Gwen Preston – “Mailbox: Heliostar”

I’ve been a subscriber for many years and enjoyed riding Great Bear up for much of its success. As I follow Heliostar with their Ana Paula property, it’s hard not to wonder if they could be the next shooting star.

Am I missing something? Why wouldn’t I put 30% of my portfolio on this play? Those are some amazing grades and, of course, the team seems to be full of energy and vision.

I know you have the model portfolio, but wondering if there’s a place for highlighting half a dozen top picks even within that.

Reader DB

I agree: Heliostar has very good potential with Ana Paula. Since I don’t need to convince you of that, I will focus on the risks.

The first risk is the market. Ana Paula will likely be a very economical operation but not a huge one. I start with that because this is such a tough market that only the very best of the best assets are getting any market traction. Getting into that group requires a project to impress on every level (such as Filo Mining’s immense porphyry or a splashy discovery with immediately apparent scale potential).

Ana Paula won’t be able to do that. It’s a good project that is likely to become a very good project in short order under this team but it will need a better gold equity market for those strong sails to catch any wind.

The second risk is old project fatigue. This is always a headwind when re-envisioning an old asset – memories of the old version keep market interest muted. The two answers are oodles of marketing (telling the new story) and project-level success (making good on the story!).

Heliostar’s team is, as you note, full of energy and vision; they understand these are critical. That they raised $20 million early this year in an ok gold market and now are raising again, with success (just upsized from $5 million to $7 million), in a terrible gold equity market says as much. So this risk, while present, is being addressed head on. I would say that project fatigue, or at least the fact that Ana Paula is already known to host a core of wide and high-grade gold mineralization, explains why the market isn’t responding to HSTR’s drill results. Hits like 53 metres of 11 g/t gold and 129 metres of 6 g/t gold would send a stock soaring if they came from a new discovery; this is not a new discovery so don’t expect that kind of reaction here.

The third risk is execution. I think this risk is limited – this is a very good technical and mine building team pushing a robust project in a new direction that they developed based on reams of past data – but it’s possible something goes wrong. That said, the thing I like most about HSTR’s new Ana Paula plan is that they see three high-likelihood ways to add significant value. This isn’t just reshaping an old pit or rescaling a mill.

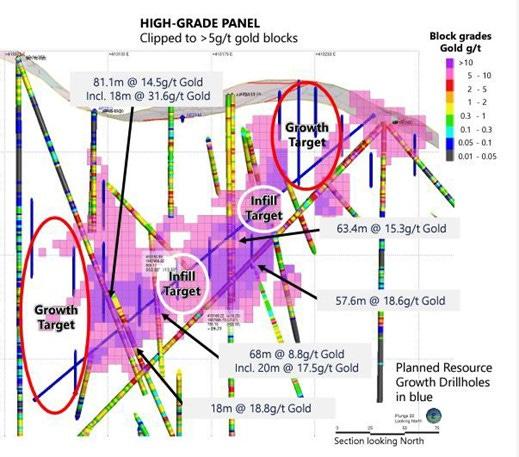

- Infill and expansion drilling of the high-grade core will likely add reserve ounces and could increase the grade.

- A mine plan with underground sequencing will highlight the positive impact that a large, consistent, high-grade zone has on a mine’s economics, especially when accessed early in the life of mine (which is certainly possible here because the production-scale exploration adit that Argonaut developed gets within a few hundred metres of the high- grade core).

- And using conventional processing instead of the expensive and limited efficacy oxidation process Argonaut had relied on to make the low-grade ore from an open pit work should increase recoveries and lower costs.

These are not complex and likely to succeed, which is why I think execution risk is limited. And they should create a new mine plan with standout economics, good scale (not huge but not small), and a short timeline to production (open pit permit already in place).

If the stars align – if the gold market opens for business late this year and into the first half of 2024 as HSTR delivers its new resource and then new mine plan – HSTR could do very well indeed. This team has the project, catalysts, and capital markets savvy to pull attention to this stock once there’s attention available to pull. So…risk #1 is the big one. Once gold is getting attention again, I think your thesis will play out nicely.

As for highlighting top picks within the model portfolio – I have attempted that a few times and each time not followed through, but thank you for the reminder. I will try to highlight within the $200,000 Portfolio the stocks each week that I think are the best buys at that moment.

Courtesy of the Resource Maven

MORE or "UNCATEGORIZED"

Antimony Resources Corp. (ATMY) (K8J0) Reports Massive Antimony Bearing Stibnite - Drills 4.17% Sb over 7.40 meters Including Three Zones of Massive Antimony Bearing Stibnite which returned 28.8% Sb, 21.9% Sb, and 17.9% Sb Respectively

Highlights Assays received High-grade assays returned for Drill H... READ MORE

Kenorland Minerals and Auranova Resources Report Drill Results at the South Uchi Project, Ontario; Auranova Completes Initial Earn-in

Kenorland Minerals Ltd. (TSX-V: KLD) (OTCQX: KLDCF) (FSE: 3WQ0) a... READ MORE

Wallbridge Exploration Drilling Continues to Intercept High-Grade Gold Mineralization at Martiniere

Wallbridge Mining Company Limited (TSX: WM) (OTCQB:WLBMF) announc... READ MORE

ValOre Reports Results from Successful 87 Hole Trado® Auger Drilling Campaign at Pedra Branca, Including 10.0 m at 12.95 g/t 2PGE+Au from Surface

Provides Update on Pedra Branca PGE Project and Strategic Growth ... READ MORE

Pasinex Announces 2024 Annual and 2025, Q1 Financial Results

Pasinex Resources Limited (CSE: PSE) (FSE: PNX) announced financi... READ MORE