Jordan Roy-Byrne – “Gold & Silver Correction Before Macro Catalyst”

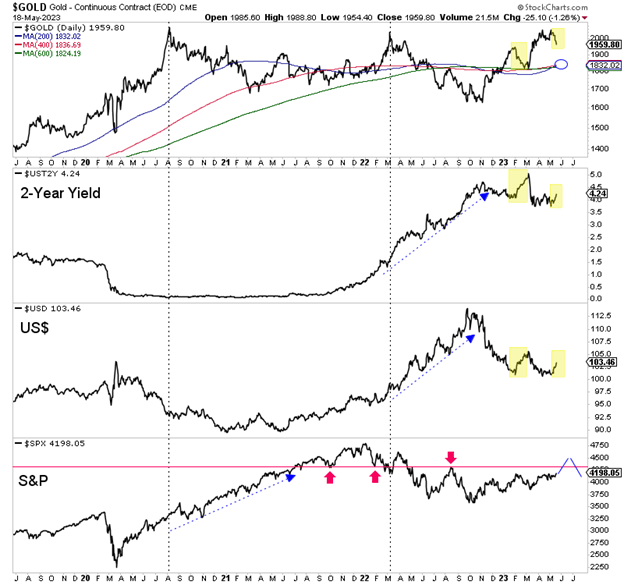

Bank failures coupled with the anticipation of the Fed pivot pushed Gold to new monthly and quarterly highs, but the breakout move through $2,100/oz has remained elusive.

Multiple failures around $2050/oz and a rebound in the Dollar and bond yields are sending precious metals lower.

Moreover, a small breakout in the stock market likely cements an interim peak in precious metals.

The S&P 500 has broken out from a three-and-a-half-month consolidation to a nine-month high. It could run to 4300 to 4400 or even slightly higher before the recession hits.

A stronger stock market pushes out Fed rate cuts and leads to higher real interest rates in the short term. Furthermore, the US Dollar is rebounding. All of these factors could pressure precious metals into summer.

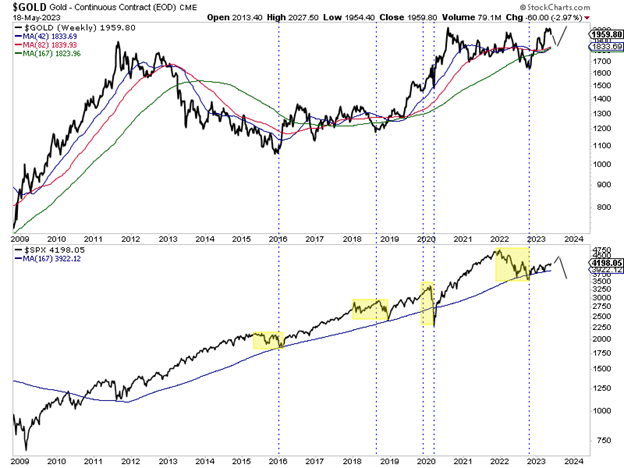

In February, we wrote about how Gold should break out when the recession hits. The worst declines in bear markets are associated with the start of recessions.

In the chart below, we mark key lows in Gold (blue lines) and the associated declines in the stock market (yellow). The next slide in the stock market should set the stage for Gold to make its breakout.

Gold has a confluence of strong support around the mid $1800s. It will not retest or break to a new all-time high until the stock market rolls over again. A market downturn is needed for the Fed to start easing.

As for silver and the mining stocks, they will outperform Gold in earnest only when Gold surpasses $2100/oz.

Now is the time to research and uncover the best opportunities while they remain cheap. This correction is also the time to reconsider the strong stocks you missed.

I continue to focus on finding high-quality gold and silver juniors with 500% upside potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE