Gwen Preston – “Where To From Here?”

It’s rough out there. Gold has held its recent gains, trading today around $1980 per oz., but gold stocks still can’t attract investor interest. Investors just don’t see enough risk on the horizon to start positioning for it.

In the meantime, the 10-year yield bested 5% on Monday for the first time since global economic strengthen fueled by the rise of China dimmed interest in Treasuries enough that yields briefly reached 5% back in 2006.

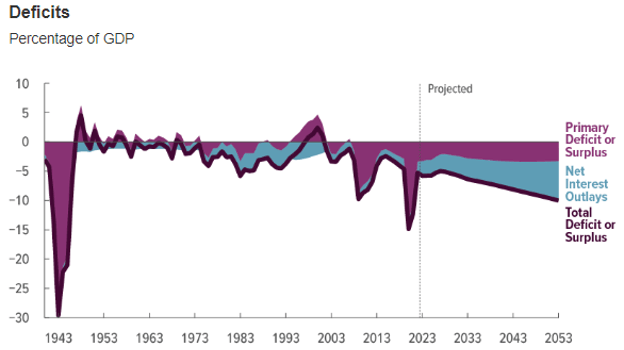

Today it’s not such a simple story. Economic strength is playing a role in pushing yields higher – investors continue to favour stocks to bonds – but structure oversupply is the bigger factor.

That the pool of buyers for US Treasuries is shrinking while America’s need to issue debt keeps rising is a slow change. And feel free to opine against this statement but I think it will be very difficult to wean America off its reliance on debt: it’s unlikely Congress can materially cut spending or raise taxes. Republicans will hold firm against tax increases, Democrats will hold firm against cuts to entitlements, military spending is unlikely to go down, and any effort to raise tax revenues on financial actions would dampen asset prices, offsetting any revenue gains because tax receipts are highly correlated with asset.

So deficit needs will continue to rise. But Treasury buyers are not likely to materialize en masse. That’s the slow change driver of higher yields.

Quick-change impacts on bond yields come from economic conditions, in particular anything that suggests recession. Investors go to safety when facing a recession and T-bills have long played that role.

It is precisely that possibility – a recession – that has prompted several outspoken investors to switch recently from being bond bears to betting bonds will rally by year end. Bill Gross is one, tweeting on Tuesday that he now expects the US to enter a recession in Q4. He ended his tweet saying: “Higher for longer” is yesterday’s mantra.

I don’t know. Data continues to show a resilient economy, including this from yesterday’s S&P Global Flash US Composite PMI:

“US companies signalled a marginal expansion in business activity during October, following broadly stagnant output seen in August and September. Manufacturers and service providers alike reported improved activity levels as the downturn in demand moderated. The rise in total output was the quickest for three months. Demand conditions at manufacturers improved for the first time since April, while service providers saw a slower drop in new orders.”

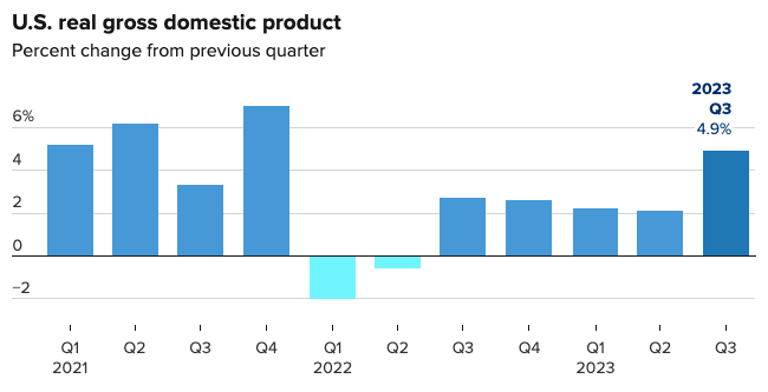

Are consumers reaping the benefits of a strong job market and easing inflation? GDP suggests so, with this morning’s Q3 reading coming in hotter than expected at 4.9%.

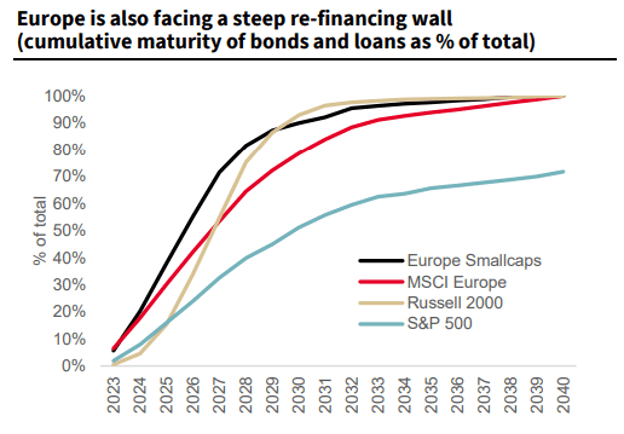

On the flip side, signs of gloom are also evident. Valuations for big fav stocks have topped. Small stocks never enjoyed a 2023 lift and are now sliding again.

Is the slide partly because investors are wary of debt pressures and their early, outsize impact on small companies? This table shows the wall of debt that smaller companies must refinance in the next two years.

We can see that worry in rising junk spreads as well (the amount extra investors demand to be paid to lend money to small cap/riskier bond issuers). They jumped in the spring with the mini banking crisis, eased in the summer, and now are ramping up again.

So there are recession warning signs in the corporate world – nothing dramatic but signs that give pause. On the household side, total interest payments by US consumers as a share of wages have surged, something that could easily contribute to a credit crunch.

Monetary policy generally works with an 18-month lag. It’s now been 18 months since the Fed started to raise rates.

I am not loving my work these days. It’s boring to keep waiting for the base metal bull market to happen; it is going to happen but not until investors see clear economic growth ahead, which isn’t happening now and might take a while yet. Gold is more interesting though the lack of investor interest in gold stocks is frustratingly persistent.

It’s also frustrating that the thing that would get investors interested in gold stocks again is a recession. I don’t want to hope for that!

My husband has a saying: Nothing changes if nothing changes. It fits today. Until or unless something shifts, we’ll remain in this boring, sideways-to-down metals market.

What might change that?

- A bond auction fails (not enough buyers for the issuance), sending Treasury yields and gold higher as investors grapple with the idea that, instead of being a safe haven, T Bills and US debt overall are the problem. Even higher debt costs increase recession risk. Gold benefits.

- A credit crunch develops as rate hike impacts aggregate. Growth slows, markets drop, gold benefits (first the metal, then gold equities after the worst is over), Treasury prices rise/yields fall (they may be starting to cuase problems but T bills remain a risk hedge for now)

- The Gaza war worsens (other countries get actively involved) and investors buy T Bills as safety. This would ease the oversupply problem and pull yields down, reducing recession risk for a time. Gold rises but investors still would not see growth so base metals remain boring.

- The Fed sees recession risk building, starts to cut rates, and navigates a perfect path from high rates choking growth to moderate rates enabling growth while keeping inflation in check. Investors then start paying attention to the global lack of the metals needed for growth. Gold participates alongside an overall metals bull market.

These are all possible. And have totally unknown timeframes. It’s easy to say – assume – that big and/or bad things are unlikely or long dated…but that’s not true. Major financial moments rarely start slowly; they happen all of a sudden, even if the warning signs are apparent in hindsight.

The first three possibilities on this list could do just that – happen all of a sudden.

The fourth would take time.

Or we could just continue to muddle along, with rising bond yields suggesting the slow development of structural problems in the Treasury market but a resilient job market keeping consumption strong and index investing continuing to support Big Tech.

Another saying, though, is that nothing lasts forever. Something will move us out of the muddle.

A recession would pull all stocks down to start, though gold stocks would not likely get hit hard because (1) no one has gains to lock in and (2) investors have been reminded of gold’s pattern of bottoming first and bouncing fast out of recessions several times in recent years, which will likely encourage investors to hold through a dip in anticipation of imminent gains. This is the reason to stay in gold.

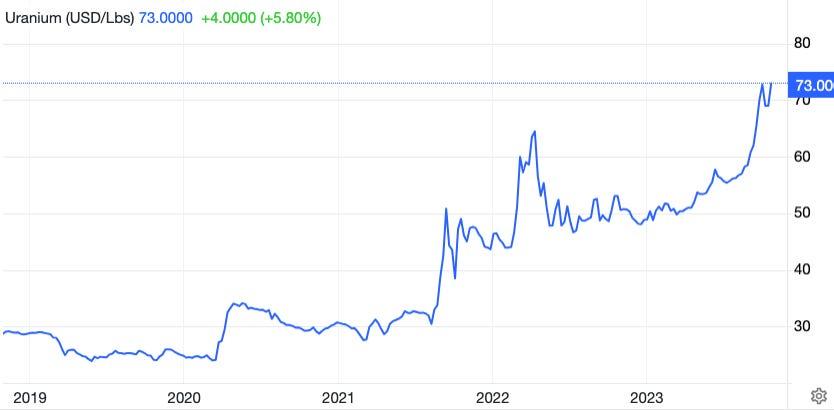

Muddling along hasn’t done much for us this year, so more of what we’ve just experienced doesn’t argue for being particularly positioned in metals outside of discovery stories and uranium.

A perfect flight from recession risk to lower rates and growth would be wonderful. And it’s possible. Gold would likely do well, buoyed by risk initially and then participating in a base metal market once growth gets underway. But this scenario would take time to develop.

Echo chambers are dangerous. My Twitter feed happens to have more Recession Ahead! Commentators than market optimists, so after reading my feed I feel like markets might tank in the next few weeks. Then I step outside of that world and read all the signs of strong consumption in the US that fed into 4.9% GDP growth for Q3 and the worry ebbs.

Odds of a recession are rising. They are not high but that setup could change suddenly. Or not.

In the midst of all this uncertainty and (to be blunt) lack of reason to own base metal stocks and gold stock other than those that will benefit first and most within a recession, I want to simplify my portfolio.

I only see reason to own:

- Discovery stocks: I’ve run through this rationale many times of late. Discoveries work no matter the markets.

- First movers when gold stocks get attention: there are lots of stocks that can fit this criteria, as it runs the gamut from major producers to top notch single asset operators to companies building or preparing to build big new gold mines to well marketed companies growing already-large deposits. Each investor has to decide which ones he/she wants to own. I choose Orezone, Silvercrest, Artemis, Marathon, Montage, Osino, Revival, Troilus, Banyan, Heliostar, Vizsla, and West Red Lake.

- Uranium: it is moving to its own beat. The price moved up steadily this week to close at US$74.38 per lb. yesterday (the 5-year chart below says $73 but that’s because it is a few days behind on the spot price)

- Lithium: I still believe good lithium discoveries will get attention in this market. Azimut saw a not huge but nice share price response to its announcement that it has drilled into visible lithium in 4 holes at its Galinee project.

Most of the stocks in my portfolio fit these categories…but a few do not.

A few Sells will tailor the portfolio for current realities.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE