Gwen Preston – “Survive the Storm”

You likely know my overall thesis by now, but after talking through it so many times over the last week, in presentations and conversations, it has refined somewhat. So I will run through it again, using some of the slides I made for these conferences to back up my points.

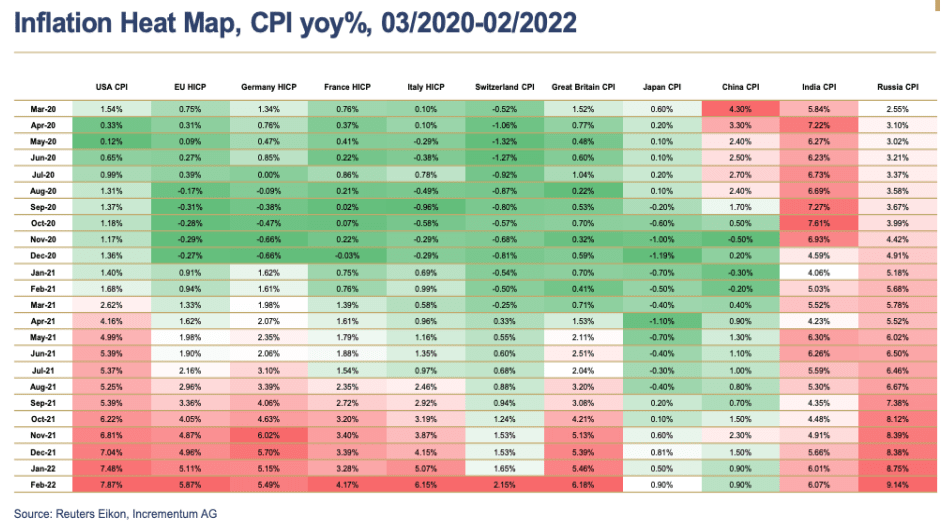

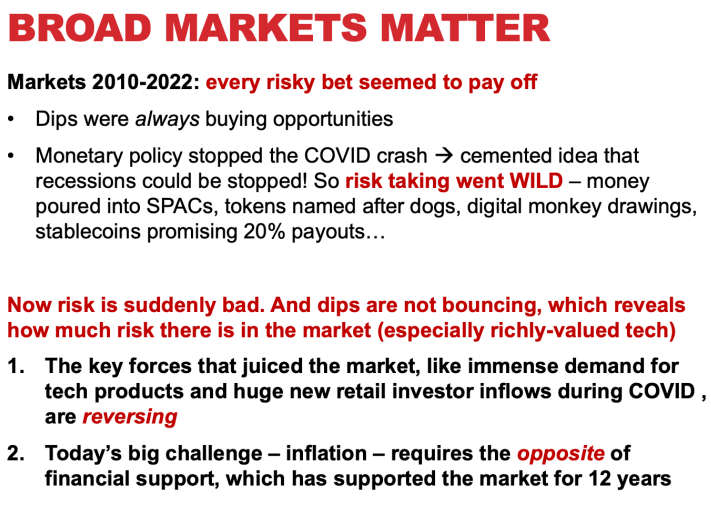

Point 1: Everyone talked about inflation in 2021 but no one really acted on it. Evidence: bond yields did not gain alongside inflation through the year (10-year yield shown below) and investors kept buying the same stuff, from Big Tech to super speculative…stuff (NFTs, SPACs, supposedly stable-coins, and the like).

Point 2: In Q1 that all changed: inflation numbers got extreme and the Russia war poured fuel on the fire. The need to fight inflation became undeniable.

Point 3: The reality of significant tightening ahead market reaction be damned set in quite suddenly in March. Reality bites!

The impacts are so dramatic because actually moving to tightening is reversal of everything that has powered the markets for the last 12 years.

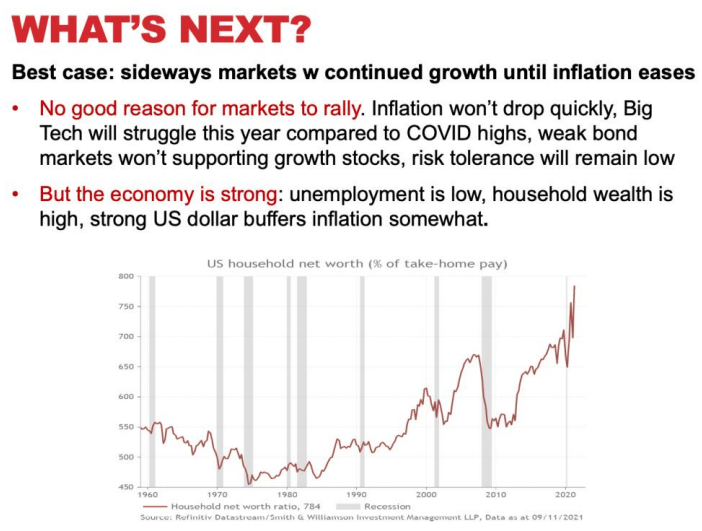

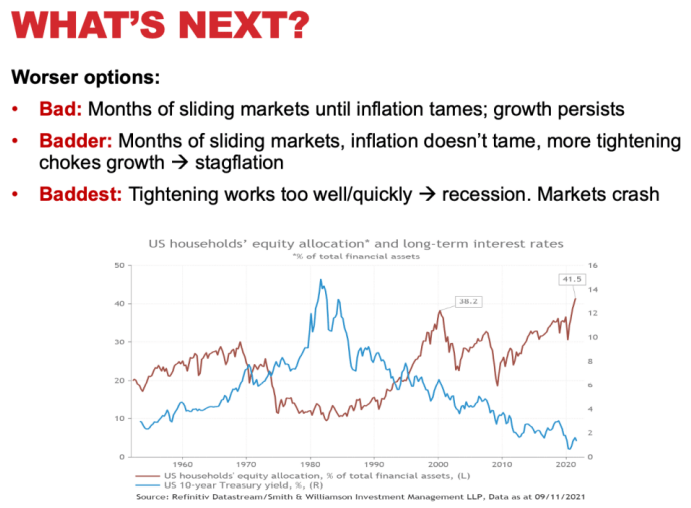

What’s next? Nothing good.

I made these slides before the conferences. As I went from conversation to conversation, something clicked with me: that the most important unknown right now is what risk appetite will look like once this storm is over.

And the answer may well depend on what shape the storm takes.

A slow grind lower – more of what we’ve been experiencing – would be the best outcome, in my opinion. The bull market in growth and risk had taken valuations way too high and those need to reset to the new reality of actual interest rates and a Fed that will not immediately rescue the markets anytime they dip.

No, it won’t be fun. But it’s necessary. A big part of what’s necessary is a reshaping of investor mentalities. For a decade now everything has worked, speculation has always paid off, and value has been a fool’s game. But we are shifting to a new reality where debt carries a cost, where stocks don’t always work (stocks do not work, in general, in inflationary environments), and where value is likely the better choice. What I’m describing here is a major change in investor outlook. It won’t happen overnight. And if markets crash in the next while, I think Buy The Dip mentalities might delay the transition, which is why I prefer a grind lower.

But if we come out the other side of this storm with investors interested in value, commodities could really shine. Because some things have not changed.

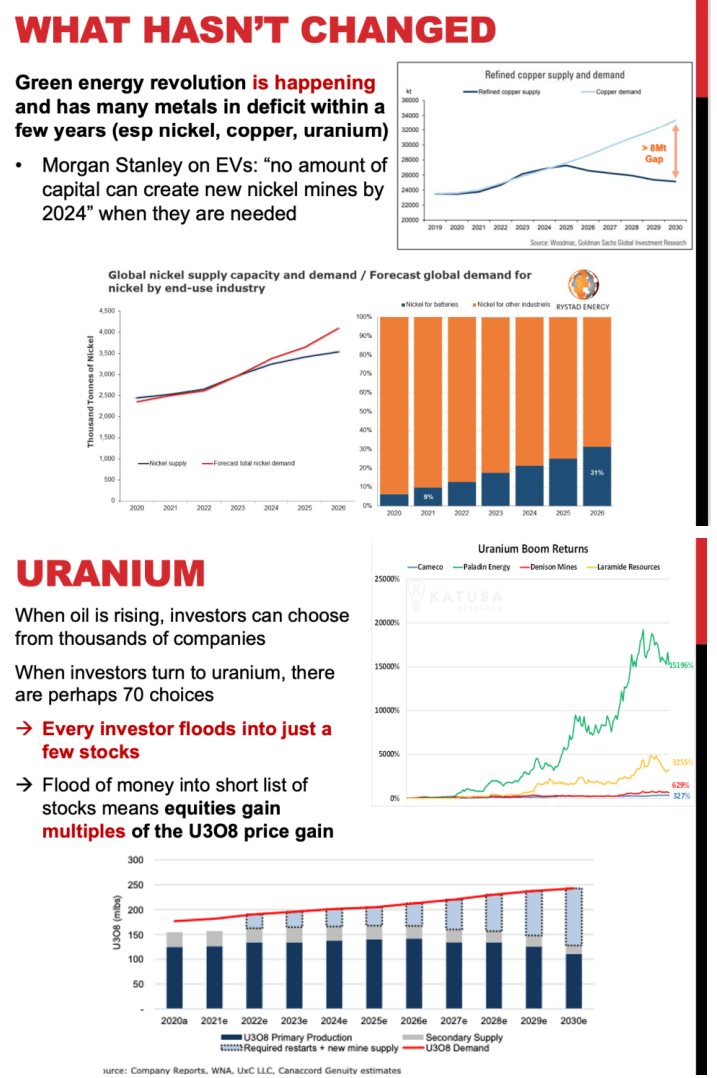

The thoughts on the two slides above are not new, but they do bear repeating. The green revolution represents a paradigm shift for metals demand and there is not enough production in the pipeline to meet that demand. That is blatantly true for copper, nickel, and uranium, to name three biggies. It is also true for a swath of other metals, including silver, platinum, vanadium, and others.

That is where I ground my medium and long-term convictions. I do not know how bad the next 4 to 8 months will be. Even that timeline is, of course, just a guess at how long the worst of the storm will last. But when the storm ends, the green revolution will still be in action and the world will be in even greater need of these green metals.

I have similar conviction in gold, if for other reasons. I think – indeed, I hope – this storm will change how investors approach investing. I think diversification and value will become much more important than they have been for the last 12 years.

If I am correct on those fronts, commodities stand to do very well. They are value plays with strong fundamentals. They represent diversification from the kinds of stocks that so many owned of late. And they fit one of the biggest global themes: greening how we live.

So when this storm abates, I want to have a portfolio of exposure to these themes. I’m already well on my way, of course, even if most of my stocks are now under water (thanks, baby and bathwater).

There will be other kinds of positions to add over the coming months – gold producers with strong cash flows and good dividends and copper producers with good growth profiles are two kinds that come to mind that I don’t own much of as yet.

I do not plan to buy anything particularly soon. I see little point trying to catch the bottom and I don’t think we’re particularly close yet anyway. But I spent time at the conferences making a list of stocks that I am interested in owning when we come out the other side. It’s still a work in progress but refining that list is my new goal and I will share it with you likely before I’m even certain it’s time to buy, as timing is anyone’s guess!

Capital Is Key

I commented on this in last week’s mega Mailbox but I want to reiterate that junior explorers lacking capital are in a very tough spot right now. It will be very hard to raise money for discovery-oriented exploration over the next few months because no one is interested in risk.

It will be possible, for really good teams and compelling targets. And it’s always possible if a team is willing to take the dilution / raise at whatever price is needed. I am not knocking that decision – if a company has compelling targets, raising money at whatever the price might be the right decision because discoveries get rewarded whatever the market.

But the need for capital is not a good thing right now. Keep that in mind if you are considering early-stage stocks.

Recession Odds

This one remains very unclear, but allow me to convey some of the ideas I’ve encountered of late that I find interesting.

- High household wealth is considered an economic cushion, a strength that can support consumer spending come what may. The problem is that stock portfolios represent a huge chunk of that high household wealth – savings rates did increase a bit over COVID but that represents only a small part of the wealth increase – and that means this now very significant stock selloff is eating into the wealth that was supposed to cushion it.

- Related: Retail exiting the market is the major force at present. Earlier in this correction, large money drove the declines while retail, especially newer retail money (Robinhood, so to speak), mostly stayed in. Now retail is exiting and liquidity is drying up.

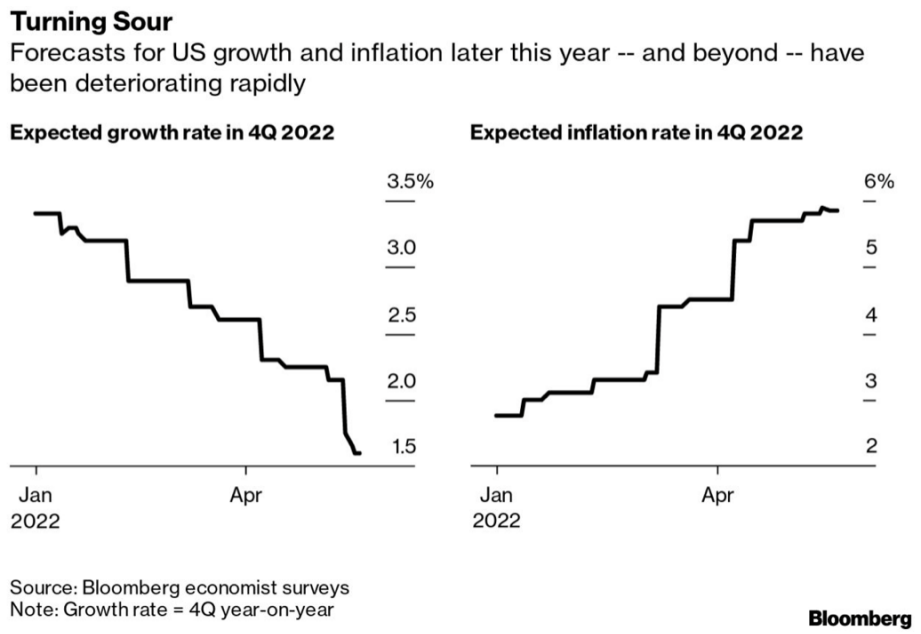

- Inflation expectations haven’t downshifted yet. But growth expectations sure have. Forecasts are only forecasts but they do drive sentiment

- On the flip side: so far, hard evidence of a recession remains scant. Consider Target. On Wednesday the stock got absolutely clobbered, its worst one-day loss since 1987. It was an almost exact repeat of Walmart’s performance the day before. But if you read the Target earnings call, consumer demand had actually remained darn strong. The problem was the consumption mix – a shift in what people bought – which caught the retailer over-inventoried. “Our traffic number are up to start the second quarter and they are shopping in multiple categories,” said CEO Brian Cornell on the call. Cisco similarly got hit after reporting earnings, but again consumer demand was not the problem (it was supply chain disruptions, especially in China). On a trailing 12-month basis they grew 28%. Factory production remains strong, retail sales was robust in April, jobless claims remain very low, card spending remains solid. So while sentiment is terrible, outlooks keep declining, energy costs are through the roof, and the tech stock crash will weaken the labour market in places, we aren’t actually seeing the big slowdown in activity that heralds a recession.

- How do those points come together? Well, I think consumer are still buying because retailers haven’t raised prices enough to fully reflect higher costs yet. That keeps demand going but hurts corporate bottom lines. Add in the loss of the Fed Put (Powell will not let a market crash derail rate hike plans), the Ukraine war, and supply chain pressures because of China’s Zero Covid policy and you have a very large stock market threat, whether there’s a recession or not.

- The Ukraine war is boosting inflation, to be sure, but there are much larger impacts evolving. This deserves a much longer comment but here I’ll just capture it briefly via a Bloomberg experiment. Here’s how they described it:

“War and plague won’t last forever. But the underlying problem – a world increasingly divided along geopolitical fault lines – only looks set to get worse.

“About $6 trillion of goods – equivalent to 7% of global GDP – are traded between democratic and autocratic countries. TO illustrate the risk of the great unraveling of globalization, Bloomberg Economics introduced a 25% tariff on all that traffic into a model of the global economy. That’s equal to the highest rates that the US and China have leveled against each other, and it can stand in for other kinds of friction too, like sanctions and export bans.

“The result: global trade plunges by some 20% relative to a scenario without the decoupling – falling back to levels at the end of the 1990s, before China joined the WTO, as a share of GDP. That’s a huge and gut-wrenching change.”

This is a process that will take time but is started. I’d say China’s complete unwillingness to buy US-made Pfizer and Moderna vaccines is a good example – in this divided world, China felt compelled to use its own vaccine, which simply doesn’t work well enough. And so China’s 1.4 billion people do not have sufficient protection, which means letting 9 Omicron rip could cause 1.6 million deaths (according to a recent study in Nature Medicine). So Beijing sees little option but to continue with draconian lockdowns.

I have no clarity as yet on whether there’s a recession coming. All I can do is keep watching the data. It remains mixed, though sentiment is deteriorating fast.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE