Jordan Roy-Byrne – “Gold Miners Follow This, Not Gold”

In a short-term and cyclical sense, gold miners and junior gold stocks follow the Gold price. However, beyond the short-term, gold miners follow the “real” price of Gold because it is a better indicator of long-term gold miner profitability than the nominal Gold price.

By the “real” price of Gold, we are talking about the Gold price in real terms. How is Gold performing against the CPI, CRB, or the stock market? The answer clarifies the outlook for Gold miners.

Gold stocks and junior gold stocks have underperformed the Gold price for over a decade (and over the past seven years) because the real price of Gold has not kept pace with the Gold price. Also, Gold was in a secular bear market from 2011 to 2022.

In a secular bull market, the Gold price rises consistently in nominal and real terms.

Gold has not risen too much in real terms since 2016, nor has it broken out to a new all-time high and held it. Not yet.

The best indicator for gold stocks over the long run is Gold against the CPI or the inflation-adjusted Gold price.

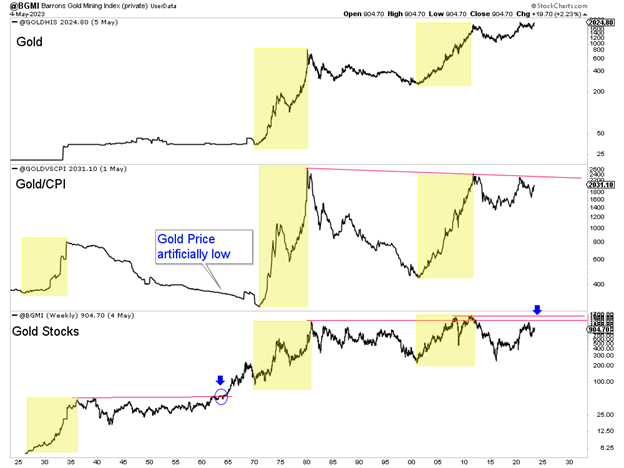

The chart below plots Gold, Gold against the CPI and Barron’s Gold Mining Index.

The gold stocks follow Gold/CPI far more closely than the Gold price.

However, when Gold is in a secular bull market, it also rises in real terms, which drives gold stocks much higher.

Should Gold breakout and double in price over the next two to three years, then Gold against the CPI will blast higher to new all-time highs.

In that scenario, the gold stocks indices will break to new all-time highs, and Barron’s Gold Mining Index would begin a move similar to the mid-1960s. See the blue arrows.

Now, before the Gold breakout, is the time to research and uncover the best opportunities while they remain cheap.

I continue to focus on finding high-quality gold and silver juniors with 500% upside potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE