Jordan Roy-Byrne – “Key Downside Levels in Gold & Silver”

The move higher in bond yields and real interest rates on the back of a stable economy (for now) is causing heavy selling in Gold & Silver.

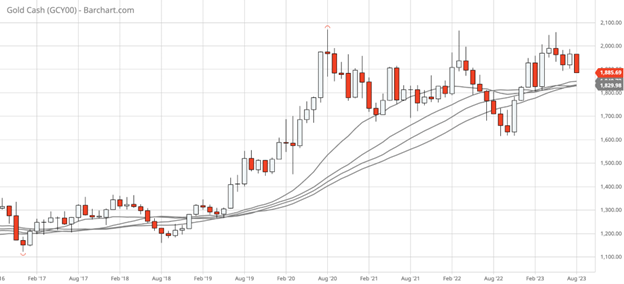

Although two weeks remain in August, Gold’s monthly candle chart shows a clear bearish engulfing candle.

The next strong support is the long-term monthly moving averages in the low to mid $1800s. There is monthly lateral support around $1820.

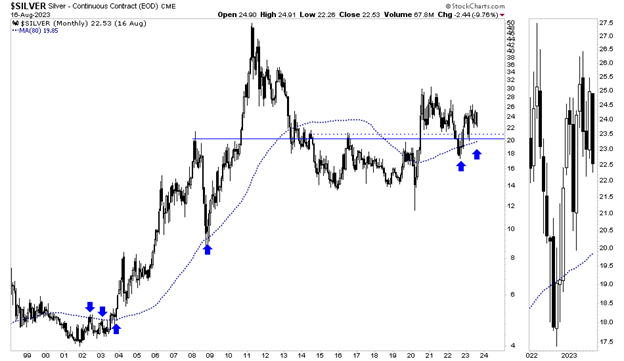

Silver is also dealing with a bearish engulfing candle on its monthly chart.

The next strong support for Silver comes in at around $20.50. The 80-month moving average (arrows), which has been quite significant for over 20 years, should surpass $20.00 before the end of the year.

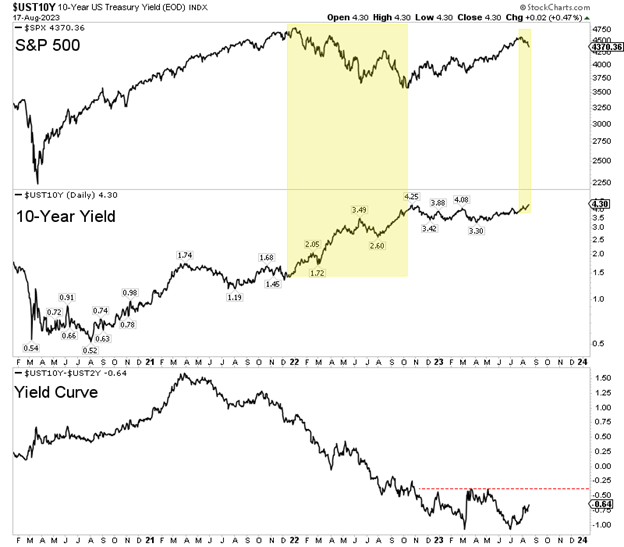

Higher rates and higher bond yields hurt precious metals, but if and when they trigger a recession, and the S&P 500 loses its 40-month moving average, it will ignite a new secular bull market in precious metals.

It was not the first wave of inflation that derailed the S&P 500 secular bull market of the 1950s and 1960s but, more so, the accelerated rise in the 10-year yield.

The gains in the S&P 500 slowed after the early 1960s as bond yields followed inflation higher. After surpassing 5.00% in 1966 and causing a near recession, the 10-year yield fell to 4.50% in 1967. Then it surged to almost 8.0% by the end of 1969. The secular bull ended in late 1968.

The S&P 500’s 27% decline in 2022 coincided with the 10-year yield rebounding from 1.35% to 4.25%. The S&P 500 rebounded as the 10-year yield retreated and stabilized.

However, the 10-year yield rebounded and closed Thursday at a new 15-year high. The stock market is showing weakness again, and the yield curve (bottom of the chart) is steepening.

Before precious metals can begin a new bull market and Gold can break $2,100/oz, the economy and stock market must run into problems.

The catalyst for these problems sometimes causes some initial pain in precious metals.

It is early, but if the 10-year yield continues to rise, it could cause more selling in precious metals but lead to the bullish catalyst (recession) that this sector desperately needs.

Gold and gold stocks are very oversold on a short-term basis, so a bounce is possible. However, mind the technical damage created from recent selling.

This is a time to research companies poised to benefit from the inevitable bull market and breakout in Gold.

I continue to focus on finding high-quality gold and silver juniors with 500% to 1000% upside potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE