Kinross reports strong 2025 third-quarter results

Kinross Gold Corporation (TSX: K) (NYSE: KGC) today announced its results for the third quarter ended September 30, 2025.

2025 third-quarter highlights:

- Production1 of 503,862 gold equivalent ounces (Au eq. oz.).

- Production cost of sales2 of $1,150 per Au eq. oz. sold and attributable production cost of sales1 of $1,145 per Au eq. oz. sold.

- Attributable all-in sustaining cost1 of $1,622 per Au eq. oz. sold.

- Operating cash flow3 of $1,024.1 million.

- Attributable free cash flow1 record of $686.7 million.

- Margins4 increased by 54% to $2,310 per Au eq. oz. sold compared with Q3 2024, outpacing the rise in the average realized gold price.

- Reported earnings5 of $584.9 million, or $0.48 per share, with adjusted net earnings6 of $529.6 million, or $0.44 per share.

- Balance sheet strength: Kinross has achieved a net cash7 position of $485 million, with approximately $1.7 billion in cash and cash equivalents and total liquidity8 of approximately $3.4 billion at September 30, 2025.

- Debt repayment: Kinross announced today the early redemption of its $500 million in Senior Notes due in 2027.

- Guidance reaffirmed: Kinross remains on track to meet its 2025 annual guidance for production, cost of sales per ounce, all-in sustaining cost and attributable capital expenditures, including the impacts of higher royalties due to strong gold prices.

Return of capital to shareholders:

- Since reactivating its share buyback program in April 2025, the Company has repurchased approximately $405 million in shares as of November 4, 2025. Further, the Company has increased its target by 20% and now aims to repurchase $600 million in shares in 2025.

- Including its quarterly dividend, Kinross has returned approximately $515 million in capital to shareholders as of November 4, 2025.

- Kinross’ Board of Directors has also approved a 17% increase to the quarterly dividend to $0.035 per common share, which would amount to $0.14 per common share on an annualized basis. The third quarter dividend, having been approved by the Board of Directors, is payable on December 10, 2025, to shareholders of record at the close of business on November 26, 2025.

Operations highlights:

- Paracatu delivered another solid quarter driven by higher grades and strong recoveries, and was, once again, the highest producing mine in the portfolio.

- Tasiast continued to perform well driven by strong mill performance and high recoveries.

- At La Coipa, production increased and costs decreased quarter-over-quarter as mining transitioned into higher-grade ore from Phase 7.

Development and exploration projects:

- Great Bear’s Advanced Exploration program continues to progress, with key infrastructure – including the camp and natural gas pipeline – now complete and commissioned. For the Main Project, detailed engineering is advancing well, initial procurement is underway, and phased Impact Statement submissions are on track.

- Round Mountain Phase X development is progressing well, with over 5,200 metres developed to date. Extensive underground drilling has been completed in both the upper and lower mineralized zones, with results continuing to show strong widths and grades. Technical studies and detailed engineering are also progressing well to support a production decision.

- Mining at Bald Mountain Redbird is advancing on schedule. Studies, detailed engineering and exploration related to the potential Phase 2 extension are all progressing well.

- At Curlew, results from infill drilling are showing high grades and good mining widths, supporting the resource estimate. Kinross completed the initial development of the exploration decline at Roadrunner and further extension of the North Stealth development, enabling access for high-grade target drilling.

- At Lobo-Marte, the dedicated project team continues to progress baseline studies to support permitting.

CEO commentary:

J. Paul Rollinson, CEO, made the following comments in relation to 2025 third-quarter results:

“Kinross delivered another excellent quarter, underscoring the strength of our operating portfolio, which together with disciplined cost management, produced robust margins and record free cash flow of approximately $700 million. With free cash flow exceeding $1.7 billion in the first three quarters of the year, and the further strengthening of our balance sheet to a net cash position, we are well positioned to continue generating strong returns for our shareholders.

“We are also pleased to announce enhancements to our return of capital program as a result of our robust financial position and strong free cash flow, and are now aiming to return approximately $750 million through both share buybacks and dividends. We have increased our share buybacks by 20% and are now aiming to repurchase $600 million in shares this year, with approximately $405 million repurchased to date in 2025. We are also increasing our longstanding quarterly dividend by 17% to $0.14 per share annually.

“Looking ahead, we’re excited by the progress across our growth pipeline. This includes strong drill results at Phase X and Curlew, continued progress at Great Bear, study and engineering advancement at Redbird Phase 2, and ongoing baseline studies at Lobo-Marte. These projects reflect our strategy to extend mine life, contain costs and enhance long-term value across our portfolio. We look forward to providing more details about Phase X, Redbird and Curlew, including economics, in Q1 2026.

“Our commitment to sustainability continues to drive meaningful impact in our host communities – including advancing education in Mauritania, award-winning reclamation work in Nevada, and ISO energy management system certification in Chile. In Brazil, our tailings facilities received the top-level AA classification for management and monitoring, reflecting the site’s strong safety practices. These initiatives reflect our dedication to responsible mining and the creation of opportunities in our communities.”

Summary of financial and operating results

| Three months ended | Nine months ended | ||||||||||||||

| September 30, | September 30, | ||||||||||||||

| (in millions of U.S. dollars, except ounces, per share amounts, and per ounce amounts) | 2025 | 2024 | 2025 | 2024 | |||||||||||

| Operating Highlights(a) | |||||||||||||||

| Total gold equivalent ounces(b) | |||||||||||||||

| Produced | 520,301 | 593,699 | 1,580,239 | 1,656,436 | |||||||||||

| Sold | 520,733 | 578,323 | 1,571,045 | 1,621,483 | |||||||||||

| Attributable gold equivalent ounces(b) | |||||||||||||||

| Produced | 503,862 | 564,106 | 1,528,524 | 1,626,843 | |||||||||||

| Sold | 504,111 | 550,548 | 1,518,975 | 1,593,708 | |||||||||||

| Gold ounces – sold | 511,564 | 569,506 | 1,547,223 | 1,578,232 | |||||||||||

| Silver ounces – sold (000’s) | 804 | 741 | 2,171 | 3,676 | |||||||||||

| Earnings(a) | |||||||||||||||

| Metal sales | $ | 1,802.1 | $ | 1,432.0 | $ | 5,028.1 | $ | 3,733.0 | |||||||

| Production cost of sales | $ | 598.6 | $ | 564.3 | $ | 1,713.7 | $ | 1,613.3 | |||||||

| Depreciation, depletion and amortization | $ | 285.4 | $ | 296.2 | $ | 836.7 | $ | 862.7 | |||||||

| Impairment reversal | $ | – | $ | (74.1 | ) | $ | – | $ | (74.1 | ) | |||||

| Operating earnings | $ | 810.1 | $ | 547.7 | $ | 2,155.3 | $ | 1,039.2 | |||||||

| Net earnings attributable to common shareholders | $ | 584.9 | $ | 355.3 | $ | 1,483.6 | $ | 673.2 | |||||||

| Net earnings per share attributable to common shareholders (basic and diluted) | $ | 0.48 | $ | 0.29 | $ | 1.21 | $ | 0.55 | |||||||

| Adjusted net earnings(c) | $ | 529.6 | $ | 298.7 | $ | 1,434.6 | $ | 598.3 | |||||||

| Adjusted net earnings per share(c) | $ | 0.44 | $ | 0.24 | $ | 1.17 | $ | 0.49 | |||||||

| Cash Flow(a) | |||||||||||||||

| Net cash flow provided from operating activities | $ | 1,024.1 | $ | 733.5 | $ | 2,613.6 | $ | 1,711.9 | |||||||

| Attributable adjusted operating cash flow(c) | $ | 845.2 | $ | 625.0 | $ | 2,365.3 | $ | 1,529.0 | |||||||

| Capital expenditures(d) | $ | 312.2 | $ | 278.7 | $ | 826.0 | $ | 794.8 | |||||||

| Attributable capital expenditures(c) | $ | 307.6 | $ | 275.5 | $ | 813.5 | $ | 772.1 | |||||||

| Attributable free cash flow(c) | $ | 686.7 | $ | 414.6 | $ | 1,704.1 | $ | 905.8 | |||||||

| Per Ounce Metrics(a) | |||||||||||||||

| Average realized gold price per ounce(e) | $ | 3,460 | $ | 2,477 | $ | 3,200 | $ | 2,304 | |||||||

| Attributable average realized gold price per ounce(c) | $ | 3,458 | $ | 2,479 | $ | 3,199 | $ | 2,301 | |||||||

| Production cost of sales per equivalent ounce sold(b)(f) | $ | 1,150 | $ | 976 | $ | 1,091 | $ | 995 | |||||||

| Attributable production cost of sales per equivalent ounce sold(b)(c) | $ | 1,145 | $ | 980 | $ | 1,086 | $ | 997 | |||||||

| Attributable production cost of sales per ounce sold on a by-product basis(c) | $ | 1,102 | $ | 956 | $ | 1,052 | $ | 962 | |||||||

| Attributable all-in sustaining cost per equivalent ounce sold(b)(c) | $ | 1,622 | $ | 1,350 | $ | 1,490 | $ | 1,349 | |||||||

| Attributable all-in sustaining cost per ounce sold on a by-product basis(c) | $ | 1,588 | $ | 1,332 | $ | 1,462 | $ | 1,324 | |||||||

| Attributable all-in cost per equivalent ounce sold(b)(c) | $ | 2,016 | $ | 1,689 | $ | 1,877 | $ | 1,697 | |||||||

| Attributable all-in cost per ounce sold on a by-product basis(c) | $ | 1,989 | $ | 1,677 | $ | 1,855 | $ | 1,682 | |||||||

| (a) | All measures and ratios include 100% of the results from Manh Choh, except measures and ratios denoted as “attributable.” “Attributable” measures and ratios include Kinross’ 70% share of Manh Choh production, sales, cash flow, capital expenditures and costs, as applicable. | ||||||||||||||

| (b) | “Gold equivalent ounces” include silver ounces produced and sold converted to a gold equivalent based on a ratio of the average spot market prices for the commodities for each period. The ratio for the third quarter and first nine months of 2025 was 87.73:1 and 91.33:1, respectively (third quarter and first nine months of 2024 – 84.06:1 and 84.34:1, respectively). | ||||||||||||||

| (c) | The definition and reconciliation of these non-GAAP financial measures and ratios is included on pages [x] to [x] of this news release. Non-GAAP financial measures and ratios have no standardized meaning under International Financial Reporting Standards (“IFRS”) and therefore, may not be comparable to similar measures presented by other issuers. | ||||||||||||||

| (d) | “Capital expenditures” is as reported as “Additions to property, plant and equipment” on the interim condensed consolidated statements of cash flows. | ||||||||||||||

| (e) | “Average realized gold price per ounce” is defined as gold revenue divided by total gold ounces sold. | ||||||||||||||

| (f) | “Production cost of sales per equivalent ounce sold” is defined as production cost of sales divided by total gold equivalent ounces sold. | ||||||||||||||

The following operating and financial results are based on third-quarter gold equivalent production:

Production: Kinross produced 503,862 Au eq. oz. in Q3 2025, compared with 564,106 Au eq. oz. in Q3 2024. The year-over-year decrease was due to lower production from Tasiast and Fort Knox, as planned.

Average realized gold price9: The average realized gold price in Q3 2025 was $3,460 per ounce, compared with $2,477 per ounce in Q3 2024.

Revenue: During the third quarter, revenue increased to $1,802.1 million, compared with $1,432.0 million during Q3 2024. The 26% year-over-year increase is due to the increase in the average realized gold price.

Production cost of sales: Production cost of sales per Au eq. oz. sold2 was $1,150 for the quarter, compared with $976 in Q3 2024. Attributable production cost of sales per Au eq. oz. sold1 was $1,145 for the quarter, compared with $980 in Q3 2024, impacted by higher royalties as a result of recent gold prices.

Attributable production cost of sales per Au oz. sold on a by-product basis1 was $1,102 in Q3 2025, compared with $956 in Q3 2024, based on attributable gold sales of 495,136 ounces and attributable silver sales of 787,523 ounces.

Margins4: Kinross’ margin per Au eq. oz. sold increased by 54% to $2,310 for Q3 2025, compared with the Q3 2024 margin of $1,501, outpacing the 40% increase in average realized gold price.

Attributable all-in sustaining cost1: Attributable all-in sustaining cost per Au eq. oz. sold was $1,622 in Q3 2025, compared with $1,350 in Q3 2024, primarily due to higher cost of sales.

In Q3 2025, attributable all-in sustaining cost per Au oz. sold on a by-product basis was $1,588, compared with $1,332 in Q3 2024.

Operating cash flow3: Operating cash flow increased to $1,024.1 million for Q3 2025, compared with $733.5 million for Q3 2024.

Attributable adjusted operating cash flow1 for Q3 2025 increased to $845.2 million, compared with $625.0 million for Q3 2024.

Attributable free cash flow1: Attributable free cash flow increased by 66% to $686.7 million in Q3 2025, compared with $414.6 million in Q3 2024.

Reported net earnings5: Reported net earnings increased by 65% to $584.9 million for Q3 2025, or $0.48 per share, compared with reported net earnings of $355.3 million, or $0.29 per share, for Q3 2024.

Adjusted net earnings6 increased by 77% to $529.6 million, or $0.44 per share, for Q3 2025, compared with $298.7, or $0.24 per share, for Q3 2024.

Capital expenditures10: Capital expenditures were $312.2 million for Q3 2025, compared with $278.7 in Q3 2024.

Attributable capital expenditures1 were $307.6 million for Q3 2025, compared with $275.5 million for Q3 2024. The increase was primarily a result of the ramp-up of development activities at Bald Mountain Redbird Phase 1, Great Bear and the Fennec satellite pit at Tasiast, partially offset by lower spending on capital development due to planned mine sequencing at Fort Knox and Manh Choh.

Realized increased consideration from Chirano divestiture

Related to the 2022 sale of the Chirano mine to Asante Gold Corporation, Kinross received cash payments from Asante and proceeds from the sale of securities that totaled $232 million in cash since the beginning of Q3 2025. Of this amount, approximately $136 million was received during Q3 2025 and $96 million was received subsequent to Q3 2025.

Since the closing of the transaction in 2022, overall Kinross has realized $314 million in cash proceeds compared with the original sale price of $225 million.

Balance sheet

As of September 30, 2025, Kinross had cash and cash equivalents of $1,721.7 million, compared with $1,136.5 million at June 30, 2025, and net cash7 of approximately $485 million.

The Company had additional available credit11 of $1.6 billion and total liquidity8 of approximately $3.4 billion as of September 30, 2025.

During the quarter, S&P announced that it upgraded Kinross’ outlook from stable to positive and affirmed the Company’s investment-grade rating of BBB-. S&P noted Kinross’ strong cash flow, solid operating performance and debt reduction as key factors driving the improved outlook.

Kinross announced today the early redemption of the outstanding 4.50% Senior Notes due July 15, 2027, which have an aggregate principal amount of $500 million, on December 4, 2025. After the Notes are redeemed, Kinross will have $750 million aggregate principal amount of Senior Notes outstanding, with the next Senior Notes maturity date on July 15, 2033, for $500 million in aggregate principal amount.

Return of capital to shareholders

Kinross is pleased to enhance its return of capital program as a result of its robust financial position and strong free cash flow and is now targeting approximately $750 million in shareholder returns in 2025 through both share buybacks and dividends.

Kinross has increased its target for share buybacks by 20% to $600 million in 2025. During the quarter, Kinross repurchased approximately $165 million in shares, and approximately $405 million to date in 2025 (representing 23.3 million shares). Including its quarterly dividend, Kinross has returned approximately $515 million in capital to shareholders to date in 2025.

Kinross’ Board of Directors has also approved a 17% increase to the quarterly dividend to $0.035 per common share, which would amount to $0.14 per common share on an annualized basis. The third quarter dividend, having been approved by the Board of Directors, is payable on December 10, 2025, to shareholders of record at the close of business on November 26, 2025.

Operating results

Mine-by-mine summaries for 2025 third-quarter operating results may be found on pages 10 and 14 of this news release. Highlights include the following:

At Tasiast, production was in line with the previous quarter, with higher throughput offset by planned grades. Year-over-year production decreased due to planned grades, partially offset by higher recoveries following mill optimizations. Cost of sales per ounce sold increased quarter-over-quarter due to higher royalties and strong throughput at lower grades. Lower production resulted in higher costs year-over-year.

At Paracatu, production was in line with the previous quarter, with strong mining rates and recoveries at higher grades offsetting lower planned throughput. Production was higher year-over-year due to higher grades, partially offset by a planned decrease in throughput due to mine sequencing, which moved into harder, higher-grade ore this year, and the timing of ounces processed through the mill. Cost of sales per ounce sold decreased quarter-over-quarter and year-over-year due to higher grades.

La Coipa delivered higher quarter-over-quarter production as planned as mining transitioned to higher-grade ore from Phase 7, and higher production year-over-year as a result of stronger throughput and higher grades. Quarter-over-quarter cost of sales per ounce sold improved as a result of higher production from higher grades, and increased year-over-year due to higher royalties, labour and maintenance supply costs, partially offset by higher production. In the fourth quarter, production is expected to be stronger as mining continues through higher-grade ore from Phase 7. Permitting work for mine life extensions continues.

At Fort Knox, production remained in line with the previous quarter, and decreased year-over-year primarily due to planned lower grades. Cost of sales per ounce sold increased quarter-over-quarter primarily due to a lower proportion of capital development tonnes mined at Phase 10. Year-over-year costs increased, as expected, primarily due to the lower proportion of capital development tonnes mined at Phase 10, higher labour and maintenance supply costs, partially offset by lower contractor costs.

At Round Mountain, production was in line quarter-over-quarter, and decreased year-over-year per planned mine sequencing as the site transitions from Phase W to Phase S with lower mill grades and fewer ounces recovered from the heap leach pads. Costs of sales per ounce sold increased quarter-over-quarter primarily due to a lower proportion of Phase S mining characterized as capital development as it shifts into operating waste. Higher unit costs year-over-year were primarily due to the shift from capital to operating waste, and the decrease in ounces produced.

At Bald Mountain, production decreased quarter-over-quarter due to planned grades, partially offset by an increase in tonnes of ore stacked. Year-over-year production was lower due to the timing of ounces recovered from the heap leach pads. Cost of sales per ounce sold was higher quarter-over-quarter, as expected, due to fewer ounces produced, and lower year-over-year as mining activities were largely focused on capital development.

Development and exploration projects

Great Bear

At Great Bear, Kinross continues to progress its Advanced Exploration program alongside permitting and detailed engineering for the Main Project.

For AEX, the natural gas pipeline is complete and has been commissioned, and the camp is now operational. Earthwork activities are well advanced, including the initial development of the portal boxcut, and the water treatment plant building is enclosed, with equipment installation currently in progress. The Company is currently working with the Ontario Ministry of Environment, Conservation and Parks as it consults with First Nations to finalize the two remaining AEX water permits and, in the interim, permitted activities continue as planned. AEX is focused on providing access for infill drilling of the underground resource and exploration drilling to further delineate extensions of mineralization at depth. AEX is not on the critical path for first production at Great Bear.

For the Main Project, which is expected to remain on schedule, Kinross continues to progress detailed engineering for the mill, tailings management facility, and other site infrastructure. Initial procurement activities for major process and water treatment equipment are in progress, with contract awards planned to start before year-end. Manufacturing of selected long-lead items is anticipated to commence in 2026.

The first of three phased submissions for the Project’s Impact Statement was submitted on schedule in September. The second submission remains on track for mid-December 2025, with the final phase targeted to be filed at the end of Q1 2026. Work has commenced on initial Main Project Federal and Provincial permits, with permitting technical documents submitted to Fisheries and Oceans Canada during the quarter.

Kinross also advanced its regional exploration program with three diamond drill rigs testing geophysical and lithological targets during the quarter, looking for new, near-surface mineralization.

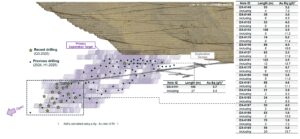

Round Mountain Phase X

Decline development at Round Mountain Phase X is advancing well, with over 5,200 metres developed to date. Extensive infill drilling has been completed in both the upper and lower mineralized zones. Third quarter drilling focused on further infill of the lower zone, with results continuing to intersect strong widths and grades, proving out the exploration thesis of a bulk tonnage underground mining target.

Lower zone highlights include:

- DX-0152 – 53m @ 4.5 g/t

- Including 8m @ 8.6 g/t

- DX-0161 – 123m @ 3.5 g/t

- Including 12m @ 13.7 g/t

- DX-0176 – 74m @ 6.5 g/t

- Including 8m @ 11.4 g/t

- DX-0184 – 21m @ 3.9 g/t

- Including 2m @ 9.3 g/t

- DX-0190 – 56m @ 5.8 g/t

- Including 20m @ 13.7 g/t

Engineering work and technical studies are also advancing well to support a production decision at Phase X. The extent of infill drilling is now sufficient to support an initial underground resource estimate, and Kinross plans to provide the initial resource estimate, a project update, and an economics update for Phase X in Q1 2026.

See Appendix A for a Round Mountain Phase X long section.

Bald Mountain Redbird

At Redbird, mining is advancing on schedule. Studies and detailed engineering related to the potential Phase 2 extension of Redbird are progressing well, including engineering related to the heap leach pad expansion, technical studies and mine plan optimization work. Exploration drilling and technical studies targeting satellite pit opportunities on the large Bald Mountain property are progressing well and showing positive results with potential to augment the production profile from Redbird 2. Kinross plans to provide a project and economics update in Q1 2026.

Curlew Basin exploration

Drilling at Curlew in Q3 was primarily focused on infill drilling with results showing high-grade mineralization and good mining widths, supporting the resource estimate. Received assay highlights include (true width):

- EVP-1248 – 2.1m @ 22.3 g/t

- K5-1516 – 6.8m @ 8.2 g/t

- K5-1518 – 5.7m @ 8.4 g/t

Kinross also completed the initial development of the Roadrunner decline and further extension of the North Stealth development in Q3, providing access for drilling of the high grade exploration target at Roadrunner and for drilling of potential extensions to the high grade mineralization at North Stealth. Exploration drilling in Q4 2025 and in 2026 will focus on expanding mineralization and resource potential in both of these areas.

Technical studies and detailed engineering are also progressing well at Curlew.

Kinross plans to provide a project and economics update for Curlew in Q1 2026.

Lobo-Marte

Kinross is progressing baseline studies to support the Environmental Impact Assessment for the Lobo-Marte project. Lobo-Marte continues to be a potential large, low-cost mine and Kinross is committed to progressing next steps to advance the project.

Company Guidance

The following section of the news release represents forward-looking information and users are cautioned that actual results may vary. We refer to the risks and assumptions contained in the Cautionary Statement on Forward-Looking Information on pages 24 and 25.

The Company expects to be slightly above the midpoint of its 2025 production guidance range of 2.0 million Au eq. oz. (+/- 5%), with fourth quarter production expected to be slightly lower than 500,000 Au eq. oz.

The Company is in line with its attributable production cost of sales1 guidance range of $1,120 per Au eq. oz. (+/-5%). The Company is tracking towards the higher end of its attributable all-in sustaining cost1 guidance range of $1,500 per Au eq. oz. (+/-5%), including the impacts of higher royalties at current gold prices as well as a higher proportion of sustaining capital expenditures. Attributable capital expenditures1 remain on track to meet guidance of $1,150 million (+/-5%) with higher spending planned for Q4.

Kinross’ annual production is expected to remain stable at 2.0 million attributable Au eq. oz. (+/- 5%) in 2026 and 2027.

Sustainability

In the third quarter, Kinross continued to advance Sustainability initiatives. In Mauritania, local educational infrastructure was strengthened with the completion of new school facilities, including 17 fully-equipped classrooms, in the Inchiri region and the distribution of school kits and uniforms to support children.

In Brazil, Paracatu’s tailings facilities recently received the top-level AA classification from the Engineer of Record, under Brazil’s National Mining Agency’s recently introduced categories for dam management and monitoring. This is a strong endorsement of the site’s safety practices, reflecting industry-leading standards in monitoring, maintenance, and risk control.

In Nevada, Bald Mountain’s strong safety culture was recognized at the Nevada Mining Association’s annual convention, receiving awards in several categories. Bald Mountain also earned the Nevada Excellence in Mine Reclamation Award, Excellence in Earthwork category, the fifth award for reclamation that the site has received. Reclamation works included recontouring approximately 131 acres across two rock disposal areas and a haul road, followed by the addition of topsoil and seeding.

In Chile, La Coipa received the ISO 50001 certification for its energy management systems after the completion of a two-stage audit that confirmed compliance. ISO 50001 is an internationally recognized voluntary standard that gives organizations a structured framework to manage energy and integrates energy efficiency into management practices.

Board update

The Board of Directors has appointed Candace MacGibbon as a Director. Ms. MacGibbon has over 25 years of experience in the mining sector and capital markets. Most recently, she served as CEO and Director of TSX-listed INV Metals Inc. and served as CFO prior to that. She also previously held roles in finance and equity research. She has a BA in Economics from Western University, a Diploma in Accounting from Wilfrid Laurier University, and is a Chartered Professional Accountant, Chartered Accountant. She also holds an ICD.D from the Institute of Corporate Directors, and a Cybersecurity Certificate from Cornell University.

Conference call details

In connection with this news release, Kinross will hold a conference call and audio webcast on Wednesday, November 5, 2025, at 8:00 a.m. ET to discuss the results, followed by a question-and-answer session. To access the call, please dial:

Canada & US toll-free – 1 (888) 596-4144; Passcode: 9425112

Outside of Canada & US – 1 (646) 968-2525; Passcode: 9425112

Replay (available up to 14 days after the call):

Canada & US toll-free – 1 (800) 770-2030; Passcode: 9425112

Outside of Canada & US – 1 (609) 800-9909; Passcode: 9425112

You may also access the conference call on a listen-only basis via webcast at our website www.kinross.com. The audio webcast will be archived on www.kinross.com.

About Kinross Gold Corporation

Kinross is a Canadian-based global senior gold mining company with operations and projects in the United States, Brazil, Mauritania, Chile and Canada. Our focus is on delivering value based on the core principles of responsible mining, operational excellence, disciplined growth, and balance sheet strength. Kinross maintains listings on the Toronto Stock Exchange (symbol: K) and the New York Stock Exchange (symbol: KGC).

Media Contact

Samantha Sheffield

Director, Corporate Communications

phone: 416-365-3034

Samantha.Sheffield@Kinross.com

Investor Relations Contact

David Shaver

Senior Vice-President, Investor Relations & Communications

phone: 416-365-2854

InvestorRelations@Kinross.com

Appendix A

Figure 1: Extensive infill drilling has established strong coverage across both the upper and lower target zones, and extension drilling continues to indicate continuation of mineralization down dip outside of the original exploration target.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/22d4811f-d826-4570-a32b-95263f8c004d

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE