Intercontinental Gold and Metals Ltd. Reports Record Gold Exports for Q3 2019; Revenue increased by 286% to $136.0M versus $35.2M in the Q3 2018

Intercontinental Gold and Metals Ltd. (TSX-V: ICAU) (OTC: GXMLF) a gold refining and commodity trading company, is pleased to announce interim financial results for the third quarter ended September 30, 2019. All amounts are expressed in Canadian dollars unless otherwise noted.

Operating and Financial Highlights – Quarter Ended September 30, 2019

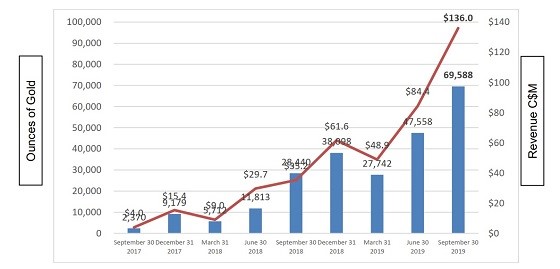

145% Increase in Export Volumes – Q3/19 refined gold exports of 69,588 ounces (2,164 kg) compared to 28,440 ounces (917 kgs) in the comparable quarter of 2018.

286% Increase in Revenue – Q3/19 revenue of $136.0 million ($7.55 per share) compared to $35.2 million ($1.99 per share) in the comparable quarter of 2018.

First Net Profit in Company History – Q3/19 net earnings of $359,557, with basic and diluted net earnings per share of $0.02 versus a net loss of $247,547 with basic and diluted loss per share of $0.02 in the comparable quarter of 2018.

Increase in Adjusted EBITDA – Q3/19 Adjusted EBITDA was positive $547,051 or $0.03 per share compared to negative $5,700 or ($nil) in the comparable quarter of 2018.

Increasing 2019 Revenue Guidance – 2019 Revenue guidance increased to between $340 and $350 million from previous guidance of between $337 million and $347 million.

Quarterly Summary of Gold Exports and Consolidated Revenue

Figure 1

Record high third quarter purchase volumes were achieved due to greater market penetration and seasonally strong producer output. Purchase volumes are forecast to decline during the fourth quarter as seasonal factors (rainy season and year-end holidays) will likely result in reduced primary production.

Record high gold purchases and refined export volumes supported record quarterly revenues. The company continued to work with mining federations, small miners and regulators on closing loopholes that enable non-compliant gold trading activity which can have a negative impact on market conditions. Our efforts were recognized by Ferreco R.L. Confiere El Pste. with Bolivian management team being presented with a “Reconocimiento por su Valioso aporte y Fidelidad” or “Recognition for Your Valuable Contribution and Loyalty” award.

With the third quarter’s record operating results we reported record revenue of $269 million, near the upper end of our full year revenue guidance range for fiscal 2019 of between $260 and $270 million. As a result, we are increasing our full year revenue guidance to between $340 and $350 million from gold and commodity trading activity, which assumes current commodity prices, exchange rates and forecast purchase volumes, refined gold export assumptions and based upon historical results and other market factors. Cost of Sales are forecast between $337 and $347 million. This forecast is subject to change due to changing market conditions and in the event, we achieve new trade finance relationships in support of expanded gold and other commodity trading opportunities.

Gorden Glenn, CEO commented “I am extremely pleased to report the IFRS and Non-IFRS results for our third quarter of 2019. First and foremost, it was a another record quarter where we achieved a major corporate milestone; the first net profit in the company’s history. We again demonstrated the triple digit growth potential of our business reporting record high export volumes, record revenues, record Adjusted EBITDA and achieved our previous full year revenue forecast in the first nine months of the year. Third quarter results re-confirm our high growth, transparent, auditable gold refining and commodity trading platform is an attractive and unique investment option for our existing shareholders and new investors seeking growth and gold exposure. Our strategic business plan remains firm, work closely with mining federations and small miners as a supportive, trustworthy and transparent business partner to increase our gold trading volumes, seek out other commodity trade opportunities to diversify and grow our business platform and ultimately attract ever increasing financial sponsorship from domestic and global banks/financial sponsors to grow our business and develop our target markets. Our expansion and growth strategy is ambitious but is supported by our solid operating and financial results to date.”.

About Intercontinental Gold and Metals Ltd.

Intercontinental Gold and Metals Ltd. is a Next Generation Metals and Mining Company. We believe our gold refining, physical commodities marketing and trading operations can provide insights in global primary supply and demand trends that create a strategic and competitive advantage for further investment and expansion opportunities on a global basis. The Company generates revenues from the purchases and sales of gold (accounted for as revenue). Cost of sales is measured at the fair value of the precious metals purchased and inventory sold, which is purchased at a competitive discount from licensed artisanal and small gold miners (ASGM) in Latin America (LATAM). Global ASGM supply is significant and supports a sustainable revenue generation model. We are unique being the only publicly listed gold refining company servicing the LATAM ASGM market.

MORE or "UNCATEGORIZED"

JUGGERNAUT CLOSES FINANCING WITH CRESCAT CAPITAL AS LEAD INVESTOR FOR 19.97%

PLANS FOLLOW UP DRILLING ON EXTENSIVE HIGH-GRADE COPPER-GOLD TARG... READ MORE

KARORA REPORTS RECORD REVENUE AND STRONG CASH FLOW FOR Q1 2024

Karora Resources Inc. (TSX: KRR) announced financial and operatin... READ MORE

OceanaGold Completes IPO, Raises US$106M for the Sale of 20% Interest in OGPI

OceanaGold Corporation (TSX: OGC) (OTCQX: OCANF) is pleased to an... READ MORE

Drilling Continues to Expand Gold Resource at OKO

G2 Goldfields Inc. (TSX: GTWO) (OTCQX: GUYGF) is pleased to provi... READ MORE

CANTEX INTERSECTS UP TO 25.07% LEAD-ZINC WITH 72g/t SILVER AT ITS 100% OWNED NORTH RACKLA PROJECT, YUKON AND WILL COMMENCE DRILLING ITS COPPER PROJECT WHERE PREVIOUS DRILLING INTERSECTED 2.5m OF 3.93% COPPER

Cantex Mine Development Corp. (TSX-V: CD) (OTCQB: CTXDF) provides... READ MORE