IsoEnergy Announces Strategic Sale of its Mountain Lake Property in Nunavut

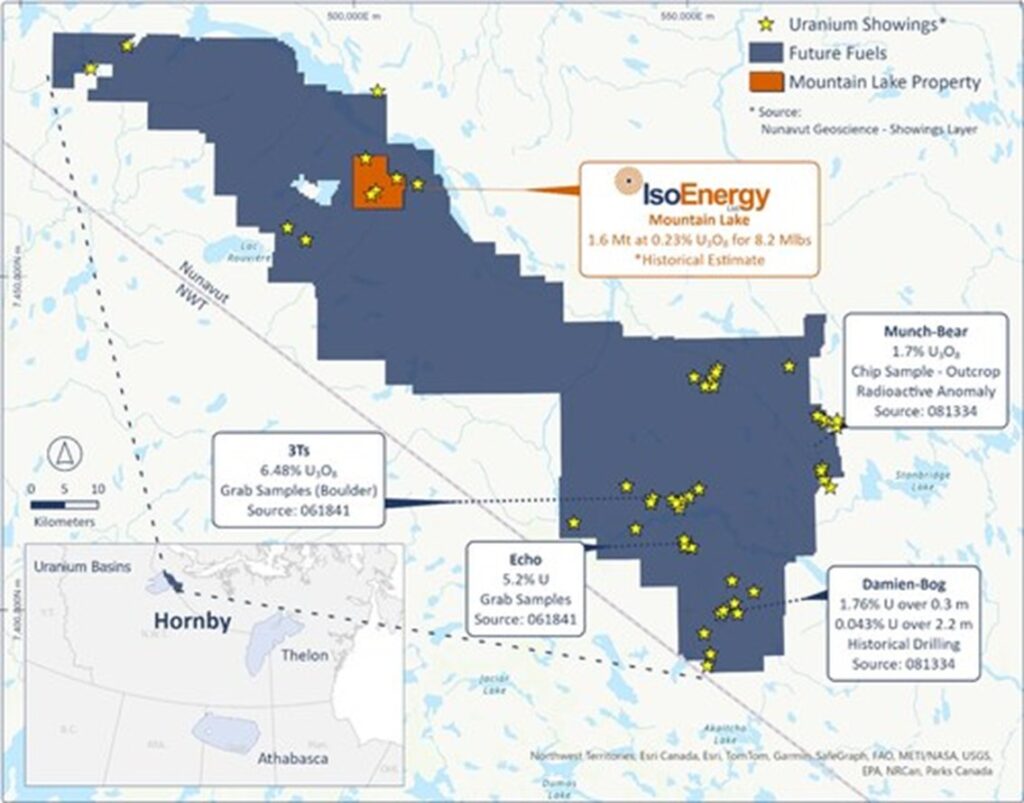

IsoEnergy Ltd. (TSX: ISO) (OTCQX: ISENF) is pleased to announce that it has entered into an asset purchase agreement with with Future Fuels Inc. pursuant to which the Company has agreed to sell to Future Fuels all of its right, title and interest in and to the Mountain Lake property located in Nunavut. Future Fuels (TSX-V: FTUR) is a publicly traded company that has consolidated a significant land holding in the Hornby Basin, surrounding Mountain Lake (Figure 1).

Transaction Highlights

- Establishes a District-Scale Uranium Opportunity by Consolidating the Mountain Lake Property and Hornby Project in the Hornby Basin – This strategic unification increases discovery potential in the Hornby Basin—one of Canada’s key uranium basins—by combining Mountain Lake’s historic resources with over 40 uranium showings across the expanded land package totalling ~342,000 ha.

- Retains Significant Exposure to the Hornby Basin through Accretive Transaction Terms – IsoEnergy will own a significant equity position in Future Fuels following completion of the transaction and will enter into an investor rights agreement, which ensures continued exposure to the Property’s advancement via participation rights in future equity financings, the right to appoint one representative to the Future Fuel board, and net smelter returns royalties.

- Unlocks Value from Non-Core Assets in Alignment with IsoEnergy’s Strategic Business Plan – The Transaction aligns with the Company’s strategy to maximize shareholder value by capitalizing on accretive opportunities and efficiently leveraging non-core assets under favourable market conditions. It also enhances the Company’s planned focus on near-term production, development, and exploration on core jurisdictions, enabling efficient allocation of resources and capital to strengthen core asset value.

- Further Strengthens Equity Portfolio, Now Estimated at C$32.2 Million – The Transaction is set to further enhance the Company’s equity portfolio1, which includes positions in NexGen Energy Ltd., Premier American Uranium Inc., Atha Energy Corp., and Jaguar Uranium Corp. by adding approximately C$4.0 million in additional value.

| _____________________________ |

| 1 Equity portfolio value as of November 13, 2024. |

Figure 1: IsoEngery’s Mountain Lake Property, Located within Future Fuels Hornby Project1

| For additional information regarding the Mountain Lake project, please refer to the Technical report entitled “Mountain Lake Property Nunavut” dated February 15, 2005 reported by Triex Mineral Corporation. |

|

This estimate is a “historical estimate” as defined under NI 43-101 (as defined herein). A Qualified Person has not done sufficient work to classify the historical estimate as current mineral resources and neither IsoEnergy nor Future Fuels is treating the historical estimate as current mineral resources. See Appendix for additional details. |

Transaction Details

Pursuant to the Agreement, Future Fuels has agreed to acquire the Mountain Lake Property from IsoEnergy in consideration for:

| (i) | the issuance to IsoEnergy of 12,500,000 common shares of Future Fuels on closing of the Transaction; |

| (ii) | the issuance to IsoEnergy of 2,500,000 common shares of Future Fuels on the earliest date practicable following Closing that will ensure that such issuance will not result in IsoEnergy owning or controlling more than 19.9% of the outstanding common shares of Future Fuels on a partially-diluted basis; and |

| (iii) | the grant by Future Fuels to IsoEnergy of (a) a 2% NSR royalty, payable on all production from Mountain Lake, of which 1% will be eligible for repurchase by Future Fuels for $1,000,000, and (b) a 1% NSR royalty, payable on all uranium production from Future Fuels properties in Nunavut other than Mountain Lake. |

The Consideration Shares, when issued, will be subject to contractual restrictions on resale beginning from the date of closing, as well as a statutory hold period of four months and one day from the date of issuance. Closing of the Transaction is subject to certain conditions and approvals, including:

| (i) | the execution of an investor rights agreement providing IsoEnergy, for so long as IsoEnergy owns 10% or more of the issued and outstanding common shares of Future Fuels on a partially diluted basis, with the right to: | |

| a. nominate one director to the Future Fuels board of directors; and b. participate in equity financings in order to maintain its pro rata share ownership in Future Fuels. |

||

| (ii) | completion of the Concurrent Financing (as defined below) for minimum gross proceeds of $2,000,000; and | |

| (iii) | the approval of the TSX Venture Exchange. | |

Future Fuels Concurrent Financing

As a condition to Closing of the Transaction, Future Fuels will complete a non-brokered private placement (the “Concurrent Financing” of a minimum of 8,000,000 units at a price of $0.25 per Unit, each Unit to consist of one common share and one-half of one warrant of Future Fuels. Each whole warrant will entitle the holder to purchase one additional common share of Future Fuels at a price of $0.40 per share for a period of 24 months from the closing of the Concurrent Financing.

Qualified Person Statement

The scientific and technical information contained in this news release was reviewed and approved by Dr. Dan Brisbin, P.Geo., IsoEnergy’s Vice President, Exploration, who is a “Qualified Person” (as defined in NI 43-101 – Standards of Disclosure for Mineral Projects).

About IsoEnergy Ltd.

IsoEnergy Ltd. is a leading, globally diversified uranium company with substantial current and historical mineral resources in top uranium mining jurisdictions of Canada, the U.S., and Australia at varying stages of development, providing near, medium, and long-term leverage to rising uranium prices. IsoEnergy is currently advancing its Larocque East Project in Canada’s Athabasca Basin, which is home to the Hurricane deposit, boasting the world’s highest grade Indicated uranium Mineral Resource.

IsoEnergy also holds a portfolio of permitted, past-producing conventional uranium and vanadium mines in Utah with a toll milling arrangement in place with Energy Fuels Inc. These mines are currently on stand-by, ready for rapid restart as market conditions permit, positioning IsoEnergy as a near-term uranium producer.

About Future Fuels Inc.

Future Fuels’ principal asset is the Hornby Uranium Project, covering the Hornby Basin in north-western Nunavut, a geologically promising area with over 40 underexplored uranium showings, including the historic Mountain Lake Deposit. Additionally, Future Fuels holds the Covette Property in Quebec’s James Bay region, comprising 65 mineral claims over 3,370 hectares.

Figure 1: IsoEngery’s Mountain Lake Property, Located within Future Fuels Hornby Project (CNW Group/IsoEnergy Ltd.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE