Headwater Gold and Centerra Gold Sign US $25 Million Earn-In Agreement to Explore the Crane Creek Gold Project in Idaho

Headwater Gold Inc. (CSE: HWG) (OTCQB: HWAUF) is pleased to announce that it has entered into a definitive earn-in agreement with a subsidiary of Centerra Gold Inc. (TSX: CG) for Centerra to earn up to a 70% interest in Headwater’s Crane Creek project in Idaho through staged exploration expenditures totalling up to US$25,000,000 and the completion of a preliminary economic assessment report.

Highlights:

- Headwater has entered into a definitive earn-in agreement with Centerra for a subsidiary of Centerra to earn up to a 70% interest in Headwater’s Crane Creek project in Idaho;

- Up to US$25,000,000 in staged earn-in expenditures: Centerra may elect to earn up to a 60% interest in the Project by funding exploration expenditures of US$25,000,000 and granting Headwater a royalty on the Project;

- US$2,500,000 expenditure commitment: Centerra to fund a minimum commitment of US$2,500,000 in exploration expenditures during the first three years of the Agreement;

- Carried interest to completion of a PEA: Centerra may earn an additional 10% interest (up to 70%) in the Project by completing a preliminary economic assessment report on the Project; and

- The Project is fully permitted for drilling under a Notice of Intent with the Bureau of Land Management and a Plan of Operation with the Idaho Department of Lands.

Caleb Stroup, Headwater’s President and CEO, states: “Since becoming a strategic Headwater shareholder last year, Centerra has been an engaged and supportive partner. We are very excited to expand that relationship into a fully aligned exploration partnership on the project level at Crane Creek. Centerra’s commitment to a substantial multi-stage earn-in underscores the scale of the opportunity at this project and allows us to properly test what we believe is a large, underexplored epithermal system with high-grade potential at depth as well as near surface bulk-tonnage potential. Centerra brings strong technical expertise and a collaborative approach and we look forward to working with them to unlock the full potential of the project for our shareholders.”

Table 1: Principal Structure of the Earn-In Agreement:

Stage |

Expenditures (US$) | Centerra Interest (%) |

Time for Each Stage |

| Minimum Commitment | $2,500,000 | 0% | 3 Years from Execution Date |

| Stage 1 | $10,000,000 1 | 51% 2 | 4 Years from Execution Date |

| Stage 2 | +$15,000,000 +1% to 2% NSR 3 to HWG |

60% | 4 Years from commencement of Stage 2 |

| Stage 3 | Completion of Preliminary Economic Assessment Report 4 |

70% | 2 years from commencement of Stage 3 |

- Stage 1 is inclusive of the Minimum Commitment of US$2,500,000.

- If Centerra completes Stage 1 but not Stage 2, its ownership interest in the Project is reduced to 49%, which Headwater retains the right to purchase at a mutually agreed price or, if a price cannot be mutually agreed within a specified period, for fair value that will be determined based on an agreed-upon process (“Fair Value”).

- Upon completion of Stage 2, Headwater will be ceded a 2% Net Smelter Return (“NSR”) royalty on royalty-free claims which are 100%-owned by Headwater and a 1% NSR royalty on land subject to existing underlying royalties.

- In order to acquire the additional 10% interest in the Project, Centerra shall be required to sole fund the completion of a Preliminary Economic Assessment Report reflecting a mineral resource of not less than 1,000,000 oz gold equivalent.

Commercial Terms:

The Agreement grants Centerra the exclusive right to acquire up to a 70% interest in the Project, subject to the terms thereof, by making an initial cash payment of US$87,000 to Headwater upon execution of the Agreement and subsequent annual cash payments of US$50,000 thereafter starting on the first anniversary of the Agreement. These payments are considered exploration expenditures for the purposes of the earn-in structure outlined below.

Earn-in Structure:

Stage 1: Centerra has the option to acquire a 51% interest in the Project by sole funding exploration expenditures of US$10,000,000 within four years of the Execution Date. Stage 1 includes a firm commitment to fund a minimum of US$2,500,000 in exploration within the first three years. Centerra will be the initial operator of the Project.

Stage 2: Centerra may elect to earn an additional 9% interest (to 60%) in the Project by solely funding additional expenditures of US$15,000,000 within four years following the completion of Stage 1. Headwater will be ceded a 2% NSR royalty on royalty-free claims which are 100% owned by Headwater and a 1% NSR royalty on land subject to existing underlying royalties.

Stage 3: Centerra may earn an additional 10% interest (to 70%) in the Project by completing a Preliminary Economic Assessment Report for the Project, which is required to include a minimum 1 million ounce gold or gold-equivalent resource, within two years following completion of Stage 2. Centerra can extend the Stage 3 earn-in period by making annual payments to Headwater or making incremental exploration expenditures.

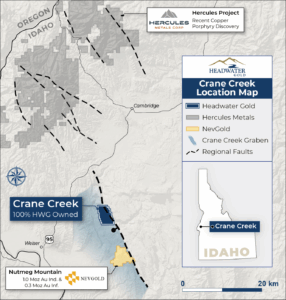

Figure 2: Location of the Crane Creek project in western Idaho with respect to the Crane Creek Graben, a major extensional fault system which hosts the Nutmeg Mountain epithermal gold deposit and lies approximately 40 km south of the recently discovered copper porphyry belt centered on the Hercules project.

About the Crane Creek Project:

The Crane Creek project is located in western Idaho, approximately 18 km northeast of the town of Weiser and 90 km northwest of the city of Boise, with a paved county road less than 1 km from the southern property boundary. The project is fully permitted for drilling under a Notice of Intent with the BLM and a Plan of Operation with the Idaho Department of Lands. The project encompasses an array of mineralized epithermal quartz veins within a broad gold and trace element geochemical anomaly and features characteristics of a well-preserved low-sulfidation system, including historical mercury workings, widespread opaline silica, and chalcedonic vein fill. This alteration cell is located 8 km along trend northwest of the Nutmeg Mountain gold project (1,006,000 oz gold Indicated, 275,000 oz gold Inferred1). The Crane Creek project comprises approximately 1,240 hectares, consisting of 123 unpatented federal mining claims on BLM land, a 640-acre State of Idaho minerals lease and a private lease.

Historic drilling took place on the property between 1984 and 1996, consisting of mainly shallow reverse-circulation holes with an average depth of 71 m. Only three holes were drilled to greater than 150 m in depth1. Historic drilling primarily targeted bulk-tonnage disseminated mineralization in a package of near-surface sedimentary rocks, with most holes terminated shortly after intercepting an underlying basalt unit. A significant number of holes encountered mineralized quartz veins ranging from 2.0 g/t Au up to 8.14 g/t Au2 that were apparently never followed up, within broader intervals of disseminated low-grade mineralization. The potential for basalt-hosted high-grade veins at depths of 100 m or more below the paleosurface, such as those occurring at the Midas mine in northern Nevada (Hecla Mining Company) and the Cerro Negro mine (Newmont Corporation) in Argentina, remains untested at the project.

Headwater recently completed a suite of airborne magnetic and radiometric surveys and a ground gravity survey across the property, which collectively delineate a large, structurally focused hydrothermal system extending well beyond the area of historical work. The radiometric data define a 4 km by 2 km potassium anomaly interpreted as illite–adularia alteration, while the magnetic and gravity datasets highlight a series of untested NNW-trending structural breaks and magnetite-destructive lows consistent with prospective fault-hosted vein zones. Integration of these datasets with surface mapping and historical results has defined multiple high-priority targets for both high-grade vein mineralization at depth and near-surface bulk-tonnage potential.

Under the earn-in agreement announced here, Headwater and Centerra will now work jointly to finalize an integrated exploration plan that incorporates the recently completed geophysical datasets, historical results and updated geological interpretation. The partners intend to prioritize and refine specific drill targets across the main vein corridor and newly generated structural and alteration targets, with the objective of initiating Phase 1 drilling as early as the spring of 2026.

About Centerra Gold:

Centerra Gold Inc. is a Canadian-based gold mining company focused on operating, developing, exploring and acquiring gold and copper properties in North America, Türkiye, and other markets worldwide. Centerra operates two mines: the Mount Milligan Mine in British Columbia, Canada, and the Öksüt Mine in Türkiye. Centerra also owns the Kemess Project in British Columbia, Canada, the Goldfield Project in Nevada, United States, and owns and operates the Molybdenum Business Unit in the United States and Canada. Centerra’s shares trade on the Toronto Stock Exchange under the symbol CG and on the New York Stock Exchange under the symbol CGAU. Centerra is based in Toronto, Ontario, Canada. Centerra holds a 9.9% equity interest in Headwater Gold Inc.

About Headwater Gold:

Headwater Gold Inc. (CSE: HWG) (OTCQB: HWAUF) is a technically-driven mineral exploration company focused on exploring for and discovering high-grade precious metal deposits in the Western USA. Headwater is actively exploring one of the world’s most well-endowed, mining-friendly jurisdictions, with a goal of making world-class precious metal discoveries. The Company has a large portfolio of epithermal vein exploration projects and a technical team with diverse experience in capital markets and major mining companies. Headwater is systematically drill-testing several projects in Nevada and has strategic earn-in agreements with Newmont Corporation on its Spring Peak and Lodestar projects and OceanaGold Corporation on its TJ, Jake Creek and Hot Creek projects. In August 2022 and September 2024, Newmont and Centerra acquired strategic equity interests in the Company, further strengthening Headwater’s exploration capabilities.

Headwater is part of the NewQuest Capital Group which is a discovery-driven investment enterprise that builds value through the incubation and financing of mineral projects and companies. Further information about NewQuest can be found on its website at www.nqcapitalgroup.com.

For more information about Headwater, please visit the Company’s website at www.headwatergold.com.

On Behalf of the Board of Directors

Caleb Stroup

President and CEO

+1 (775) 409-3197

cstroup@headwatergold.com

For further information, please contact:

Brennan Zerb

Investor Relations Manager

+1 (778) 867-5016

bzerb@headwatergold.com

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE