Koryx Copper Announces Multiple Higher-Grade Drill Results Over Wide Intercepts at the Haib Copper Project, Southern Namibia

Koryx Copper Inc. (TSX-V: KRY) is pleased to announce assay results from 10 boreholes (2,542m) received as part of the Phase 2 drill program for its 2025 exploration and project development strategy for its wholly-owned Haib Copper Project in southern Namibia.

Haib is an advanced-stage, long-life, low-cost, low-risk open pit copper/molybdenum/gold project that is envisaged to produce a clean copper concentrate via a conventional crushing/milling/flotation metallurgical process, with the potential for additional copper production via heap leaching.

Highlights

- Completed 17 drill holes out of a planned 37 holes in Phase 2 for 4,759m of diamond drilling.

- Assay results received have significantly higher Cu-equivalent grade than the average mineral resource estimate grade over large intercepts and include:

- HM52: 146m @ 0.53% CuEq (112 – 258m)

- HM56: 191m @ 0.47% CuEq (72 – 263m)

- HM43: 141m @ 0.45% CuEq (202 – 343m)

- HM35: 126m @ 0.40% CuEq (16 – 142m)

- HM54: 38m @ 0.45% CuEq (14 – 52m)

- HM55: 106m @ 0.37% CuEq (0 – 106m) and 80m @ 0.58% CuEq (138 – 218m)

- These and the remaining assay results are tabulated in Table 1 below. Assay results for a further 7 out of 17 completed holes are expected within the next 3 weeks.

- 4 drill rigs (2 track-mounted and 2 man portable) are currently drilling on site with a further 4 man-portable rigs expected to be mobilised during Q2.

- The Phase 2 drill program objective is to investigate the controls and continuity of higher-grade mineralisation within the Haib system and guide the design of the follow-up drill programs.

- This program will be followed up by Phase 3 and Phase 4 drilling throughout 2025 and will be used to validate, confirm and upgrade the MRE.

Heye Daun, Koryx Copper’s President and CEO commented: “These drill results are highly encouraging and demonstrate the potential for the Haib mineral resource grade to be improved further with the drilling planned for this year. Our thesis was always that we would be able to improve the grade through 1) targeting higher grade domains 2) tighter geological modelling and 3) the inclusion of significant molybdenum and gold byproduct credits. These drill results are testament to the validity of that thesis.

We are putting a big effort into increasing our geological horsepower and infrastructure on the ground in Namibia in order to improve our geological understanding of Haib and to be able to expedite the 55,000m drill program which we are planning for 2025.

With the met testwork program going very well and ongoing excellent drill results we believe that 2025 will be another transformative year for the Haib Copper Project in Namibia, as we rapidly advance the project towards economic and technical feasibility.”

2025 Technical Strategy

Koryx 2025 technical strategy comprises an intensive drill and study program, including more than 55,000m of growth and quality improvement drilling, aiming to increase the size and grade of the Haib MRE as well as multiple technical, environmental and metallurgical studies. This program will result in an updated Preliminary Economic Assessment and Pre-Feasibility Study for Haib to be published before the end of 2025.

This fast-tracked technical strategy of drilling, study, infrastructure and permitting activities represents a major step-change in the development of Haib and is geared towards the rapid development of the Project to the bankability stage, with major permitting and all technical studies to be concluded by the end of 2026.

Drill Program Description

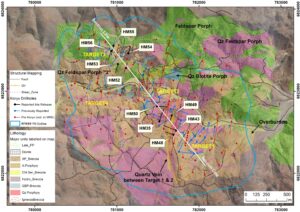

Haib comprises 4 major target areas, each of which has different geological and grade features. All 4 of these target areas are contained within a single large open pit extending approximately 1,400 – 2,400m in width and over 600m in depth from surface, as indicated by the blue outline in Figure 1 below.

Figure 1: Plan view indicating the ten recent drill hole locations and approximate section line shown in Figure 2

Target 1 is in the southeastern portions of Haib and is bounded by the quartz vein in the west, potential faults in the south and east but is open to the north. Potassic alteration dominates with Cu mineralisation hosted in quartz feldspar porphyries. The high-grade Cu mineralisation trends almost WNW to ESE and dips towards the northeast at 15°-20°. Mo is present but not as well developed as in the other target areas. Target 1 is interpreted as being from deeper within the original porphyry complex than the other target areas.

Target 2 is located centrally in a broad band of Cu mineralisation trending northwest to southeast, dipping at >80° towards the southwest. It is bounded by the quartz vein in the southeast and the feldspar porphyries that host Target 3 in the northwest. Better Cu mineralisation is associated with hydrothermal breccias but the quartz feldspar porphyries are also well mineralised in places. The upper portions of Target 2 are dominated by propylitic alteration, becoming potassic with depth. Mo is well developed across most of Target 2 but particularly in the central and western parts.

Target 3 shows some of the widest and highest-grade Cu intersections at Haib. Cu mineralisation appears to start on surface and is associated with steeply dipping breccias within the feldspar porphyries present here. Mineralisation terminates against the large east-west striking, steeply dipping shear zone that defines the northern limit of the Target 3 mineralisation and against possible fault structures in the west. Propylitic alteration dominates. Mo grades are low initially but increase with depth where a number of wide, higher-grade intersections were obtained.

Target 4 is disconnected from the northwest-southeast trend along which the other Targets lie but appears to extend to and intersect with Target 2 in the east. Propylitic alteration dominates with the highest Cu grades occurring in steeply dipping breccias as well as within quartz feldspar porphyry. Overall, Cu mineralisation exhibits an east-west trend dipping steeply (>80°) towards the south. In the north it terminates against a series of parallel east-west faults. Mo is very well developed and along with the western portions of Target 2 exhibit some of the best Mo intersections obtained to date.

The ten holes reported were drilled in the Target 2 and Target 3 areas, with five holes drilled in each area primarily focusing on targeting areas of better Cu grades. Using the positive 2024 results the holes were positioned following modelling of the grades reported in the August 2024 press release. The drilling strategy was to position holes along strike from existing Cu assay results in order to extend the wireframes within the RPEEE pit area to produce additional minable material at above the average resource grade for copper.

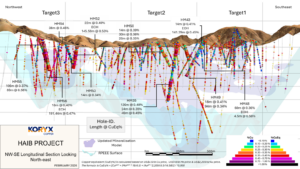

The diagram below indicates a longitudinal section through the long axis of the Haib mineralised area.

Figure 2: Long section looking northeast showing the ten reported drillhole intersection depths relative to the model for Cu mineralization

Five drillholes have been reported for each of the Target 2 and Target 3 areas at Haib. The holes were located along the main strike of the mineralised trend in areas where the continuity of higher-grade intercepts provided the potential for more mineralized material at an above average mineral resource grade.

Discussion of Drill Results

All samples underwent multi-element analyses as well as gold fire assay to ensure the projects ability to account for all byproducts in the next mineral resource estimation (MRE). Assays for molybdenum show a consistent presence and narrower high-grade intercepts both in the copper envelope and outside it. Gold assays indicate a very low grade (mean of 0.020g/t and median of 0.018g/t from over 4,000 samples), but consistent presence of the precious metal almost throughout the copper envelope.

The additional molybdenum data will allow the geological team to begin understanding the controls on molybdenum distribution and produce a specific model for estimation and selective mining. The gold grades are planned to be estimated within the copper wireframe as a credit in the milling and flotation circuit.

Target 2 Results

Results were reviewed in comparison to the existing model, where HM35, HM48 and HM49 successfully produced higher grade assays than the current model. This is particularly pleasing where the higher-grade intercepts start near to surface. HM35 shows a high-grade Mo zone some 70m below surface returning 52m at 0.032% including 4m at 0.078% and 10m at 0.055% Mo.

The results from holes HM43 and HM50 successfully confirmed the projection of higher grades within the existing model and particularly better grades starting near to surface in both holes. The lower part of HM43 ends in a high-grade Mo zone returning 23m at 0.067% and the last 6m of the hole averaging 0.147% Mo. Such high-grades will have a material impact on the CuEq grades in these portions of Target.

HM43 intersected 12m of Au at 0.084g/t which is a significantly elevated grade for the project and will add to the geological understanding of the controls of distribution of gold.

Target 3 Results

The results for five holes were received from the Target 3 area, where the assay results also showed upside against the current model.

HM52 intersected a well-defined high-grade zone (146m at 0.53% CuEq) not previously indicated by historical drilling in an area which the current resource estimate assigned a relatively low grade (0.2-0.3% Cu). These new assays will result in a significant increase in the estimated Cu grades here once a re-estimation using HM52 is completed.

In hole HM54, a 38m wide high-grade zone (0.45% CuEq) was intersected near surface, confirming shallow high-grade mineralisation in this area at a higher grade than the current estimate.

HM55 and HM56 where drilled in proximity to one another, with both confirming shallow higher-grade mineralisation. Both holes were stopped in mineralisation at the planned depth and will be extended. Mo grades within the upper portions of Target 3 are low but improve with depth. From 150m, there is a significant increase in the Mo grades of HM56 averaging 0.014% Mo over 84m.

No significant mineralisation was intersected in HM53 suggesting that the modelled contact of Target 3 mineralisation here is 15m further north. Although this hole does not provide upside, this is already a low-grade area in the model and the results of HM53 will not have a material effect.

HM54 and HM55 show an elevated Au zone with both holes returning 14m zones with grades 0.056-0.068g/t from 20m depth.

In general the good grades that are close to surface in the Target 3 area reinforce this as a potential starter pit for the future open pit.

Drill Program Update

Drilling of the Phase 2 program continues on site with the two existing drill rigs now successfully transitioned to double shift, and increasing the meter production. Two skid mounted rigs were mobilized to site in February and have begun drilling. A further four fully man portable rigs will be mobilized to site in Q2 and initial payments made to the drill contractors enabling them to purchase and mobilize the specialized equipment to site. The new rigs are designed to manage drilling in difficult to access areas given the terrain conditions.

A total of 4,759m have been drilled out of the 8,200m planned in the Phase 2 drilling program. The new rigs are expected to accelerate the completion of the Phase 2 program before moving onto the Phase 3 (29,000m) and Phase 4 (20,000m) programs.

Table of Significant Intersections

| Borehole ID | Zone | From (m) | To (m) | Width (m)1 | CuEq (%)2 | Cu (%) | Mo (%) | Au (g/t) |

| HM35 | Main | 16.00 | 142.00 | 126.00 | 0.40 | 0.31 | 0.017 | 0.024 |

| Including | 70.00 | 82.00 | 12.00 | 0.51 | 0.31 | 0.05 | 0.03 | |

| Including | 88.00 | 106.00 | 18.00 | 0.52 | 0.35 | 0.04 | 0.02 | |

| Main | 180.00 | 204.00 | 24.00 | 0.35 | 0.31 | 0.007 | 0.020 | |

| Main | 334.00 | 384.00 | 50.00 | 0.45 | 0.41 | 0.005 | 0.023 | |

| Including | 348.00 | 356.00 | 8.00 | 0.75 | 0.68 | 0.011 | 0.037 | |

| Main | 448.00 | 494.00 | 46.00 | 0.47 | 0.39 | 0.015 | 0.021 | |

| HM43 | Main | 100.00 | 114.00 | 14.00 | 0.41 | 0.37 | 0.004 | 0.028 |

| Main | 202.00 | 343.29 | 141.29 | 0.45 | 0.37 | 0.016 | 0.028 | |

| Including | 234.00 | 246.00 | 12.00 | 1.32 | 1.25 | 0.003 | 0.084 | |

| Including | 326.00 | 343.29 | 17.29 | 0.69 | 0.36 | 0.077 | 0.033 | |

| HM48 | Main | 18.00 | 78.00 | 60.00 | 0.36 | 0.33 | 0.003 | 0.024 |

| Main | 196.00 | 200.57 | 4.57 | 0.58 | 0.57 | 0.001 | 0.004 | |

| HM49 | Main | 0.00 | 18.00 | 18.00 | 0.41 | 0.40 | 0.001 | 0.014 |

| Main | 54.00 | 148.00 | 94.00 | 0.34 | 0.31 | 0.005 | 0.021 | |

| HM50 | Main | 12.00 | 26.00 | 14.00 | 0.39 | 0.36 | 0.002 | 0.024 |

| Main | 44.00 | 74.00 | 30.00 | 0.36 | 0.33 | 0.003 | 0.025 | |

| Main | 118.00 | 144.00 | 26.00 | 0.35 | 0.29 | 0.010 | 0.021 | |

| HM52 | Main | 78.00 | 100.00 | 22.00 | 0.40 | 0.37 | 0.003 | 0.023 |

| Main | 112.00 | 257.58 | 145.58 | 0.53 | 0.50 | 0.004 | 0.029 | |

| Including | 146.00 | 156.00 | 10.00 | 0.91 | 0.85 | 0.007 | 0.040 | |

| HM53 | Main | 166.00 | 180.00 | 14.00 | 0.34 | 0.28 | 0.009 | 0.023 |

| HM54 | Main | 14.00 | 52.00 | 38.00 | 0.45 | 0.41 | 0.003 | 0.037 |

| HM55 | Main | 0.00 | 106.00 | 106.00 | 0.37 | 0.34 | 0.003 | 0.023 |

| Main | 138.00 | 218.00 | 80.00 | 0.58 | 0.53 | 0.006 | 0.032 | |

| HM56 | Main | 46.00 | 64.00 | 18.00 | 0.40 | 0.38 | 0.001 | 0.015 |

| Main | 72.00 | 263.44 | 191.44 | 0.47 | 0.42 | 0.009 | 0.020 | |

| Including | 84.00 | 90.00 | 6.00 | 0.70 | 0.65 | 0.005 | 0.031 | |

| Including | 112.00 | 130.00 | 18.00 | 0.92 | 0.88 | 0.004 | 0.032 | |

| Including | 148.00 | 152.00 | 4.00 | 1.09 | 1.06 | 0.003 | 0.028 |

- Widths are constrained to where the average assay grade ≥0.35% CuEq. Within the interval width where grades are between 0.3% and 0.35% CuEq these intervals make up <40% of interval; where sample grades are between 0.25% and 0.3% CuEq these intervals are <30% of the interval; where grades are below 0.2% CuEq these intervals are <20% of the interval.

- CuEq (copper equivalent) has been used to express the combined value of copper, molybdenum and gold and is provided for illustrative purposes only. No allowances have been made for recovery losses that may occur should mining eventually result. Calculations use metal prices of US$4.50/lb copper, US$18/lb molybdenum and US$2,200/oz gold, using the formula: CuEq% = [Cuppm + (Moppm * 18/4.50) + (Aug/t * 2,200/(4.5/14.58))] / 10,000. Small differences may exist due to rounding when converting assays reported in ppm to % values.

Quality Control

All drill core was logged, photographed, and cut in half with a diamond saw. Half of the core was bagged and sent to ALS Laboratories Ltd. in Johannesburg, South Africa for analysis (SANAS Accredited Testing Laboratory, No. T0387), while the other half was quartered with one quarter archived and stored on site for verification and reference purposes while the other quarter will be used for metallurgical test work. 33 elements are analyzed by Induced Coupled Plasma (ICP) utilizing a 4-acid digestion and gold is assayed for using a 30g fire assay method. Duplicate samples, blanks, and certified standards are included with every batch and are actively used to ensure proper quality assurance and quality control. The QA/QC frequency is 1 in 20 for each of blanks, duplicates and standards.

Qualified Person

Mr. Dean Richards Pr.Sci.Nat., MGSSA – BSc. (Hons) Geology is the Qualified Person for the Haib Copper Project and has reviewed and approved the scientific and technical information in this news release and is a registered Professional Natural Scientist with the South African Council for Natural Scientific Professions (Pr. Sci. Nat. No. 400190/08) and a Qualified Person for the purposes of National Instrument 43-101.

About Koryx Copper Inc.

Koryx Copper Inc. is a Canadian copper development Company focused on advancing the 100% owned Haib Copper Project in Namibia whilst also building a portfolio of copper exploration licenses in Zambia. Haib is a large, advanced (PEA-stage) copper/molybdenum porphyry deposit in southern Namibia with a long history of exploration and project development by multiple operators. More than 80,000m of drilling has been conducted at Haib since the 1970’s with significant exploration programs led by companies including Falconbridge (1964), Rio Tinto (1975) and Teck (2014).

Haib has a current mineral resource of 414Mt @ 0.35% Cu for 1,459Mt of contained copper in the Indicated category and 345Mt @ 0.33% Cu for 1136Mt of contained copper in the Inferred category (0.25% Cu cut-off). In addition to extensive drilling and metallurgical testing various technical studies have been completed at Haib to date. Extensive additional studies are underway aiming to demonstrate Haib as a future long-life, low-cost, low-risk open pit, sulphide flotation copper project with the potential for additional copper production from heap leaching.

Mineralization at Haib is typical of a porphyry copper deposit and it is one of only a few examples of a paleoproterozoic porphyry copper deposit in the world and one of only two in southern Africa (both in Namibia). Due to its age, the deposit has been subjected to multiple metamorphic and deformation events but still retains many of the classic mineralization and alteration features typical of these deposits. The mineralization is dominantly chalcopyrite with minor bornite and chalcocite present and only minor secondary copper minerals at surface due to the arid environment.

Further details are available on the Company’s website at https://koryxcopper.com and under the Company’s profile on SEDAR+ at www.sedarplus.ca

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE