Imperial Provides Update on Mount Polley 2025 Production and Exploration

Imperial Metals Corporation (TSX:III) reports that 2025 metal production from Mount Polley mine was 30.715 million pounds of copper and 37,555 ounces of gold. The mine production exceeded the 2025 target of 25.0 – 27.0 million pounds for copper production and met the target of 35 – 40 thousand ounces for gold production.

Mount Polley Mine – Production

During 2025, 6,714,195 tonnes of ore were treated, which was flat compared to 2024, and 30.715 million pounds copper (down 14.0% from 2024) and 37,555 ounces gold (down 4% from 2024) were produced.

The majority of the mill feed during the fourth quarter was from Phase 5 and low grade stockpiles. This led to lower grades and lower copper recovery during the period. The Phase 4 and 5 pushbacks of the Springer Pit generated approximately 50% of the mill feed during the quarter with the remainder coming from lower grade stockpiles. Phase 4 mining will be completed in February 2026.

| Mount Polley Mine Production | Three Months Ended December 31 | Year Ended December 31 | ||||||

| 2025 | 2024 | 2025 | 2024 | |||||

| Ore milled – tonnes | 1,452,466 | 1,660,937 | 6,714,195 | 6,741,127 | ||||

| Ore milled per calendar day – tonnes | 15,788 | 18,054 | 18,395 | 18,418 | ||||

| Grade % – copper | 0.193 | 0.306 | 0.255 | 0.292 | ||||

| Grade g/t – gold | 0.216 | 0.256 | 0.254 | 0.263 | ||||

| Recovery % – copper | 75.5 | 82.5 | 81.4 | 82.3 | ||||

| Recovery % – gold | 65.4 | 69.9 | 68.5 | 68.6 | ||||

| Copper – 000’s pounds | 4,660 | 9,242 | 30,715 | 35,700 | ||||

| Gold – ounces | 6,589 | 9,564 | 37,555 | 39,108 | ||||

The 2026 production target for Mount Polley mine is 19 – 21 million pounds copper and 40,000 – 44,000 ounces gold. The majority of the mill feed in 2026 will come from the Phase 5 pushback in the Springer Pit which will be supplemented with low grade stockpiles to supply the mill feed.

Red Chris mine 2025 production will be released when the reconciled information is received from Newmont Corporation.

Mount Polley Exploration Update

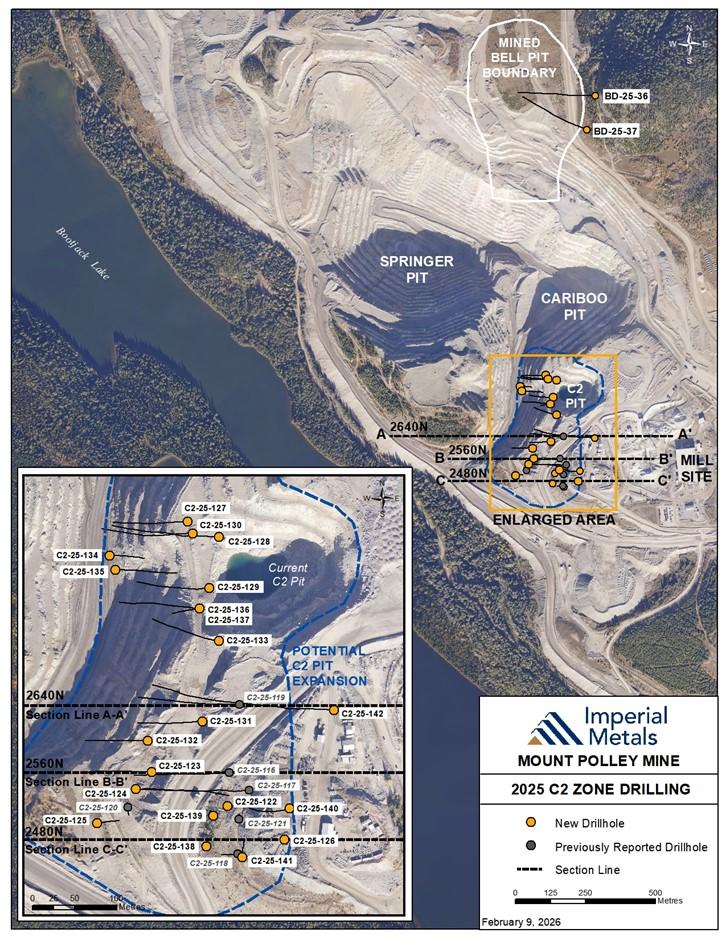

Imperial reports additional results from the Mount Polley 2025 Phase 2 exploration program which had three goals: to test a high-grade zone beneath the Wight Pit (see previous News Release January 22, 2026); to expand and determine the boundaries for mineralization in a potential C2 open pit expansion and find the boundaries of the higher gold grade encountered at depth in the C2 zone; and to test beneath the previously mined Bell Pit for depth extension. The intervals were analyzed for both total copper and non-sulphide copper. The ratio of non-sulphide to total copper is key to determining copper recovery from the often highly oxidized near surface mineralization in C2 zone. Two holes were drilled beneath the previously mined Bell Pit for depth extension.

Figure 1 – Plan Map.

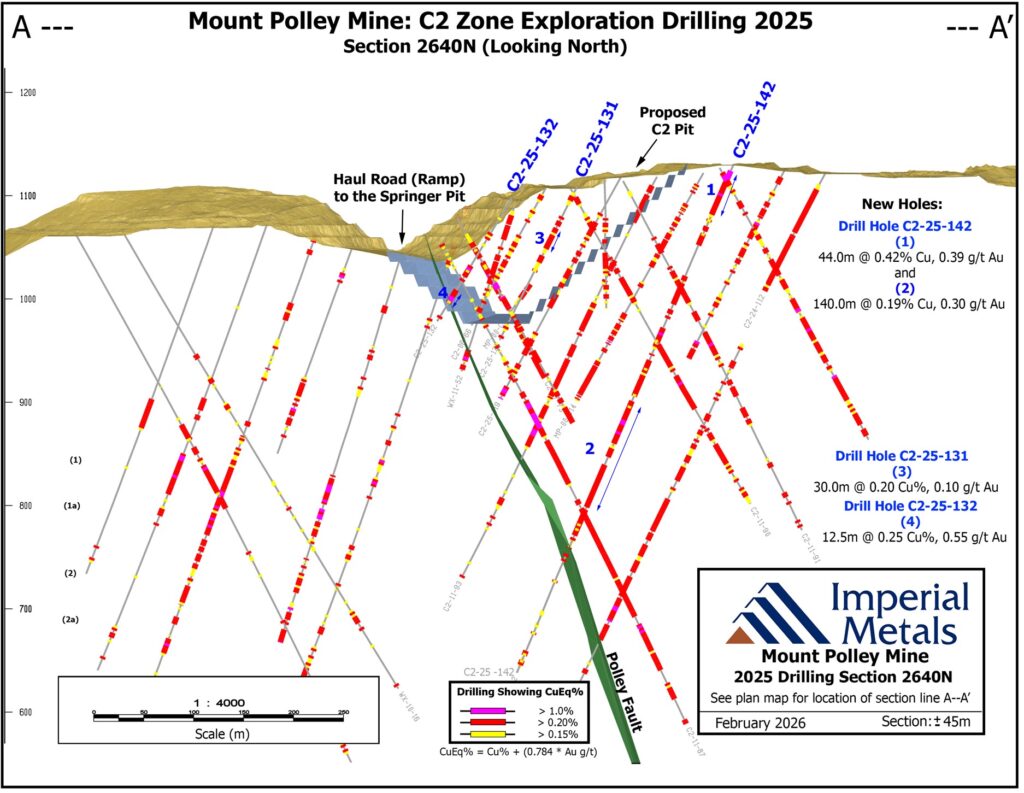

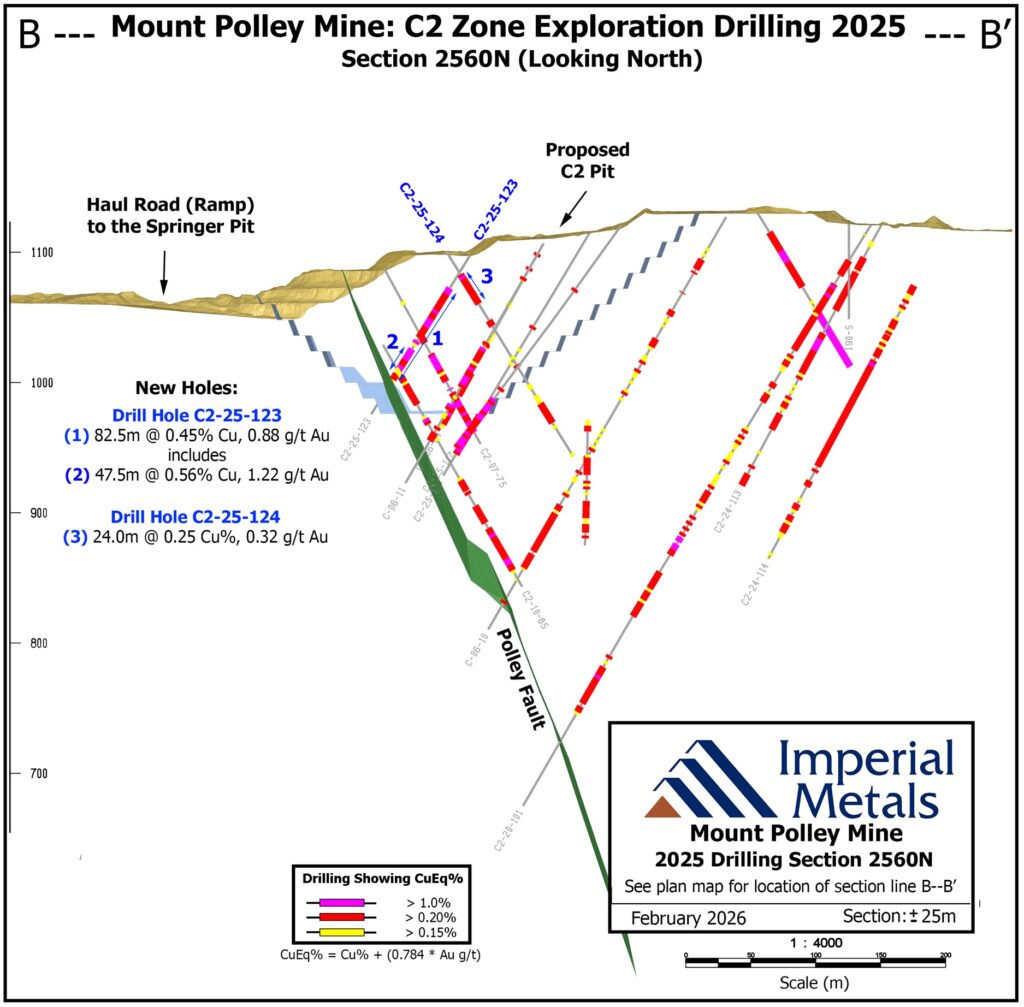

Thirteen drill holes intersected significant gold and copper values near surface in the C2 zone. Of note, drill hole C2-25-123 intersected 82.5 metres grading 0.45% copper and 0.88 g/t gold from a depth of 30.0 metres. That intercept included 47.5 metres grading 0.56% copper and 1.22 g/t gold from a depth of 57.5 metres.

Table 1: Significant results from near surface C2 zone drilling (See Figures 2 and 3, Section A-A’ and B-B’).

| Hole ID | From (m) | To (m) | Width (m) | Cu (%) | Au (g/t) | CuOx Ratio%* | ||||||

| C2-25-123 | 30.0 | 112.5 | 82.5 | 0.45 | 0.88 | 49 | ||||||

| Including | 57.5 | 105.0 | 47.5 | 0.56 | 1.22 | 54 | ||||||

| C2-25-124 | 21.0 | 45.0 | 24.0 | 0.25 | 0.32 | 38 | ||||||

| C2-25-127 | 35.0 | 50.0 | 15.0 | 0.13 | 0.17 | 8 | ||||||

| C2-25-128 | 100.0 | 120.0 | 20.0 | 0.16 | 0.35 | 4 | ||||||

| C2-25-129 | 65.0 | 90.0 | 25.0 | 0.32 | 0.54 | 3 | ||||||

| And | 110.0 | 125.0 | 15.0 | 0.24 | 0.28 | 29 | ||||||

| C2-25-130 | 47.5 | 65.0 | 17.5 | 0.18 | 0.37 | 2 | ||||||

| And | 145.0 | 160.0 | 15.0 | 0.27 | 0.25 | 26 | ||||||

| C2-25-131 | 52.0 | 82.5 | 30.0 | 0.20 | 0.10 | 32 | ||||||

| C2-25-132 | 105.0 | 117.5 | 12.5 | 0.25 | 0.55 | 27 | ||||||

| C2-25-133 | 105.0 | 135.0 | 30.0 | 0.15 | 0.27 | 40 | ||||||

| C2-25-135 | 87.5 | 99.0 | 11.5 | 0.20 | 0.36 | 12 | ||||||

| C2-25-136 | 12.5 | 65.0 | 52.5 | 0.16 | 0.17 | 56 | ||||||

| C2-25-137 | 16.5 | 142.5 | 126.0 | 0.20 | 0.27 | 39 | ||||||

| Including | 99.4 | 132.5 | 33.1 | 0.28 | 0.39 | 32 | ||||||

| C2-25-139 | 42.5 | 90.0 | 47.5 | 0.27 | 0.35 | 31 | ||||||

| C2-25-142 | 6.0 | 50.0 | 44.0 | 0.42 | 0.39 | 59 | ||||||

| And | 250.0 | 390.0 | 140.0 | 0.19 | 0.30 | 7 | ||||||

| *CuOx Ratio% = (Copper Oxide%/ Total Copper %) * 100 | ||||||||||||

Five drill holes targeted mineralization beneath the near surface C2 zone. Hole C2-25-139 which targeted the northwestern extent of the inferred deep C2 zone and intersected significant shallow mineralization starting at 42.5 metres depth but was unsuccessful at intercepting the deeper C2 zone. The shallow interval intersected 47.5 metres grading 0.27% copper and 0.35 g/t gold from a depth of 42.5 metres.

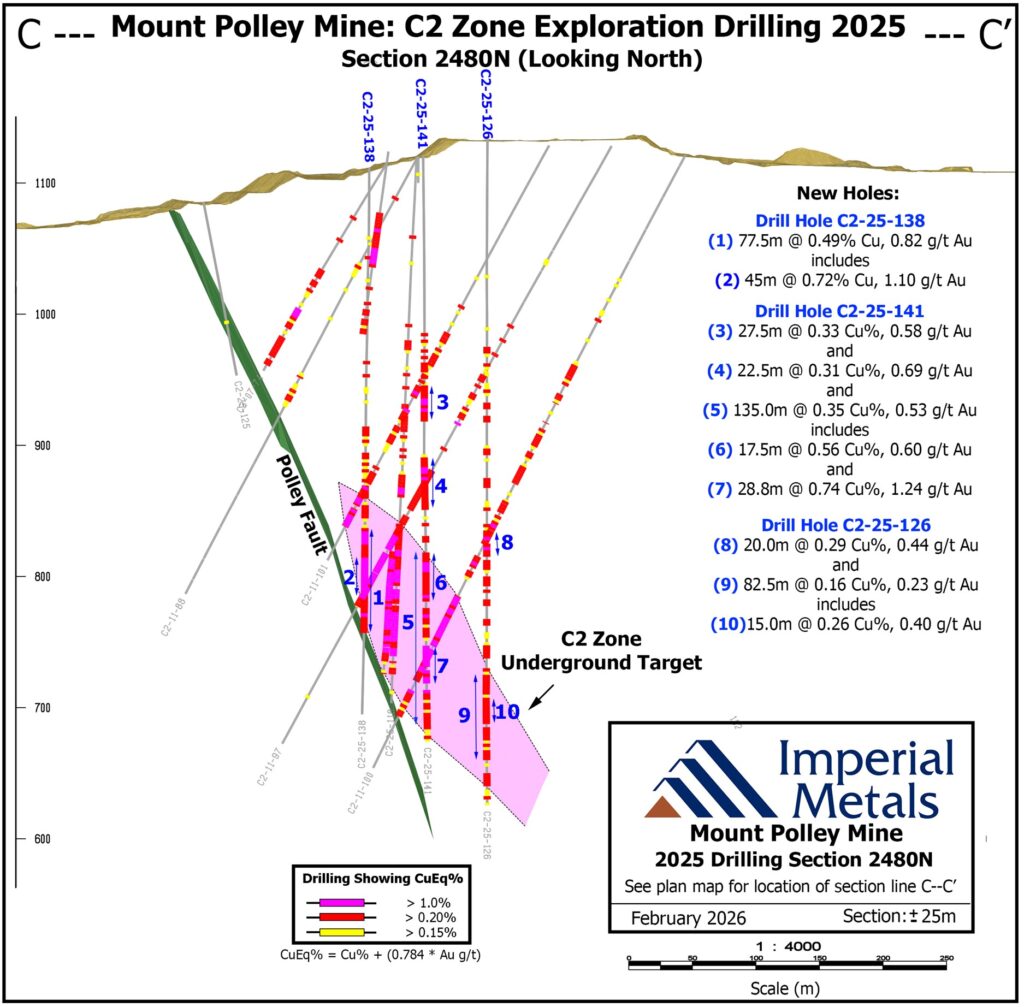

All the remaining drill holes were successful in intercepting deeper mineralization. Hole C2-25-142 intersected both shallow and deep mineralization, returning 44.0 metres grading 0.42% copper and 0.39 g/t gold from a depth of 6.0 metres, and 140.0 metres grading 0.19% copper and 0.30 g/t gold from a depth of 250.0 metres. Hole C2-25-138 also targeted the deep C2 zone target and intersected 77.5 metres grading 0.49% copper and 0.82 g/t gold from a depth of 277.5 metres. Including 45.0 metres grading 0.72% copper and 1.10 g/t gold from a depth of 277.5 metres.

Figure 2 – Section A – A’.

Figure 3 – Section B – B’.

Table 2: Significant results from deep C2 zone drilling (See Figure 4, Section C – C’).

| Hole ID | From (m) | To (m) | Width (m) | Cu (%) | Au (g/t) | |||||

| C2-25-126 | 292.5 | 312.5 | 20.0 | 0.29 | 0.44 | |||||

| And | 427.5 | 442.5 | 15.0 | 0.26 | 0.40 | |||||

| C2-25-138 | 277.5 | 355.0 | 77.5 | 0.49 | 0.82 | |||||

| including | 277.5 | 322.5 | 45.0 | 0.72 | 1.10 | |||||

| C2-25-140 | 222.5 | 230.0 | 7.5 | 0.40 | 1.29 | |||||

| And | 255.0 | 260.0 | 5.0 | 0.49 | 1.01 | |||||

| C2-25-141 | 302.5 | 437.5 | 135.0 | 0.35 | 0.53 | |||||

| including | 305.0 | 322.5 | 17.5 | 0.56 | 0.60 | |||||

| And | 373.7 | 402.5 | 28.8 | 0.74 | 1.24 | |||||

Figure 4 Section C – C’.

Two drill holes, BD-25-36 and BD-25-37, were collared east of the Bell Pit and oriented west, testing beneath the previously mined Bell Pit for depth extension. The two holes were both successful at extending the Bell mineralization deeper than previously tested. Hole BD-25-37 intersected 235.0 metres grading 0.22% copper and 0.27 g/t gold from a depth of 62.5 metres including 45.0 metres grading 0.35% copper and 0.51 g/t gold from a depth of 250.0 metres.

Table 3: Significant results from the Bell Zone drilling.

| Hole ID | From (m) | To (m) | Width (m) | Cu (%) | Au (g/t) | |||||

| BD-25-36 | 125.0 | 180.0 | 55.0 | 0.33 | 0.41 | |||||

| including | 150.0 | 167.5 | 17.5 | 0.69 | 0.75 | |||||

| and | 210.0 | 353.1 | 143.1 | 0.29 | 0.33 | |||||

| including | 290.9 | 353.1 | 62.2 | 0.37 | 0.50 | |||||

| BD-25-37 | 62.5 | 297.5 | 235.0 | 0.22 | 0.27 | |||||

| and | 250.0 | 295.0 | 45.0 | 0.35 | 0.51 | |||||

The next phase of diamond drilling is scheduled to start in February 2026 and will initially follow up on the successful results from the first drilling campaign in more than a decade in the Bell Pit area.

Steve Robertson, P.Geo., Imperial’s Vice President Corporate Development has reviewed the production disclosures contained in this news release and is the designated Qualified Person as defined by National Instrument 43-101.

Jim Miller-Tait, P.Geo., Imperial’s Vice President Exploration, has reviewed this news release as the designated Qualified Person as defined by National Instrument 43-101 for the Mount Polley exploration program. Samples reported were analyzed at Activation Laboratories Ltd. located in Kamloops. A full QA/QC program using blanks, standards and duplicates was completed for all diamond drilling samples submitted to the labs. Significant assay intervals reported represent apparent widths. Insufficient geological information is available to confirm the geological model and true width of significant assay intervals.

About Imperial

Imperial is a Vancouver based exploration, mine development and operating company with holdings that include the Mount Polley mine (100%), the Huckleberry mine (100%), and the Red Chris mine (30%). Imperial also holds a portfolio of 23 greenfield exploration properties in British Columbia.

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE