Gwen Preston – “Gold Besting $2000/oz – It IS Different This Time”

Gold broke up through $2000 per oz. decisively on Friday and has stayed aloft since. It’s only been a few days but sticking above $2000 for a week – and not just lingering just above but running as high as $2044.45 and then sticking above $2035 – is markedly different from the last few times gold bested this round-number resistance.

The clear reason is rates. The market is convinced hikes are over, a stance that various Federal Reserve officials have reinforced in the last while, and that conviction has bond yields falling. The most important factor for the gold price is real rates – gold rises when they fall – and real rates are now clearly falling.

It’s a classic investment move – buy gold when a rate hike cycle ends – and it seems investors are heeding that classic pattern. And they are also buying gold miners in the classic way: the GDX fund of major gold miners is up 6.8% over the week, providing almost 3x leverage to gold’s 2.4% gain.

It feels different this time. I want to credit my superb intuition for that…but it probably feels different because this time gold is not fighting rate hikes. I can’t overstate the importance of that change.

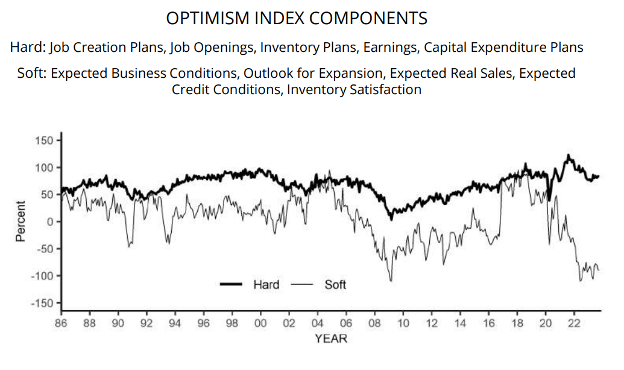

I still have no idea whether we’re heading towards a recession. Hard data keep looking good; soft data (sentiment surveys) keep looking bad.

This disconnect started soon after COVID, growing for two years and then sticking wide open for the last two years. Inflation also certainly plays a big role in this: people see much higher prices than before and assume it must mean something is going to break. But in fact the economy keeps chugging along and consumers, despite saying they are worried about what’s ahead, keep spending.

It helps that wages have largely kept pace with those price increases. But I read an interesting suggestion last week: people see wage gains as personal, not macro (I earned this!). Business managers similarly take credit for things that are going well but blame the economy for things that are not.

This could explain the hard-soft disconnect. Sentiment is negative because people and businesses blame the economy for things that aren’t going well, while taking credit for things that are.

I liked the idea because it’s the first I’ve seen that might explain this wide, persistent, and otherwise confusing disconnect between data and sentiment. I also like it because inflation is coming down and rates are moderating, which eases the ‘bad things’ in the macro picture and might help improve sentiment.

I am by no means convinced we’re out of recession danger. Rate hike impacts continue to work through the economy. But if those impacts start to cause real trouble, the Fed could enact significant cuts and, in the context of an economy that’s been doing just fine ofr years now, that might be enough to avert disaster and keep things chugging.

I would love for things to keep chugging along. Base metals deserve a break and that won’t happen until investors feel confident there’s growth ahead (sentiment matters!) and start positioning for it.

At the same time, gold runs when rates fall. That is a forecast I am confident in making – I know now when nor how quickly rates might come down but that does now seem the path ahead.

In other words: gold breaking above $2000 per oz. is different this time.

Courtesy of the Resource Maven

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE