K92 Mining Announces 2024 Q2 Financial Results – Strong Financial Position and Stage 3 and 4 Expansions Fully Financed

K92 Mining Inc. (TSX: KNT) (OTCQX: KNTNF) is pleased to announce financial results for the three and six months ended June 30, 2024.

Production

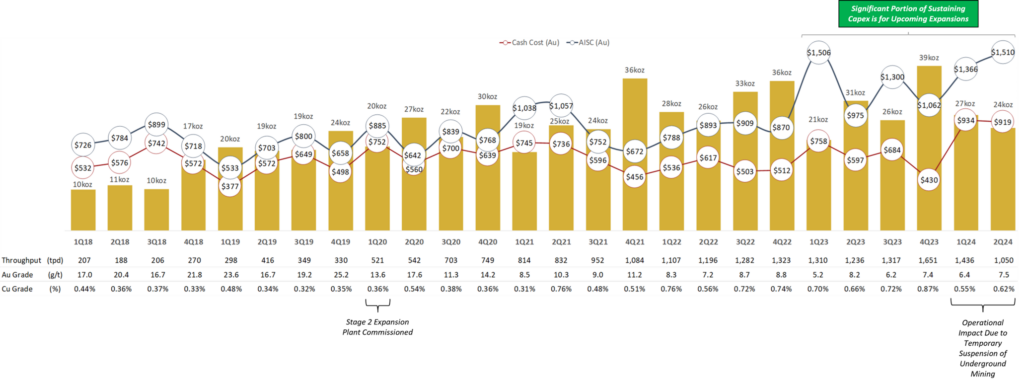

- Quarterly production of 24,347 ounces gold equivalent or 21,661 oz gold, 1,246,639 lbs copper and 26,754 oz silver (1). Production for the quarter was impacted by the temporary suspension of operations as previously announced.

- Cash costs of US$919/oz gold and all-in sustaining costs of US$1,510/oz gold (2).

- Strong metallurgical recoveries in Q2 of 93.7% gold and 95.3% copper, representing the highest gold recoveries since Q4 2019 and record quarterly recoveries to date for copper.

- Quarterly ore processed of 95,582 tonnes and total ore mined of 99,209 tonnes, with long hole open stoping performing to design, and 1,938 metres of total mine development.

- Head grade of 8.5 grams per tonne AuEq or 7.5 g/t gold, 0.62% copper and 10.6 g/t silver. Gold and copper grades were in-line with budget, and both gold and copper delivered a positive grade reconciliation when compared with the mineral resource model of 11% and 9%, respectively.

Financials

- Entered into two separate credit facilities for up to US$120 million with an accordion feature that allows for an increase in the aggregate amount available to US$150 million with Trafigura Pte Ltd. As at June 30, 2024, US$100 million of the Loan is available for immediate drawdown (US$40 million drawn) and subsequent to quarter end, US$120 million of the Loan is available.

- The Company entered into a new offtake agreement with Trafigura.

- Strong cash and cash equivalent position of US$71.1 million, which excludes restricted cash of $20 million (4). Under the terms of the Loan, the Company has the ability to convert restricted cash to cash and cash equivalents on January 1, 2025. Subsequent to quarter end, the Company completed an additional drawdown of $20 million of unrestricted cash and has $60 million of unrestricted cash available to draw anytime.

- Operating cash flow (before working capital adjustments) for the three months ended June 30, 2024, of US$17.3 million or US$0.07 per share, and earnings before interest, taxes, depreciation and amortization (2) of US$17.1 million or US$0.07 per share.

- Quarterly revenue of US$47.8 million.

- Quarterly net income of US$6.1 million or $0.03 per share.

- Sales of 19,064 oz gold, 898,578 lbs copper and 18,467 oz silver. Gold concentrate and doré inventory of 4,968 oz as of June 30, 2024, an increase of 3,291 oz over the prior quarter.

Growth

- On the Stage 3 and 4 Expansions, 57% of growth capital has been either spent or committed as of July 31, 2024. K92 has completed handover to GR Engineering Services (GRES) for the construction of the 1.2 million tpa Stage 3 Process Plant, with commissioning of the Stage 3 Process Plant targeting late-April 2025. Multiple long-lead time items have arrived on site for the process plant and well ahead of when required for its construction schedule, including but not limited to: flotation cells, mill components including motors, ball mill (shell and ends), SAG mill (ends), concentrate thickener and tailings thickener. The SAG mill shell is in-country and scheduled to arrive on site imminently. Underground, the two raise bore rigs are operational, with the first raise (5 m diameter) to be completed to upgrade ventilation to the main mine. The first waste/ore pass is scheduled to commence boring in Q3 2024.

- Strong results in the quarter from 140 diamond drill holes were reported from underground and surface at Kora, Kora South, Judd, and Judd South deposits in addition to Kora and Judd Northern Deeps. Multiple dilatant zones intersected at Kora’s K2 Vein, including a new dilatant zone discovered outside of the Kora resource at Kora South and the extension of an existing dilatant zone down-dip:

- Kora South new dilatant zone intercepts:

- KUDD0053: 78.50 m at 27.03 g/t AuEq (3)

- KUDD0056: 34.00 m at 8.14 g/t AuEq

- Known Dilatant zone extended down-dip:

- KUDD0058: 51.00 m at 7.04 g/t AuEq

- Kora South new dilatant zone intercepts:

High-grade zones extended in multiple directions including up-dip from the main underground mining area at the K1, K2 and J1 Veins, to the South outside the Kora resource at the K2 Vein and 300 m to the North near surface at the J1 Vein. Highlights include:

- KMDD0590: 3.26 m at 86.92 g/t AuEq from the K1 Vein

- KMDD0634: 12.09 m at 18.90 g/t AuEq from the K1 Vein

- KMDD0662: 9.00 m at 40.36 g/t AuEq from the K2 Vein

- KMDD0654A: 17.45 m at 23.79 g/t AuEq from the K2 Vein

- JDD0235: 4.13 m at 69.10 g/t AuEq from the J1 Vein

- KODD0055: 9.85 m at 7.58 g/t AuEq from the J1 Vein

See the Company’s news release dated May 6, 2024 for additional details.

- Results from the second set of holes were reported in the quarter from K92’s maiden drill program at the Arakompa project, with significant bulk intersections and multiple high grade lodes intersected. Between the high-grade lodes, the tonalite to dioritic host rock is overprinted with porphyry style mineralization increasing the potential for bulk mining. The target size of Arakompa is very large, with mineralization demonstrated from drill holes, rock samples and surface workings for at least 1.7 km of strike, hosted within a ~150-225 m wide mineralized intense phyllic altered package, and exhibits a vertical extent of +500 m. Arakompa is sparsely drilled, with K92’s maiden drill results representing the first drilling on the project completed in 32 years. Exploration has ramped up from 1 rig in Q1 2024 to 4 rigs currently operating. K92 is targeting a maiden mineral resource estimate for Arakompa by Q1 2025. Highlights from the second set of drill results include:

- KARDD0006 recording 12.60 m at 19.87 g/t AuEq within a bulk intersection of 94.40 m at 3.14 g/t AuEq.

- KARDD0002 recording 3.70 m at 42.35 g/t AuEq within a bulk intersection of 86.60 m at 2.12 g/t AuEq.

Other historic highlights reported include:

- 004DA92 recording 4.00 m at 32.03 g/t AuEq

- 013AD92 recording 4.00 m at 20.21 g/t AuEq

- 016AD92 recording 6.30 m at 14.96 g/t AuEq

- 010AD92 recording 9.20 m at 10.67 g/t AuEq

See the Company’s news release dated June 10, 2024 for additional details.

The Company’s interim consolidated financial statements and associated management’s discussion and analysis for the three and six months ended June 30, 2024 are available for download on the Company’s website and under the Company’s profile on SEDAR+ (www.sedarplus.ca). All amounts are in U.S. dollars unless otherwise indicated.

See Figure 1: Quarterly Production, Cash Cost and AISC Chart

John Lewins, K92 Chief Executive Officer and Director, stated, “In the second quarter, K92 continued to deliver strong financial results even with the impact of the Form 29 (temporary suspension of underground operations for part of March and April) due to the non-industrial fatal incident. Our financial position at quarter end is strong, with $71 million (4) in cash and cash equivalents plus $20 million of restricted cash that can be available January 1, 2025. This includes proceeds from our first drawdown of $40 million from the Loan with Trafigura. Trafigura has been our offtake partner since the start of operations and the upsized credit facilities and new-offtake agreement reinforces our strong long-term relationship. Subsequent to quarter end a drawdown of $20 million was made, with $60 million remaining for immediate drawdown as unrestricted cash, plus another $30 million through an accordion feature providing considerable liquidity going forward. Operationally, performance strengthened in the second half of Q2, and production in the second half of the year is expected to be considerably higher than the first half – we reiterate our 2024 operational guidance.

In terms of production growth, the fully funded Stage 3 and 4 Expansions to transform K92 into a Tier 1 Mid-Tier Producer continues to gain momentum, making significant progress to date, with 57% of the Stage 3 Expansion growth capital either spent or committed as at July 31st, 2024. The timing of long lead time item deliveries is tracking well, including the arrival of the ball mill and flotation cells on site in August with the SAG mill in-country and scheduled to arrive on site imminently, well ahead of our construction schedule.

Lastly, we are very excited about our exploration programs with 11 drill rigs operating. At Arakompa, the fourth drill rig recently commenced drilling, increasing the number of rigs to four, from one at the start of the year. We look forward to providing updates in due course.”

| Mine Operating Activities | ||||

| Three months ended June 30, 2024 |

Three months ended June 30, 2023 |

|||

| Operating data | ||||

| Gold head grade (Au g/t) | 7.5 | 8.2 | ||

| Copper grade (%) | 0.62% | 0.66% | ||

| Gold equivalent head grade (AuEq g/t) | 8.5 | 9.2 | ||

| Gold recovery (%) | 93.7% | 92.4% | ||

| Copper recovery (%) | 95.3% | 92.8% | ||

| Gold ounces produced | 21,661 | 27,405 | ||

| Gold ounces equivalent produced (1) (2) | 24,347 | 30,794 | ||

| Tonnes of copper produced | 565 | 692 | ||

| Silver ounces produced | 26,754 | 34,001 | ||

| Financial data (in thousands of dollars) | ||||

| Gold ounces sold | 19,064 | 28,141 | ||

| Revenues from concentrate and doré sales | US$47,791 | US$51,759 | ||

| Mine operating expenses | US$11,248 | US$9,782 | ||

| Other mine expenses | US$8,489 | US$12,268 | ||

| Depreciation and depletion | US$8,005 | US$7,148 | ||

| Statistics (in dollars) | ||||

| Average realized selling price per ounce, net | US$2,246 | US$1,883 | ||

| Cash cost per ounce (2) | US$919 | US$597 | ||

| All-in sustaining cost per ounce (2) | US$1,510 | US$975 | ||

Notes:

(1) AuEq in Q2 2024 is calculated based on: gold $2,338 per ounce; silver $28.84 per ounce; and copper $4.42 per pound. AuEq in Q2 2023 is calculated based on: gold $1,976 per ounce; silver $24.13 per ounce; and copper $3.85 per pound.

(2) The Company provides some non-international financial reporting standard measures as supplementary information that management believes may be useful to investors to explain the Company’s financial results. Please refer to non-IFRS financial performance measures in the Company’s management’s discussion and analysis dated August 8, 2024, available on SEDAR+ and on the Company’s website, for reconciliation of these measures.

(3) AuEq exploration results are calculated using longer-term commodity prices with a copper price of US$4.00/lb, a silver price of US$22.50/oz and a gold price of US$1,750/oz.

(4) The restricted cash is in relation to a condition precedent in the Loan with Trafigura. All conditions precedent for the advance of US$100 million have been satisfied, with the remaining conditions precedent for the additional US$20 million satisfied subsequent to June 30, 2024. Restricted cash can become unrestricted beginning January 1, 2025. Subsequent to quarter end, the Company completed an additional drawdown of $20 million of unrestricted cash and has $60 million of unrestricted cash available to draw anytime.

Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Qualified Person

K92 Mine Geology Manager and Mine Exploration Manager, Mr. Andrew Kohler, PGeo, a qualified person under the meaning of Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has reviewed and is responsible for the technical content of this news release.

Technical Report

The Integrated Development Plan including the Definitive Feasibility Study and Preliminary Economic Assessment for the Kainantu Gold Mine Project in Papua New Guinea is included in the Technical Report, titled, “Independent Technical Report, Kainantu Gold Mine Integrated Development Plan, Kainantu Project, Papua New Guinea” dated October 26, 2022, with an effective date of January 1, 2022.

About K92

K92 Mining Inc. is engaged in the production of gold, copper and silver at the Kainantu Gold Mine in the Eastern Highlands province of Papua New Guinea, as well as exploration and development of mineral deposits in the immediate vicinity of the mine. The Company declared commercial production from Kainantu in February 2018 and is in a strong financial position. A maiden resource estimate on the Blue Lake copper-gold porphyry project was completed in August 2022. K92 is operated by a team of mining company professionals with extensive international mine-building and operational experience.

Figure 1: Quarterly Production, Cash Cost and AISC Chart

MORE or "UNCATEGORIZED"

SLAM Raises $2,072,750 From Oversubscribed Private Placement

SLAM Exploration Ltd. (TSX-V: SXL) is pleased to report that it h... READ MORE

First Quantum Minerals Announces Sale of Çayeli Mine

First Quantum Minerals Ltd. (TSX: FM) announces that it has enter... READ MORE

Summit Royalties Announces Agreement to Acquire Royalty on Newmont's Saddle North Deposit

Summit Royalties Ltd. (TSX-V: SUM) (OTCQB: SUMMF) is pleased to a... READ MORE

G Mining Ventures Reports Year-End 2025 Mineral Reserves and Resources; Gold Reserves Increase 221% to 6.52 Moz

Proven and Probable Mineral Reserves total 6.52 Moz of gold at an... READ MORE

Q4 and Full Year 2025 Operational and Financial Results: Q4 Net Income of $38.1M ($0.70 per Share) vs. Net Loss of $8.2M ($0.16 per Share) in Q4 2024; Advancing Key Developments to Double Production by 2030

McEwen Inc. (NYSE:MUX) (TSX: MUX) announced its fourth quarter (Q... READ MORE