Gwen Preston – “If Gold Moves Without A Reason…Is It A Bull Market?”

The Fed had its meeting. The result was as predictable as rain in Vancouver: no change in rates and a dot plot that still suggests three cuts this year but a statement that says no cuts will actually occur until the committee has more confidence inflation has been tamed. The statement also raised the Fed’s inflation forecast for year end to 2.6% (from 2.4% previously) and increased the GDP growth forecast to 2.1% at year end (from a 1.4% estimate a few months ago).

So…it was a non event, with forecasts that highlighted good growth and persistent inflation. A non event is fine in many ways – central bank surprises are rarely good! – but it somehow still prompted gold to jump to new heights in dramatic fashion.

If gold jumps higher without good fundamental reason, is it a bull market?

I’m honestly asking that. Because my first response to the non event Fed statement and press conference was to wonder two things:

- Will three cuts be enough of a rate drop to get investors interested in gold?

- Will three cuts happen? The Fed just strengthened its economic forecast (better growth, higher inflation) while leaving its unemployment forecast unchanged at 4%. That’s not an environment that seems to need rate cuts. As such, the only reason to cut rates would be to normalize them relative to historic levels, which isn’t a pressing need if growth is doing just fine.

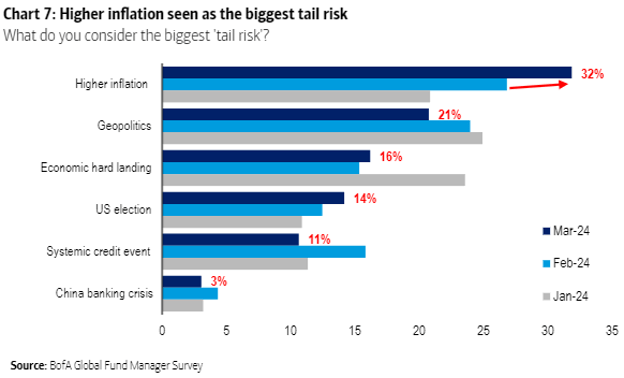

The risk to gold in these questions comes to the fore when you see things like the Bank of America Global Fund Manager Survey, which says money managers now think that the greatest risk is overheating. As you can see, inflation now leads money managers’ risk list, taking over from Economic Hard Landing and Geopolitics.

If inflation indeed remains a big risk, we shouldn’t be looking to rate cuts to support a gold bull market.

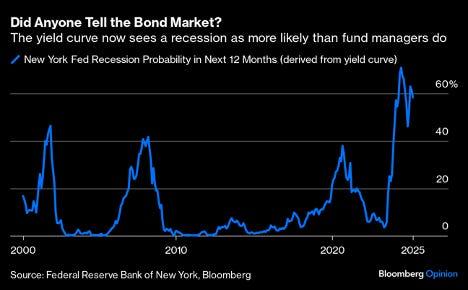

What remains very weird is that while two-thirds of fund managers now describe a recession within the next 12 months as “unlikely”, the bond market is saying the opposite. The New York Fed’s recession indicator derives the implicit chance of a recession in the next 12 months from the (still deeply inverted) yield curve and it shows a 60% bet we are headed into darker days.

So those signals remain totally mixed. The big question to me is: how do we get a strong gold market? I think there are two answers.

One: through rate cuts intended to normalize within an economy and stock market that hold on, while showing signs of stress. That scenario would have investors still keen to deploy and make money, but interested in doing it in a hedged way. That would be the magic sauce for gold: a keen investor crowd actively thinking about gold and gold equities.

The other answer: through a robust economy with strong global growth that creates a broad metals bull market, in which gold gets to participate.

The people I know who are calling gold’s latest move “the start of a new gold bull market” think we’re in the first scenario. And perhaps we are. My hesitation comes from seeing mostly signs of strength and not enough signs of stress. (That has me leaning towards the second scenario…but aware we’re not there yet in terms of global growth.)

If there isn’t much stress but Powell remains committed to cutting for the sake of cutting, we’ll get two rate cuts this year in an economy doing just fine. Given gold’s performance over the last few years (incredible resilience), I think gold can hold its (high) ground in such a setup. The question is how much investors will care/react to that.

Gold pushed above $2200 today. That’s a great price. But lacking traditional drivers – generalist investors buy gold to hedge rampant inflation, when rates are clearly falling, and to diversify when economic weakness surfaces…and none of those conditions are forward – I remain uncertain that investors will think to think of gold. In particular, I an uncertain they will think to buy gold stocks.

After a few months at this level, gold producers will start printing some very nice profits (assuming costs don’t rise, which seems reasonable given inflation is not worsening). That should pull some attention to gold stocks.

I was hoping this Fed meeting could provide some clarity – that Powell would either come out hawkish, killing the thought of three cuts and denting gold’s ascent, or make clear he planned to cut in order to normalize rates no matter the setup, which would have boosted gold to its next level.

We got neither of those. Instead, it’s back to Go Slow (in terms of changing rates), which given the data is a way of saying that cutting rates for the sake of cutting is not a priority.

I could be wrong. We are still past rate hikes, which historically has been the most important factor in helping gold get on a new bull run, and there’s a lot of fundamental support for the yellow metal. In fact, there’s so much support that the price jumps even without fundamental reason, with today a prime example. If that support can lift it enough to attract attention (can we get to $2300?), the market could just go – there’s lots of investor capital that flows to the bull market of the moment and gold could become that.

I’ve been thinking so much about gold fundamentals for so long that it’s hard for me to accept gold moving without clear reason. But bull markets can do that…and perhaps I need to be open to it!

I’m sticking to my plan to position for both outcomes: that we are at the start of a new gold bull market (own gold producers, under construction large gold mines, companies discovering high grade, and gold projects with scale and momentum) and that we’re not (the same stocks are fine to own, though the expected timeline to significant returns is longer).

For either setup, I’m also happy to own really good pre discovery stocks, since discoveries work in any market.

And I’m happy to own uranium (even if the spot price is down 18% – more on that soon).

MORE or "UNCATEGORIZED"

Doubleview Gold Corp. Reports Updated Mineral Resource Estimate as of February 25, 2026 Including a Copper Equivalent Mineral Resource: 609 (Mt) of Measured and Indicated Resources at 0.43% CuEq containing CuEq 5.82 Billion lbs. 503 (Mt) of Inferred Resources at 0.41% CuEq containing CuEq 4.57 Billion lbs

Doubleview Gold Corp (TSX-V: DBG) (OTCQB: DBLVF) (FSE: 1D4) is pleased to announce the update... READ MORE

NexGold Intersects 9.30 g/t Gold Over 11.0 Metres and 2.31 g/t Gold Over 21.5 Metres at the Goldlund Deposit, Ontario

NexGold Mining Corp. (TSX-V: NEXG) (OTCQX: NXGCF) is pleased to provide additional results f... READ MORE

Canterra Minerals Extends Lundberg Deposit with 86m of 0.91% CuEq at Buchans Project, Newfoundland

Canterra Minerals Corporation (TSX-V:CTM) (OTCQB: CTMCF) (FSE:DXZB) is pleased to announce drill re... READ MORE

Osisko Intersects 694 Metres Averaging 0.31% Cu at Gaspé

Osisko Metals Incorporated (TSX: OM) (OTCQX:OMZNF) (FRANKFURT: 0B51) is pleased to announce new dri... READ MORE

West Red Lake Gold Reports 219.73 g/t Au over 4.8m, 148.36 g/t Au over 3m and 133.13 g/t Au over 2.5m in Austin 904 Complex – Madsen Mine

West Red Lake Gold Mines Ltd. (TSX-V: WRLG) (OTCQB: WRLGF) is pleased to report drill results from i... READ MORE