Gwen Preston – “Two Projects, Two Potential Discoveries”

Repeated high-grade discoveries around the town of Stewart are why northwest BC is called The Golden Triangle.

This summer Blackwolf Copper and Gold (TSX-V:BWCG) drilled targets on two forgotten projects and the core looks very promising.

Shareholders are so excited they just put another $3.2 million into the company. And now those drill results are imminent.

The best place to look for high-grade gold is in an area brimming with it. Geologists have usually scoured such areas…but sometimes forgotten history, receding glacial ice, and market timing can hand area experts not one but two new targets to test.

That’s the essence of the Blackwolf Copper and Gold story.

This is a bet that a small exploration company is about to deliver a discovery (perhaps two). Picking winners among pre-discovery explorers is very hard. But there are ways to increase your odds

- Choose companies with more than one opportunity to deliver splashy results

- Demand a clear exploration plan based in deep technical expertise

- Only buy companies that have and can raise money.

Of the few companies out there today that meet these requirements, Blackwolf Copper and Gold stands out. Blackwolf drilled two projects this summer, both near Stewart, BC. Both have potential to generate splashy results in the form of high-grade discoveries.

The Blackwolf technical team are experts in this area and backing from a famous mining investor plus a team with deep junior mining experience means this company has cash.

Results from these projects are imminent, including a hole with chunky visible gold from one project and holes with vein intercepts and wall rock that also looks mineralized from the other project.

Discovery bets are hard. But drilling into never-before-tested veins that carry high gold and silver grades where they outcrop across a cliff and drilling beside a few high-grade-but-forgotten hits in a target that geologists with deep regional expertise just reinterpreted makes Blackwolf one of the strongest discovery bets I’ve ever seen.

Visible Gold at the Harry Project

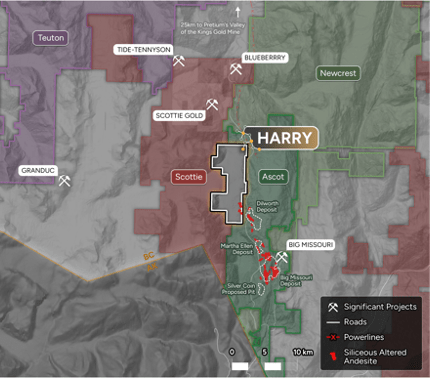

This map is a good start to the story of the Harry project, which sits in between the line of high-grade deposits that Ascot is about to start mining and the rich old Scottie gold mine. Continue 25km along trend to the northwest and you hit the Brucejack project, home to 7.6 million oz. of very high-grade gold.

The target zones at Harry parallel this overall trend, running northwest. They look like the zones that carry all the gold at Premier – intense alteration, quartz veins and breccias, and lots of sulphides.

Each target area looks obvious today but only a few years ago ice covered the entire project, obscuring these gaudy rocks.

The cluster of targets at the north end has seen the most work. It is also where Blackwolf drilled this summer, after buying a small explore-co called Optimum Ventures to get Harry. Optimum pulled a nice hit from the Swann zone in late 2021 – 15.6 metres grading 3.1 g/t gold, 433 g/t silver, 0.6% copper, 7.2% lead, and 8.7% zinc starting just 9 metres downhole – but got no love for it from a weak metals market.

The lack of market response worked out well in the end because it prompted Optimum to merge with Blackwolf, which put the Harry project with some of the best geologists in the Stewart area. Those geos came up with a different concept around which way the rocks sit.

And that concept seems to have worked – we don’t have results yet but all seven holes drilled into Swann appear mineralized and one returned “coarse visible gold” in a hit 250 metres away from Optimum’s stellar hit.

If this first pass drill effort outline a nicely mineralized gold zone that already shows scale with just a few drill holes, the market will likely see Swann as a splashy new gold discovery in an area renowned for high-grade gold. And that discovery will be in company with the backing to keep advancing and a geologic team who are absolute experts in the Stewart area. That could generate a nice reaction.

The first results from Harry are likely in a week. But while the imminent release of 7 drill assays from a likely new discovery is a good reason to own a stock, Blackwolf is also awaiting results from three holes drilled at Cantoo. And those holes might also deliver a discovery.

First Drilling of High-Grade Veins at Hyder

Two years ago Blackwolf’s then CEO and now chairman, Rob McLeod, unearthed records of some high-grade veins almost visible from the Premier mine that had been forgotten. McLeod’s local knowledge and connections (he’s from the Stewart area) soon put five new projects into Blackwolf’s hands. Collectively they are the Hyder properties.

It’s amazing these projects had been forgotten. Back in 1925 prospectors found incredibly high-grade gold in loose rocks. They traced them back to the Texas Glacier, which they tunneled underneath (!!) to mine the high-grade bedrock.

Getting ore out required a road with a bridge. Small-scale mining ebbed and flowed over the years, ending in 1961 when the bridge washed out. That was long enough ago that the rich operation was apparently forgotten.

In the last 60 years the glacier retreated. The image on the left is taken from inside one of the tunnels mined through thick glacial ice. The image on the right is taken from the same spot, now ice free.

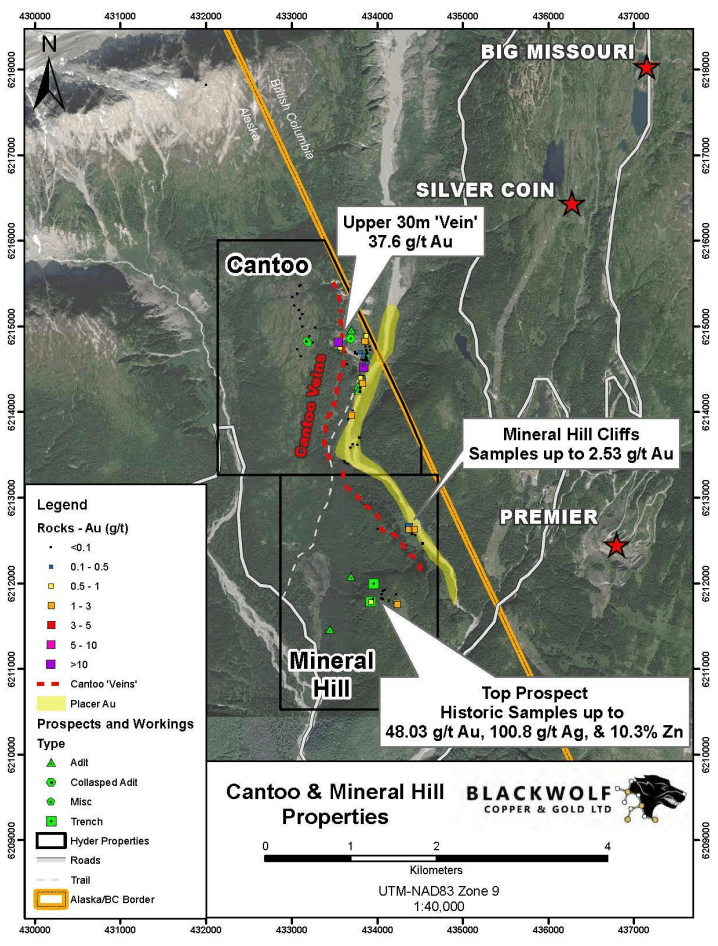

That operation tapped the Cantoo veins, which are visible across a cliff rising up from the west side of a creek loaded with placer gold (highlighted in yellow below). The Premier mine is a few kilometres to the east, over a ridge.

Premier matters for two reasons. First, it is being built as a hub and spoke operation tapping three deposits. It goes almost without saying that Ascot would be interested in a fourth deposit, should Blackwolf find such.

Second, Premier’s deposits are high-grade veins, exactly the kind Blackwolf seeks at Cantoo. These veins exist in significant scale just across the ridge.

The photo shows what the target looks like.

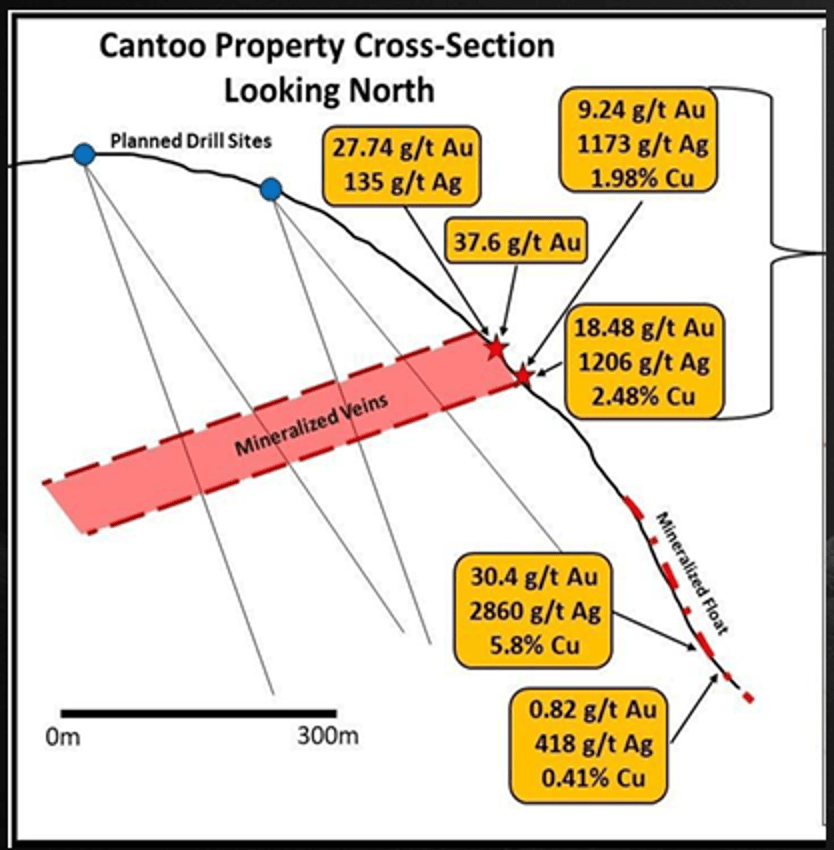

The cross section shows the sampling grades (!) and drill plan.

Blackwolf ended up drilling three holes from the top of the ridge.

All three returned veins right where expected, which is promising given the very high grades these veins carry along the cliff face.

As a bonus the holes showed that those veins sit within surprisingly altered and potentially porphyry mineralized host rocks.

Then There’s Niblack

Blackwolf has a third project called Niblack. It hosts lenses of sulphide mineralization right at tidewater on an island in Alaska and several rounds of exploration already delineated 5.9 million indicated tonnes grading 0.94% copper, 1.8 g/t gold, 29 g/t silver, and 1.7% zinc, plus a small inferred resource.

Niblack has good grades, it’s already got some scale, and there remain a host of untested targets. But it takes a lot of drilling to work a project like this as you search for multiples lenses of mineralization within rocks that have been twisted and overturned. Ever pragmatic, the team at Blackwolf decided it wasn’t in shareholders’ interest to spend a pile of money drilling to grow the deposit at this time

So they got creative. BWCG is working with three other companies in the area – Dolly Varden Silver, Goliath Resource, and Coast Copper – on a hub-and-spoke concept that would see a central mill processing material from multiple mines. It’s a good idea because mills are expensive to build and operate; sharing that burden could well make several small/medium deposits that might not have been worth mining alone very much worth the effort.

This could create a winning path forward for the Niblack project, one that has not had any love from the market even though it has good grades, some scale, and lots of potential to grow.

Cashed Up and Results Pending

Blackwolf has 122 million shares outstanding. At a share price of $0.22, it is valued at $27 million.

There are lots of junior explore-co’s today trading at less than that. But there are very few junior explore-co’s with results pending from two projects, each of which has very strong targets and kicked out drill core with visible veins, alteration, and (in the case of Harry) globby gold.

It’s also exceptionally unusual for a junior to have a famous mining financier actively backing the company. Frank Guistra owns 13% of Blackwolf after re-upping his stake in the latest financing.

That financing added $3.28 million to BWCG’s bank account, bringing cash on hand to roughly $7 million. It’s enough to work at Niblack this winter before getting back to Cantoo and Harry next summer.

There are good odds the Swann target at Harry produces some high-grade intercepts, turning a forgotten one-hit wonder into a strong new gold discovery. It’s also likely the Cantoo target at Hyder returns some splashy gold-silver intercepts from at least one vein and likely several stacked veins, perhaps within a mineralized porphyry envelope, giving Blackwolf a second new discovery. And both projects sit just kilometres from an under-construction hub-and-spoke gold mine in a part of the world famous for high-grade gold.

To Learn More about Blackwolf Copper and Gold Corp

MORE or "UNCATEGORIZED"

Bonterra Announces Closing of Upsized Brokered Private Placement for Proceeds of $10.5M

Bonterra Resources Inc. (TSX-V: BTR) (OTCQX: BONXF) (FSE: 9BR2) i... READ MORE

ESGold Expands Montauban Mine Building to 4,000 sq. ft. Ahead of Key Operational Milestones

Increased facility footprint reflects advanced construction progr... READ MORE

ARIS MINING COMPLETES INSTALLATION AND COMMISSIONING OF SECOND MILL AT SEGOVIA, ON TIME AND ON BUDGET

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces the... READ MORE

Zodiac Gold Expands Arthington Discovery with Broad Gold Intercepts

Zodiac Gold Inc. (TSXV: ZAU) a West-African gold exploration co... READ MORE

Appia Announces Final Closing of Its Non-Brokered Private Placement

Appia Rare Earths & Uranium Corp. (CSE: API) (OTCQB: APAAF) (... READ MORE