Jordan Roy-Byrne – “Gold Market Will Turn When This Happens”

I have written about the importance of a bear market, recession, and Fed shift for a Gold bull market. But today, I want to be more precise.

There has to be a potential tipping point that precedes these catalysts.

Markets anticipate the near future and slowly discount it as it becomes a probability and later a certainty.

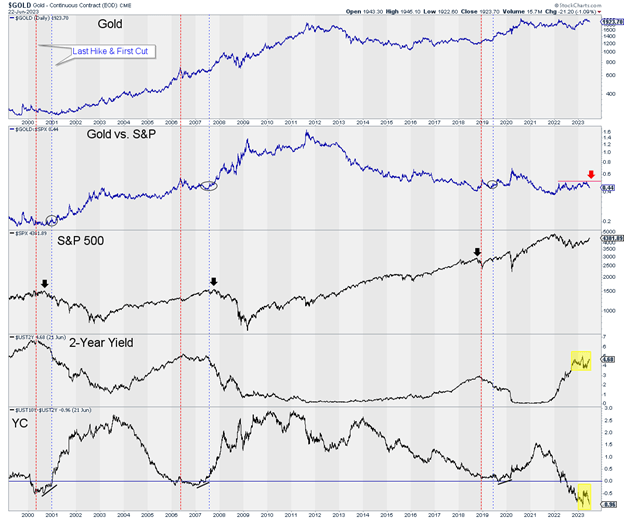

In the chart below, we plot Gold, Gold against the stock market, the stock market, the 2-year yield, and the yield curve (10-year yield less the 2-year yield). The red line marks the final rate hike, while the blue line marks the first rate cut (in that cycle).

Focus on the Gold to S&P 500 ratio, stock market peaks (black arrows), and the yield curve.

The Gold to S&P 500 ratio did not gain traction to the upside until the first rate cut. The circles coincide with the rate cuts. Note the yield curve begins to steepen (turn higher) before the rate cut.

Concerning the stock market, every cycle is different, but the move from hikes to cuts because of a recession is very bearish, which is super bullish for precious metals.

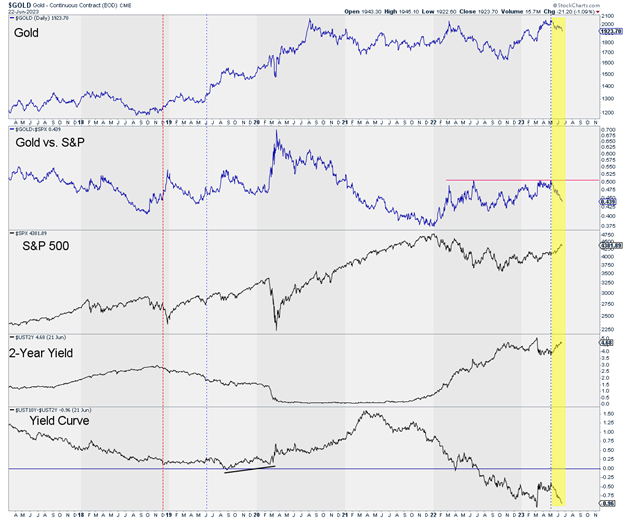

Since Gold’s peak in May, bond yields have rebounded, and the stock market has broken out. The inversion in the yield curve has intensified.

As you can see below (yellow), these things are moving against Gold for now.

In short, the steepening of the yield curve will mark the turning point for the Gold market because that precedes the start of rate cuts.

The yield curve began to steepen in the spring with the multiple bank failures, but the Fed was able to paper over that, and the economy has avoided recession for now.

The stock market should peak around the time the Fed ends its rate hikes.

How quickly the yield curve steepens depends on the health of the economy. The closer we are to a recession, and the faster it hits means, the closer the yield curve is to steepening and Gold starting its breakout move.

Speculators and investors have time to research and uncover the best opportunities while they remain cheap. This correction is also the time to reconsider the strong stocks you missed.

I continue to focus on finding high-quality gold and silver juniors with 500% upside potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE