Kinross reports 2025 fourth-quarter and full-year results

Delivered on all key guidance metrics, maintains three-year outlook of 2.0 million Au eq. oz. per year

Record free cash flow of $2.5 billion and returned $1.5 billion to debt and equity holders in 2025

Targeting 40% of free cash flow in return of capital to shareholders in 2026

Kinross Gold Corporation (TSX: K) (NYSE: KGC) announced its results for the fourth quarter and year ended December 31, 20251.

This news release contains forward-looking information about expected future events and financial and operating performance of the Company. We refer to the risks and assumptions set out in our Cautionary Statement on Forward-Looking Information located on pages 41 and 42 of this release. All dollar amounts are expressed in U.S. dollars, unless otherwise noted.

2025 full-year results and 2026 guidance:

| 2025 guidance (+/- 5%) |

Q4 2025 results |

2025 full-year results |

2026 guidance (+/- 5%) |

|

| Gold equivalentproduction1 (ounces) |

2.0 million | 483,582 | 2.0 million | 2.0 million |

| Production cost of sales2 Attributable production cost of sales1 |

– $1,120 |

$1,297 $1,289 |

$1,140 $1,135 |

– $1,360 |

| ($ per Au eq. oz.) | ||||

| Attributable all-in sustaining cost1 ($ per Au eq. oz.) |

$1,500 | $1,825 | $1,571 | $1,730 |

| Capital expenditures3 Attributablecapital expenditures1 |

– $1,150 |

$368 $362 |

$1,194 $1,175 |

– $1,500 |

| (million) |

- Kinross has forecasted stable production guidance of approximately 2.0 million attributable Au eq. oz. (+/- 5%) in 2027 and 2028.

Record Q4 and full-year highlights:

- Margins4 of $2,847 per Au eq. oz. sold in Q4 2025, and $2,283 for 2025.

- Operating cash flow5 of $1,146.9 million in Q4 2025, and $3,760.5 million in 2025.

- Attributable free cash flow1 of $769.4 million in Q4 2025 and $2,473.5 million in 2025.

- Reported net earnings6 of $906.5 million in Q4 2025, or $0.75 per share, and $2,390.1 million, or $1.96 per share, in 2025.

- Adjusted net earnings7, 8 of $809.3 million, or $0.67 per share in Q4 2025, and $2,243.9 million, or $1.84 per share, in 2025.

- In 2025, Kinross returned $752.4 million to shareholders through its share buyback program and dividend. This included repurchasing $600.3 million in shares, and a 17% increase to its dividend during the year. In 2026, Kinross is targeting 40% of free cash flow to return of capital through both share buybacks and dividends.

- Kinross’ Board of Directors has approved an additional 14% increase to its quarterly dividend to $0.04 per common share, which would amount to $0.16 per common share on an annualized basis. This represents a total increase of 33% since Q3 2025.

- The Company continued to prioritize debt reduction and repaid $700 million in 2025. Kinross had net cash9 of $1,004.1 million, with $1,742.3 million of cash and cash equivalents and total liquidity10 of $3.5 billion as at December 31, 2025.

Operational highlights:

- Tasiast was the highest-margin operation in the portfolio.

- Paracatu produced over 600,000 gold ounces (“Au oz.”), which is the 8th consecutive year over 500,000 Au oz.

- La Coipa had a strong fourth quarter with higher mill throughput and met full-year production guidance.

- U.S. Operations had another solid year, with production and costs on plan.

Development project and mineral reserves and resources highlights:

- Proceeding to construction at Phase X, Kettle River-Curlew (“Curlew”) and Redbird 2. Read more here.

- At Great Bear, surface construction for the Advanced Exploration (“AEX”) program is 80% complete. For the Main Project, detailed engineering is approximately 35% complete, and the final phase of the federal Impact Statement submission is planned for the end of Q1 2026.

- At Lobo-Marte, Kinross completed baseline studies and plans to submit its Environmental Impact Assessment (“EIA”) by Q2 2026. Kinross also plans to provide a project update later this year.

- Reserves and Resources: Kinross added 1.2 million Au oz. (“Moz.”) to proven and probable mineral reserves, partially offsetting production depletion. Kinross increased measured and indicated resource estimates to 27.5 Moz. and increased inferred resource estimates to 16.6 Moz.

CEO Commentary:

- Paul Rollinson, CEO, made the following comments in relation to 2025 fourth-quarter and year-end results:

“2025 marked another excellent year for Kinross. We met our guidance once again, delivered robust margins, and generated record free cash flow of $2.5 billion, an 85% increase year-over-year. We returned approximately $1.5 billion to debt and equity holders, and achieved an end-of-year net cash position of $1 billion, further strengthening our balance sheet. These results underscore the consistency of our operating portfolio and our rigorous focus on cost discipline.

“We recently announced that we are proceeding with three U.S.-based projects, Phase X, Curlew and Redbird, which together are expected to contribute over $4 billion of net asset value and extend mine lives. In addition to these U.S. projects, we will have meaningful catalysts in the coming year at both of our world class development projects – Great Bear and Lobo-Marte.

“We are carrying strong momentum into 2026 and are forecasting another strong year of production of approximately 2.0 million gold equivalent ounces. Our focus will be on margins and cash flow as we continue to hold the line on controllable costs while maintaining capital discipline as we execute on our grade enhancement strategy. We are planning to continue with our capital allocation strategy by reinvesting in our business, further strengthening our balance sheet, and returning capital to our shareholders. This includes investing an additional $350 million in our business and are targeting 40% of free cash flow to return of capital through both share buybacks and dividends. This includes increasing our quarterly dividend by 14%, in addition to the 17% increase in Q3 2025.”

Financial results

Summary of financial and operating results

| Three months ended | Years ended | |||||||||||

| December 31, | December 31, | |||||||||||

| (in millions of U.S. dollars, except ounces, per share amounts, and per ounce amounts) | 2025 | 2024 | 2025 | 2024 | ||||||||

| Operating Highlights(a) | ||||||||||||

| Total gold equivalent ounces(b) | ||||||||||||

| Produced | 489,671 | 514,355 | 2,069,910 | 2,170,791 | ||||||||

| Sold | 487,972 | 531,729 | 2,059,017 | 2,153,212 | ||||||||

| Attributable gold equivalent ounces(b) | ||||||||||||

| Produced | 483,582 | 501,209 | 2,012,106 | 2,128,052 | ||||||||

| Sold | 481,560 | 517,980 | 2,000,535 | 2,111,688 | ||||||||

| Gold ounces – sold | 479,347 | 522,389 | 2,026,570 | 2,100,621 | ||||||||

| Silver ounces – sold (000’s) | 659 | 791 | 2,830 | 4,467 | ||||||||

| Earnings(a) | ||||||||||||

| Metal sales | $ | 2,023.0 | $ | 1,415.8 | $ | 7,051.1 | $ | 5,148.8 | ||||

| Production cost of sales | $ | 632.7 | $ | 583.8 | $ | 2,346.4 | $ | 2,197.1 | ||||

| Depreciation, depletion and amortization | $ | 268.3 | $ | 284.8 | $ | 1,105.0 | $ | 1,147.5 | ||||

| Impairment reversal | $ | (116.1 | ) | $ | – | $ | (116.1 | ) | $ | (74.1 | ) | |

| Operating earnings | $ | 1,122.3 | $ | 501.1 | $ | 3,277.6 | $ | 1,540.3 | ||||

| Net earnings attributable to common shareholders | $ | 906.5 | $ | 275.6 | $ | 2,390.1 | $ | 948.8 | ||||

| Net earnings per share attributable to common shareholders (basic) | $ | 0.75 | $ | 0.22 | $ | 1.96 | $ | 0.77 | ||||

| Net earnings per share attributable to common shareholders (diluted) | $ | 0.75 | $ | 0.22 | $ | 1.95 | $ | 0.77 | ||||

| Adjusted net earnings(c) | $ | 809.3 | $ | 240.0 | $ | 2,243.9 | $ | 838.3 | ||||

| Adjusted net earnings per share(c) | $ | 0.67 | $ | 0.20 | $ | 1.84 | $ | 0.68 | ||||

| Cash Flow(a) | ||||||||||||

| Net cash flow provided from operating activities | $ | 1,146.9 | $ | 734.5 | $ | 3,760.5 | $ | 2,446.4 | ||||

| Attributable adjusted operating cash flow(c) | $ | 1,136.0 | $ | 677.0 | $ | 3,605.2 | $ | 2,293.9 | ||||

| Capital expenditures(d) | $ | 368.2 | $ | 280.7 | $ | 1,194.2 | $ | 1,075.5 | ||||

| Attributable capital expenditures(c) | $ | 361.7 | $ | 278.8 | $ | 1,175.2 | $ | 1,050.9 | ||||

| Attributable free cash flow(c) | $ | 769.4 | $ | 434.4 | $ | 2,473.5 | $ | 1,340.2 | ||||

| Per Ounce Metrics(a) | ||||||||||||

| Average realized gold price per ounce(e) | $ | 4,144 | $ | 2,663 | $ | 3,423 | $ | 2,393 | ||||

| Attributable average realized gold price per ounce(c) | $ | 4,144 | $ | 2,665 | $ | 3,426 | $ | 2,391 | ||||

| Production cost of sales per equivalent ounce sold(b)(f) | $ | 1,297 | $ | 1,098 | $ | 1,140 | $ | 1,020 | ||||

| Attributable production cost of sales per equivalent ounce sold(b)(c) | $ | 1,289 | $ | 1,096 | $ | 1,135 | $ | 1,021 | ||||

| Attributable production cost of sales per ounce sold on a by-product basis(c) | $ | 1,235 | $ | 1,069 | $ | 1,096 | $ | 988 | ||||

| Attributable all-in sustaining cost per equivalent ounce sold(b)(c) | $ | 1,825 | $ | 1,510 | $ | 1,571 | $ | 1,388 | ||||

| Attributable all-in sustaining cost per ounce sold on a by-product basis(c) | $ | 1,781 | $ | 1,490 | $ | 1,539 | $ | 1,365 | ||||

| Attributable all-in cost per equivalent ounce sold(b)(c) | $ | 2,343 | $ | 1,868 | $ | 1,989 | $ | 1,739 | ||||

| Attributable all-in cost per ounce sold on a by-product basis(c) | $ | 2,308 | $ | 1,854 | $ | 1,964 | $ | 1,725 | ||||

| (a) | All measures and ratios include 100% of the results from Manh Choh, except measures and ratios denoted as “attributable.” “Attributable” measures and ratios include Kinross’ 70% share of Manh Choh production, sales, cash flow, capital expenditures and costs, as applicable. |

| (b) | “Gold equivalent ounces” include silver ounces produced and sold converted to a gold equivalent based on a ratio of the average spot market prices for the commodities for each period. The ratio for the fourth quarter and full year 2025 was 76.34:1 and 86.29:1, respectively (fourth quarter and full year 2024 – 84.67:1 and 84.43:1, respectively). |

| (c) | The definition and reconciliation of these non-GAAP financial measures and ratios is included on pages 27 to 33 of this news release. Non-GAAP financial measures and ratios have no standardized meaning under IFRS and therefore, may not be comparable to similar measures presented by other issuers. |

| (d) | “Capital expenditures” is “Additions to property, plant and equipment” on the consolidated statements of cash flows. |

| (e) | “Average realized gold price per ounce” is defined as gold revenue divided by total gold ounces sold. |

| (f) | “Production cost of sales per equivalent ounce sold” is defined as production cost of sales divided by total gold equivalent ounces sold. |

The following operating and financial results are based on fourth-quarter and full-year 2025 gold equivalent production:

Production: Kinross produced 483,582 Au eq. oz. in Q4 2025, compared with 501,209 Au eq. oz. in Q4 2024.

Over the full year, Kinross produced 2,012,106 Au eq. oz., compared with full-year 2024 production of 2,128,052 Au eq. oz.

Average realized gold price11: The average realized gold price in Q4 2025 was $4,144 per ounce, compared with $2,663 per ounce in Q4 2024. For full-year 2025, the average realized gold price per ounce was $3,423 compared with $2,393 per ounce for full-year 2024.

Revenue: During the fourth quarter, revenue increased to $2,023.0 million, compared with $1,415.8 million during Q4 2024. Revenue increased to $7,051.1 million for full-year 2025, compared with $5,148.8 million for full-year 2024. The 37% year-over-year increase is primarily due to the increase in the average realized gold price.

Production cost of sales: Production cost of sales per Au eq. oz.2 sold was $1,297 for Q4 2025, compared with $1,098 in Q4 2024. Production cost of sales per Au eq. oz.2 sold was $1,140 for full-year 2025, compared with $1,020 for full-year 2024. The increase is primarily due to higher royalty costs as a result of the higher average realized gold price, and slightly lower production year-over-year.

Attributable production cost of sales per Au eq. oz.1 sold was $1,289 for Q4 2025, compared with $1,096 in Q4 2024. Attributable production cost of sales per Au eq. oz.1 sold was $1,135 for full-year 2025, compared with $1,021 for full-year 2024.

Attributable production cost of sales per Au oz. sold on a by-product basis1 was $1,235 in Q4 2025, compared with $1,069 in Q4 2024, based on attributable gold sales of 473,093 ounces and attributable silver sales of 646,265 ounces.

Attributable production cost of sales per Au oz. sold on a by-product basis1 was $1,096 for full-year 2025, compared with $988 in full-year 2024, based on attributable gold sales of 1,968,741 ounces and attributable silver sales of 2,772,508 ounces.

Margins4: Kinross delivered record margins in both comparable periods. Margins per Au eq. oz. sold increased by 82% to $2,847 for Q4 2025, compared with the Q4 2024 margin of $1,565, outpacing the 56% increase in the average realized gold price. Full-year 2025 margin per Au eq. oz. sold increased by 66% to $2,283, compared with $1,373 for full-year 2024, outpacing the 43% increase in the average realized gold price.

Attributable all-in sustaining cost1: Attributable all-in sustaining cost per Au eq. oz. sold was $1,825 in Q4 2025, compared with $1,510 in Q4 2024. Full-year attributable all-in sustaining cost per Au eq. oz. sold was $1,571, compared with $1,388 for full-year 2024.

In Q4 2025, attributable all-in sustaining cost per Au oz. sold on a by-product basis1 was $1,781, compared with $1,490 in Q4 2024. Attributable all-in sustaining cost per Au oz. sold on a by-product basis1 was $1,539 for full-year 2025, compared with $1,365 for full-year 2024.

Operating cash flow5: Kinross delivered record operating cash flow in both comparable periods. Operating cash flow was $1,146.9 million for Q4 2025, compared with $734.5 million for Q4 2024. Operating cash flow for full-year 2025 was $3,760.5 million, compared with $2,446.4 million for full-year 2024.

Kinross delivered record attributable adjusted operating cash flow in both comparable periods. Attributable adjusted operating cash flow1 for Q4 2025 was $1,136.0 million, compared with $677.0 million for Q4 2024. Attributable adjusted operating cash flow1 for full-year 2025 was $3,605.2 million, compared with $2,293.9 million for full-year 2024.

Attributable free cash flow1: Kinross delivered record attributable free cash flow in both comparable periods. Attributable free cash flow of $769.4 million was generated in Q4 2025, compared with $434.4 million in Q4 2024. Attributable free cash flow of $2,473.5 million was generated in full-year 2025, compared with attributable free cash flow of $1,340.2 million in full-year 2024.

Earnings6: Kinross delivered record earnings in both comparable periods. Reported net earnings were $906.5 million for Q4 2025, or $0.75 per share, compared with reported net earnings of $275.6 million, or $0.22 per share, for Q4 2024. Full year reported net earnings in 2025 were $2,390.1 million, or $1.96 per share, compared with reported net earnings of $948.8 million, or $0.77 per share, for full-year 2024.

Kinross delivered record adjusted net earnings in both comparable periods. Adjusted net earnings7, 8 were $809.3 million, or $0.67 per share, for Q4 2025, compared with $240.0 million, or $0.20 per share, for Q4 2024. Full-year adjusted net earnings7, 8 were $2,243.9 million, or $1.84 per share, compared with $838.3 million, or $0.68 per share, for full-year 2024.

Capital expenditures3: Capital expenditures were $368.2 million for Q4 2025, compared with $280.7 million for Q4 2024. Capital expenditures for full-year 2025 were $1,194.2 million, compared with $1,075.5 million for full-year 2024, which included the ramp-up of development activities at Great Bear, Round Mountain Phase X, and Bald Mountain Redbird 1 and 2.

Attributable capital expenditures1 were $361.7 million for Q4 2025, compared with $278.8 million for Q4 2024. Attributable capital expenditures1 for full-year 2025 were $1,175.2 million, compared with $1,050.9 million for full-year 2024.

Balance sheet

During the quarter, Kinross repaid its outstanding 4.50% Senior Notes, which had an aggregate principal amount of $500 million, ahead of their July 15, 2027 due date. In 2025, Kinross repaid approximately $700 million of its debt, in line with its commitment to balance sheet strength.

Moody’s Investors Service upgraded the senior unsecured rating of Kinross to Baa2 (stable) from Baa3 (positive).

As of December 31, 2025, Kinross had cash and cash equivalents of $1.7 billion, compared with $611.5 million at December 31, 2024, and net cash9 of $1.0 billion.

The Company had additional available credit12 of $1.7 billion as of December 31, 2025, and total liquidity10 of approximately $3.5 billion.

Capital allocation

In 2025, Kinross returned $752.4 million to shareholders through its share buyback program and quarterly dividend. This included repurchasing $600.3 million in shares at an average price of $19.58 (reducing our share count by 2.5%) and a 17% increase to its dividend during the year.

Kinross will continue to maintain its disciplined approach to capital allocation, including strengthening its balance sheet, investing in its business and project pipeline, and returning capital to shareholders. The $350.0 million increase in its 2026 capital expenditures guidance is primarily driven by additional investment in non-sustaining capital to support the Company’s production profile later in this decade, but primarily in the 2030s. In 2026, Kinross is planning to allocate 40% of free cash flow to shareholders through both share buybacks and dividends, assuming recent gold prices are sustained and operations continue to deliver on plan.

Kinross’ Board of Directors has also approved a further 14% increase to the quarterly dividend to $0.04 per common share, which would amount to $0.16 per common share on an annualized basis. Since Q3 2025, Kinross has increased its dividend by 33%. The fourth quarter dividend, having been approved by the Board of Directors, is payable on March 26, 2026, to shareholders of record at the close of business on March 11, 2026.

Operating results

Mine-by-mine summaries for 2025 fourth-quarter and full-year operating results may be found on pages 21 and 25 of this news release. Highlights include the following:

Tasiast delivered on its annual production and cost guidance. Primarily due to planned lower grades, full-year production decreased compared with 2024. Quarter-over-quarter production increased primarily due to higher grades. Cost of sales per ounce sold increased compared with 2024 and quarter-over-quarter primarily due to higher royalties driven by higher gold prices.

During the quarter, the Company successfully finalized a five-year collective labour agreement at Tasiast.

Paracatu performed well in 2025 as full-year production increased and cost of sales per ounce sold decreased compared with 2024 primarily due to the higher production. The higher production was a result of planned higher grades, higher recoveries and the timing of ounces processed through the mill, partially offset by a decrease in throughput.

Production increased quarter-over-quarter due to higher grades, higher recoveries and the timing of ounces processed through the mill, partially offset by lower throughput, consistent with mine plan sequencing. Cost of sales per ounce sold increased quarter-over-quarter due to lower throughput and higher royalties driven by higher gold prices.

La Coipa delivered on its full-year production guidance and had its strongest quarter of the year with increased throughput through the mill. Primarily as a result of planned mine sequencing, full-year production decreased compared with 2024. Quarter-over-quarter production increased primarily due to stronger mill throughput. Full-year cost of sales per ounce sold was higher mainly due to higher royalties, labour and contractor costs. Cost of sales per ounce sold decreased quarter-over-quarter mainly as a result of the increase in production. Kinross continues to progress permitting work for mine life extensions at the operation.

During the quarter, the Company successfully finalized a two-year collective labour agreement at La Coipa.

Annual production at Fort Knox increased compared with 2024 due to a full year of production from higher-grade, higher-recovery ore from Manh Choh, partially offset by a decrease in throughput. Cost of sales per ounce sold increased year-over-year, primarily due to higher royalties and maintenance costs. Quarter-over-quarter, production decreased due to planned mine sequencing, including fewer tonnes of higher-grade Manh Choh ore processed, and cost of sales per ounce sold increased due to the decrease in production.

At Round Mountain, full-year production decreased compared with 2024 per planned mine sequencing as the site transitioned from Phase W to the start of Phase S ore in Q3 2025, with lower mill grades, and fewer ounces stacked and recovered from the heap leach pads. Full-year cost of sales per ounce sold increased compared with 2024 primarily due to the decrease in ounces sold. Quarter-over-quarter, production decreased due to planned lower grades and reduced stacking on the heap leach pads per mine plan sequencing. Cost of sales per ounce sold increased quarter-over-quarter due to higher cost ounces from the heap leach pads and blending of higher-grade mill ore with lower-grade stockpiles.

At Bald Mountain, full-year production and cost of sales per ounce sold was in line with 2024. Quarter-over-quarter, production was lower due to planned mine sequencing, and cost of sales per ounce sold increased due to higher royalties and lower production.

Development projects

Kinross was pleased to announce construction decisions in January 2026 for Round Mountain Phase X, Curlew and Bald Mountain Redbird 2. These projects are expected to contribute 3 million ounces of production at attractive economics and extend mine lives in Nevada well into the 2030s. Together, the projects have an Internal Rate of Return13 of 59% and a Net Present Value14 of $4.3 billion at a gold price of $4,500 per ounce.

In 2022, Kinross initiated a portfolio and grade enhancement strategy that is expected to provide organic offsets to inflation pressures. The implementation began with the completion of the Tasiast 21k and 24k mill expansions, and the restart of the La Coipa mine, increasing the proportion of higher-grade mill feed in the portfolio. Following these portfolio enhancements, Manh Choh came online in 2024, contributing high-grade production at Fort Knox.

Higher-grade underground mining at Phase X and Curlew are expected to benefit long-term costs within Kinross’ U.S. portfolio. These three projects are expected to start contributing in 2028, coinciding with getting back into higher-grade mining at Tasiast. Looking to the end of the decade and into the early 2030s, with strong grades and low costs, Great Bear and Lobo-Marte are expected to contribute to the next phases of the Company’s grade enhancement strategy.

The announcement is available here.

Great Bear

At Great Bear, Kinross continues to progress its AEX program alongside permitting, detailed engineering and procurement of major equipment for the Main Project.

For AEX, surface construction is currently 80% complete. The Company is currently working with the Ontario Ministry of Environment, Conservation and Parks to finalize the two remaining AEX water permits. The AEX underground development will provide access for resource and exploration drilling to further delineate extensions of mineralization at depth. AEX is not on the critical path for first production at Great Bear.

For the Main Project, detailed engineering is advancing well and is approximately 35% complete. Initial procurement for major process plant and surface infrastructure is underway, with contract awards in progress. Manufacturing of selected long-lead items is anticipated to commence later in 2026.

Federally, the second of three phased submissions for the Project’s Impact Statement was submitted on schedule in December. The third and final submission remains on track for the end of Q1 2026. In addition to the Impact Statement, Kinross has advanced other federal Main Project permits, with technical documents submitted to Fisheries and Oceans Canada and Environment and Climate Change Canada during the quarter.

Provincially, the Company is also advancing Main Project permitting and pleased to report that the Ontario Minister of Energy and Mines officially designated the Great Bear Main Project for inclusion in its streamlined One Project, One Process (“1P1P”) permitting framework, which is expected to provide a more coordinated and integrated approach to Ontario’s mining project authorizations, permitting and Indigenous community consultation. Kinross is supportive of this streamlined approach and expects it will help facilitate Great Bear’s targeted first gold production in late 2029.

Lobo-Marte

Kinross has completed baseline studies to support the Environmental Impact Assessment for the Lobo-Marte project and plans to submit it by Q2 2026. Kinross also plans to provide a project update later this year. Lobo-Marte continues to be a potential large, low-cost mine with the potential to contribute to the portfolio in the early 2030s.

Company Guidance

The following section of the news release represents forward-looking information and users are cautioned that actual results may vary. We refer to the risks and assumptions contained in the Cautionary Statement on Forward-Looking Information on pages 41 and 42 of this news release.

This Company Guidance section below references attributable production cost of sales per equivalent ounce, attributable all-in sustaining cost per equivalent ounce sold, and sustaining, non-sustaining and attributable capital expenditures, which are non-GAAP ratios and financial measures, as applicable, with no standardized meaning under IFRS and therefore, may not be comparable to similar measures presented by other issuers. The definitions of these non-GAAP ratios and financial measures and comparable reconciliations are included on pages 27 to 33 of this news release.

Production guidance

In 2026, Kinross expects to produce 2.0 million attributable Au eq. oz.15 (+/- 5%) from its operations. Production is expected to remain stable at 2.0 million attributable Au eq. oz.15 (+/- 5%) for each of 2027 and 2028. In 2025, Kinross produced 2,012,106 attributable Au eq. oz.

| Annual attributable1 gold equivalent production guidance (+/- 5%) |

|

| 2026 | 2.0 million oz. |

| 2027 | 2.0 million oz. |

| 2028 | 2.0 million oz. |

Cost guidance

Attributable production cost of sales1 is expected to be $1,360 per Au eq. oz. (+/- 5%) for 2026. In 2025, production cost of sales2 and attributable production cost of sales1 were $1,140 per Au eq. oz. and $1,135 per Au eq. oz., respectively. The year-over-year increase in 2026 is primarily a result of the impact of higher gold prices on royalty costs, inflationary impacts, as well as planned mine sequencing, which has a higher proportion of waste stripping being classified as operating expense versus capital costs, while overall mined tonnes remain similar.

The Company expects its attributable all-in sustaining cost1 to be $1,730 per Au eq. oz. (+/- 5%) for 2026. In 2025, attributable all-in sustaining cost1 was $1,571 per Au eq. oz. sold. The expected 10% increase in 2026 is largely a result of the impact of higher gold prices on royalty costs (4%) and inflationary impacts (5%), as well as a minor impact from mine plan sequencing (1%), demonstrating strong management of controllable costs.

2026 production and cost guidance

| Q4 2025 results |

2025 full-year results |

2026 guidance (+/- 5%) |

|

| Gold equivalent basis | |||

| Production (Au eq. oz.) | 483,582 | 2.0 million | 2.0 million11 |

| Attributable production cost of sales per Au eq. oz. sold1 | $1,289 | $1,135 | $1,360 |

| Production cost of sales per Au eq. oz. sold2 | $1,297 | $1,140 | – |

| Attributable all-in sustaining cost per Au eq. oz. sold1 | $1,825 | $1,571 | $1,730 |

2026 attributable1 production and cost guidance by country

| Country | 2026 attributable production guidance (Au eq. oz.)1, 15 (+/-5%) |

Percentage of total forecast production16 | 2026 attributable production cost of sales guidance (per Au eq. oz. sold)1 (+/-5%) |

2025 production cost of sales (per Au eq. oz. sold)2 |

2025 attributable production cost of sales (per Au eq. oz. sold)1 |

| Mauritania | 505,000 | 25% | $1,050 | $884 | $884 |

| Brazil | 600,000 | 30% | $1,240 | $978 | $978 |

| Chile | 210,000 | 11% | $1,320 | $1,208 | $1,208 |

| United States | 685,000 | 34% | $1,700 | $1,417 | $1,426 |

| TOTAL | 2.0 million | 100% | $1,360 | $1,140 | $1,135 |

Material assumptions used to forecast 2026 guidance, most notably relating to production cost of sales, are as follows:

- a gold price of $4,500 per ounce;

- a silver price of $65 per ounce;

- an oil price of $70 per barrel;

- foreign exchange rates of:

- 5.25 Brazilian reais to the U.S. dollar;

- 940 Chilean pesos to the U.S. dollar;

- 40 Mauritanian ouguiyas to the U.S. dollar; and

- 1.38 Canadian dollars to the U.S. dollar;

Taking into account existing currency and oil hedges:

- a 10% change in foreign currency exchange rates17 would be expected to result in an approximate $30 impact on attributable production cost of sales per equivalent ounce sold1;

- specific to the Brazilian real, a 10% change in this exchange rate would be expected to result in an approximate $50 impact on Brazilian attributable production cost of sales per equivalent ounce sold1;

- specific to the Chilean peso, a 10% change in this exchange rate would be expected to result in an approximate $50 impact on Chilean attributable production cost of sales per equivalent ounce sold1;

- a $10 per barrel change in the price of oil would be expected to result in an approximate $3 impact on fuel consumption costs on attributable production cost of sales per equivalent ounce sold1; and

- a $100 change in the price of gold would be expected to result in an approximate $5 impact on attributable production cost of sales per equivalent ounce sold1 as a result of a change in royalties.

Attributable capital expenditures18 guidance

Attributable capital expenditures for 2026 are forecast to be approximately $1,500 million (+/- 5%) and are summarized in the table below. In 2025, capital expenditures3 and attributable capital expenditures were $1,194.2 million and $1,175.2 million, respectively.

Kinross’ attributable capital expenditures outlook for 2027 and 2028 is expected to be in line with 2026, subject to ongoing inflationary impacts and project opportunities currently under study, which have the potential to contribute in the 2030s.

| Country | Forecast 2026 sustaining capital18 (+/-5%) (attributable) (million) |

Forecast 2026 non-sustaining capital18 (+/-5%) (attributable) (million) |

Total 2026 forecast capital18 (+/-5%) (attributable) (million) |

2025 sustaining capital18 (million) |

2025 non-sustaining capital18 (million) |

2025 total capital18 (consolidated) (million) |

2025 total capital18 (attributable) (million) |

| Mauritania | $80 | $195 | $275 | $113 | $239 | $352 | $352 |

| Brazil | $190 | $45 | $235 | $189 | $- | $189 | $189 |

| Chile | $40 | $50 | $90 | $91 | $19 | $110 | $110 |

| U.S. | $140 | $500 | $640 | $214 | $224 | $438 | $419 |

| Canada and other |

$- | $260 | $260 | $- | $105 | $105 | $105 |

| TOTAL | $450 | $1,050 | $1,500 | $607 | $587 | $1,194 | $1,175 |

2026 sustaining capital18 includes the following forecast spending estimates:

|

$15 million (United States), $15 million (Chile), $20 million (Mauritania) |

|

$55 million (United States), $95 million (Brazil), $30 million (Mauritania) |

|

$10 million (United States), $25 million (Brazil), $10 million (Chile), $10 million (Mauritania) |

|

$15 million (United States) |

|

$55 million (Brazil), $10 million (Chile), $10 million (Mauritania) |

2026 non-sustaining capital18 includes the following forecast spending estimates:

|

$260 million |

|

$100 million |

|

$180 million |

|

$150 million |

|

$180 million |

Other 2026 guidance

| Category | 2026 Guidance | Summary |

| Exploration and Business Development ($M) | $220 (+/- 5%) | 2026 guidance includes approximately $185 million of exploration spend on brownfields, minex and greenfields exploration targets (2025 – $173.5 million).For details about the 2026 exploration program, see page 18. |

| General and Administrative ($M) |

$135 (+/- 5%) | In line with 2025 results. |

| Other Operating Costs ($M) |

$125-$150 | Primarily relates to studies and permitting activities that do not meet the criteria for capitalization, as well as care and maintenance and reclamation activities at non-operating sites. |

| Effective Tax Rate (ETR)19 | 28% – 33% | ETR based on adjusted net earnings. |

| Taxes paid (cash) ($M) |

$1,125 (+/- 5%) | Taxes paid is expected to increase by approximately $16 million for every $100/oz movement in the realized gold price.Includes approximately $100 – $125 million of withholding taxes paid, based on currently planned distributed earnings from our operating subsidiaries. |

| DD&A ($/oz.)20 | $550 (+/- 5%) | In line with 2025 results. |

| Interest paid ($M) | $60 | Total interest incurred is expected to be $60 million, of which 50% is expected to be expensed and 50% capitalized. Expected interest expense of $30 million excludes accretion of the Company’s reclamation and remediation obligations, as well as lease liabilities, which for 2025 totaled $50.7 million. |

Sustainability

Kinross continued to advance its Sustainability priorities in 2025, delivering meaningful progress across energy efficiency, community partnerships and governance. The Company maintained its strong position with external Sustainability rankings, including its leading position in the S&P Corporate Sustainability Assessment.

During the year, the Company completed its 2025 energy efficiency program, delivering an estimated 1.5% reduction in greenhouse gas emissions through the implementation of more than 30 projects. This included haul route optimization and cycle time improvements.

Across operating regions, Kinross delivered tangible social benefits to local communities. Kinross Chile was recognized as the Best Company of Atacama 2025 for its stakeholder engagement and social investment programs. In Alaska, Fort Knox committed $100,000 to expand its partnership with Trout Unlimited, supporting aquatic habitat and watershed health. In Brazil, Paracatu completed its second Social Progress Index measurement, showing measurable improvements in community well-being compared with the 2022 baseline. In Mauritania, through its long-standing partnership with Project C.U.R.E. and Mauritania’s Ministry of Health, Kinross delivered another donation of medical supplies, fulfilling its commitment to reach every region of the country. To date, the program has supported more than 70 health clinics.

Kinross maintained its focus on strong governance standards for its Board of Directors, including welcoming a new Board Chair and two new Board members in 2025. Kinross was, once again, the top scoring mining Company in The Globe and Mail’s annual corporate governance ranking, placing in the top 15% of companies overall.

Exploration update

In 2025, approximately 275,000 metres of drilling was completed for all exploration projects (brownfields, minex and greenfields).

Brownfields and minex exploration

The Company’s brownfields and minex exploration efforts – which accounted for approximately 85% of the Company’s exploration – continued to focus within the footprint of existing mines and projects during 2025.

Great Bear

In 2025 exploration at Great Bear shifted to focus on regional exploration work on the ~120 square kilometre land package to look for additional open pit and underground opportunities, and approximately 62,000 metres were drilled.

Exploration has generated encouraging results stepping out up to 1.8 kilometres along strike of the main LP zone, both to the northwest and southeast.

- BR-952: 2.2m @ 12.1 g/t Au

- BR-959: 1.7m @ 10.2 g/t Au

- BR-941: 1.0m @ 64.1 g/t Au

- BR-941: 1.7m @ 5.94 g/t Au

- REG-25-110: 0.6m @ 14.20 g/t Au

There were also encouraging results on the broader land package outside of the main LP trend:

- REG-25-131: 1.0m @ 1.99 g/t Au

- REG-25-137: 0.5m @ 11.60 g/t Au

- DL25-150A: 8.9m @ 4.83 g/t Au

These areas will be followed up in the 2026 drilling program, which includes approximately 55,000 metres of planned drilling.

Additionally, prospecting and mapping on the Red Lake North property, located 66 kilometres from the Great Bear property, has identified shear hosted, mineralized quartz veining that can be traced for over 1 kilometre in length. Highlights from grab samples include values of 7.9 g/t, 13.9 g/t and 65.3 g/t gold. Detailed mapping and sampling, and drilling will be conducted in 2026 to follow up on these positive initial results.

Round Mountain

In 2025, work at Round Mountain was focused on underground infill drilling of the Phase X exploration target, which confirmed good grades and robust widths within the target zone and defined a significant initial mineral reserve of approximately 1.2 Moz., and initial mineral resource of 0.2 Moz. of measured and indicated, and 0.5 Moz. of inferred. Approximately 28,000 metres were drilled underground at Phase X.

Highlights from Phase X underground drilling campaign:

- RX-0030: 140m @ 4.4 g/t Au Eq.

- RX-0031: 58m @ 5.8 g/t Au Eq.

- RX-0032: 23m @ 37.5 g/t Au Eq.

- RX-0034: 29m @ 24.1 g/t Au Eq.

- RX-0064: 105m @ 4.1 g/t Au Eq.

- DX-0117: 125m @ 5.4 g/t Au Eq.

- DX-0125: 223m @ 2.7 g/t Au Eq.

The Company also received results from step out drilling ~220 metres down dip and along plunge of the Phase X resource, showing mineralization with similar grades and widths to the initial resource with RX-0105 intersecting 68 metres at 3.1 g/t, supporting the hypothesis that this system extends significantly down dip and highlighting potential for further resource and mine plan additions.

In 2026, Kinross plans to focus exploration at Phase X on proximal and down dip extensions of the resource, alongside further infill drilling of the lower zone and surface exploration targeting future open pit extensions on the broader land package.

Curlew

The 2025 drilling program at Curlew included approximately 14,000 metres of underground drilling. Exploration development was also driven to establish more efficient drilling platforms in both the North Stealth and Roadrunner zones.

Drilling in the North Stealth zone was focused on expanding inferred high-grade mineralization, as well as infill drilling of areas that will be targeted in the early years of the mine plan.

Program highlights from assays received in 2025 include:

- N. Stealth-1221 – 10.0m @ 16.4 g/t Au

- N. Stealth-1554 – 10.4m @ 11.7 g/t Au

- K5-1261 – 25.7m @ 7.8 g/t Au

- K5-1522 – 6.9m @ 8.9 g/t Au

- K2N-1482 – 11.7m @ 10.4 g/t Au

In 2026, Kinross plans to focus on expanding areas of wide, higher-grade mineralization proximal to North Stealth and in the Roadrunner area down dip with potential to augment the life of mine plan, alongside infill drilling across the property in preparation for the initial years of mining.

Alaska

At Fort Knox, approximately 29,000 metres of drilling in 2025 focused on growth at two main target areas: the area proximal to the satellite Gil pit, and growth opportunities proximal to the Fort Knox pit, which may offer potential to augment medium-term production plans at Fort Knox

Gil highlights include:

- GPC25-902 – 16.8m @ 2.9 g/t Au

- GR25-915 – 6.1m @ 4.4 g/t Au

- GC25-925 – 14.0m @ 3.4 g/t Au

- GC25-933 – 6.9m @ 8.8 g/t Au

Fort Knox highlights include:

- FFR25-1923 – 4.6m @ 7.7 g/t Au

- FFC25-1957 – 7.4m @ 2.71 g/t Au

- FFC25-1958 – 17.3m @ 2.0 g/t Au

- FFC25-1958 – 4.9m @ 33.0 g/t Au

In 2026, drilling at Fort Knox will continue to focus on growth opportunities proximal to the Gil and Fort Knox pits.

Bald Mountain

At Bald Mountain, drilling in 2025 targeted both the north and south areas of existing operations. Approximately 26,000 metres of drilling was completed covering exploration and infill targets.

As a result of strong near mine exploration and progression of project studies, Bald Mountain converted approximately 200,000 Au. oz. to reserves, largely driven by near-pit exploration, more than offsetting production depletion.

Highlights for the exploration campaign beyond the reserve conversion included positive results at both the Rat and Top target areas.

Highlights from Rat and Top:

- RRD25-001: 12.0m @ 12.7 g/t

- RRD25-002: 16.0m @ 10.4 g/t

- RRD25-005: 7.5m @ 2.7 g/t

- TC25-002: 4.6m @ 6.4 g/t

- TC25-001: 39.6m @ 1.2 g/t

In 2026, Kinross plans to target near mine growth opportunities at several of the existing Bald Mountain open pits as well as advancing drilling on other satellite target opportunities.

Tasiast

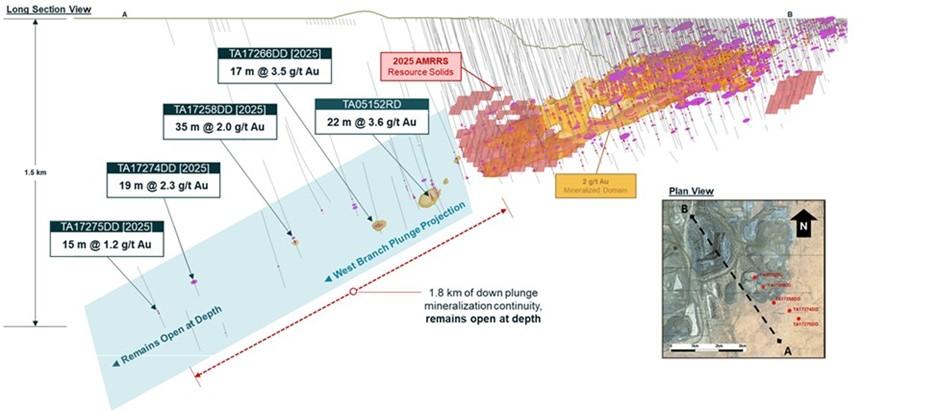

At Tasiast, approximately 44,000 metres of drilling were completed in 2025. Drill testing of the West Branch orebody continued at depth throughout the year, providing additional data to support the assessment of future underground mining potential. The program intersected several broad, well-mineralized zones down plunge of the current West Branch underground resource, which includes 1.8 Moz. These results extend mineralization approximately 1,800 metres along strike and down plunge, confirming strong continuity beyond current resource boundaries.

Figure 1: Strong underground potential at Tasiast West Branch

Highlighted intercepts from West Branch deep drilling:

- TA17263DD: 23m @ 2.8 g/t Au

- TA17266DD: 7m @ 2.3 g/t Au

- TA17266DD: 27m @ 2.3 g/t Au

- TA17271ADD: 20m @ 2.1 g/t Au

- TA17274DD: 19m @ 2.3 g/t Au

- TA17275DD: 15m @ 1.2 g/t Au

- TA17258DD: 35m @ 2.0 g/t Au

In addition to the reserve additions at Fennec, Kinross also advanced exploration across other target areas, including C68, Piment and Prolongation. While further drilling is required to fully define these targets, results to date are encouraging and indicate continued exploration upside.

Highlighted intercepts include:

- TA17268ADD: 6m @ 2.5 g/t Au

- TA17268ADD: 7m @ 1.7 g/t Au

- TA17273ADD: 6m @ 2.0 g/t Au

- TA17277DD: 6m @ 1.4 g/t Au

- TA17280DD: 5m @ 1.5 g/t Au

- TA17281DD: 8m @ 1.3 g/t Au

- TA17281DD: 3m @ 1.3 g/t Au

Drilling in 2026 will focus on following up on 2025 results at the satellite open pit ore bodies and extending underground targets at depth.

Chile

At La Coipa, the 2025 drilling program completed approximately 12,000 metres of drilling across multiple deposits further defining existing trends within the La Coipa area of operations, targeting extensions of previously mined orebodies.

Drill results in the Puren area, where we are currently mining and which includes our next planned layback at La Coipa were encouraging, including:

- PUR-037A: 10m @ 1.9 g/t Au & 31 g/t Ag

- PUR-037A: 16m @ 1.3 g/t Au & 146 g/t Ag

- PUR-037A: 10m @ 2.0 g/t Au & 11 g/t Ag

- PUR-036: 10m @ 0.03 g/t Au & 181 g/t Ag

- PUR-035: 14m @ 1.3 g/t Au & 6.8 g/t Ag

- PUR-034: 14m @ 2.9 g/t Au & 4.4 g/t Ag

- PUR-032: 44m @ 1.2 g/t Au & 15.3 g/t Ag

- PUR-031: 32m @ 1.4g/t Au & 138 g/t Ag

Drill results in closer proximity to Phase 7 (Pompeya) pit which we are also currently mining were also encouraging, including:

- CAT-123: 20m @ 1.1 g/t & 10 g/t Ag

- CAT-122: 16m @ 1.0 g/t Au & 37 g/t Ag

Drilling in 2026 will focus on growth opportunities, following up the 2025 near mine successes around the existing La Coipa operations and planned future laybacks.

Brazil

Brownfields exploration in 2025 focused on the large licenses south of and adjacent to the Paracatu mine. Approximately 9,000 metres of drilling was completed. Drilling showing similar style of mineralization to Paracatu will be followed up on in 2026. New gold in soil anomalies and induced polarization geophysics anomalies identified in 2025 will also be drill tested in 2026.

The 2025 minex campaign focused on several near mine opportunities, including the south pile, southwest expansion, and the northeast target areas.

Together with mine design optimization, resource drilling supported the addition of 700,000 Au oz. to reserves in 2025, nearly offsetting production depletion.

Greenfields exploration update

The greenfields exploration strategy is to identify high potential geological units that have the right age, structural complexity and potential to host high-grade gold mineralization. The Company looks for opportunities where it can stake its own claims or collaborate with high-quality junior exploration companies through either joint venture agreements or via equity investment. The primary focus is exploring for orogenic, epithermal, Carlin and intrusion related gold and gold-copper style deposits.

The greenfields exploration programs in 2025 were focused on targets located in Canada, the U.S.A. and Finland with approximately 40,000 metres of drilling completed on all projects.

Canada

Exploration in Canada was primarily on the large land holdings in Snow Lake, Manitoba, where Kinross has 100% ownership of six exploration properties: Laguna, Laguna North, Puella Bay, Lucky Jack, DSN and SLG and has an earn-in agreement on the McCafferty property with Strider Resources whereby Kinross can earn 100% of the property for cash and work commitments.

High-grade gold was discovered on the SLG property through prospecting and mapping. Sampling along a 1.0 kilometre length returned gold grades of 73.1 g/t, 16.8 g/t, 16.5 g/t, 16.3g/t, 16.0 g/t, 14.2 g/t, 11.7 g/t and 10.9 g/t. Drill testing of this prospective trend will take place in the winter of 2026.

Kinross conducted the first drill program on the McCafferty property during the fourth quarter of 2025. The drilling successfully intersected the target vein with the deepest intercept occurring at ~200m below surface. Preliminary highlights of the drilling are as follows:

- MCA25-002: 2.9m @ 16.9 g/t Au

- MCA25-003: 4.0m @ 5.4 g/t Au

- MCA25-005: 2.0m @ 17.5 g/t Au

- MCA25-006: 4.0m @ 33.7 g/t Au

Outside of Manitoba, Kinross has 100% ownership of four greenfield exploration properties in northwest Ontario, three of which are in the Red Lake district and one in the Kenora district. Mapping, prospecting and airborne magnetic geophysics were conducted on several of these properties and the initial results will be followed up in 2026.

In October 2025, the company became the operator of the joint venture properties in New Brunswick under option with Puma Resources. Work consisted of prospecting, mapping and drilling on the Williams Brook property at the Lynx Zone where gold rich quartz veining has been identified and was reported by the joint venture company.

Kinross will continue to advance this area and drill test other known showings starting with a winter 2026 drilling program followed by mapping and prospecting throughout the spring and summer that will be followed up with a late summer to fall drilling campaign.

U.S.A.

Kinross holds a number of projects in Nevada that are either 100% owned or are in joint venture with private individuals, state agencies or junior exploration companies. Work on Kinross’ Nevada projects in 2025 included geophysics, prospecting, mapping, reverse circulation and diamond drilling of early-stage targets.

Since 2024, the company has been in a joint venture was with Riley Gold Corporation on its PWC project, which is contiguous with the western boundary of Nevada Gold Mines’ Pipeline Complex. In 2025 Kinross completed two diamond drill holes, designed to test for favourable lower plate carbonate Carlin-type host rocks. The highlight of the program was reported by Riley Gold in a press release dated November 24, 2025, in which they announced a 149 metre core intercept at 0.09 g/t gold in hole PW25-03 confirming the presence of Carlin type disseminated gold mineralization. Other high-grade results in the hole occur along faults that are interpreted to have acted as fluid conduits carrying gold up from lower plate hosted mineralization.

Work in 2026 will follow-up on the exciting results at PWC and advance exploration on the other projects.

Finland

Kinross actively explored its projects in the Central Lapland Greenstone Belt a greenstone belt of similar scale to the Abitibi that has had limited historical gold exploration and development. Kinross’ land positions are proximal to Agnico Eagle’s Kittilä gold mine and Rupert Resource’s Ikkari gold deposit, which reported more than 4 million ounces at 2.2 g/t Au in indicated resources.

Work in 2025 included approximately 15,000 metres of drilling on the projects, of which 11,000 metres was base-of-till drilling and is used to test the surface of bedrock under cover for gold anomalies. Base-of-till drilling was used successfully in the discoveries of Agnico Eagle’s Kittilä gold mine and Rupert Resource’s Ikkari gold deposit.

Work will continue on the joint venture ground in 2026 and advance the other projects through base-of-till drilling, mapping and prospecting and diamond drilling of the highest priority anomalies.

2026 Focus

2026 exploration expenditure guidance (brownfields, minex and greenfields) is $185 million (+/-5%) compared with the $174 million incurred in 2025. The 2026 programs are designed to follow-up on existing zones of mineralization and extend the life of mine operations and to make new discoveries in all of Kinross’ jurisdictions.

Priority exploration projects:

- At Great Bear, focus on the discovery of new open pit and underground targets outside of the LP, Hinge and Limb areas on Kinross’ 120 square kilometre land package.

- At Curlew, delineate and extend zones of high-grade mineralization at North Stealth, and Roadrunner.

- At Round Mountain, explore for proximal and down dip extensions of the initial resource while continuing infill drilling of the lower zone at Phase X.

- At Fort Knox, focus on extension opportunities in proximity to both the Gil and Fort Knox open pits.

- At Tasiast, continue to demonstrate continuity at depth and extend underground resources at West Branch while progressing further exploration of multiple satellite targets on the large TMLSA land package.

- In Chile, drill test a number of greenfields and brownfields projects, targeting both porphyry and high sulphidation epithermal styles of mineralization as well as extensions of known oxide deposits.

- At Paracatu, continue testing targets along the mine trend and advance greenfields exploration regionally.

- In Canada, advance exploration at Snow Lake in Manitoba, on the Red Lake North property in Ontario, and through the Puma Resources joint venture in New Brunswick.

Full drill results are available here: www.kinross.com/Exploration-Drill-Results-Appendix-A-Q4-YE-2025

2025 Mineral Reserves and Mineral Resources update

(See the Company’s detailed Annual Mineral Reserve and Mineral Resource Statement estimated as at December 31, 2025 and explanatory notes starting at page 35.)

Kinross increased its gold price assumptions from $1,600 per ounce to $2,000 per ounce for its mineral reserve estimates and from $2,000 per ounce to $2,500 per ounce for its mineral resource estimates, as of December 31, 202521.

The Company also increased its silver price assumptions to $23.53 per ounce and $29.41 per ounce for its mineral reserve and mineral resource estimates, respectively.

Kinross continues to prioritize quality, high-margin, low-cost ounces in its portfolio, and maintained its fully loaded costing methodology with the objective of converting to reserves.

| Kinross Gold Mineral Reserve and Mineral Resource estimates22 | ||||

| 2024 (Au koz.) |

Depletion (Au koz.) |

Geology & Engineering (Au koz.) |

2025 (Au koz.) |

|

Proven and Probable Reserves |

21,857 | (2,131) | 1,217 | 20,942 |

Measured and Indicated Resources |

25,867 | (33) | 1,666 | 27,499 |

Inferred Resources |

13,193 | (42) | 3,482 | 16,633 |

Proven and Probable Mineral Reserves

Kinross’ total estimated proven and probable gold reserves at December 31, 2025, were approximately 20.9 million ounces, a decrease of 4% or 1.0 million ounces from 21.9 million ounces at December 31, 2024. The net decrease was driven by depletion of 2.1 million ounces, partially offset by 1.2 million ounces added to proven and probable reserves, mainly at Paracatu, Bald Mountain, Tasiast, and Round Mountain.

Paracatu added 700,000 Au oz. to reserves before depletion through mine design optimizations and exploration nearly offsetting production depletion.

Bald Mountain added 200,000 Au oz. to reserves before depletion driven by conversion of resources to reserves along with the Redbird 2 and satellites project approvals.

Tasiast added 200,000 Au oz. to reserves before depletion driven by additions within the existing reserve pit design at West Branch and further additions to reserves at the Fennec satellite pit.

Round Mountain’s 2025 reserve update reflects the transition to the Phase X underground. Higher margin underground reserves (3.2 g/t) replaced lower margin open pit reserves (0.8 g/t), adding approximately 100,000 Au oz. to reserves before depletion, and driving improved value, margins and returns, with a significantly higher IRR and NPV. The higher-grade component of Phase W resource converted to underground reserve. The remaining lower grade open pit resource with high strip ratio was removed, improving the quality of the overall resource. Phase X underground extends mine life by eight years to 2038. Underground mining also has significant potential to extend resources with lower incremental capital relative to open pit expansions with potential extensions of mineralization down-dip.

Measured and Indicated Mineral Resources

Kinross’ total measured and indicated mineral resource estimate increased by 6% to 27.5 million Au oz. at year-end 2025, compared with 25.9 million Au oz at year-end 2024. The net addition of 1.6 million ounces was driven by gains across the portfolio, including at Fort Knox, La Coipa, Paracatu, Maricunga and Lobo-Marte, partially offset by reduction at Round Mountain with the transition to underground.

Inferred Mineral Resources

Kinross’ total inferred mineral resource estimate increased by 26% to 16.6 million Au oz at year-end 2025, compared with 13.2 million Au oz. at year-end 2024. The addition of 3.4 million ounces was driven by strong growth across the portfolio, including at Tasiast, Fort Knox, Round Mountain, Bald Mountain, Maricunga and Lobo-Marte. These results reflect continued discovery, and the advancement of exploration programs across Kinross’ global portfolio.

About Kinross Gold Corporation

Kinross is a Canadian-based global senior gold mining company with operations and projects in the United States, Brazil, Mauritania, Chile and Canada. Our focus is on delivering value based on the core principles of responsible mining, operational excellence, disciplined growth, and balance sheet strength. Kinross maintains listings on the Toronto Stock Exchange (symbol: K) and the New York Stock Exchange (symbol: KGC).

Review of operations

| Three months ended December 31, | Gold equivalent ounces | |||||||||||||||||

| Produced | Sold | Production cost of sales ($millions) | Production cost of sales/equivalent ounce sold | |||||||||||||||

| 2025 | 2024 | 2025 | 2024 | 2025 | 2024 | 2025 | 2024 | |||||||||||

| Tasiast | 125,625 | 139,411 | 118,912 | 144,041 | 119.2 | 104.4 | 1,002 | 725 | ||||||||||

| Paracatu | 155,048 | 123,899 | 154,565 | 124,690 | 165.0 | 131.6 | 1,068 | 1,055 | ||||||||||

| La Coipa | 67,319 | 58,533 | 71,419 | 57,852 | 80.7 | 68.2 | 1,130 | 1,179 | ||||||||||

| Fort Knox | 71,523 | 104,901 | 74,294 | 108,512 | 125.8 | 141.0 | 1,693 | 1,299 | ||||||||||

| Round Mountain | 31,754 | 42,969 | 31,641 | 45,342 | 86.6 | 80.0 | 2,737 | 1,764 | ||||||||||

| Bald Mountain | 38,402 | 44,642 | 37,141 | 51,291 | 55.4 | 58.7 | 1,492 | 1,144 | ||||||||||

| United States Total | 141,679 | 192,512 | 143,076 | 205,145 | 267.8 | 279.7 | 1,872 | 1,363 | ||||||||||

| Less: Manh Choh non-controlling interest (30%) | (6,089 | ) | (13,146 | ) | (6,412 | ) | (13,749 | ) | (12.2 | ) | (15.9 | ) | ||||||

| United States Attributable Total | 135,590 | 179,366 | 136,664 | 191,396 | 255.6 | 263.8 | 1,870 | 1,378 | ||||||||||

| Operations Total(a) | 489,671 | 514,355 | 487,972 | 531,729 | 632.7 | 583.8 | 1,297 | 1,098 | ||||||||||

| Attributable Total(a) | 483,582 | 501,209 | 481,560 | 517,980 | 620.5 | 567.9 | 1,289 | 1,096 | ||||||||||

| Years ended December 31, | Gold equivalent ounces | |||||||||||||||||

| Produced | Sold | Production cost of sales ($millions) | Production cost of sales/equivalent ounce sold | |||||||||||||||

| 2025 | 2024 | 2025 | 2024 | 2025 | 2024 | 2025 | 2024 | |||||||||||

| Tasiast | 503,429 | 622,394 | 486,401 | 609,614 | 430.2 | 415.4 | 884 | 681 | ||||||||||

| Paracatu | 601,318 | 528,574 | 600,110 | 528,209 | 587.1 | 548.6 | 978 | 1,039 | ||||||||||

| La Coipa | 231,770 | 246,131 | 235,233 | 241,077 | 284.2 | 231.3 | 1,208 | 959 | ||||||||||

| Fort Knox | 410,822 | 377,258 | 417,104 | 375,402 | 558.6 | 452.5 | 1,339 | 1,205 | ||||||||||

| Round Mountain | 143,402 | 215,387 | 142,739 | 214,996 | 273.8 | 328.3 | 1,918 | 1,527 | ||||||||||

| Bald Mountain | 179,169 | 181,047 | 177,430 | 182,760 | 212.5 | 220.3 | 1,198 | 1,205 | ||||||||||

| United States Total | 733,393 | 773,692 | 737,273 | 773,158 | 1,044.9 | 1,001.1 | 1,417 | 1,295 | ||||||||||

| Less: Manh Choh non-controlling interest (30%) | (57,804 | ) | (42,739 | ) | (58,482 | ) | (41,524 | ) | (76.7 | ) | (40.8 | ) | ||||||

| United States Attributable Total | 675,589 | 730,953 | 678,791 | 731,634 | 968.2 | 960.3 | 1,426 | 1,313 | ||||||||||

| Operations Total(a) | 2,069,910 | 2,170,791 | 2,059,017 | 2,153,212 | 2,346.4 | 2,197.1 | 1,140 | 1,020 | ||||||||||

| Attributable Total(a) | 2,012,106 | 2,128,052 | 2,000,535 | 2,111,688 | 2,269.7 | 2,156.3 | 1,135 | 1,021 | ||||||||||

| (a) Totals include immaterial sales and related costs from Maricunga for the three and twelve months ended December 31, 2024. | ||||||||||||||||||

Consolidated balance sheets

| (expressed in millions of U.S. dollars, except share amounts) | |||||||||

| As at | |||||||||

| December 31, | December 31, | ||||||||

| 2025 | 2024 | ||||||||

| Assets | |||||||||

| Current assets | |||||||||

| Cash and cash equivalents | $ | 1,742.3 | $ | 611.5 | |||||

| Restricted cash | 13.5 | 10.2 | |||||||

| Accounts receivable and prepaid assets | 145.8 | 257.3 | |||||||

| Inventories | 1,370.3 | 1,243.2 | |||||||

| Other current assets | 16.6 | 4.5 | |||||||

| 3,288.5 | 2,126.7 | ||||||||

| Non-current assets | |||||||||

| Property, plant and equipment | 8,289.4 | 7,968.6 | |||||||

| Long-term investments | 99.3 | 51.9 | |||||||

| Other long-term assets | 708.9 | 713.1 | |||||||

| Deferred tax assets | 25.0 | 5.3 | |||||||

| Total assets | $ | 12,411.1 | $ | 10,865.6 | |||||

| Liabilities | |||||||||

| Current liabilities | |||||||||

| Accounts payable and accrued liabilities | $ | 716.4 | $ | 543.0 | |||||

| Current income tax payable | 595.7 | 236.7 | |||||||

| Current portion of long-term debt | – | 199.9 | |||||||

| Current portion of provisions | 74.2 | 62.5 | |||||||

| Other current liabilities | 13.3 | 18.0 | |||||||

| 1,399.6 | 1,060.1 | ||||||||

| Non-current liabilities | |||||||||

| Long-term debt | 738.2 | 1,235.5 | |||||||

| Provisions | 976.6 | 941.5 | |||||||

| Other long-term liabilities | 64.8 | 78.9 | |||||||

| Deferred tax liabilities | 537.8 | 549.0 | |||||||

| Total liabilities | $ | 3,717.0 | $ | 3,865.0 | |||||

| Equity | |||||||||

| Common shareholders’ equity | |||||||||

| Common share capital | $ | 4,382.0 | $ | 4,487.3 | |||||

| Contributed surplus | 10,137.6 | 10,643.0 | |||||||

| Accumulated deficit | (5,943.3 | ) | (8,181.3 | ) | |||||

| Accumulated other comprehensive loss | (0.3 | ) | (87.4 | ) | |||||

| Total common shareholders’ equity | 8,576.0 | 6,861.6 | |||||||

| Non-controlling interests | 118.1 | 139.0 | |||||||

| Total equity | $ | 8,694.1 | $ | 7,000.6 | |||||

| Total liabilities and equity | $ | 12,411.1 | $ | 10,865.6 | |||||

| Common shares | |||||||||

| Authorized | Unlimited | Unlimited | |||||||

| Issued and outstanding | 1,199,843,037 | 1,229,125,606 | |||||||

Consolidated statements of operations

| (expressed in millions of U.S. dollars, except per share amounts) | ||||||||||

| Years ended | ||||||||||

| December 31, | December 31, | |||||||||

| 2025 | 2024 | |||||||||

| Revenue | ||||||||||

| Metal sales | $ | 7,051.1 | $ | 5,148.8 | ||||||

| Cost of sales | ||||||||||

| Production cost of sales | 2,346.4 | 2,197.1 | ||||||||

| Depreciation, depletion and amortization | 1,105.0 | 1,147.5 | ||||||||

| Impairment reversal | (116.1 | ) | (74.1 | ) | ||||||

| Total cost of sales | 3,335.3 | 3,270.5 | ||||||||

| Gross profit | 3,715.8 | 1,878.3 | ||||||||

| Other operating expense | 93.9 | 14.0 | ||||||||

| Exploration and business development | 204.4 | 197.8 | ||||||||

| General and administrative | 139.9 | 126.2 | ||||||||

| Operating earnings | 3,277.6 | 1,540.3 | ||||||||

| Other (expense) income – net | (24.6 | ) | 14.3 | |||||||

| Finance income | 73.0 | 18.2 | ||||||||

| Finance expense | (131.3 | ) | (91.4 | ) | ||||||

| Earnings before tax | 3,194.7 | 1,481.4 | ||||||||

| Income tax expense – net | (724.7 | ) | (487.4 | ) | ||||||

| Net earnings | $ | 2,470.0 | $ | 994.0 | ||||||

| Net earnings attributable to: | ||||||||||

| Non-controlling interests | $ | 79.9 | $ | 45.2 | ||||||

| Common shareholders | $ | 2,390.1 | $ | 948.8 | ||||||

| Earnings per share attributable to common shareholders | ||||||||||

| Basic | $ | 1.96 | $ | 0.77 | ||||||

| Diluted | $ | 1.95 | $ | 0.77 | ||||||

Consolidated statements of cash flows

| (expressed in millions of U.S. dollars) | ||||||||||

| Years ended | ||||||||||

| December 31, | December 31, | |||||||||

| 2025 | 2024 | |||||||||

| Net inflow (outflow) of cash related to the following activities: | ||||||||||

| Operating: | ||||||||||

| Net earnings | $ | 2,470.0 | $ | 994.0 | ||||||

| Adjustments to reconcile net earnings to net cash provided from operating activities: | ||||||||||

| Depreciation, depletion and amortization | 1,105.0 | 1,147.5 | ||||||||

| Impairment reversal | (116.1 | ) | (74.1 | ) | ||||||

| Share-based compensation expense | 13.1 | 9.0 | ||||||||

| Finance expense – net | 90.1 | 73.2 | ||||||||

| Income tax expense – net | 724.7 | 487.4 | ||||||||

| Gain on sale of Asante Gold Corporation holdings | (63.0 | ) | – | |||||||

| Foreign exchange losses (gains) | 5.7 | (13.8 | ) | |||||||

| Other | 2.0 | (44.1 | ) | |||||||

| Reclamation payments, net of reclamation (recovery) expense | (92.3 | ) | (22.3 | ) | ||||||

| Changes in working capital: | ||||||||||

| Accounts receivable and other assets | 9.5 | 27.5 | ||||||||

| Inventories | (83.9 | ) | 14.3 | |||||||

| Accounts payable and accrued liabilities | 114.1 | 26.0 | ||||||||

| Cash flow provided from operating activities | 4,178.9 | 2,624.6 | ||||||||

| Income taxes paid | (418.4 | ) | (178.2 | ) | ||||||

| Net cash flow provided from operating activities | 3,760.5 | 2,446.4 | ||||||||

| Investing: | ||||||||||

| Additions to property, plant and equipment | (1,194.2 | ) | (1,075.5 | ) | ||||||

| Interest paid capitalized to property, plant and equipment | (19.8 | ) | (92.6 | ) | ||||||

| Proceeds from long-term investments and other assets | 189.8 | 4.8 | ||||||||

| Additions to long-term investments and other assets | (72.1 | ) | (43.2 | ) | ||||||

| Increase in restricted cash – net | (3.3 | ) | (0.4 | ) | ||||||

| Interest received and other – net | 42.8 | 17.0 | ||||||||

| Net cash flow of continuing operations used in investing activities | (1,056.8 | ) | (1,189.9 | ) | ||||||

| Net cash flow of discontinued operations provided from investing activities | 53.4 | 10.0 | ||||||||

| Financing: | ||||||||||

| Repayment of debt | (700.0 | ) | (800.0 | ) | ||||||

| Interest paid | (65.2 | ) | (35.6 | ) | ||||||

| Payment of lease liabilities | (7.2 | ) | (12.1 | ) | ||||||

| Funding from non-controlling interest | – | 31.3 | ||||||||

| Distributions paid to non-controlling interest | (102.0 | ) | (40.5 | ) | ||||||

| Dividends paid to common shareholders | (152.1 | ) | (147.5 | ) | ||||||

| Repurchase and cancellation of shares | (600.3 | ) | – | |||||||

| Other – net | (1.2 | ) | (1.5 | ) | ||||||

| Net cash flow used in financing activities | (1,628.0 | ) | (1,005.9 | ) | ||||||

| Effect of exchange rate changes on cash and cash equivalents | 1.7 | (1.5 | ) | |||||||

| Increase in cash and cash equivalents | 1,130.8 | 259.1 | ||||||||

| Cash and cash equivalents, beginning of period | 611.5 | 352.4 | ||||||||

| Cash and cash equivalents, end of period | $ | 1,742.3 | $ | 611.5 | ||||||

| Operating Summary | |||||||||||||||||||

| Mine | Period | Tonnes Ore Mined | Ore Processed (Milled) | Ore Processed (Heap Leach) | Grade (Mill) | Grade (Heap Leach) | Recovery (a)(b) | Gold Eq Production(c) | Gold Eq Sales(c) | Production cost of sales | Production cost of sales/oz(d) | Cap Ex – sustaining(e) | Total Cap Ex (e) | ||||||

| (‘000 tonnes) | (‘000 tonnes) | (‘000 tonnes) | (g/t) | (g/t) | (%) | (ounces) | (ounces) | ($ millions) | ($/ounce) | ($ millions) | ($ millions) | ||||||||

| West Africa | Tasiast | Q4 2025 | 3,120 | 2,252 | – | 1.87 | – | 94 | % | 125,625 | 118,912 | $ | 119.2 | $ | 1,002 | $ | 28.6 | $ | 80.5 |

| Q3 2025 | 1,685 | 2,181 | – | 1.78 | – | 94 | % | 120,934 | 116,251 | $ | 103.4 | $ | 889 | $ | 47.6 | $ | 102.0 | ||

| Q2 2025 | 1,921 | 1,730 | – | 2.11 | – | 95 | % | 119,241 | 121,745 | $ | 102.6 | $ | 843 | $ | 23.1 | $ | 89.7 | ||

| Q1 2025 | 1,812 | 1,932 | – | 2.15 | – | 95 | % | 137,629 | 129,493 | $ | 105.0 | $ | 811 | $ | 13.7 | $ | 80.1 | ||

| Q4 2024 | 1,824 | 2,205 | – | 2.13 | – | 94 | % | 139,411 | 144,041 | $ | 104.4 | $ | 725 | $ | 33.7 | $ | 105.4 | ||

| Americas | Paracatu | Q4 2025 | 10,929 | 12,395 | – | 0.45 | – | 83 | % | 155,048 | 154,565 | $ | 165.0 | $ | 1,068 | $ | 67.6 | $ | 67.6 |

| Q3 2025 | 12,958 | 13,214 | – | 0.44 | – | 82 | % | 150,367 | 149,903 | $ | 139.9 | $ | 933 | $ | 58.2 | $ | 58.2 | ||

| Q2 2025 | 13,497 | 14,527 | – | 0.39 | – | 82 | % | 149,264 | 148,787 | $ | 142.6 | $ | 958 | $ | 38.4 | $ | 38.4 | ||

| Q1 2025 | 13,318 | 12,507 | – | 0.43 | – | 83 | % | 146,639 | 146,855 | $ | 139.6 | $ | 951 | $ | 24.4 | $ | 24.4 | ||

| Q4 2024 | 12,944 | 13,116 | – | 0.40 | – | 80 | % | 123,899 | 124,690 | $ | 131.6 | $ | 1,055 | $ | 35.1 | $ | 35.1 | ||

| La Coipa(f) | Q4 2025 | 1,219 | 1,203 | – | 2.42 | – | 74 | % | 67,319 | 71,419 | $ | 80.7 | $ | 1,130 | $ | 31.7 | $ | 31.7 | |

| Q3 2025 | 1,006 | 932 | – | 2.36 | – | 76 | % | 57,997 | 57,544 | $ | 69.0 | $ | 1,199 | $ | 18.5 | $ | 18.5 | ||

| Q2 2025 | 580 | 911 | – | 1.77 | – | 78 | % | 54,139 | 50,400 | $ | 70.4 | $ | 1,397 | $ | 25.0 | $ | 25.0 | ||

| Q1 2025 | 1,265 | 971 | – | 2.19 | – | 80 | % | 52,315 | 55,870 | $ | 64.1 | $ | 1,147 | $ | 15.6 | $ | 15.6 | ||

| Q4 2024 | 1,385 | 1,017 | – | 1.98 | – | 79 | % | 58,533 | 57,852 | $ | 68.2 | $ | 1,179 | $ | 26.6 | $ | 26.6 | ||

| Fort Knox (100%)(g) | Q4 2025 | 11,056 | 1,645 | 8,805 | 1.02 | 0.23 | 88 | % | 71,523 | 74,294 | $ | 125.8 | $ | 1,693 | $ | 38.0 | $ | 38.0 | |

| Q3 2025 | 8,140 | 1,511 | 6,538 | 1.86 | 0.23 | 90 | % | 112,181 | 117,500 | $ | 159.7 | $ | 1,359 | $ | 45.0 | $ | 45.0 | ||

| Q2 2025 | 7,639 | 1,636 | 5,529 | 1.72 | 0.23 | 88 | % | 115,064 | 113,200 | $ | 141.3 | $ | 1,248 | $ | 43.0 | $ | 43.0 | ||

| Q1 2025 | 6,530 | 1,071 | 4,790 | 2.77 | 0.19 | 91 | % | 112,054 | 112,110 | $ | 131.8 | $ | 1,176 | $ | 28.2 | $ | 28.2 | ||

| Q4 2024 | 7,692 | 1,524 | 6,664 | 1.51 | 0.21 | 82 | % | 104,901 | 108,512 | $ | 141.0 | $ | 1,299 | $ | 53.3 | $ | 54.0 | ||

| Fort Knox (attributable)(g) | Q4 2025 | 11,001 | 1,597 | 8,805 | 0.93 | 0.23 | 87 | % | 65,434 | 67,882 | $ | 113.6 | $ | 1,673 | $ | 31.5 | $ | 31.5 | |

| Q3 2025 | 8,056 | 1,425 | 6,538 | 1.55 | 0.23 | 89 | % | 95,742 | 100,878 | $ | 138.4 | $ | 1,372 | $ | 40.4 | $ | 40.4 | ||

| Q2 2025 | 7,535 | 1,567 | 5,529 | 1.47 | 0.23 | 87 | % | 97,561 | 95,277 | $ | 118.8 | $ | 1,247 | $ | 38.7 | $ | 38.7 | ||

| Q1 2025 | 6,445 | 982 | 4,790 | 2.35 | 0.19 | 90 | % | 94,281 | 94,585 | $ | 111.1 | $ | 1,175 | $ | 24.6 | $ | 24.6 | ||

| Q4 2024 | 7,619 | 1,483 | 6,664 | 1.28 | 0.21 | 81 | % | 91,755 | 94,763 | $ | 125.1 | $ | 1,320 | $ | 51.1 | $ | 52.1 | ||

| Round Mountain | Q4 2025 | 737 | 966 | 1,110 | 0.49 | 0.29 | 67 | % | 31,754 | 31,641 | $ | 86.6 | $ | 2,737 | $ | 8.6 | $ | 41.5 | |

| Q3 2025 | 1,659 | 914 | 1,113 | 0.66 | 0.32 | 72 | % | 37,297 | 37,274 | $ | 78.1 | $ | 2,095 | $ | 4.5 | $ | 33.0 | ||

| Q2 2025 | 2,881 | 856 | 1,682 | 0.72 | 0.30 | 80 | % | 38,665 | 37,864 | $ | 52.1 | $ | 1,376 | $ | 5.7 | $ | 32.8 | ||

| Q1 2025 | 1,927 | 856 | 2,163 | 0.66 | 0.27 | 77 | % | 35,686 | 35,960 | $ | 57.0 | $ | 1,585 | $ | 2.8 | $ | 29.6 | ||

| Q4 2024 | 3,111 | 768 | 1,736 | 1.05 | 0.22 | 82 | % | 42,969 | 45,342 | $ | 80.0 | $ | 1,764 | $ | 4.4 | $ | 33.9 | ||

| Bald Mountain | Q4 2025 | 3,165 | – | 3,165 | – | 0.30 | nm | 38,402 | 37,141 | $ | 55.4 | $ | 1,492 | $ | 13.1 | $ | 51.6 | ||

| Q3 2025 | 2,182 | – | 2,182 | – | 0.31 | nm | 41,525 | 42,261 | $ | 48.5 | $ | 1,148 | $ | 5.3 | $ | 27.9 | |||

| Q2 2025 | 1,578 | – | 1,578 | – | 1.07 | nm | 53,704 | 54,227 | $ | 59.4 | $ | 1,095 | $ | 12.7 | $ | 40.4 | |||

| Q1 2025 | 5,803 | – | 5,803 | – | 0.35 | nm | 45,538 | 43,801 | $ | 49.2 | $ | 1,123 | $ | 6.9 | $ | 17.8 | |||

| Q4 2024 | 7,622 | – | 7,622 | – | 0.46 | nm | 44,642 | 51,291 | $ | 58.7 | $ | 1,144 | $ | 4.6 | $ | 6.4 | |||

| (a) | Due to the nature of heap leach operations, recovery rates at Bald Mountain cannot be accurately measured on a quarterly basis. Recovery rates at Fort Knox and Round Mountain represent mill recovery only. |

| (b) | “nm” means not meaningful. |

| (c) | Gold equivalent ounces include silver ounces produced and sold converted to a gold equivalent based on the ratio of the average spot market prices for the commodities for each period. The ratios for the quarters presented are as follows: Q4 2025: 76.34:1; Q3 2025: 87.73:1; Q2 2025: 97.41:1; Q1 2025: 89.69:1; Q4 2024: 84.67:1. |

| (d) | “Production cost of sales per equivalent ounce sold” is defined as production cost of sales divided by total gold equivalent ounces sold. |

| (e) | “Total Cap Ex” is “Additions to property, plant and equipment” on the consolidated statements of cash flows. “Cap Ex – sustaining” is a non-GAAP financial measure. The definition and reconciliation of this non-GAAP financial measure is included on page [•] of this news release. |

| (f) | La Coipa silver grade and recovery were as follows: Q4 2025: 33.21 g/t, 41%; Q3 2025: 41.34 g/t, 49%; Q2 2025: 28.89 g/t, 50%; Q1 2025: 31.97 g/t, 60%; Q4 2024: 42.57 g/t, 43%. |

| (g) | The Fort Knox segment is composed of Fort Knox and Manh Choh. Manh Choh tonnes of ore processed and grade were as follows: Q4 2025: 158,016 tonnes, 4.08 g/t; Q3 2025: 286,496 tonnes, 7.05 g/t; Q2 2025: 231,451 tonnes, 7.39 g/t; Q1 2025: 294,238 tonnes, 7.39 g/t; Q4 2024: 138,937 tonnes, 9.58 g/t. The attributable results for Fort Knox include 100% of Fort Knox and 70% of Manh Choh. |

MORE or "UNCATEGORIZED"

Axo Copper Announces Closing of $40,250,000 Bought Deal Financing Including Full Exercise of the Over-allotment Option

Axo Copper Corp. (TSX-V:AXO) is pleased to announce that it has c... READ MORE

Discovery Reports Strong Earnings Growth and Cash Generation in Q4 2025

Cash of $410.7 million at December 31, 2025 75% INCREASE I... READ MORE

BOREALIS MINING ANNOUNCES UPDATED NI 43-101 PRELIMINARY ECONOMIC ASSESSMENT FOR THE SANDMAN GOLD PROJECT HIGHLIGHTING STRONG STAND-ALONE ECONOMICS, ADR-ENABLED CAPITAL EFFICIENCY AND SUBSTANTIAL LEVERAGE TO GOLD PRICES

Base Case NPV(6%) of US$203 million with 105% IRR at US$2,600 gol... READ MORE

Scorpio Gold Drills 49.62 Metres Grading 3.14 g/t Gold, from 59.95 Metres Extending Mineralization Along Zanzibar Trend at the Manhattan District, Nevada

Highlights Hole 25MN-044 returned 3.14 g/t gold over 49.62 metres... READ MORE

Pecoy Copper Intersects 1,014 m of 0.37% Cu and 0.13 g/t Au from 17 m, Extending 407 m Below Resource Pit Shell

Pecoy Copper Corp. (TSX-V: PCU) (FSE: D5E) (OTCQB: PCUUF) is plea... READ MORE