IAMGOLD Signs Agreement to Acquire Mines D’Or Orbec Inc.

IAMGOLD Corporation (NYSE: IAG) (TSX: IMG) is pleased to announce that the Company has signed a definitive arrangement agreement with Mines D’Or Orbec Inc. (TSX-V: BLUE) pursuant to which IAMGOLD has agreed to acquire all of the issued and outstanding common shares of Orbec by way of a court-approved plan of arrangement under the Business Corporations Act (Ontario). The acquisition will consolidate IAMGOLD’s existing ownership of Orbec Shares through which the Company will add the highly prospective Muus Project, which is adjacent to the Company’s Nelligan and Monster Lake Projects in the Chibougamau region of Quebec, Canada.

Pursuant to the Arrangement Agreement, Orbec shareholders will receive total consideration representing a value of C$0.125 per Orbec Share in a cash and shares transaction comprised of C$0.0625 per Orbec Share and 0.003466 of an IAMGOLD common share for each Orbec Share. This implies a total equity value based on fully diluted shares outstanding, net of IAMGOLD’s ownership, of C$17.2 million and represents a premium of approximately 25% to the closing price of the Orbec Shares on the TSX Venture Exchange as of market close on October 17, 2025. IAMGOLD currently owns 7.14 million Orbec Shares, representing approximately 6.70% of the Orbec Shares outstanding. Excluding IAMGOLD’s existing ownership of Orbec, IAMGOLD expects to issue approximately 369,341 IAMGOLD Shares.

Highlights of the Transaction

- Consolidation of IAMGOLD’s land position in the Chibougamau district, a rapidly growing premier mining jurisdiction in Quebec, where the Company’s Nelligan and Monster Lake assets are located.

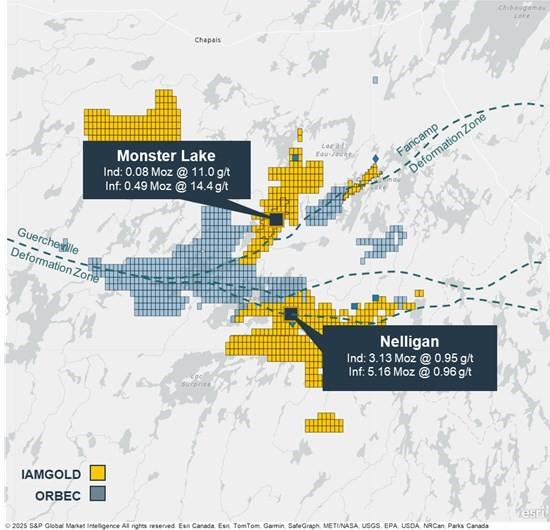

- The Nelligan and Monster Lake Projects have combined estimated Measured and Indicated Mineral Resources of 3.2 million ounces of gold (“Moz Au”) and Inferred Mineral Resources of 5.6 Moz Au positioning the consolidated camp among the largest pre-production projects in Canada1.

- The Muus Project would contribute 24,979 hectares (“ha”) of mineral rights within the immediate area of IAMGOLD’s properties which total 38,403 ha.

- The Muus Project is at the intersection of two mineralized structural breaks: the northeast trending Fancamp Deformation Zone (FDZ), which hosts IAMGOLD’s Monster Lake deposit and the East-West trending Guercheville Deformation Zone (GDZ), which hosts IAMGOLD’s Nelligan deposit, as well as historical resources at Philibert, Meston and Joe Mann.

- An immediate premium of 25% to Orbec shareholders based on the closing price of Orbec’s common shares on October 17, 2025.

“The addition of the Muus Project provides a highly prospective land package to our rapidly expanding Nelligan Mining Complex Project,” said Renaud Adams, President and Chief Executive Officer of IAMGOLD. “The Chibougamau region is quickly advancing to become one of the most exciting gold mining districts in Canada. We look forward to expanding our exploration program in the region with a goal of further expansion and extension of the mineralization at Nelligan and Monster Lake, while continuing the exploration efforts of the Orbec team.”

The Muus Project

Orbec controls 24,979 hectares of mineral rights approximately 50 kilometers SW of Chibougamau, Quebec. The properties are highly prospective for gold and base-metals at the intersection of two major mineralized structural breaks: including the northeast trending Fancamp Deformation Zone (FDZ), which hosts IAMGOLD’s Monster Lake deposit and Orbec’s Fancamp Property; and the East-West trending Guercheville Deformation Zone (GDZ), which hosts IAMGOLD’s Nelligan deposit. Exploration activities have been limited since the mid-1990s with past focus primarily targeting east-west oriented conductors in volcanic units for base-metals, with little effort drilling broad disseminated gold systems hosted within sediments, like Nelligan, or structural gold targets similar to Monster Lake.

Figure 1 – Nelligan Mining Complex & Muus Project Land Package

Transaction Details

Directors and executive officers of Orbec have entered into voting support agreements with IAMGOLD pursuant to which they have agreed, subject to the terms of such agreements, to vote their Orbec Shares in favour of the Transaction.

Full details of the Transaction will be included in a management information circular of Orbec that is expected to be mailed to Orbec’s shareholders in November 2025.

In addition to the cash and share consideration of the Transaction, (i) each “in-the-money” Orbec option outstanding on the completion of the Transaction, whether vested or unvested, will be deemed to be surrendered, assigned and transferred for a cash payment made by or on behalf of Orbec, equal to the amount by which the consideration exceeds the exercise price payable under such Orbec Option for an Orbec Share, multiplied by the number of Orbec Shares such Orbec Option entitles the holder thereof to purchase; (ii) all Orbec Options (other than “in-the-money” Orbec Options) will be cancelled without any payment therefor; (iii) each issued and outstanding “in-the-money” warrant to purchase Orbec Shares will be deemed to be surrendered, assigned and transferred for a cash payment made by or on behalf of Orbec, equal to the amount by which the consideration exceeds the exercise price for such Orbec Warrant, multiplied by the number of Orbec Shares such Orbec Warrant entitles the holder thereof to purchase; and (iv) all Orbec Warrants (other than “in-the-money” Orbec Warrants) will be cancelled without any payment therefor.

The Transaction will be effected by way of a court-approved plan of arrangement under the Business Corporations Act (Ontario), will constitute a “business combination” for purposes of Multilateral Instrument 61-101 — Protection of Minority Security Holders in Special Transactions (“MI 61-101”), and will require the approval of at least (i) 66 2/3% of the votes cast by Orbec’s shareholders, (ii) 66 2/3% of the votes cast by Orbec’s shareholders, optionholders and warrantholders, voting together as members of a single class, and (iii) 50%+1 of the votes cast by disinterested Orbec shareholders at a special meeting of Orbec shareholders.

Orbec is relying on the “Issuer Not Listed on Specified Markets” exemption from the requirement under MI 61-101 to obtain a formal valuation of the Orbec Shares. Further details of this exemption will be provided in the Circular.

In addition to shareholder and court approvals, the Transaction is subject to applicable regulatory approvals and the satisfaction of certain other closing conditions customary in transactions of this nature. The Transaction is expected to close in the fourth quarter of 2025.

None of the securities to be issued pursuant to the Transaction have been or will be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws, and any securities issuable in the Transaction are anticipated to be issued in reliance upon available exemptions from such registration requirements pursuant to Section 3(a)(10) of the U.S. Securities Act and applicable exemptions under state securities laws. This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities.

Further details of the Transaction are set out in the Arrangement Agreement and the Circular, both of which will be made available on Orbec’s SEDAR+ profile at www.sedarplus.ca.

Laurentian Bank Securities Inc. is acting as special advisor and Norton Rose Fulbright Canada LLP is acting as legal advisor to IAMGOLD in connection with this Transaction.

Early Warning Disclosure

In connection with the Arrangement Agreement and concurrently with the execution thereof, Orbec issued to the Company an unsecured convertible debenture in the aggregate principal amount of C$500,000.

Prior to the issuance of the Debenture, the Company directly or indirectly, owned or controlled, 7,142,857 Orbec Shares, representing approximately 6.70% of the then issued and outstanding Orbec Shares.

Following the issuance of the Debenture, based on the number of the issued and outstanding Orbec Shares and without additional issuance or conversion of securities (including the Debenture), the security holdings of the Company in Orbec have not changed, except that the Company now owns the Debenture.

The Principal Amount is convertible into a number of Orbec Shares equal to the quotient obtained by dividing (i) the Principal Amount by (ii) the closing price of the Orbec Shares on the TSX Venture Exchange (rounded up to the nearest C$0.005) on the business day after the transactions contemplated by the Arrangement Agreement have been announced, or such other date as may be required by the TSXV in order to comply with TSXV Policy 4.1 – Private Placements (the “Conversion Price”). For the purposes of this news release, assuming a Conversion Price equal to the total consideration offered to the Orbec shareholders pursuant to the Arrangement Agreement, being C$0.125 per Orbec Share, if Orbec was to convert all of its Debenture (exclusive of accrued interest), the Company would own, directly or indirectly, 11,142,857 Orbec Shares, representing approximately 10.08% of the issued and outstanding Orbec Shares (based on the then current number of issued and outstanding Orbec Shares, assuming no additional issuance or conversion). Additionally, if applicable, any accrued and unpaid default interest may be converted by Orbec into a number of Orbec Shares equal to the quotient obtained by dividing (x) the amount of accrued and unpaid default interest under the Debenture being converted by (y) the Conversion Price for such accrued and unpaid default interest established in accordance with the rules of the TSXV, subject to the TSXV’s prior approval.

The participation by the Company in the issuance of the Debenture was undertaken to assist Orbec with funding working capital requirements during the interim period. The Company may, from time to time, acquire additional securities of Orbec for investment purposes, such as contemplated in the Arrangement Agreement, and may, from time to time, increase or decrease its beneficial ownership or control of Orbec depending on market or other conditions.

This section of this news release is being issued as required by National Instrument 62-103 — The Early Warning System and Related Take-Over Bid and Insider Reporting Issues and National Instrument 62-104 — Take-Over Bids and Issuer Bids and relates to: Mines D’Or Orbec Inc., whose head office is located at 2000 rue de l’Éclipse, Suite 500, Brossard, Québec J4Z 0S2. A copy of the early warning report with additional information in respect of the foregoing matters will be available under Orbec’s profile on the SEDAR+ website at www.sedarplus.ca.

QUALIFIED PERSON AND TECHNICAL INFORMATION

The technical and scientific information in the news release was also reviewed and approved by Marie-France Bugnon, P.Geo. Vice-President, Exploration for IAMGOLD, who is a qualified person (“QP”), as defined in National Instrument 43-101 – Standard of Disclosure for Mineral Projects, with respect to the technical information being reported on in this news release. The technical information has been included herein with the consent and prior review of Ms. Bugnon.

About IAMGOLD

IAMGOLD is an intermediate gold producer and developer based in Canada with operating mines in North America and West Africa, including Côté Gold (Canada), Westwood (Canada) and Essakane (Burkina Faso). The Côté Gold Mine achieved full nameplate in June 2025 and has the potential to be among the largest gold mines in Canada. IAMGOLD operates Côté in partnership with Sumitomo Metal Mining Co. Ltd. In addition, the Company has an established portfolio of early stage and advanced exploration projects within high potential mining districts. IAMGOLD employs approximately 3,700 people and is committed to maintaining its culture of accountable mining through high standards of Environmental, Social and Governance practices. IAMGOLD is listed on the New York Stock Exchange (NYSE: IAG) and the Toronto Stock Exchange (TSX: IMG).

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE