Gwen Preston – “Navigating the Gold Bull Market: Strategies for Success”

Gold is suddenly racing higher, powered by forces that have been building for years.

This gold move is completely different from previous gold bull markets. Gold moves are usually driven by Western investors hedging risk and inflation. This time it’s China driving gold up. Chinese individuals are buying it to protect wealth amidst a sliding stock market, a popped real estate bubble, and uselessly low interest rates. And the Chinese central bank is buying huge amounts of gold to diversify from the dollar in a deglobalizing world.

These forces kept gold strong when it should have crumbled against rising interest rates, because gold has long moved against real rates. With the end of rate hikes that downside pressure vanished and gold started to surge.

The yellow metal gained 17% from February 29 to April 11. That’s a big, fast move for any commodity – and it started with gold already near record levels. The result: gold is at all-time highs and has serious momentum.

Gold markets love momentum. The charts are incredibly bullish and gold companies can make a lot of money at $2300/oz. In a world where investors buy momentum and computers make a lot of trading decisions, gold’s move is standing out.

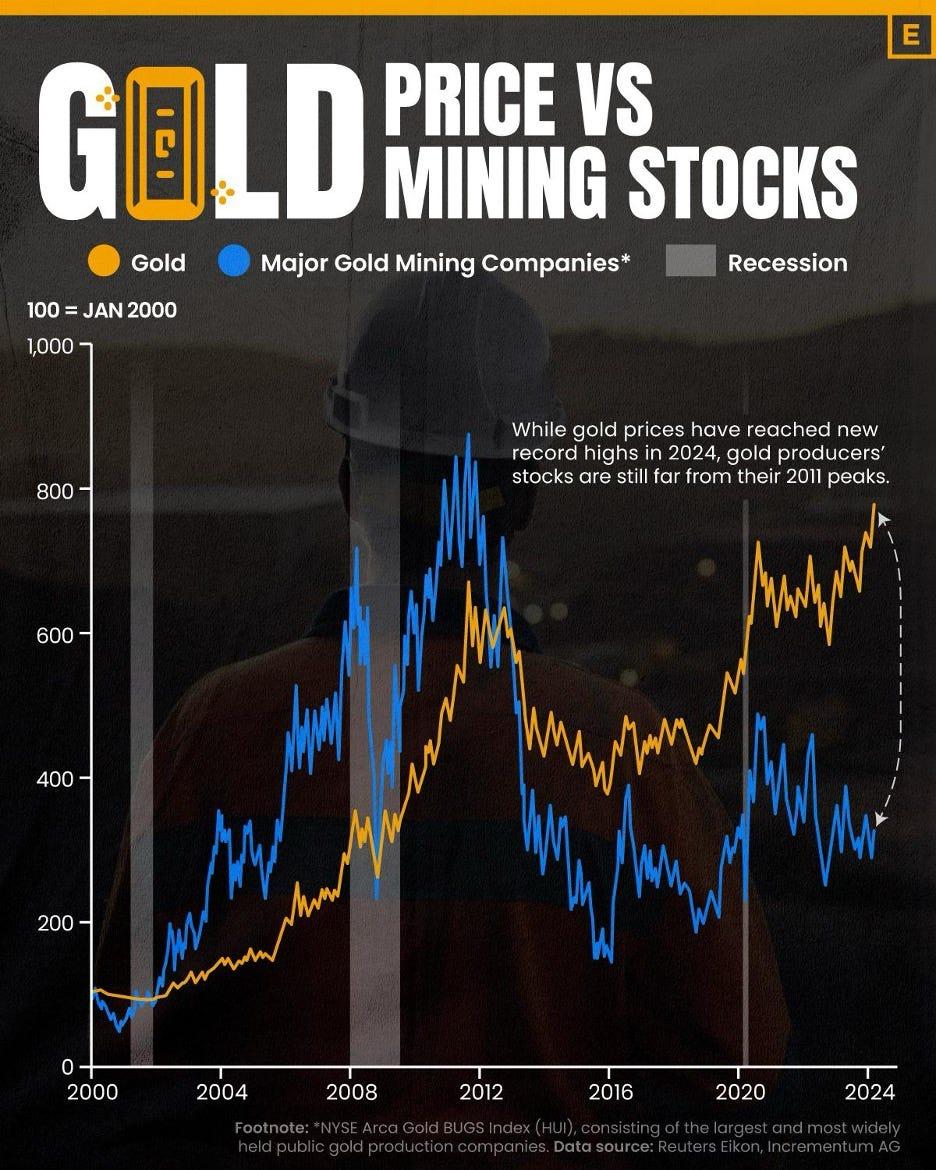

But Western investors are just starting to notice gold’s spike. That matters because Western investors are the ones who buy gold stocks. As Western money starts to position for this gold market, that leverage will arrive in spades and gold stocks that have been lagging the metal’s move will catapult higher.

This isn’t theory. It started in late March: after gold banked a few weeks of sizeable and sustained gains, we saw the first wave of gold stocks respond to gold’s gains with outsize gains.

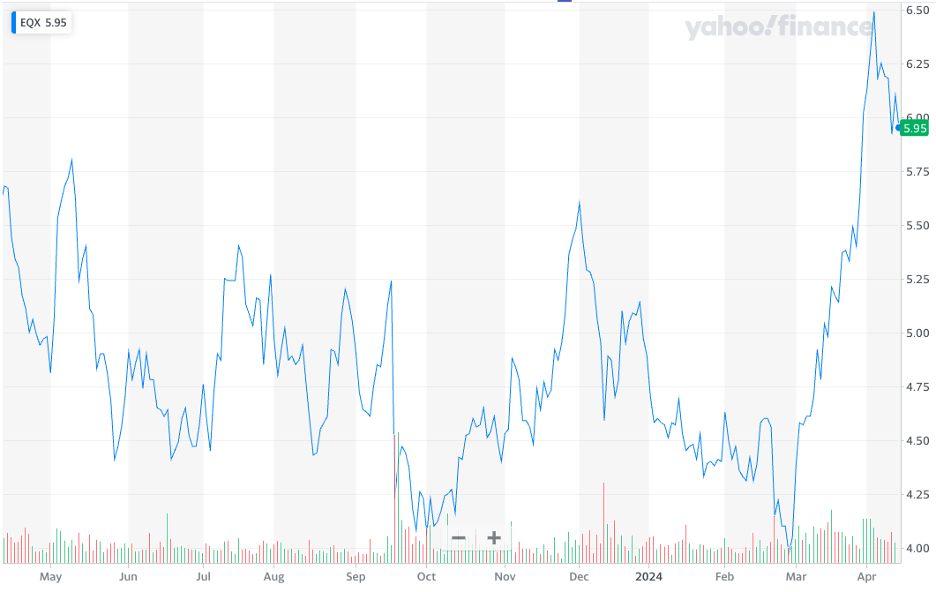

Equinox Gold gained 63% in the first six weeks of this new gold bull market

Montage Gold doubled in the first six weeks of gold’s run

This first wave is only a small segment of the gold stock universe – mid-sized producers with standout production growth and/or low costs, near-build developers with best-in-class projects and shareholder registries, explorers set to grow strong discoveries significantly, and large producers.

The rest of the gold stock universe is awaiting its turn. And it will happen. Early investors are already making great returns on gold stocks and will rotate those wins down to smaller companies just as more investors move in. Collectively, this interest will send gold stocks soaring from their historically low valuations.

There is an incredible opportunity over the next few months to buy these still-inexpensive gold stocks before all this attention arrives. When it does arrive the rising gold tide will lift all boats…but the stocks with the best projects, teams, and plans will gain the most.

Resource Maven can help you position your portfolio for this incredible opportunity. By telling subscribers what she is buying and selling in her own portfolio and why, Gwen lets gold-interested investors see what a gold expert is doing to make this most of this rare opportunity: a true gold bull market.

Courtesy of the Resource Maven

MORE or "UNCATEGORIZED"

Surge Copper Announces Closing of First Tranche of $20 Million Private Placement

Surge Copper Corp. (TSX-V: SURG) (OTCQB: SRGXF) (Frankfurt: G6D2) is pleased to announce that it has... READ MORE

Spanish Mountain Gold Drilling Intersects 205.87 Metres Grading 0.58 G/T Gold, 142.00 Metres of 0.77 G/T Gold, and 69.40 Metres of 0.99 G/T Gold in Three Separate Drill Holes Containing Numberous Higher-Grade Sub-Intervals

Spanish Mountain Gold Ltd. (TSX-V: SPA) (FSE: S3Y) (OTCQB: SPAUF) is pleased to report additi... READ MORE

Aura Signed the Agreement to Relocate Road at Borborema Mine, Unlocking an additional 670 Koz of gold in Mineral Reserves, totaling 1.5 Moz

Aura Minerals Inc. (Nasdaq: AUGO) (B3: AURA33) is pleased to announce that it has signed the agreem... READ MORE

Aura Announces Q4 2025 and FY 2025 Financial and Operational Results

Aura Minerals Inc. (NASDAQ: AUGO) (B3: AURA33) announces that it has filed its audited consolidated ... READ MORE

Endeavour Silver Announces Q4 2025 Financial Results; Earnings Call at 10AM PST (1PM EST) Today

Endeavour Silver Corp. (NYSE: EXK) (TSX: EDR) announces its financial and operating results ... READ MORE