all pit constrained (Au Eq is inclusive of recovery, please see Santa Fe Project Technical Report*). The Company will continue to aggressively explore Santa Fe during 2023 and begin the process of evaluating development scenarios to bring the Santa Fe Mine back into production. Quentin J. Browne, P.Geo., Consulting Geologist to Lahontan Gold Corp., is the Qualified Person for the Company and approved the technical content of this news release |

|

| * Please see the Santa Fe Project Technical Report, Authors: Trevor Rabb and Darcy Baker, P. Geos. Effective Date: December 7, 2022, Report Date: March 2, 2023. The Technical Report is available on the Company’s website and SEDAR. |

|