Jordan Roy-Byrne – “Historical Comparisons for Gold Right Now”

Gold has made six major breakouts since the end of the Gold Standard in 1971.

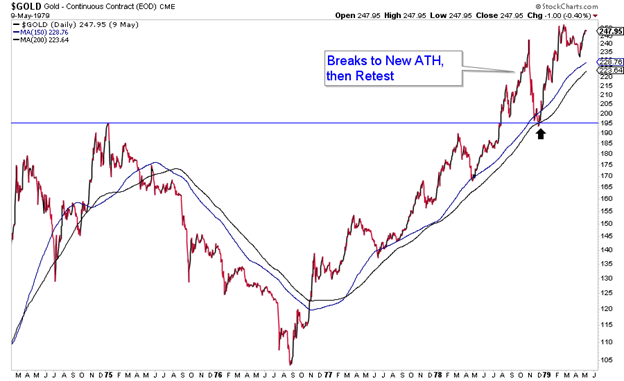

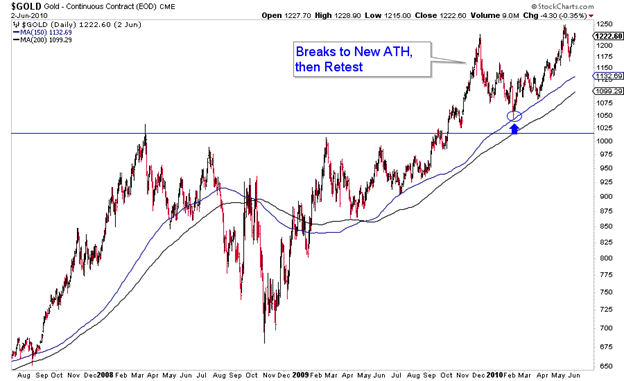

Only two of the breakouts retested the breakout. Those two were the two previous breakouts to new all-time highs: 1978 and 2009.

Precious Metals are weakening ahead of the end of the month and quarter. The odds of a retest of the breakout, as those mentioned above did, are increasing.

Gold gained a whopping 136% from its low in 1976 to its breakout in 1978. From the breakout to the first correction, it gained 25%.

It retested the breakout perfectly, correcting 20% and finding support at the 200-day moving average. It also bottomed near the 38% retracement.

Gold gained 80% from its low in 2008 to its breakout in 2009, and 21% from the breakout to the first correction.

It declined 15% and bottomed at its 150-day moving average.

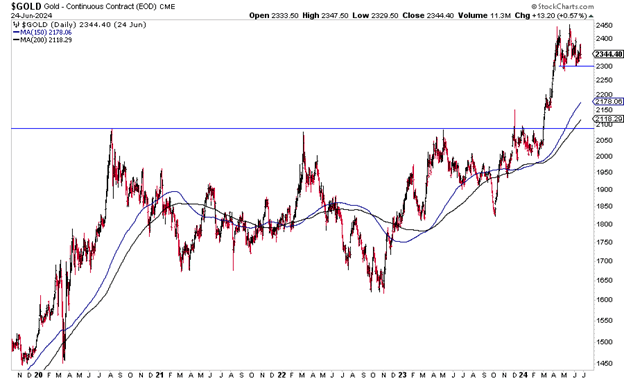

Let us look at today.

From its low in 2022 to the recent peak, Gold gained 50%, and the post-breakout gain was 18%.

Thus far, Gold has corrected 6%. But it is threatening a break below $2300. A test of $2150-$2175 would be an 11%-12% correction.

If Gold loses $2300, a retest of $2100-$2150 is quite likely.

Although there would be some technical damage, this is nothing to worry about. If the US economy continues to slow, the odds of rate cuts will increase, and Gold and precious metals will rebound.

After Gold retested its breakout in 1978, it gained 122% in 13 months, and after the retest of the breakout in 2009, it gained 63% in 13 months.

If this current correction continues, it will be a gift because one will gain a second and perhaps final opportunity to buy high-quality juniors at excellent prices.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE