Bob Moriarty & Rick Mills – “Hunting closer to home”

Richard Mills, Editor/ Publisher, Ahead of the Herd:

I firmly believe that as investors we must know about global unfolding situations, predictable pathways, subsequent consequences and how they play out.

I also think, over our eight talks, this is our ninth, we’ve been very upfront about what we see and interpret.

We’re going to do it again. I’m going to propose that I don’t think the largest players in the global long-term debt market are going to continue to keep buying US long-term debt.

To reduce risk they are going to bring their capital closer to home by buying their own, and other government’s long-term debt, just not US debt. And their money is going to be used in a two-pronged approach; dual use military and civilian infrastructure build outs, and a massive military global rearmament and equipment increase.

Let me read something: Britain’s 30-year borrowing costs have hit 5.5%, that’s the highest since before 2000, except a slight spike in April, Germany’s up over 3%, that’s within touching distance of its highest yield in long-term since the Eurozone’s debt crisis in early 2010. And in intra-day trading on May 21, the yield on 30-year Japanese government bonds rose to nearly 3.2%, setting a record.

And this is because what happens in America really doesn’t stay in America. Their economy is so big that it accounts for 26% of the world’s output. But the US also has an outsized government deficit, their deficit is so high it’s an amount that tilts savings and investment globally and raises the cost of capital for everyone.

Instinctively you’d expect higher returns on US Treasuries would lead investors and traders to prefer America’s debt, but what’s happening, as I said is that other countries’ yields are now also rising.

Another concern to mention is that Goldman Sachs thinks that a structural source of demand for long-dated government debt is drying up. They said asset liability managers such as defined pension funds that use fixed income streams from bonds to guarantee their future liabilities, have long been big buyers of these long-term bonds. But yields have now been high enough, long enough, for them to lock in these cash flows for years and so many of them can afford to, and are, withdrawing from the market.

So, as the supply of bonds remains high, fueled by fiscal deficits and central banks shrinking their balance sheets, this is going to set the stage for long-term borrowing costs to rise even more because you need long-term yields continuously rising to attract the fewer and fewer buyers that will be out there for US debt.

There’s a saying among bond traders the 30-year couldn’t get much above 5% and stay there long because at that level long-term investors such as pension funds and university endowments are going to snap up every bond they can. When they get sated then there’s no more of that buying, so Bob what happens when these big investors walk away from buying government debt, especially the US long-term debt. What’s the situation?

Bob Moriarty, Founder, 321gold:

Well, what it is we have a giant crisis and there’s no way out. Anybody that passed Economics 101 recognizes that the debt-based system of the West is failing, and this is the first domino to fall.

The end or possible reversal of the Japanese carry trade is really a giant deal that affects literally trillions of dollars. With Trump flip flopping so much, just today he’s come out and said that China’s cheating on tariffs which is frankly a bizarre think to say, no one in the world has any confidence in loaning money at low interest for a long term and it is a crisis.

It’s going to get worse, and I believe we’re going to have a tipping point where everything breaks. I see something bad on the horizon, and it’s all connected.

RM: It is all connected, just to drop in on the yen carry trade for a minute, it’s such an incredibly powerful force on the global market. For decades trillions of dollars have outflowed from Japan, pushing up asset prices and returns for investors.

But something snapped. Japanese bond yields went through the roof, the Yen climbed, and now there’s a fear that the Yen carry trade is blowing up.

The carry trade is reversing, investors who have been buying US debt and other US assets appear to no longer need, nor want to hunt for yield so far from their own shores.

Bob you are right on both counts, investors are demanding greater returns for holding government debt and that pushes up the cost of borrowing.

Let’s listen to what Albert Edwards said, he’s the Société Générale’s guy on this stuff, he said “Both the US Treasury and equity markets are vulnerable, having been inflated by Japanese flows of funds, as has the dollar. And if sharply higher Japanese government bond yields entice Japanese investors to return home, the unwinding of the carry trade could cause a loud sucking sound.”

Concerns about America’s creditworthiness, and as you said their haywire policies, and just absurd statements coming from the president, these are already pushing US government yields higher.

The global price of money, which is set by the US 10-year Treasury could be about to jump. And when I say the price of money I’m talking about the cost of borrowing because that’s the price of money; how much interest you pay to borrow.

This is going to weigh on the value of every asset in every investor’s portfolio.

The change has just been remarkable, and the damage is global as higher rates signal that demand’s weak already. The US Treasury’s going to have to entice investors with higher and higher yields.

BM: Well, you’re correct but there’s something you missed. If you are a Japanese bond buyer for the last 20 years you were sitting on enormous losses, so it’s not just an issue of the Japanese being able to buy bonds with high interest rates now, it means that everybody, every brokerage firm, every insurance company, every bank in Japan, is sitting on trillions of dollars in losses.

And that’s what nobody wants to talk about but that’s the most important thing to consider. The system is coming unglued; we had 40 years of declining bond interest rates and that has ended. We had free money for 40 years and that just changed.

Now if you recall two years ago the UK banking system just about collapsed because of the rate of change of interest rates. Interest rates were going up so high that long-term government bonds in the UK dropped 53% in one year and that’s exactly what we’re seeing right now and everybody’s pretending “Well we can put up with this.”

No, you can’t, you cannot take a 23% loss in government bonds, anybody’s government bonds, and the financial system continue to operate. So, we’re in a crisis, it’s far worse than anybody sees and it’s going to come to a tipping point very soon.

I’ve seen so many bizarre things out of Trump that he’s going to blow the system up. Now he didn’t cause the problem, but he’s the one lighting the fuse. Do you know why he’s going after Harvard?

RM: No, but it’s interesting that he has some Harvard guys on his staff.

BM: It’s simple. Barron Trump applied for Harvard, but he didn’t get in.

RM: You know that kind of follows along with a lot of what else he’s doing, it seems like his second admin is the revenge tour.

BM: Right, it is, and he’s going to get even with everybody. Now a lot of it I agree with, the whole Russia gate thing was obscene, James Comey should be in a courtroom right now.

There was so much treason being committed in the United States, why is nobody getting tried? It’s amazing to me and scary to me but at the same time the debt-based system of the West is collapsing and it’s going to continue.

All your points are good and they’re all valid, and we are going to get far higher inflation but we’re going to see a collapse the economy. Did you see this morning how much imports have dropped in the last month?

RM: The ports are empty.

BM: Do you remember a few years back when there was some kind of glitch in the computer system and the EBT cards never got paid. Do you know what I’m talking about?

RM: No, I don’t remember.

BM: Okay, electronic transfer food stamps. If you want to see a collapse, riots in the streets, try not paying the food stamps. If you want riots in the streets wait until poor people go into Walmart or Kmart and they can’t buy anything because the shelves are empty.

Things are going to get bad and they’re going to get bad in a hurry, now some of this stuff I would think that Trump would recognize that whatever benefit he got out of bashing China, if there was anything good to be accomplished it would’ve done it already. But instead of attacking China with a baseball bat now Trump is attacking China with a tire iron, and I don’t see anything good coming out of it.

I’ve discussed many times in many interviews everything we’re told by the government, everything we’re told by the mainstream media is a lie; 100%. And who’s talking about empty shelves? Nobody. But if you’re not importing anything and inventories are dropping to days, what are you going to put on the shelf and the answer is nothing.

RM: Most of the poor would not have money to buy supplies even if there was anything to buy because prices are going to go through the roof, and the deepest SNAP, aka food stamps cut in history is in the new budget. Various reports say it’s going to take food assistance away from millions of low-income families.

We’ve talked about food being so important, when somebody’s kid is crying because it’s hungry they are going to stop at nothing to get that kid food. We talked about what caused the Arab Spring, food shortages, and we talked about the chances of an American Spring.

Even though America is considered a breadbasket you’ve still got to get that food to the people.

BM: Let me give you a statistic that’s really kind of shocking. The distance from the West Coast to the East Coast is 2,200 miles okay, that’s more or less correct but the average food in the United States travels 2,500 miles.

We’re so dependent on food from Canada, food from Mexico, food from Chile and we don’t even realize it. If you’re eating a grape in January, that grape came from Chile.

And we’ve got bad times coming. I hope that the whole purpose of us having this discussion is to help investors see what’s coming and sometimes really bad things are coming, and I’m absolutely 100% convinced that’s true; quite bluntly I can’t think of anything in the last eight interviews that we missed.

I’m not saying we didn’t discuss, I’m saying we were wrong on, we’ve been right for two months and everything’s getting worse in a hurry and some of this stuff, every time I go to CNN I say, “God I mean he didn’t really do that.”

This thing about Harvard, Harvard is one of the top universities, most respected universities in the world and to go after Harvard because your kid didn’t get in, that’s just weird. And to go after the Chinese and accuse them of cheating on the tariffs, how do you cheat on tariffs? I didn’t even know you could cheat on tariffs.

RM: I don’t know how you cheat on a 145% tariff rate; you’re not trading.

BM: Yeah, exactly.

RM: Let’s look at something else, Neel Kashkari, he’s the Federal Reserve Bank of Minneapolis president and he says, “major shifts in US trade and immigration policy are creating uncertainty for Fed officials to move on interest rates before September.”

So, the Fed’s not going to move, Jay Powell, the chair of the Federal Reserve met with Trump and Trump told him straight out to lower interest rates, that he was wrong in keeping them high.

Powell looked him down, he said, (I’m paraphrasing) no we’re not going to lower rates until we know exactly what’s going on with all the chaos and turmoil, till than we can’t possibly lower rates. So they left the meeting at that.

If we believe the US is not going to find enough buyers for its debt no matter the yield, then we should also believe the Treasury and the Fed are going to step in to cover a lack of demand, and they already have.

The Fed has already bought $42 billion worth of Treasuries this year. Janet Yellen, the previous Treasury Secretary, was being very sneaky as she was quietly buying 2-years through the Treasury by borrowing money from the Federal Reserve. She was buying the 2-year Treasuries attempting to lower yields.

I’m not sure how many tricks they’ve got left up their sleeves, but they’re not going to lower rates anytime soon, the environment is just too chaotic and potentially inflationary.

So, if Donald Trump’s spending policy is going to drive enormous amounts of ongoing deficit spending the deficits certainly going to double, perhaps triple within the next few years. This is going to require the US government to buy enormous amounts of new Treasuries, and we know the Fed generally purchases bonds, monetizes the debt, with newly created fiat currency.

We have three new things to worry about: a non-funding event as large buyers exit the US long-term bond market; a collapse of US assets in general; and global massive inflation from the Federal Reserve creating more fiat to buy bonds.

BM: Oh absolutely, let’s talk about the Big Beautiful Bill, okay? Do you know where it stands right now from a legal point of view?

RM: It’s in front of the Senate and they’re going to work their magic on it and send it back to the House.

BM: Well okay, you got it partially right. It passed the House and of course it passed the House because it’s so filled with pork they just couldn’t wait to send it to the Senate; it’s one of the most inflationary bills in history and there are enough Republican senators who have said “We’re not going to pass this bill” I would not be surprised if it doesn’t get totally shitcanned.

It’s the most dangerous bill I’ve ever seen the United States pass. Some of this stuff like increasing defence spending 13%. who is the threat that requires a 13% increase in spending to the military industrial complex and the answer is none. We have created the threat; do you remember when Donald Trump was running for election and he was going to end the war in Ukraine in 24 hours?

RM: It was going to end before he was even elected.

BM: How’s he doing on that?

RM: Well, let me say that German Chancellor Merz just announced that the US, Germany, France, the UK have all now given permission for Ukraine to use much longer-range missiles and bomb deeper inside of Russia, so I’ve got to say it hasn’t been going very well.

BM: Okay, and what did Russia say in response?

RM: They said, ‘we are going to consider that an act of war by NATO and we will look at bombing Berlin.’

BM: It is absolutely an act of war. Now one thing nobody but we discuss, there are American troops in Ukraine, there are British troops in Ukraine, there are French troops in Ukraine, there are German troops in Ukraine, there are Polish troops in Ukraine, NATO is already 100% behind Ukraine. Now if you go back to February 2022 who’s winning.

RM: Russia

BM: Well, here’s what’s interesting and again, everything the media tells you is a lie. Do you remember how many troops Russia invaded Ukraine with?

RM: No.

BM: 90,000, and one of reasons Russia invaded Ukraine, and they absolutely did invade Ukraine, but they didn’t start the war, NATO and the United States started the war, Ukraine had 150,000 troops on the border with Donbass, and was prepared to invade Donbass and they were going to do it March 10th.

So, in every way what Russia did was legal. There’s something called R2P which is the right to protect, and this goes back to the conflict in Rwanda under Clinton. The UN came out afterwards and said look, countries have a right to protect innocent people from being attacked, and Ukraine had attacked and killed 14,000 civilians in Donbass, so everything Americans know about the conflict is wrong.

And everything that they’re being told is a lie, and the Russians have won right from the very beginning. Now they invaded in February but in March Ukraine came to the table in Istanbul at the peace conference and they initialed a peace agreement giving Russia what they wanted, which was to enforce the Minsk 2 agreement.

But Boris Johnson went in there, at the instigation of the United States, “Nah you don’t want to stop fighting, you keep fighting we’ll keep sending you weapons, you can sell the weapons and keep the money,” and that’s what’s happened since then.

I’m not sure if we talked about the incident with French President Macron and Merz on the train going to Kiev, but clearly it appeared they were hiding a cocaine baggie and certainly a cocaine spoon. The French government came out and said, “No it wasn’t a baggie it was just a napkin,” well if you look at Macron’s face you realize he was hiding something very important. I’ll be candid, I was in the military for six years, I was in Vietnam for 20 months and they’re losing. The governments in Europe are the weakest leadership I’ve ever heard or read about in history, and these guys are coked up and they’re making stupid decisions based on bad information. I will absolutely say under international law Russia has an absolute right to attack Germany should those missiles go into Russia.

RM: Let’s switch gears here a bit, I’m going to call this next segment “Shades of Fosterville.”

We’ve talked two or three times about New Found Gold’s resource estimate. Well, NFG just came out with a private placement and Eric Sprott is going to be the control person after it closes. What are your thoughts on that?

BM: Do you remember how big the private placement is?

RM: No.

BM: $69 million, this is not a small private placement. Now if you were a large shareholder of New Found Gold and you wanted to increase your holdings it would be in your financial best interest to see lower prices and that’s exactly what we got.

Now I made it clear in several interviews that the 43-101 that New Found Gold put out was total bullshit. You could not possibly have as many high-grade intercepts as there were and only have 2,000,000 ounces in a resource.

I absolutely concede that the young guys who were running New Found Gold until a few months ago have made some mistakes. What they were trying to do was drill off the entire project at one time and I think some of those drill holes were 14 kilometers apart. The greater the distance between drill holes the less the certainty that the QP [Qualified Person] has so all you have to do is stretch the drill holes out and you will lower the apparent amount of gold.

But I believe somebody told the QP “We want the resource to show 2 million ounces.” I believe it was deliberate add I think the fact that there’s a $69,000,000 private placement going on is an indication that my opinion is probably correct.

We’re going to know when they come out with the next resource because I think there will be a big jump in the resource.

RM: Do you think right now, obviously if you’re already in and you want to hang around you try and get a piece of the private placement or buy in the market, because Sprott just showed an enormous level of confidence in the deposit itself, it’s kind of hard to deny that – when he already owns so much and he’s going to become the control person through this private placement.

But what about new people looking at this, new potential investors, what have they got to think about their prospects for making more money off New Found Gold than maybe one of these low-market-cap juniors that we talk about all the time. Some of them have already doubled and tripled. What would you say would be the better investment?

BM: Well, that’s a good question and I’m going to try to define what the purpose of investing is. Obviously one of the purposes is to make money, but one of the negative considerations is how safe is the investment?

Now I’ll tell you why Eric Sprott has so much money in it, because he made $3 billion out of Fosterville. Eric Sprott has seen this movie before, he knows how it ends, he knows exactly what it is, and I’ll guarantee that Eric Sprott understands that the 43-101 was bullshit.

But those shares went from $2.50 a share to $1.40 in two weeks okay, so if you’re buying now and you want safety in a major deposit in a safe country right now, I think New Found Gold is absolutely a good buy.

Now if you were in at $4-5-6 you’ve taken a hit, but this is absolutely a situation where I personally would average down, and I would be happy to do that.

But there is another consideration, and that is other than safety what are you looking for and the answer to that is quite simple. You’re looking for a return on the investment, not losing money, what kind of a return can I expect?

We talked about Harvest Gold, Harvest Gold went from 3 to 6 cents in a month, that’s a 100% return. You want safety, but the fact is if you can make 100% in a month that’s a good thing to do.

New Found Gold’s got a $439 million market cap right now, and I know it was well above a billion or $1.1B. So New Found Gold could double or triple easily and it’s a very safe, secure stock to buy, however if you want to make money you want to buy the cheap stocks like Harvest Gold.

RM: It’s a risk situation, you’ve got to know what your risk tolerances are. Some tolerate more risk than others.

This is a quote from you: “Traditionally when Vancouver or Toronto brokers hear of a pending finance for a company, they short the shit out of the stock, waiting to drive the private placement price lower.

They clear their shorts and put the money into their private placement and three months and three weeks – a week short of the four-month hold – they dump all their shares. As a result, junior resource companies are under constant attack by the brokers who stand to make the most money. All at the expense of ordinary investors.”

BM: Yeah of course. Now do you understand why it happens, and there’s a very rational reason for it. What is the purpose, why do they invest in those shares in the first place? They want to make money.

Believe me, the brokerage firms don’t give a damn about retail investors, they really don’t give a damn about the companies themselves, they make their money on the 7-10% they get for doing the placement in the first place.

But they sell because they can hold onto the warrants, okay? You’ve still got the potential for massive gain with no risk whatsoever.

Now do I like it? No. Do I understand it? Yes. Is there anything I can do that’s ever going to change it? No. Do I care? No. But it’s something ordinary investors should be aware of. Brokerage houses are not there to make money for the average investor or any investment, they’re there to make money for themselves.

RM: Yes, the institutional mindset.

You were a commodity broker. I know you know the primary purpose of the commodity exchange is only to determine price, it’s not to facilitate the exchange of commodities. Can one naked short a commodity?

BM: There is no such thing as a naked short in commodities, it does not exist. What has happened is these con men, and they are con men, have turned around and said, “Well gee if you don’t have the silver and you sell it that’s a naked short,” and that is an absolute lie.

Commodities are a zero-sum game; there is one buyer and one seller for each contract. Now what people are doing is confusing shares with commodities. You can have naked short selling in shares. You cannot have naked short selling in commodities.

The purpose of commodity trading is to set price as you said, and there is no requirement that a person hold the commodity. There’s no requirement that the person who buys it takes it okay. Guys who are con men have thrown those terms in deliberately to confuse investor. If you ever read about commodities and the guy uses the term “naked short selling” it means he has no idea what he’s talking about.

RM: But you can naked short shares, how?

BM: It’s easy for them, you sell shares you don’t own. They do that all the time, it’s illegal, but it’s done. Now here’s the difference. You understand that commodities are a zero-sum game, but shares are not a zero-sum game?

RM: Yes, but please explain.

BM: If you buy IBM shares today, and your bid drives the price up $1.00 that affects every single share of IBM, but there’s nobody there on the other side, it’s not a zero-sum game, so it’s a totally different environment.

Naked short selling absolutely exists in shares. There are funds and there are brokerage houses that do it all the time and it’s illegal, its wrong but they still do it.

RM: So, when they talk about silver or gold having all these naked shorts and they’re going to corner the market and silver’s going to go up its pretty much bullshit.

BM: No, it’s not pretty much bullshit, it’s 100% bullshit. Strangely enough when they talk about bullion banks and the bullion banks are massively short silver or gold, do you understand when a bullion bank lends money to a mine to go into production that they require the mine to forward-sell commodities? Do you understand why they do that?

RM: It’s security for the money they put into it.

BM: Exactly. They want to know they’re going to get their money back. Now the mine may be willing to speculate but the bullion bank does not want to speculate so it is always true, 100% of the time, the bullion banks are always going to be short gold and silver and it’s part of financial management.

It’s not manipulation and frankly if anybody talks about any financial instrument and uses the turn manipulation, they’re trying to con you. Can you name any financial instrument and take your pick, you can go from beanie babies to bitcoin to gold and silver, can you name any financial instrument that’s not manipulated?

RM: No.

BM: No, because there are none and I used to laugh at GATA because GATA would be talking about how they had driven the price of gold up because they had a conference in South Africa and all of a sudden the price of gold was up $10 and “We were the ones who caused it” well wait a minute, is that manipulation okay, and guys talking about naked short selling silver and silver goes from $4 to $50 and the price is suppressed, well if the price was suppressed and it went from 4 bucks to $50 the suppression wasn’t all that effective.

There’s so much nonsense when people start talking about commodities because they’re trying to tell people what they want to hear and everybody wants to believe that somebody’s up there operating like a puppet master, pulling the strings, controlling the price of gold and silver. There are two things that affect the price of gold and silver, do you know what they are?

RM: Supply and demand.

BM: Supply and demand, and those are what affect every commodity, every financial instrument, it’s as simple as supply and demand and you could not possibly manipulate gold or silver for a 25-year period and get away with it.

Nobody’s got resources that large, so much of the information that people are told about gold-silver manipulation conspiracies, naked short selling most of it’s absolute rubbish.

RM: We talked Harvest Gold (TSX.V:HVG) in an earlier talk, we started talking about it because it had a ridiculously low market cap of $2 million, and that pretty much was the only reason we bought it, correct?

BM: Yeah, that’s the only reason you need to buy it.

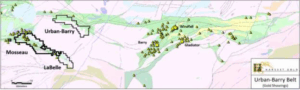

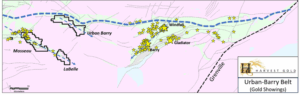

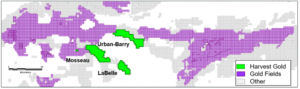

RM: Let’s go deep, Harvest Gold has three projects: Mosseau, Urban Barry and La Belle, and they’re all sitting on the same geological contact. All three are on the Urban Barry Greenstone Belt in the Abitibi, world-famous for gold.

The Mosseau is where they’re going to focus; it has north, central and a southern area, where La Belle is connected onto it, and it’s their flagship project.

Urban Barry to the northeast is almost unexplored, it hasn’t had much work at all, and the La Belle, to the southeast, is unexplored. They’re focusing on finalizing drill targets in the north and the Central Mosseau areas and they’re going to raise money for drilling start.

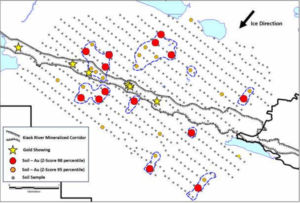

They had a news release earlier this week where they put out the soil geochemical surveys, done in 2024, on a mineralized corridor in central Mosseau called the Kiask River Fault Corridor, the KMRC. The important thing about this area and why they did this geochemical survey was the fault.

All three properties are very close to each other and all of them are in contact with the granite of the Wilson pluton. Now I’m just going to say that for non-geos sometimes this geo-speak doesn’t mean a whole lot but understand that these contacts are where the big deposits lie. And here the contact is between the granites and the volcanics, and then of course you’ve got the cross-cutting structures that go through that contact and that can act as a trap for gold.

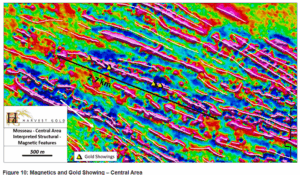

So, this is why were so excited about the central area. Now if you look at the map of the Mosseau you’ll see a large structure running right through the middle of Mosseau the central area and that’s where they did all the work, on the KMRC last summer and they finally got the results.

Can you tell me, have you ever seen gold Z scores, values, at the 98th percentile, over such a big area? They clearly defined eight zones on this mineralized corridor, what do you think?

BM: Well strangely enough it is that simple. The results were excellent; we’ve gone through a year or two of utter disaster in the juniors and certainly it’s affected Harvest Gold.

And then they came out with good results and frankly us talking about it certainly had an effect, but when you’ve got good results and you’ve got a company with a $5 million market cap in the best mining district in Canada that’s a pretty good deal.

The problem with the mining business, nobody ever talks about it, but we’re willing to, is always money. Mining just sucks up money, so you’ve got to have the ability to raise money, and they haven’t had the ability to raise money for a couple of years and now they have it.

We’re going through a sea change in the juniors and there is more opportunity there than I have ever seen in my life if people will act. It was cheap when it was 2.5 cents a share, it’s cheap when it’s 6 cents a share, and they’ve got some money to do something now and they’ve got good results.

And frankly what Donald Trump is doing is driving people to resources because you certainly don’t want long-term debt of any government in the world so it’s going to be good for the resource business and it’s going to be exceptionally good for the junior lottery tickets.

RM: Yeah, and that’s why Harvest Gold in my mind stands out as one of the top tickets, I’ll explain why I think that.

When they looked at these results from the Kiask River mineralized corridor in the centre of Mosseau they confirmed three gold trains that were already known mineralization, another five are brand new. And they’re also associated with magnetic highs and geologically you see the diorite and the gabbros there, so to me that’s an excellent target.

Central area – Soil Sampling Au (Z Scores)

They’re going to be talking about drill targets in the next news release, and they’re going to just refine the information and then tell people about their targets. We’ve got to remember too that they have 49 known gold showings and a very shallow small gold deposit up in the northern area. They’ve got five drill targets already proved out without doing any of the kind of work that’s been done in the central area.

So, at least five priority targets there, eight in the central area, they’re probably not going to get to drill all 13 of them, but the excitement is in that’s a lot of targets with gold and you’re right, we’re in the perfect environment and it’s still cheap.

A little bit of history here: Gold Fields was expanding out of South Africa; and they took over Osisko Mining and the Windfall deposit and all their properties.

Gold Fields now effectively owns almost the entire Urban Barry Greenstone Belt. Rick Mark, the CEO, was talking to the VP exploration of Gold Fields about the Urban Barry belt. He’s another x Osisko mining guy, here’s a quote: “We certainly couldn’t help but notice you guys.” Of course they would, Harvest is a huge property owner on their greenstone belt in the Abitibi.

BM: Right.

RM: The other interesting thing is that part of the x Osisko team joined a company called Vior, and the cool part of the story is these guys joined Vior, they got the Mosseau and they optioned it – Harvest can do 100% earn-in.

Vior than staked more claims down around the Kiask River Fault and they put that into the deal, so not only do we have somebody working with us who they own a piece of the company, but Vior, well they’re former Osisko guys who have spent over 10 years working on this belt.

So, when you combine those guys working with an already excellent management team, you’re going to have about the best decisions made that you can get concerning drill holes and areas and how to move forward, would you agree to that?

BM: Absolutely, I mean they have ticked all the boxes, they’ve got people with experience, they’re in one of the safest countries to mine in the world, they’ve got money in the bank, and they’ve got a project that they can actually go get some good results. I was quite happy to buy it for no other reason than it was cheap, but from a technical point of view they managed to tick all the boxes and it’s still cheap.

RM: Quinton Hennigh likes the Mosseau because he likes structures, doesn’t he?

BM: Yes.

RM: Rick said that Quinton’s interest in the project is based on the structures running through the property, and now everybody understands that when you look at these cross-cutting structures that’s where the gold can get trapped. Now it’s still a challenge as you’ve got still to go find it, but Crescat Capital kept their 20% interest, and I think that’s important for investors to know.

BM: There is one thing I would like to cover. I think that crypto is setting up a trap that’s exceptionally dangerous for Trump’s reputation. Donald Trump always wants to make money, and he’s made hundreds of millions of dollars through the Trump meme coin and frankly it’s unseemly and probably illegal for the President of the United States to do that. But he’s enriching his family and that’s going to turn around and bite him in the ass.

RM: As for crypto currencies the only one I’ve ever seen backed by anything, this one is gold backed, is Hedera’s stable coin, it is backed one coin for one gold ounce, so every stable coin has one ounce of gold locked up in a vault in Switzerland and this is official. The rest appear to be a Ponzi scheme backed by nothing at all like all fiat currencies.

BM: Let me give you, my opinion. Would you agree that bitcoin is 99% speculation and 1% utility?

RM: Yes.

BM: Do you remember Beanie Babies?

RM: Yes, I do.

BM: Okay, Beanie Babies were 95% speculation, but they were 5% utility, because at the end of the day no matter what the value of the Beanie Baby was you still had a 79-cent stuffed toy. And bitcoin can’t even claim that.

Now, somebody entered a big, long position to the tune of $2-3 billion and they were going to be forced to sell if the price went under $105,000 and it did that today. When bitcoin crashes it’s going to crash big time.

RM: Want to hear a story about the original NFT?

BM: Sure.

RM: I grew up on Prince Edward Island and this was before the bridge, I don’t know what it’s like now as I haven’t been back in almost 50 years, but the economy was mostly based on tourists and basically how much you could get the tourist to spend.

I can remember, even as a kid laughing because they were selling the most ridiculous things. They would take an old tobacco can and print a label, stick it on, they canned Prince Edward Island air.

They would sell the cans to tourists with the promise that this winter, when you’re home and you’re longing for PEI and you’re reminiscing about all the beautiful times you had, you could crack this can and take a deep sniff.

That was I think the first non-fungible token.

BM: That’s a good story.

RM: We’ll talk again next week.

BM: Okay, super deal.

Rick Mills

aheadoftheherd.com

Bob Moriarty

321gold.com

Subscribe to AOTH’s free newsletter

Richard owns shares of Harvest Gold Corp. (TSX-V:HVG). HVG is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of HVG.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE