Gwen Preston – “Gold’s Big, Unexpected Move”

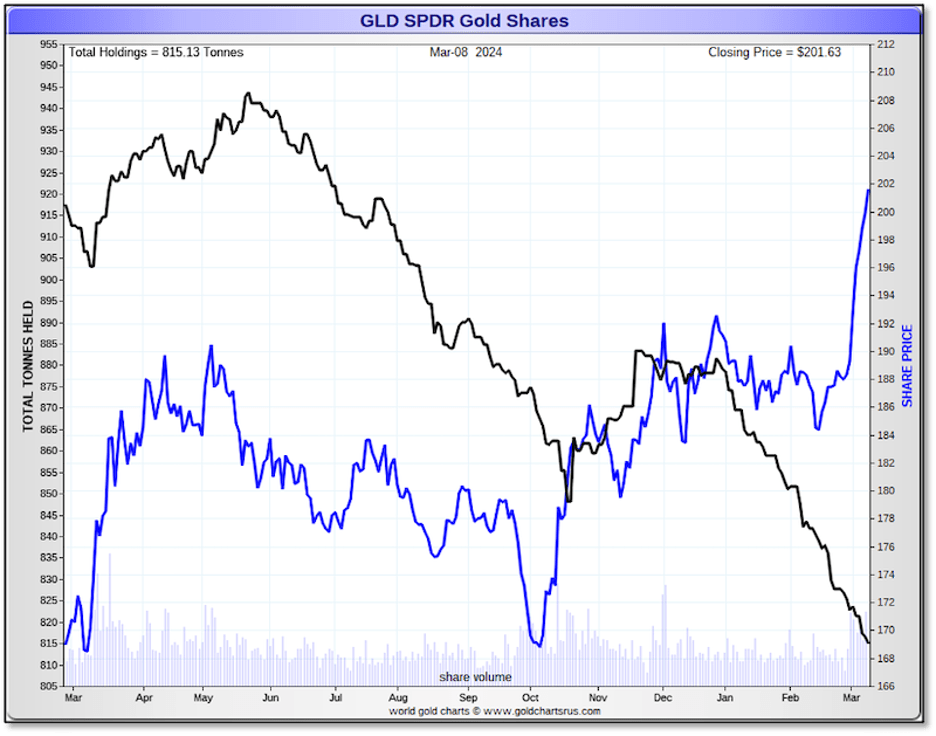

Why did gold suddenly shoot higher? Good question. It’s not because western investors are buying gold ETFs. In fact, as of a few days ago they were still selling those, creating this rather amazing chart (thanks to Brien Lundin for it) showing the gold price rising and gold held in GLD falling.

Yet gold moved. I think it happened because gold-interested investors decided three pieces of news supported the idea that rate cuts are coming.

In the JOLTS report we saw another drop in the quits rate, putting quits lower than they were pre-COVID. People are hanging onto their jobs, which reduces labor market friction and eases wage inflation.

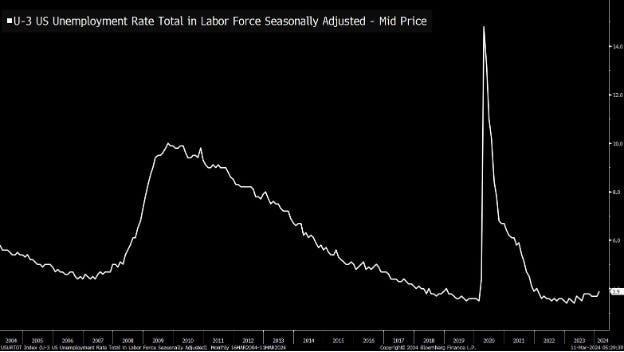

The jobs report showed decent job growth for February but revised January’s blockbuster 353,000 gain to 229,000 (the start of the year was not all that hot) and showed unemployment bouncing from 3.7% to 3.9%. That’s still a fine number…but it’s a notable rise.

Then Jerome Powell, in his testimony to Congress, reiterated that he still views policy as restrictive and that the FOMC is “not far” from having the confidence to cut rates.

The idea that rates are ‘restrictive’ is debatable. Stocks are at all-time highs! But the Fed isn’t charged with managing the stock market. The FOMC is charged with managing inflation and employment. The wealth created in a roaring market likely pushes inflation and helps create jobs, but that’s not strongly evident in the data right not.

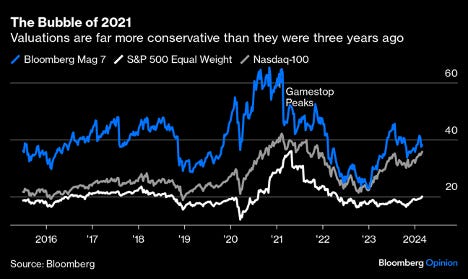

I also think it’s important to note that the broad markets are more reasonable than they were a few years ago. Yes, there are lots of questions about whether we are in, or headed for, a bubble. Several prominent fund manager recently wrote editorials on that question and answered “not yet”, including Bridgewater’s Ray Dalio and Bloomberg’s James Mackintosh.

Key in their arguments is that valuations are not that crazy. Valuations were way more extreme three years ago.

- Are gold-attuned investors enough? If the overall markets continue to do well and the Fed only does two small rate cuts, will generalist investor start thinking about gold? They might if gold miners start posting 15% profit yields, which is possible with gold at $2100 per oz., but that takes months to establish. In the meantime, is there enough money left in the gold-attuned investor world to get this party started?

I don’t have the answers. I am watching gold stocks very closely these days to get a sense of investor interest. If gold goes a bit higher and gold stocks hand out as good or better leverage, I will be more convinced. I am also very curious to hear what Jerome Powell has to say on March 20, the next FOMC meeting. No one expects a rate cut in March but gold investors will be hanging on every word for a sense of when and how much rates will come down. If Powell gives reason to think there will be only one or two cuts, I think gold’s ascent will stall.

However, the fact that gold moved so far so clearly and stuck demonstrates that the metal has strong foundational support and is just awaiting its moment. So if that moment happens – if Powell gives reason to think there will be three rate cuts, if economic data deteriorates and gives reason of its own for three cuts – then gold could really go. And gold at $2100, let alone $2200 or $2300, will create a lot of profits for miners. That money will matter – it should attract investors and give miners the firepower and confidence to invest in or buy smaller companies.

Bottom line: this gold move could be the start of something big. But we need a few more key pieces to fall into place before we’ll know.

MORE or "UNCATEGORIZED"

Doubleview Gold Corp. Reports Updated Mineral Resource Estimate as of February 25, 2026 Including a Copper Equivalent Mineral Resource: 609 (Mt) of Measured and Indicated Resources at 0.43% CuEq containing CuEq 5.82 Billion lbs. 503 (Mt) of Inferred Resources at 0.41% CuEq containing CuEq 4.57 Billion lbs

Doubleview Gold Corp (TSX-V: DBG) (OTCQB: DBLVF) (FSE: 1D4) is pleased to announce the update... READ MORE

NexGold Intersects 9.30 g/t Gold Over 11.0 Metres and 2.31 g/t Gold Over 21.5 Metres at the Goldlund Deposit, Ontario

NexGold Mining Corp. (TSX-V: NEXG) (OTCQX: NXGCF) is pleased to provide additional results f... READ MORE

Canterra Minerals Extends Lundberg Deposit with 86m of 0.91% CuEq at Buchans Project, Newfoundland

Canterra Minerals Corporation (TSX-V:CTM) (OTCQB: CTMCF) (FSE:DXZB) is pleased to announce drill re... READ MORE

Osisko Intersects 694 Metres Averaging 0.31% Cu at Gaspé

Osisko Metals Incorporated (TSX: OM) (OTCQX:OMZNF) (FRANKFURT: 0B51) is pleased to announce new dri... READ MORE

West Red Lake Gold Reports 219.73 g/t Au over 4.8m, 148.36 g/t Au over 3m and 133.13 g/t Au over 2.5m in Austin 904 Complex – Madsen Mine

West Red Lake Gold Mines Ltd. (TSX-V: WRLG) (OTCQB: WRLGF) is pleased to report drill results from i... READ MORE