Koryx Copper Announces Further Positive Drill Results at the Haib Copper Project, Southern Namibia

Highlights

|

|

|

74m @ 0.36% Cu (66 to 140m) incl. 16m @ 0.56% Cu (106 to 122m) |

|

19m @ 0.64% Cu (204 to 223m) |

|

18m @ 0.45% Cu (12 to 30m) |

|

26m @ 0.36% Cu (220 to 246m) 214m @ 0.34% Cu (272 to 486m) |

|

62m @ 0.31% Cu (0 to 62m) 66m @ 0.37% Cu (254 to 320m) |

|

22m @ 0.31% Cu (264 to 376m) |

|

56m @ 0.33% Cu (38 to 94m) |

|

66m @ 0.32% Cu (428 to 494m) 16m @ 0.39% Cu (540 to 556m) |

|

|

Koryx Copper Inc. (TSX-V: KRY) is pleased to announce assay results from 9 drill holes (4,007m) received as part of the Phase 2 and 3 drill program for its 2025 exploration and project development strategy on the wholly-owned Haib Copper Project in southern Namibia.

Haib is an advanced-stage, open pit porphyry Cu/Mo/Au project that is envisaged to produce a copper concentrate via conventional crushing/milling/flotation, with the potential for additional copper production via heap leaching. What sets it apart are its world-class geological scale, technical simplicity with no fatal flaws, scalability and predictable permitting environment in Namibia.

Heye Daun, Koryx Copper’s President and CEO commented: “The latest drill results reinforce the strong fundamentals of the Haib Copper Project, confirming consistent grades over wide intercepts like 214m @ 0.34% Cu in HM104, and delivering localized higher-grade intercepts such as 19m @ 0.64% Cu in HM102. These results provide confidence in the consistency of the metal content as well as opportunities to enhance the grade profile during the mine scheduling process. The team continues to fast track the drill programs, with 12 rigs now operating on site and undertaking varied programs, focused on resource conversion as well as advancing pit wall stability and civil construction geotechnical drilling in preparation for the PFS study which has been initiated. Also, we are fully engaged in completing the updated mineral resource estimate, which for the first time will include gold & molybdenum by-product credits plus a substantially enhanced geological interpretation and improved understanding of the geological controls of the Haib deposit.”

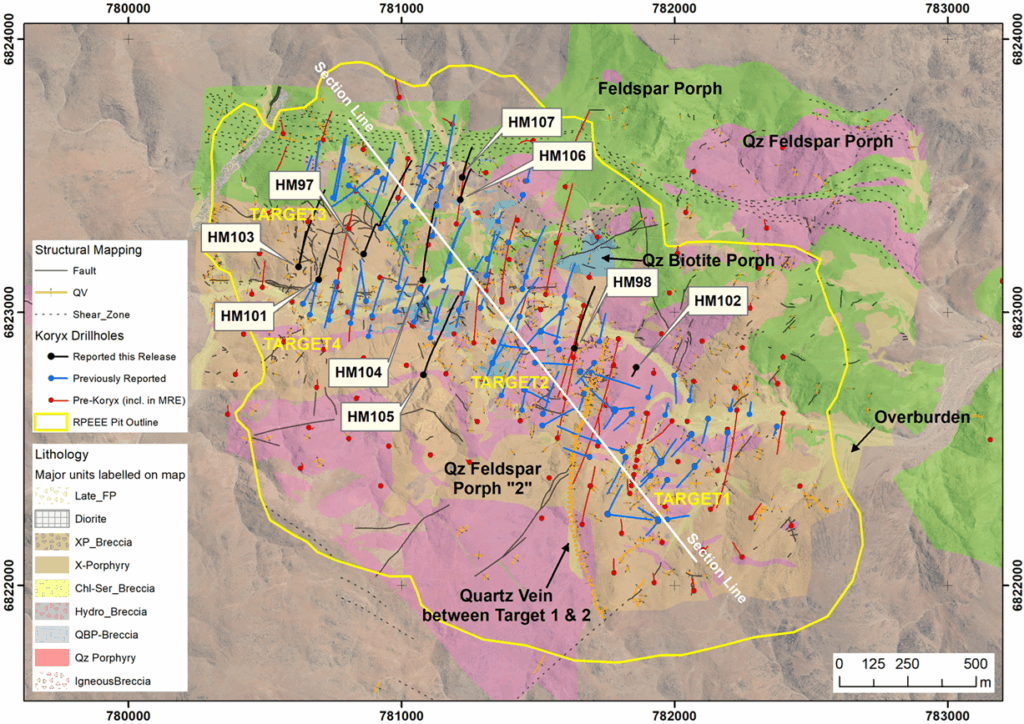

Figure 1: Plan view indicating recent drill hole locations. Assay results indicated in black shown on the long section below

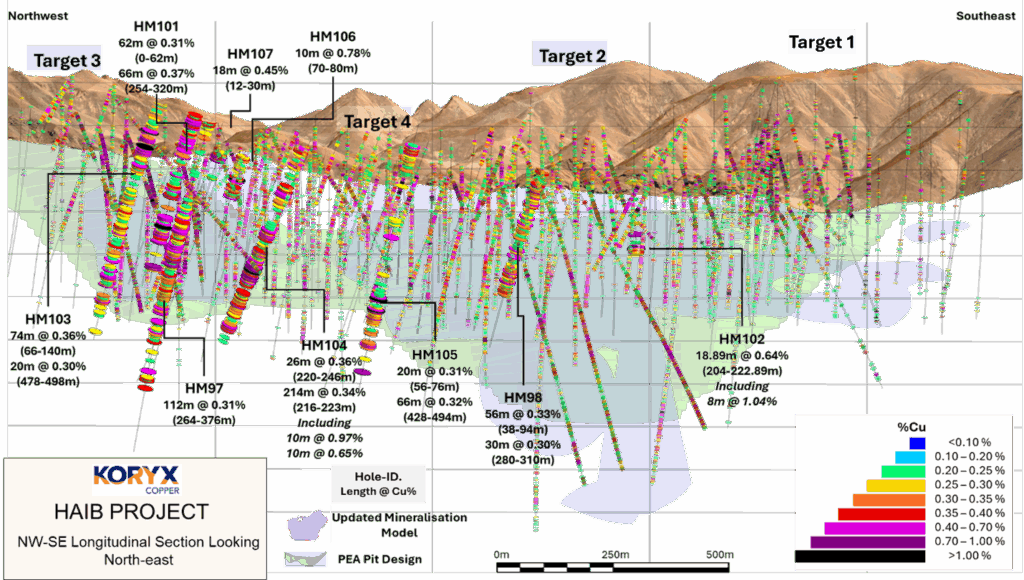

Figure 2. Long section looking northeast showing nine drillhole intersections relative to the model for Cu mineralization

Discussion of Drill Results

Nine drillholes are reported across the main mineralised zone at Haib including one in Target 1, two in Target 2, four in Target 3 and two in Target 4. Approximately half are in-fill holes, while the remainder tested extensions of mineralisation around the periphery of known higher-grade zones. Most peripheral holes returned positive results, suggesting potential for localised increases in resource tonnage. Another encouraging observation is the presence of broad, Au-enriched intervals (>0.1 g/t), particularly in the northern parts of Targets 2 and 3, although their overall significance is not yet fully understood.

Target 1 Results

HM102 was collared just south of the Volstruis River in the northwest of Target 1 to test the down-dip extension of shallow higher-grade mineralisation. Cu mineralisation begins at 204m, slightly deeper than predicted, and continues to end of hole. Based on nearby drilling, this depth difference is more likely related to faulting near the Volstruis River than to a change in dip. Mo and Au are generally absent, except for a 6m interval between 206–212m averaging 0.13 g/t Au and 1.18% Cu.

Target 2 Results

HM98 was drilled northwards from the centre of Target 2, to better define the northern limit of Cu mineralisation. Results align closely with expectations with mineralisation ending at 358m (predicted 360m). Within the broad mineralised zones, Cu grades remain consistently between 0.30 and 0.35%, with higher grades restricted to isolated samples. Mo is not present in significant amounts, and Au is low overall, except for a short interval between 62 and 70m where it averages just below 0.1 g/t.

HM105 was collared southwest of Target 2 to test the westward extension of newly identified NW–SE trending Cu mineralisation along the southwestern margin of the target. A secondary objective was to determine whether Cu mineralisation intersected historically by RTZ hole HB012, located 145m to the south, extended north-eastwards. As no mineralisation had previously been modelled in this area, the positive Cu intersections represent new resource tonnage and potentially a new Cu zone. Mo is largely absent except between 40 and 114m, where it averages 0.02% (including three samples >0.1%). Gold remains at or near the detection limit (0.005 g/t).

Target 3 Results

HM97 was collared in the north of Target 4 and drilled northwards into the main Target 3 system. As expected, Cu grades are initially low and continue down to 230m, which is deeper than the current resource model. Although this suggests potential localised tonnage loss, the mineralised interval at depth is significantly wider, offsetting this. Mo increases between 198 and 338m, averaging 0.03%, including two samples >0.1% and one at 0.43%. Gold is mostly absent except for a substantial 76m interval between 590 and 660m averaging 0.17 g/t, including multiple samples exceeding 0.2–0.4 g/t and a maximum of 0.55g/t.

HM104 was also collared in northern Target 4 and drilled northwards. It intersects shallow higher-grade mineralisation consistent with holes to the south, confirming that this zone reaches surface just north of the collar. Multiple narrower Cu intervals (6 and 26m wide) occur to 246m, after which the hole enters the main Target 3 mineralisation for 214m intersection width from 272m depth. These results represent significant local tonnage gains, both within the deeper Target 3 and in the volume between Targets 4 and 3.

HM106 was drilled in the northeastern part of Target 3 and positioned to tighten hole spacing near the Shear Zone that bounds the northern extent of mineralisation. Here, Cu occurs in several moderately steep, parallel zones separated by low-grade intervals. This is reflected in HM106 where an upper barren interval is followed by Cu mineralisation between 70 and 120m with multiple narrower higher-grade zones, including a peak grade of 2.2% Cu with 0.16 g/t Au. Below 120m, Cu grades decrease but remain above 0.1%, suggesting the hole did not intersect the Shear Zone. Mo remains low throughout.

HM107 was drilled 80m north of HM106 on the same section and encountered Cu mineralisation near surface, including 12m at 0.9 g/t Au. This correlates well with HM106 and supports a southwest-dipping mineralised geometry. From 34m downward, Cu drops below 0.1% for the remainder of the hole, indicating intersection of the main Shear Zone. Mo is absent; however, between 92–104m, Au averages 0.1 g/t, and the final 2.8m sample returned 0.51 g/t Au.

Target 4 Results

HM101 was collared in the northwest of Target 4 and drilled towards Target 3. It unexpectedly intersected a relatively broad, well-mineralised Cu zone from surface to 62m, despite the resource model predicting little to no shallow Cu here. Additional higher-grade intervals extend to 106m. A 66m intersection averaging 0.37% Cu from 254m lies outside the existing higher-grade domain and, together with upper mineralisation, should contribute positively to local resource tonnage. Mo is elevated between 142 to 204m (~0.02%) and largely absent elsewhere. Gold remains at detection limit.

HM103 was collared west of HM101 and drilled towards Target 3. It also contrasts with the resource model prediction by intersecting a well-developed higher-grade Cu zone between 66 to 144m, followed by three further high-grade intervals down to 436m. At 478m, the hole enters the main Target 3 mineralisation, remaining in it to 498m. Mo is sporadic and low grade, becoming absent below 466m. Au remains at detection limit throughout.

Table of Significant Intersections

| Hole# | Zone | From (m) | To (m) | Width (m)1 | Cu (%) | Mo (%) | Au (g/t) |

| HM97 | Entire Hole | 0 | 839 | 839 | 0.16 | 0.007 | 0.029 |

| Main | 2 | 12 | 10 | 0.32 | 0.001 | 0.010 | |

| Main | 264 | 376 | 112 | 0.31 | 0.026 | 0.024 | |

| Including | 286 | 292 | 6 | 0.59 | 0.022 | 0.037 | |

| Including | 322 | 326 | 4 | 0.53 | 0.254 | 0.069 | |

| Including | 358 | 362 | 4 | 0.69 | 0.003 | 0.047 | |

| Main | 480 | 494 | 14 | 0.31 | 0.002 | 0.020 | |

| HM98 | Entire Hole | 0 | 462 | 462 | 0.24 | 0.003 | 0.028 |

| Main | 0 | 12 | 12 | 0.30 | 0.002 | 0.018 | |

| Main | 38 | 94 | 56 | 0.33 | 0.005 | 0.039 | |

| Main | 120 | 138 | 18 | 0.31 | 0.006 | 0.035 | |

| Main | 250 | 358 | 108 | 0.30 | 0.003 | 0.024 | |

| Including | 280 | 286 | 6 | 0.48 | 0.003 | 0.026 | |

| Including | 352 | 358 | 6 | 1.07 | 0.003 | 0.055 | |

| HM101 | Entire Hole | 0 | 417 | 417 | 0.20 | 0.004 | 0.009 |

| Main | 0 | 62 | 62 | 0.31 | 0.002 | 0.009 | |

| Including | 20 | 24 | 4 | 0.49 | 0.004 | 0.004 | |

| Including | 30 | 34 | 4 | 0.56 | 0.001 | 0.022 | |

| Main | 68 | 82 | 14 | 0.33 | 0.008 | 0.018 | |

| Main | 102 | 106 | 4 | 0.49 | 0.013 | 0.011 | |

| Main | 150 | 154 | 4 | 0.39 | 0.021 | 0.008 | |

| Main | 178 | 190 | 12 | 0.30 | 0.011 | 0.009 | |

| Main | 200 | 208 | 8 | 0.42 | 0.008 | 0.011 | |

| Main | 254 | 320 | 66 | 0.37 | 0.005 | 0.011 | |

| Including | 278 | 282 | 4 | 1.19 | 0.001 | 0.011 | |

| Including | 296 | 302 | 6 | 0.54 | 0.003 | 0.011 | |

| Including | 314 | 318 | 4 | 0.70 | 0.001 | 0.016 | |

| Main | 374 | 382 | 8 | 0.62 | 0.002 | 0.041 | |

| HM102 | Entire Hole | 0 | 223 | 223 | 0.16 | 0.001 | 0.021 |

| Main | 204 | 223 | 19 | 0.64 | 0.002 | 0.058 | |

| Including | 204 | 212 | 8 | 1.04 | 0.003 | 0.126 | |

| HM103 | Entire Hole | 0 | 591 | 591 | 0.24 | 0.004 | 0.027 |

| Main | 66 | 140 | 74 | 0.36 | 0.006 | 0.015 | |

| Including | 66 | 70 | 4 | 1.28 | 0.002 | 0.017 | |

| Including | 84 | 92 | 8 | 0.50 | 0.005 | 0.014 | |

| Including | 106 | 122 | 16 | 0.56 | 0.015 | 0.026 | |

| Main | 152 | 160 | 8 | 0.37 | 0.002 | 0.029 | |

| Main | 306 | 314 | 8 | 0.32 | 0.008 | 0.020 | |

| Main | 428 | 436 | 8 | 0.47 | 0.001 | 0.048 | |

| Main | 478 | 498 | 20 | 0.30 | 0.000 | 0.034 | |

| HM104 | Entire Hole | 0 | 515 | 515 | 0.25 | 0.008 | 0.022 |

| Main | 10 | 22 | 12 | 0.33 | 0.001 | 0.021 | |

| Main | 50 | 56 | 6 | 0.33 | 0.001 | 0.023 | |

| Main | 106 | 120 | 14 | 0.34 | 0.011 | 0.024 | |

| Including | 118 | 120 | 2 | 0.76 | 0.001 | 0.040 | |

| Main | 126 | 134 | 8 | 0.44 | 0.008 | 0.030 | |

| Including | 126 | 128 | 2 | 0.60 | 0.008 | 0.049 | |

| Including | 132 | 134 | 2 | 0.84 | 0.008 | 0.049 | |

| Main | 220 | 246 | 26 | 0.36 | 0.005 | 0.027 | |

| Main | 272 | 486 | 214 | 0.34 | 0.010 | 0.024 | |

| Including | 312 | 316 | 4 | 0.83 | 0.005 | 0.031 | |

| Including | 320 | 330 | 10 | 0.97 | 0.006 | 0.052 | |

| Including | 338 | 348 | 10 | 0.65 | 0.007 | 0.030 | |

| Including | 414 | 420 | 6 | 0.44 | 0.004 | 0.027 | |

| HM105 | Entire Hole | 0 | 657 | 657 | 0.15 | 0.005 | 0.013 |

| Main | 56 | 76 | 20 | 0.31 | 0.042 | 0.019 | |

| Main | 428 | 494 | 66 | 0.32 | 0.002 | 0.018 | |

| Including | 434 | 440 | 6 | 0.52 | 0.001 | 0.015 | |

| Including | 460 | 464 | 4 | 0.97 | 0.003 | 0.051 | |

| Main | 540 | 556 | 16 | 0.39 | 0.002 | 0.025 | |

| HM106 | Entire Hole | 0 | 223 | 223 | 0.16 | 0.002 | 0.022 |

| Main | 70 | 80 | 10 | 0.78 | 0.006 | 0.063 | |

| Including | 72 | 76 | 4 | 1.42 | 0.010 | 0.107 | |

| Main | 100 | 106 | 6 | 0.34 | 0.003 | 0.021 | |

| HM107 | Entire Hole | 0 | 223 | 223 | 0.10 | 0.001 | 0.040 |

| Main | 12 | 30 | 18 | 0.45 | 0.006 | 0.060 |

- Widths are interval widths and not true widths. The reported intervals are calculated using the following parameters:

- Only Cu(%) was used to determine the intervals

- The target composite grade is ≥0.30% Cu.

- Composites start and end with samples ≥0.30% Cu.

- Grades between 0.20% and 0.30% are included in interval but generally constitute <40% of the interval.

- Consecutive samples between 0.20% and 0.30% should be fewer than 5 samples (10m).

- Grades below 0.20% are included but generally constitute <20% of the interval.

- Consecutive grades <0.2% should be fewer than 2 samples (4m).

Resource Modelling Update

The early Phase 2 drill programs completed in the first half of 2025 successfully targeted areas of localised higher grade in the core of the system. The subsequent Phase 3 and 4 drill programs focused on stepping back from the central areas of the deposit to begin extension as well as resource conversion drilling. To this end, the new drillhole results locally extend mineralisation, while infill drilling is broadly in line with expectations and supports the average grade of the resource, confirming the metal content while converting material from Indicated to Inferred category.

Encouragingly, localised areas of higher-grade material are still being intersected away from the centralised trend, for example HM102 (19m @ 0.64% Cu). This provides opportunities for localised improvements to the grade model and mine scheduling opportunities.

Work on the updated MRE is ongoing, and the modelling continues to be informed by new geological insights into the controls on mineralisation. The team have recently generated models on fault zones which are being incorporated as an additional control. Work is near finalisation on the new MRE, which will incorporate Mo and Au assay results from the most recent drilling campaign, which successfully expanded the known mineralized zones and confirmed continuity in several key areas of the deposit.

It is anticipated that the updated MRE will be published before the end of January 2026.

Drill Program Update

The drill program on site has progressed steadily as additional rigs continue to be mobilized to site in line with the team’s capacity to log and process the core, as well as balancing the increasing need to gain access to further drill sites as the drilling program footprint expands into logistically more difficult terrain.

Since the previous drill update in October with 10 rigs, two additional rigs have been added and currently there are 12 diamond core machines operating. As the drill requirements become more dynamic, the team are now managing and resourcing multiple programs, meaning that while nine rigs continue on the resource conversion program, one rig is drilling pit geotechnical holes, and two rigs are drilling civils geotechnical holes in preparation for the PFS.

Quality Control

All drill core was logged, photographed, and cut in half with a diamond saw. Half of the core was bagged and sent to ALS Laboratories Ltd. in Johannesburg, South Africa for analysis (SANAS Accredited Testing Laboratory, No. T0387) and ActLabs in Canada, while the other half was quartered with one quarter archived and stored on site for verification and reference purposes while the other quarter will be used for metallurgical test work. 33 elements are analysed by Induced Coupled Plasma (“ICP”) utilizing a 4-acid digestion and gold is assayed for using a 30g fire assay method. Duplicate samples, blanks, and certified standards are included with every batch and are actively used to ensure proper quality assurance and quality control The QA/QC frequency is 1 in 20 for each of blanks, duplicates and standards.

Qualified Person

Mr. Dean Richards Pr.Sci.Nat., MGSSA – BSc. (Hons) Geology is the Qualified Person for the Haib Copper Project and has reviewed and approved the scientific and technical information in this news release and is a registered Professional Natural Scientist with the South African Council for Natural Scientific Professions (Pr. Sci. Nat. No. 400190/08). Mr. Richards is independent of the Company and its mineral properties and is a Qualified Person for the purposes of National Instrument 43-101.

About Koryx Copper Inc.

Koryx Copper Inc. is a Canadian copper development Company focused on advancing the 100% owned Haib Copper Project in Namibia whilst also building a portfolio of copper exploration licenses in Zambia. Haib is a large, advanced (PEA-stage) copper/molybdenum porphyry deposit in southern Namibia with a long history of exploration and project development by multiple operators. More than 80,000m of drilling has been conducted at Haib since the 1970’s with significant exploration programs led by companies including Falconbridge (1964), Rio Tinto (1975) and Teck (2014). Extensive metallurgical testing and various technical studies have also been completed at Haib to date.

Additional studies are underway aiming to demonstrate Haib as a future long-life, low-cost, low-risk open pit, sulphide flotation copper project with the potential for additional copper production from heap leaching. Haib has a current mineral resource of 511Mt @ 0.33% Cu and 51ppm Mo for 1,668kt of contained copper and 25.9kt contained Mo in the Indicated category and 308.9Mt @ 0.31% Cu and 40ppm Mo for 949Mt of contained copper and 12.4kt contained Mo in the Inferred category (0.15% Cu cut-off).

Mineralization at Haib is typical of a porphyry copper deposit and it is one of only a few examples of a Paleoproterozoic porphyry copper deposit in the world and one of only two in southern Africa (both in Namibia). Due to its age, the deposit has been subjected to multiple metamorphic and deformation events but still retains many of the classic mineralization and alteration features typical of these deposits. The mineralization is dominantly chalcopyrite with minor bornite and chalcocite present and only minor secondary copper minerals at surface due to the arid environment.

MORE or "UNCATEGORIZED"

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE

Monument Reports Second Quarter Fiscal 2026 Results

Monument Mining Limited (TSX-V: MMY) (FSE: D7Q1) today announced its financial results for the three... READ MORE

Taseko announces First Cathode Harvest at Florence Copper

Taseko Mines Limited (TSX: TKO) (NYSE American: TGB) (LSE: TKO) is pleased to announce its F... READ MORE

Highland Copper Closes Sale of 34% Interest in White Pine for US$30 Million

Highland Copper Company Inc. (TSX-V: HI) (OTCQB: HDRSF) is pleased to announce, further to its press... READ MORE