IsoEnergy Announces Acquisition of Anfield, Securing Expanded Near-Term U.S. Uranium Production and the Shootaring Canyon Mill

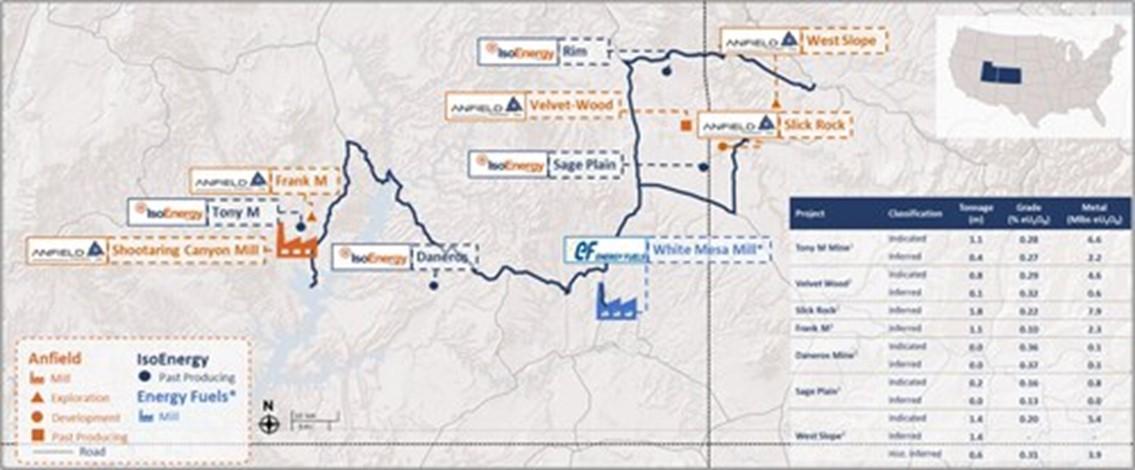

IsoEnergy Ltd. (TSX: ISO) (OTCQX: ISENF) and Anfield Energy Inc. (TSX-V: AEC) (OTCQB: ANLDF) (FRANKFURT: 0AD) are pleased to announce that they have entered into a definitive agreement pursuant to which IsoEnergy will acquire all of the issued and outstanding common shares of Anfield by way of a court-approved plan of arrangement. Anfield owns 100% of the Shootaring Canyon Mill located in southeastern Utah, United States, one of only three licensed, permitted, and constructed conventional uranium mills in the United States, as well as a portfolio of conventional uranium and vanadium projects in Utah, Colorado, New Mexico, and Arizona (Figure 1).

Under the terms of the Transaction, Anfield shareholders will receive 0.031 of a common share of IsoEnergy for each Anfield Share held. Existing shareholders of IsoEnergy and Anfield will own approximately 83.8% and 16.2% on a fully-diluted in the-money basis, respectively, of the outstanding ISO Shares on closing of the Transaction.

The Exchange Ratio implies consideration of $0.103 per Anfield Share, based on the closing price of the ISO Shares over all Canadian exchanges on October 1, 2024. Based on each company’s 20-day volume weighted average trading price over all Canadian exchanges for the period ending October 1, 2024, the Exchange Ratio implies a premium of 32.1% to the Anfield Share price. The implied fully-diluted in the-money equity value of the Transaction is equal to approximately $126.8 million.

Strategic Rationale

- Expected to Expand Near-Term U.S. Uranium Production Capacity – The combined portfolio (“Combined Portfolio“) of permitted past-producing mines and development projects in the Western U.S. (Figure 1) is expected to provide for substantial increased uranium production potential in the short, medium and long term.

- Ownership of Shootaring Canyon Mill Secures Access to Two of Only Three U.S. Permitted Conventional Uranium Mills –

-

- A restart application has been submitted to the State of Utah for the Shootaring Canyon Mill to increase throughput from 750 stpd to 1,000 stpd and expand licensed annual production capacity from 1 million lbs U₃O₈ to 3 million lbs U₃O₈.

- Existing toll-milling agreements with Energy Fuels at the White Mesa Mill provide additional processing flexibility for current IsoEnergy mines.

- Meaningful Growth in U.S. Uranium Mineral Endowment – With combined current mineral resources of 17.0 Mlbs Measured & Indicated (+157%) and 10.6 Mlbs Inferred (+382%)1, and historical mineral resources of 152.0 Mlbs Measured & Indicated (+14%), and 40.4 Mlbs Inferred2 (+33%), the proforma company will rank among the largest in the U.S.

- Complimentary Project Portfolio Provides Immediate Operational Synergies – Benefits from the proximity of the Combined Portfolio in Utah and Colorado are expected to include, reduced transportation costs, increased operational flexibility for mining and processing, reduction in G&A on a per lb basis, and risk diversification through multiple production sources.

- Aligned with Goal of Building a Multi-Asset Uranium Producer in Tier-One Jurisdictions – Beyond the impressive Combined Portfolio in the U.S., the proforma company will have a robust pipeline of development and exploration-stage projects in tier-one uranium jurisdictions, including the world’s highest grade published Indicated uranium resource in Canada’s Athabasca Basin.

- Well-Timed to Capitalize on Strong Momentum in the Nuclear Industry – Recent industry headlines relating to increasing demand and support for nuclear power are expected to drive uranium demand and, by extension prices, coinciding with expected production and development of the Combined Portfolio.

CEO and Director of IsoEnergy, Philip Williams, commented, “IsoEnergy is committed to becoming a globally significant, multi-asset uranium producer in the world’s top uranium mining jurisdictions. The U.S. is a key jurisdiction for us, and we believe today’s acquisition of Anfield strengthens both our resource base and near-term production potential. The combined uranium mineral endowment will rank as one of the largest in the U.S., supported by a 100% owned processing facility, multiple fully permitted mines ready for rapid restart, and a strong pipeline of longer-term development projects.

With the global shift towards nuclear power, we believe the outlook for uranium has never been stronger, making this a pivotal move for IsoEnergy at the right time. We commend the Anfield team for assembling and managing this impressive portfolio over the years, and we look forward to advancing these assets back into production into a time of anticipated rising demand for uranium.”

CEO and Director of Anfield, Corey Dias, commented, “We believe this Transaction represents an excellent opportunity for Anfield shareholders, and the culmination of our team’s strategic approach to assembling a unique, U.S.-focused portfolio of potential near-term uranium production assets. This Transaction underscores our view that Anfield acquired the right assets in the right place at the right time.”

| ____________________________ |

| 1 For additional information, see the Tony M Technical Report and Velvet-Wood/Slick Rock PEA. |

| 2 This estimate is a “historical estimate” as defined under NI 43-101. A Qualified Person has not done sufficient work to classify the historical estimate as current mineral resources and neither IsoEnergy nor Anfield is treating the historical estimate as current mineral resources. See Appendix for additional details. |

“Beyond the immediate share price premium, shareholders will gain exposure to a broad array of uranium projects, from the high grade and strategically located Hurricane project in Saskatchewan to a large inventory of earlier stage resource assets. The most fundamental benefit of the Transaction is the high level of economic synergies that we believe will be generated by the marriage of our mill and mining assets with IsoEnergy’s U.S. mining assets, particularly the advanced stage Tony M mine which is located within 4 miles of our Shootaring Canyon mill. Other tangential benefits to Anfield shareholders will include higher levels of trading liquidity, a robust combined balance sheet, and exposure to extensive research analyst coverage and institutional ownership. We look forward to working with the IsoEnergy team to complete the Transaction and to integrating our two platforms with a view to revitalize American uranium mining in pursuit of clean, domestic energy security.”

Benefits to IsoEnergy Shareholders

- Secures Shootaring Canyon Mill, one of only three permitted conventional uranium mills in the U.S., located adjacent to IsoEnergy’s Tony M Mine

- Diversified access to both Shootaring Canyon and White Mesa Mills to boost near-term production capacity while unlocking anticipated operational synergies

- Strengthens ranking among the U.S. uranium players in terms of production capacity, advanced mining assets and resource exposure

- Potential re-rating from de-risking near-term potential production, increased scale, asset diversification within the U.S. and additional exploration upside

- A combined company backed by corporate and institutional investors of Anfield including, enCore Energy Corp.

- Creation of a larger platform with greater scale for M&A, access to capital and liquidity

Benefits to Anfield Shareholders

- Immediate and attractive premium

- Exposure to a larger, more diversified portfolio of high-quality uranium exploration, development and near-term production assets in tier one jurisdictions of U.S., Canada and Australia

- Entry into the Athabasca Basin, a leading uranium jurisdiction, with the high-grade Hurricane deposit

- Upside from an accelerated path to potential production as well as from synergies with IsoEnergy’s other Utah uranium assets

- A combined company backed by corporate and institutional investors of IsoEnergy including, NexGen Energy Ltd., Energy Fuels Inc., Mega Uranium Ltd. and uranium ETFs

- Participation in a larger platform with greater scale for M&A

- Increased scale expected to provide greater access to capital, trading liquidity and research coverage

Figure 1: IsoEnergy and Anfield Combined Portfolio of permitted past producing mines and development projects in the Western U.S. 3

| ___________________________ |

| 3 Each of the mineral resource estimates of IsoEnergy and Anfield, except for the Tony M Mine and Velvet-Wood/Slick Rock Project, contained in this press release are considered to be “historical estimates” as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). A Qualified Person has not done sufficient work to classify the historical estimates as current mineral resources or mineral reserves and IsoEnergy and Anfield are not treating the historical estimates as current mineral resources or mineral reserves. See Disclaimer on Mineral Resource Estimates below for additional details. |

Shootaring Canyon Mill and Velvet-Wood and Slick Rock Uranium Projects

Located approximately 48 miles (77 kilometers) south of Hanksville, Utah and 4 miles from IsoEnergy’s Tony M Mine, the Shootaring Canyon Mill is one of three licensed, permitted and constructed conventional uranium mills in the United States. Built in 1980 by Plateau Resources, the mill commenced operations in 1982 but ceased operations due to the decline in the uranium price after approximately six months of operation. Despite its relatively short period of operation, the Mill historically produced and sold 27,825 lbs of U3O8. The Mill has not been decommissioned and has been under care and maintenance since cessation of operations. The Shootaring Canyon Mill has a radioactive source materials license on Standby status which will need to be amended, among other things, to allow Mill operations to resume.

In May 2023, Anfield completed a Preliminary Economic Assessment assuming that mineral processing of the Velvet-Wood and Slick Rock Projects would take place at the Shootaring Canyon Mill.

The Velvet-Wood project is a 2,425-acre property located in the Lisbon Valley uranium district of San Juan County, Utah, which was previously the largest uranium producing district in Utah. The Velvet-Wood Uranium project consists of two areas with mineral resources as outlined below.

Past production from underground mines in the Velvet area during 1979 to 1984 yielded significant results, recovering around 4 Mlbs of U3O8 and 5 Mlbs of V2O5 from mining approximately 400,000 tons of ore with grades of 0.46% U3O8 and 0.64% V2O5. The Velvet mine retains underground infrastructure, including a 3,500 ft long, 12′ x 9′ decline to the uranium deposit. Along with the Tony M Mine, the Velvet-Wood Project is the most advanced uranium asset in the Combined Portfolio and is believed to represent a potential near-term path to uranium and vanadium production.

Table 1: Velvet-Wood and Slick Rock Uranium Mineral Resource Summary Effective April 30, 2023

| eU3O8 Resources | V2O5 Resources | |||||

| Category | Tons

(000 st) |

Grade

(%) |

Contained

(Mlbs) |

Tons

(000 st) |

Grade

(%) |

Contained

(Mlbs) |

| M&I | 811,000 | 0.29 % | 4,627,000 | – | – | – |

| Inferred | 1,836,000 | 0.24 % | 8,410,000 | 2,647,000 | 1.03 | 54,399,000 |

| 1. | See Preliminary Economic Assessment for Velvet-Wood/Slick Rock entitled “The Shootaring Canyon Mill and Velvet-Wood And Slick Rock Uranium Projects, Preliminary Economic Assessment, National Instrument 43-101” dated May 6, 2023 was authored by Douglas L. Beahm, P.E., P.G. Principal Engineer, Harold H. Hutson, P.E., P.G. and Carl D. Warren, P.E., P.G. of BRS Inc. Terence P. (Terry) McNulty, P.E., D. Sc, of T.P. McNulty and Associates Inc. | |||||

| 2. | Reported in accordance with CIM Definition Standards on Mineral Resources & Reserves (2014). | |||||

| 3. | GT cut-off varies by locality from 0.25-0.40 for eU3O8 and 0.25-0.50 for V2O5 | |||||

| 4. | Mineral resources are not mineral reserves and do not have demonstrated economic viability. However, reasonable prospects for future economic extraction were applied to the mineral resource estimates herein through consideration of grade and GT cutoffs as well as mineralization proximity to existing and proposed conceptual mining. As such, economic considerations were exercised by screening out areas which were below these cutoffs or of isolated mineralization and thus would not support the cost of conventional mining under current and reasonably foreseeable conditions. | |||||

| 5. | The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues, although Anfield is aware of any such issues. | |||||

| 6. | V2O5 mineral resources were estimated based primarily on documented vanadium: uranium production ratios and are thus considered inferred mineral resources. | |||||

The Slick Rock property is an advanced stage conventional uranium and vanadium project located in San Miguel County, Colorado. The project consists of 315 contiguous mineral lode claims and covers approximately 5,333 acres. Past production came from the upper or third-rim sandstone of the Salt Wash member of the Morrison Formation. This is the target host for uranium/vanadium mineralization within Anfield’s Slick Rock project area.

Board of Directors’ Recommendations

The Arrangement Agreement has been unanimously approved at meetings of the board of directors of each of IsoEnergy and Anfield, including, in the case of Anfield, following, among other things, the receipt of the unanimous recommendation of a special committee of independent directors of Anfield. Evans & Evans, Inc. provided an opinion to the special committee of Anfield and Haywood Securities Inc. provided an opinion to the board of directors of Anfield, to the effect that, as of the date of such opinion, the consideration to be received by Anfield shareholders pursuant to the Transaction is fair, from a financial point of view, to the Anfield shareholders, subject to the limitations, qualifications and assumptions set forth in such opinion. The board of directors of Anfield unanimously recommends that Anfield securityholders vote in favour of the Transaction. Canaccord Genuity Corp. provided an opinion to the board of directors of IsoEnergy to the effect that, as of the date of such opinion, the consideration to be paid to Anfield shareholders pursuant to the Transaction is fair, from a financial point of view, to IsoEnergy, subject to the limitations, qualifications and assumptions set forth in such opinion. The board of directors of IsoEnergy unanimously recommends that IsoEnergy shareholders vote in favour of the Transaction.

Material Conditions to Completion of the Transaction

The Transaction will be effected by way of a court-approved plan of arrangement under the Business Corporations Act (British Columbia), requiring the approval of (i) at least 662/3% of the votes cast by Anfield shareholders, (ii) if required, a simple majority of the votes cast by Anfield shareholders, excluding certain related parties as prescribed by Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions, voting in person or represented by proxy at a special meeting of Anfield shareholders to consider the Transaction; and (iii) a simple majority of votes cast by shareholders of IsoEnergy, voting in person or represented by proxy at a special meeting of IsoEnergy shareholders to consider the Transaction or by written resolution. The Anfield Meeting and the IsoEnergy Meeting, if applicable, are expected to take place in November 2024. An information circular regarding the Transaction will be filed with regulatory authorities and mailed to Anfield shareholders and, if applicable, to IsoEnergy shareholders, in accordance with applicable securities laws. The Transaction is expected to be completed in the fourth quarter of 2024, subject to satisfaction of the conditions under the Arrangement Agreement.

Each of Anfield’s and IsoEnergy’s directors and officers, along with certain key shareholders, including enCore Energy Corp., NexGen Energy Ltd. and Mega Uranium Ltd., representing an aggregate of approximately 21.16% of the outstanding Anfield Shares and approximately 36.14% of the outstanding ISO Shares (on a non-diluted basis), have entered into voting support agreements, and have agreed, among other things, to vote their Anfield Shares and ISO Shares, respectively, in favour of the Transaction.

In addition to shareholder and court approvals, closing of the Transaction is subject to applicable regulatory approvals including, but not limited to, approval of the Toronto Stock Exchange and the TSX Venture Exchange and the satisfaction of certain other closing conditions customary in transactions of this nature.

The Arrangement Agreement provides for customary deal protection provisions, including non-solicitation covenants of Anfield, “fiduciary out” provisions in favour of Anfield and “right-to-match superior proposals” provisions in favour of IsoEnergy. In addition, the Arrangement Agreement provides that, under certain circumstances, IsoEnergy would be entitled to a $5,000,000 termination fee. Each of IsoEnergy and Anfield have made customary representations and warranties and covenants in the Arrangement Agreement, including covenants regarding the conduct of their respective businesses prior to the closing of the Transaction.

Following completion of the Transaction, the ISO Shares will continue trading on the TSX and the Anfield Shares will be de-listed from the TSXV. Approximately 178.8 million ISO Shares are currently outstanding on non-diluted basis and approximately 206.2 million ISO Shares are currently outstanding on a fully diluted basis. Upon completion of the Transaction (assuming no additional issuances of ISO Shares or Anfield Shares), there will be approximately 210.3 million ISO Shares outstanding on a non-diluted basis and approximately 251.5 million ISO Shares outstanding on a fully diluted basis.

IsoEnergy and Anfield will file material change reports in respect of the Transaction in compliance with Canadian securities laws, as well as copies of the Arrangement Agreement and the voting support agreements, which will be available under IsoEnergy’s and Anfield’s respective SEDAR+ profiles at www.sedarplus.ca.

Bridge Loan

In addition, in connection with the Transaction, IsoEnergy has provided a bridge loan in the form of a promissory note of approximately $6.0 million to Anfield, with an interest rate of 15% per annum and a maturity date of April 1, 2025, for purposes of satisfying working capital and other obligations of Anfield through to the closing of the Transaction. IsoEnergy has also agreed to provide an indemnity for up to US$3 million in principal with respect to certain of Anfield’s property obligations. The Bridge Loan and the Indemnity are secured by a security interest in all of the now existing and after acquired assets, property and undertaking of Anfield and guaranteed by certain subsidiaries of Anfield. The Bridge Loan, Indemnity and related security are subordinate to certain senior indebtedness of Anfield. The Bridge Loan is immediately repayable, among other circumstances, in the event that the Arrangement agreement is terminated by either IsoEnergy or Anfield for any reason.

Advisors

Canaccord Genuity Corp. is acting as financial advisor to IsoEnergy and has provided a fairness opinion to the IsoEnergy board of directors. Cassels Brock & Blackwell LLP is acting as legal advisor to IsoEnergy.

Haywood Securities Inc. is acting as financial advisor to Anfield and has provided a fairness opinion to the Anfield board of directors. DuMoulin Black LLP is acting as legal advisor to Anfield. Evans & Evans, Inc. has provided a fairness opinion to the Anfield special committee.

Qualified Person Statement

The scientific and technical information contained in this news release with respect to IsoEnergy was reviewed and approved by Dean T. Wilton, PG, CPG, MAIG, a consultant of IsoEnergy, who is a “Qualified Person” (as defined NI 43-101).

The scientific and technical information contained in this news release with respect to Anfield was prepared Douglas L. Beahm, P.E., P.G., Anfield’s Chief Operating Officer, who is a “Qualified Person” (as defined NI 43-101).

About IsoEnergy

IsoEnergy Ltd. is a leading, globally diversified uranium company with substantial current and historical mineral resources in top uranium mining jurisdictions of Canada, the U.S. and Australia at varying stages of development, providing near, medium, and long-term leverage to rising uranium prices. IsoEnergy is currently advancing its Larocque East Project in Canada’s Athabasca Basin, which is home to the Hurricane deposit, boasting the world’s highest grade Indicated uranium Mineral Resource.

IsoEnergy also holds a portfolio of permitted, past-producing conventional uranium and vanadium mines in Utah with a toll milling arrangement in place with Energy Fuels Inc. These mines are currently on stand-by, ready for rapid restart as market conditions permit, positioning IsoEnergy as a near-term uranium producer.

About Anfield

Anfield is a uranium and vanadium development and near-term production company that is committed to becoming a top-tier energy-related fuels supplier by creating value through sustainable, efficient growth in its assets.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE