LaFleur Minerals Completes Mineral Resource Estimate for the Swanson Property in the Abitibi Greenstone Belt, Québec

LaFleur Minerals Inc. (CSE: LFLR) (OTC Pink: WPNNF) is pleased to announce a Mineral Resource Estimate for its 100%-owned Swanson Property located in the southern portion of the Abitibi Gold Belt in Québec. The current MRE is an update to the historical estimate completed by previous operator Monarch Mining Corp. in 2021. The Company has filed a Technical Report completed to National Instrument 43-101 standards with an effective date of September 17, 2024 on its SEDAR+ profile that includes the current MRE results for the Swanson Property and detailed technical information on the entire Swanson Gold Project.

Highlights

- Total Indicated Mineral Resource Estimate of 2,113,000 t with an average grade of 1.8 g/t gold for 123,400 oz of contained gold.

- Total Inferred Mineral Resource Estimate of 872,000 t with an average grade of 2.3 g/t gold for 64,500 oz of contained gold.

- Results of the most recent drilling completed at Swanson in 2021-2022 indicates an 8% increase in the number of gold ounces in the Indicated Resource category and a 626% increase in the number of gold ounces in the Inferred Resource category compared to the 2021 historical estimate.

- LaFleur Minerals moving forward with recommended Phase 1 exploration program at Swanson including a very high-resolution magnetic-VLF-EM geophysical survey, oriented soil sampling program, and prospecting and geological mapping with plans to commence drilling in late 2024 and early 2025.

The MRE was completed by InnovExplo, based in Val-d’Or Québec and is derived from drill hole database which contains 242 surface drill holes totalling 36,271.7 m and 17,109 sampled intervals. The MRE includes an additional 31 drill holes totaling 11,194 m that were not included in the previous historical estimate dated January 2021. The recent drilling was carried out by Monarch in 2021-2022, prior to the Property being purchased by LaFleur Minerals in 2024. No new drilling has been conducted by LaFleur Minerals to date.

By incorporating these 31 additional exploration drill holes, the Swanson mineral resource has increased to 123,400 contained gold ounces in the Indicated Resource category (an increase of 8%) and to 64,500 contained gold ounces in the Inferred Resource category (a significant increase of 626%).

“LaFleur Minerals is very excited to announce an updated mineral resource estimate for the Swanson Property and a Technical Report on the entire Swanson Gold Project,” stated Paul Ténière, CEO of LaFleur Minerals. “Swanson benefits from being an advanced exploration and resource stage project with a large property position hosting numerous significant gold showings. The substantial increase in the total number of gold ounces from the limited recent drilling demonstrates the significant growth potential of the deposit and of the Swanson Gold Project in general.”

Swanson Mineral Resource Estimate

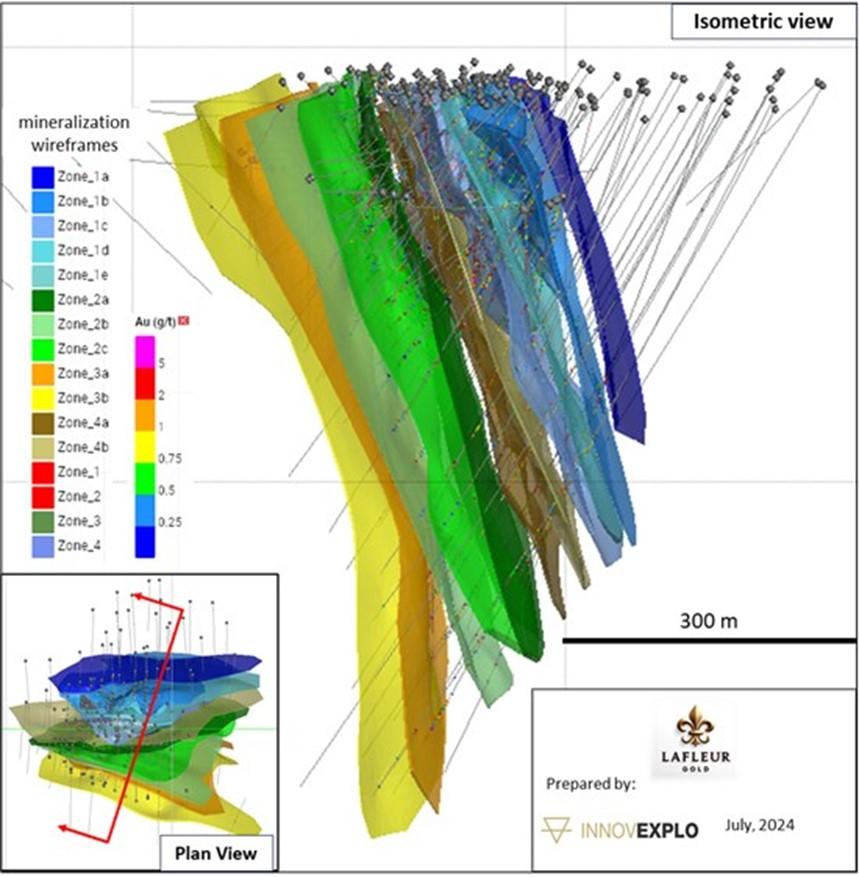

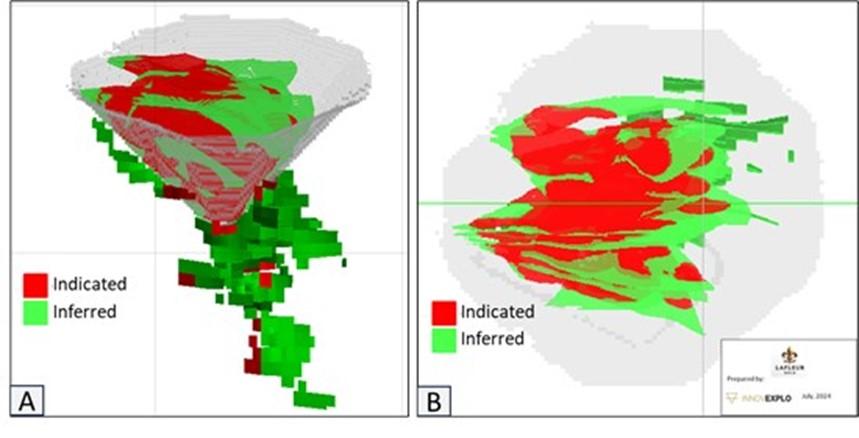

The current MRE is summarized in Table 1 and incorporates a total of 242 surface drill holes (36,271.7 m) that includes 17,109 sampled intervals. The deposit database also includes lithological, alteration, mineralization and structural descriptions and measurements taken from drill core logs. An additional 31 drill holes (11,194 m) were incorporated into the existing drill hole database, representing the drilling completed by Monarch since the initial MRE completed in 2021. No new drilling has been conducted by LaFleur Minerals to date. The mineral resource area for the Swanson deposit covers an area 475 m long, 425 m wide and 500 m deep and is constrained by a combined open-pit and underground mining scenario to meet reasonable prospects for eventual economic extraction (RPEEE) (Figure 1, 2).

The current MRE was optimized with a price of gold at $1,850 resulting in a cut-off grade of 0.80 g/t gold cut-off grade for the open-pit constrained resource and a cut-off grade of 2.30 g/t Au for the underground constrained resource with a minimum width of 2.0 m, which is appropriate for this style of deposit and typical of similar gold mines in the Abitibi Gold Belt.

Table 1: Swanson Project Mineral Resource Estimate for a combined open-pit and underground scenario

| Swanson Gold Project | |||

| Open-Pit Mineral Resource (at 0.8 g/t Au cut-off) | |||

| Resource Classification |

Tonnes | Grade | Contained Ounces |

| (t) | (g/t Au) | (oz Troy Au) | |

| Indicated | 2 064 000 | 1,8 | 119 300 |

| Inferred | 450 000 | 2,0 | 28 500 |

| Underground Mineral Resource (at 2.3 g/t Au cut-off) | |||

| Resource Classification |

Tonnes | Grade | Contained Ounces |

| (t) | (g/t Au) | (oz Troy Au) | |

| Indicated | 49 000 | 2,6 | 4 100 |

| Inferred | 422 000 | 2,7 | 36 000 |

| Swanson Gold Project Total Resources | |||

| Resource Classification |

Tonnes | Grade | Contained Ounces |

| (t) | (g/t Au) | (oz Troy Au) | |

| Total Indicated | 2 113 000 | 1,8 | 123 400 |

| Total Inferred | 872 000 | 2,3 | 64 500 |

Notes to Accompany Mineral Resource Estimate Table:

(1) These mineral resources are not mineral reserves as they do not have demonstrated economic viability. The MRE follows current CIM Definition Standards (2014) and CIM MRMR Best Practice Guidelines (2019). The results are presented undiluted and are considered to have reasonable prospects for eventual economic extraction.

(2) The independent and qualified persons for the mineral resource estimate, as defined by NI 43-101, are Chafana Hamed Sako, P.Geo., Martin Perron, P.Eng. and Simon Boudreau, P.Eng. (InnovExplo), and the effective date of the mineral resource estimate is July 4, 2024.

(3) The estimation encompasses twelve (12) zones and a dilution envelope using LeapFrog Geo and interpolated using LeapFrog Edge.

(4) 1.5-m composites were calculated within the mineralized zones using the grade of the adjacent material when assayed or a value of zero when not assayed. 47 visible gold (VG) occurrences originally marked at 34.29 g/t Au were ignored during the compositing. High-grade capping on composites (supported by statistical analysis) was set between 10.0 and 20.0 g/t Au for high-grade envelopes and 5.0 g/t Au for the dilution envelope.

(5) The estimate was completed using a sub-block model in Leapfrog Edge, with a parent block size of 4m x 4m x 4m (X,Y,Z) and a sub-block size of 0.75m x 0.75m x 0.75m (X,Y,Z).

(6) Grade interpolation was obtained by the Ordinary Kriging (OK) method using hard boundaries.

(7) Density values of 2.78 to 2.9 g/cm3 were assigned to all mineralized zones.

(8) Mineral resources were classified as Indicated and Inferred. Indicated resources are defined for blocks were estimated if the 7 holes closest to the block have an average distance < 20 m with pass 1 or 2, and there is reasonable geological and grade continuity. The inferred category is defined for blocks estimated if the 7 holes closest to the block have an average distance < 20 m and if the block was estimated with pass 3 or if the 7 holes closest to the block have an average distance < 40 m and if the block was estimated with pass1, pass 2 or pass 3. and there is reasonable geological and grade continuity.

(9) The MRE is locally pit constrained. The out-pit resources meet the RPEEE requirement by applying constraining volumes to all blocks (combined bulk and selective underground long-hole extraction scenario) using Deswik Mineable Shape Optimizer (DSO).

(10) The RPEEE requirement is satisfied by having cut-off grades based on reasonable parameters for surface and underground extraction scenarios, minimum widths, and constraining volumes. The estimate is presented for potential underground scenarios (realized in Deswik) over a minimum width of 2 m for blocks 20 m high by 20 m long at a cut-off grade of 2.3 g/t Au for the long-hole method. Cut-off grades reflect the currently defined geometry and dip of the mineralized envelopes. The potential open-pit component of the 2023 MRE is locally constrained by an optimized surface in GEOVIA Whittle™ using a rounded cut-off grade of 0.80 g/t Au. The surface cut-off grade was calculated using the following parameters: mining cost = CA$5.50/t; mining overburden cost = CA$4.50/t; processing & transport cost = CA$48.00/t; G&A cost = CA$10.00/t; selling costs = CA$5.00/t; gold price = US$1,850/oz; USD/CAD exchange rate = 1.30; overburden slope angle = 30°; bedrock slope angle = 50°; and mill recovery = 95%. The underground cut-off grade was calculated using the following parameters: mining cost = CA$110.00/t; processing & transport cost = CA$48.00/t; G&A cost = CA$10.00/t; selling costs = CA$5.00/t; gold price = US$1,850/oz; USD/CAD exchange rate = 1.30 and mill recovery = 95%.

(11) Cut-off grades should be re-evaluated in light of future prevailing market conditions (metal prices, exchange rates, mining costs etc.).

(12) The number of metric tons (tonnes) was rounded to the nearest thousand, following the recommendations in NI 43-101. The metal contents are presented in troy ounces (tonnes x grade / 31.10348) rounded to the nearest hundred. Any discrepancies in the totals are due to rounding effects.

(13) The QPs are not aware of any known environmental, permitting, legal, title-related, taxation, socio-political, or marketing issues or any other relevant issue not reported in the Technical Report that could materially affect the Mineral Resources Estimate.

Figure 1: Wireframes of Interpreted Mineralized Domains of the Swanson deposit

Figure 2: Isometric (A) and plan view (B) showing the classified mineral resources of the Swanson deposit

Swanson Development Potential

The zones of gold mineralization defined in the current Mineral Resource Estimate remain open, with numerous recent gold intersections defining drill-ready targets highlighting the potential for mineral resource growth and new discoveries. Several gold showings on the Swanson Gold Project (Jolin, Bartec) also include historical mineral resource estimates referenced in SIGÉOM and completed prior to the introduction of CIM and NI 43-101 disclosure standards.

Historical drilling results along the Swanson deposit trend as well as discoveries in the Jolin and Bartec areas underscore the exploration and development potential of the Property. The Property includes several favourable gold bearing regional structures and deformation corridors that extend across the Property.

LaFleur has recently commenced geological prospecting, soil geochemistry along with property-wide airborne geophysics (magnetics and VLF-EM) to develop an exploration path to support discovery of new deposits in this underexplored Property. This field work along with compilation and 3D modelling will develop drill targets for resource expansion.

Exploration efforts contemplated for 2024-2025 include:

- Geological prospecting and surface geochemistry programs (in progress)

- High Resolution airborne magnetics and VLF-EM survey over the entire property (in progress)

- Infill and step-out diamond drilling program within the Swanson Deposit resource area

- Ground geophysics consisting of IP surveys over known showings

- Drill testing of the Swanson Deposit and other mineral showings

The Swanson Property also benefits from a historical scoping study completed by Agnico Eagle in 2009 to better evaluate the economics for a potential open-pit mining scenario and factoring in the existing railroad on the Property.

Qualified Person Statements

InnovExplo Inc., an independent mining consulting company based in Val-d’Or, Québec, has prepared this mineral resource estimate following CIM and NI 43-101 standards. The independent Qualified Persons for this MRE are Martin Perron, P.Eng., Chafana Sako, P.Geo., and Simon Boudreau, P.Eng., all employees of InnovExplo Inc. Each of these independent QP’s have prepared and approved the scientific and technical information related to the MRE and disclosed in this news release.

All scientific and technical information in this news release has also been reviewed and approved by Louis Martin, P.Geo., Technical Advisor to the Company, and a QP for the purposes of NI 43-101.

About LaFleur Minerals Inc.

LaFleur Minerals Inc. is focused on the acquisition and development of district-scale gold projects in the Abitibi Gold Belt near Val-d’Or, Québec. Our mission is to advance mining projects with a laser focus on our resource-stage Swanson Gold Project, which has significant potential to deliver long-term value. The Swanson Gold Project is approximately 15,000 hectares in size and includes several prospects rich in gold and critical metals previously held by Monarch Mining, Abcourt Mines, and Globex Mining. LaFleur has recently consolidated a large land package along a major structural break that hosts the Swanson, Bartec, and Jolin gold deposits and several others. The Swanson Gold Project is easily accessible by road with a rail line running through the property allowing direct access to several nearby gold mills, further enhancing its development potential.

LaFleur is currently acquiring high-resolution airborne geophysics (mag VLF-EM) to help identify mineralized structures at Swanson and completing detailed soil surveys and prospecting/geological mapping for the purpose of drill hole targeting with the goal to commence diamond drilling on several targets within the next several months.

MORE or "UNCATEGORIZED"

Great Pacific Gold Announces Closing of Upsized $16.9 Million Private Placement Financing Led by Canaccord Genuity Corp

Great Pacific Gold Corp. (TSX-V: GPAC) (OTCQX: FSXLF) (FSE: V3H)... READ MORE

Ridgeline Minerals Provides Assay Results and Drill Program Updates for the Big Blue and Atlas Projects

Big Blue highlights: 0.6 meters grading 0.7% Cu, 3,194 g/t Ag and... READ MORE

Goldshore Intersects 42.7m of 1.09 g/t Au at the Eastern QES Zone of the Moss Deposit

Goldshore Resources Inc. (TSX-V: GSHR) (OTCQB: GSHRF) (FSE: 8X00)... READ MORE

Dios Sells K2 to Azimut

Dios Exploration Inc. (TSX-V: DOS) is pleased to report it has e... READ MORE

Northisle Announces Near Surface Intercepts and Higher-Grade Intercepts at Depth at West Goodspeed on its North Island Project

Highlights: Recent drilling at West Goodspeed supports the presen... READ MORE