Jordan Roy-Byrne – “Watch These 3 Gold Indicators Now”

Last week we wrote about the inevitable bullish fundamentals for Gold.

Recent events that followed our editorial signal that the inevitable is moving closer to imminent.

Due to bank failures, a pending hard landing, and the like, the Federal Reserve will have to cease its rate hikes and ease policy amid not moderate but relatively high inflation.

Markets may recover for a little while in response to immediate policy actions. Gold’s sudden rebound could pause.

However, we know where this is ultimately going.

In the meantime, you should watch three important indicators to get a feel for Gold’s short-term momentum and outlook.

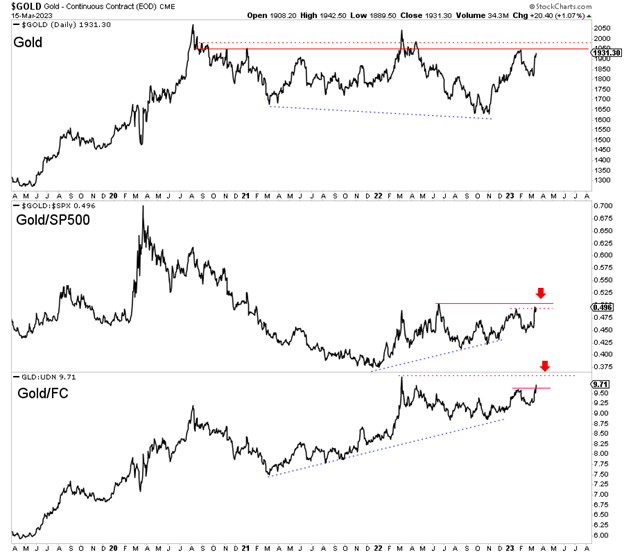

The first is how Gold performs around resistance at $1950, which is weekly, monthly, and quarterly resistance.

If Gold can close March above $1953, it will mark the highest quarterly close ever and the highest monthly close in almost three years. It would also mark the third-highest monthly close in history.

The other two things to watch for are Gold’s performance against the stock market and Gold’s performance against foreign currencies. These two usually lead or signal future moves in the Gold price.

On Wednesday, Gold against the foreign currency basket made its second-highest close ever, while Gold against the stock market made its third-highest close in the last two years. If and when both charts surpass and hold above the red lines (arrows), Gold should be on its way to the August 2020 high.

If Gold cannot surpass $1950 and the stock market plunges, Silver and mining stocks could get hit one last time.

On the other hand, if Gold can break $1950-$2000 relatively soon, then the gold stocks and Silver will follow. They will strongly outperform when Gold breaks $2100.

I focus on finding high-quality juniors with 500% upside potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.

MORE or "UNCATEGORIZED"

Labrador Gold Announces Closing of Change of Business and Acquisition of Units of Northern Shield

Labrador Gold Corp. (TSX-V: LAB) (FNR: 2N6) is pleased to announc... READ MORE

La Mancha Exercises Right to Subscribe for Additional Shares of G Mining Ventures

G Mining Ventures Corp. (TSX:GMIN) (OTCQX:GMINF) announces that t... READ MORE

Osisko Development Announces Proceeds of $24.9 Million From Warrant Exercise

Osisko Development Corp. (NYSE: ODV, TSX-V: ODV) announces that i... READ MORE

LIFT Closes Acquisition with SOQUEM for an Additional 25% Interest in the Galinée Property, Quebec

Li-FT Power Ltd. (TSX-V: LIFT) (OTCQX: LIFFF) (Frankfurt: WS0) i... READ MORE

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE