Jordan Roy-Byrne – “Gold to Breakout As Recession Hits”

Gold’s winter rebound thwarted a 2013-like scenario. However, the sharp February selloff and nasty monthly candles reflect no bull market yet.

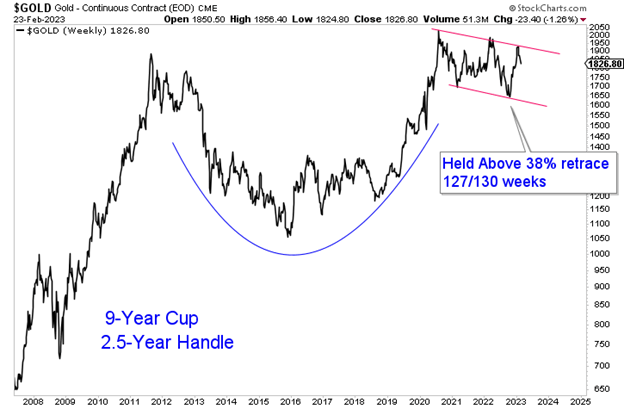

Gold is stuck but remains in a larger handle consolidation within a super-bullish cup and handle pattern.

I am not a fan of trendline and channel analysis as it is prone to error, but the handle consolidation is trading within parallel trendlines.

More importantly, the handle, now two-and-a-half years old, has spent 98% of its time above the 38% retracement ($1675).

Gold has not broken out yet because of the Federal Reserve’s delayed but aggressive rate hikes, the large increase in real interest rates, and, most recently, the economy avoiding recession.

However, while a recession is not imminent, it is inevitable.

Leading economic indicators like the LEIs (leading economic indicators) and yield curve inversions are issuing stark warnings for the second half of this year.

Furthermore, rates above 3% have only been in effect for several months, and moving from 0% to 2.5% or even 3% is not that restrictive. Let’s see how the economy fares when 4%-5% rates are in effect for another four or five months.

Precious Metals are getting hit because the adage of “higher for longer” is becoming a reality, at least for now. However, it likely increases the odds of a hard landing later.

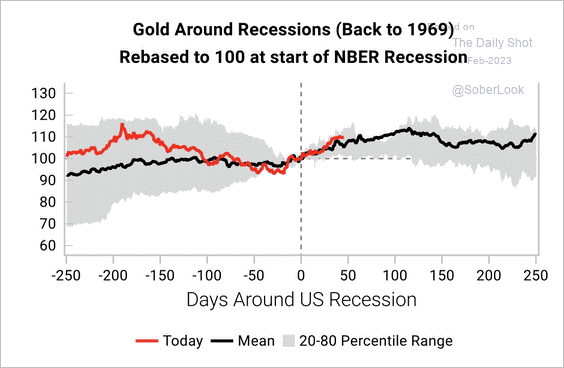

The average performance of Gold around a recession entails a move of nearly 20% from a low a few months before the recession through the first four months of the recession.

The performance of the 80th percentile is a 20% gain in the first four months of the recession.

Ultimately, Gold should begin its move to a breakout as the recession hits. Should Gold hold above $1700 over the next few months and a recession hits in the third quarter, then look for Gold to retest its all-time high by year-end.

The threats of lower prices and more time until a breakout move presents us another chance to buy the highest quality juniors with the most potential. Recently, I have introduced a larger watch list of these types of companies for my subscribers.

I focus on finding high-quality juniors with 500% upside potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE