Gwen Preston – “Putin’s Pushing Inflation (among other things…) & Rotation Takes Time”

From the Maven Letter: February 23, 2022

The Ukraine situation has evolved. Whether sanctions will limit Putin’s ambitions to annexing the Donbas, leaving the rest of Ukraine alone, is yet to be seen. Certainly his hour-long rambling monologue on his take on Ukraine-Russia history makes clear he thinks he – I mean Russia – should control all of Ukraine. And tonight he officially moved into Ukraine, moving the three-quarters of Russia’s army that he had posted on the Ukraine border – in the largest mobilization of troops in Europe since WWII, I might add – supposedly to “enforce the independence” of Donetsk and Luhansk provinces. Enforce by bombing, it would seem.

(Separatist groups in those two regions of eastern Ukraine, which have large Russian populations, proclaimed independence from Ukraine in 2014. Russia is the only government in the world to recognize that claim, as there have not been referendums showing majority support.)

No one knows whether Putin has his sights set beyond Donbas. We also don’t know when (now or if Putin moves past the Donbas?) NATO allies might decide to fight. We will probably know more in the morning.

Whatever form it takes, this war will last some time. And while it does, the most pertinent impact for commodities investing will be inflation.

Energy is a huge factor in inflation. And to get what it wants, Russia will squeeze Europe’s energy supplies.

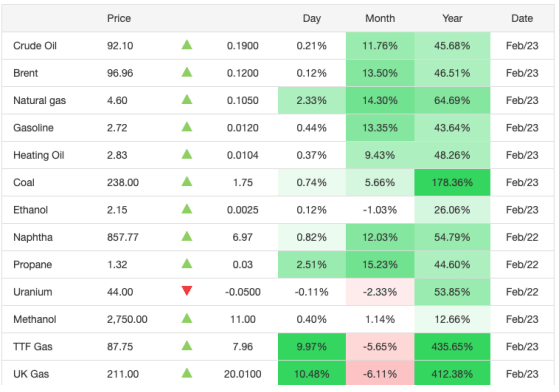

In the chart below, the month price increases layer the Russia-Ukraine situation on top of the inflation story that had already propelled most energy prices way up over the last year. Given Russia’s moves tonight, do not think that these ascents are done.

That will keep inflation high, which will force rate hikes. And so we come to it: the metals bull market we’ve all been waiting for.

This morning I recorded an interview. After I ran through a simplified version of the commodities argument – insufficient supplies to meet demand that’s ramping higher with the green energy paradigm shift are powering prices higher and inflation only amplifies such moves – the interviewer asked me if I’m deploying capital into that thesis.

Not a lot right now, I said, because I’ve been preparing for this for years!

The gold move has been very strong. Look at this six-month chart.

Unfortunately, juniors are still not feeling any love. Gold miners finally started to follow gold up in the last two weeks but investor interest has not flowed downstream yet. Even companies currently building gold mines aren’t seeing additional interest; those ‘just’ exploring still feel alone in the wilderness.

That will change. It always takes a frustratingly long time for generalist interest to rotate into gold or metals, and then even longer for money to get interested in the high-risk end of the spectrum. That’s the case even though every bull market begins a different way.

This one is fueled by a global green energy revolution that’s driving metals demand far higher than supply and has inflation amplifying metal price gains while propelling gold as rates start to rise, but despite such strong fundamentals it has to work to earn attention from investors who have been handed gains in the broad markets for a decade.

I think that ‘work’ is still underway. As I outlined in my last letter, a swath of metals have gained significantly and reliably over the last year. Now tech stocks are cracking as they emerge from crazy COVID buying and a crazy accommodative monetary environment, pulling the markets down and requiring investors to think – for the first time in years – about where they should put their money.

Value stocks are a part of that answer (after years of Growth Growth Growth!). And metals, including gold, make sense to almost anyone who thinks about it. So generalist investors are rotating in – it just takes a very long time for a freighter that has been steaming along in one direction for years to turn around.

|

|

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE