Gwen Preston – “An Explorer Testing a Suite of Strong Lithium Projects This Summer is Financing – Resource Maven Wants To Help You Get In”

Below is the lithium sector update I wrote in my Maven Letter on June 7 and the Premium note I sent yesterday outlining the investment rationale for Targa Exploration.

Lithium

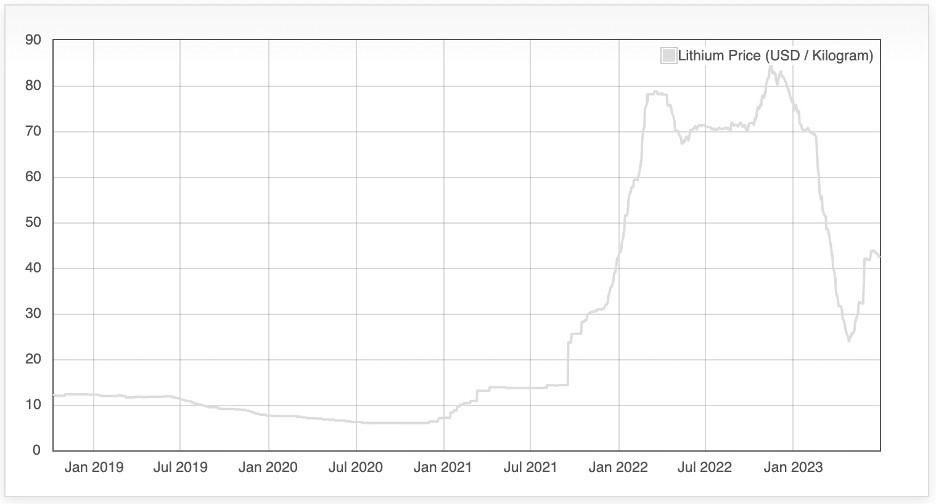

Lithium prices soared in 2021 and 2022, reaching as high as $80,000 per tonne. Then they plummeted to $25,000.

But two months ago that dive reversed. Lithium hydroxide is back above $40,000 per tonne today.

So where it is going next? And is there opportunity for investors?

The driver here is electric vehicles. EV sales are now expected to triple from current levels by 2030. And since most EVs use lithium-ion batteries, lithium demand is expected to triple in the next seven years.

Supply will struggle to keep up.

Let’s set the scene: in 2010 the world used only 100,000 tons of lithium. By 2030, demand will best 3 million tons. It is incredibly difficult to increase supply of any mined commodity 30 fold in 20 years.

Here’s another way of looking at it: Tesla alone plans to make 20 million cars a year by 2030. To put batteries in all those cars would require twice the lithium that the world produces annually today.

Lithium is relatively abundant. The challenge is in finding good deposits, permitting them to become mines, and getting to production successfully. Since lithium is a new market of scale, there is no long history of lithium exploration; there is no roster of shelved lithium projects that companies can reignite. Instead, we need new lithium discoveries. This is happening (and creating some great investor opportunities – more on that in a moment) but it takes a long time for a new discovery to become a mine.

As for getting to production successfully, that’s a challenge for every new mine but it’s particularly tough when new technologies are in play. With lithium, anyone forecasting we will produce enough lithium to meet demand in 2030 is assuming that Direct Lithium Extraction (DLE) will work easily across the board. DLE is a new way of pulling lithium out of brines, which is usually done by letting the water slowly evaporate and collecting the evaporite left behind. DLE is better because it’s faster, doesn’t require huge evaporation fields, and should recover more of the contained lithium. But it’s a chemistry experiment that has not yet been commercially deployed.

DLE will work (where there’s a will, and lots of funding, there’s a way!) but it will not happen quickly or smoothly.

Between DLE struggles and a shortage of new mines, analysts are now forecasting that lithium prices will double by the end of the year. That’s because the market knows that new mines – lithium or other – are slow to permit and build, so if a project is not already being built or close to it won’t be producing in three years…when the shortage in the lithium market is expected to be as much as global demand totalled last year.

That shortfall is why car makers are moving to buy stakes in lithium mines or secure offtakes from projects that aren’t yet built.

Volvo keeps talking to lithium miners about becoming a major shareholder. Volkswagen’s CEO said his company is not going to become a mining company “but certainly we will get significantly closer.”

Ford paid last year for a third of the lithium that will be produced at a proposed Nevada mine. A few months later, GM inked a similar deal. Mercedes Benz is looking to do the same.

To me, these moves underline how tight the market is for this essential commodity.

How to Play

New discoveries dole out the explosive upside when a particular metal goes on a run. We’ve seen many examples of this in the Quebec lithium scene alone.

Patriot Battery Metals (TSX-V: PMET) is the standout example. It discovered a large zone of spodumene (a lithium mineral) of good grade and its share price has run from under $1 to over $15 in return. It expects to define an initial resource shortly and then plan a mine while also drilling the other spodumene targets on the Corvette project.

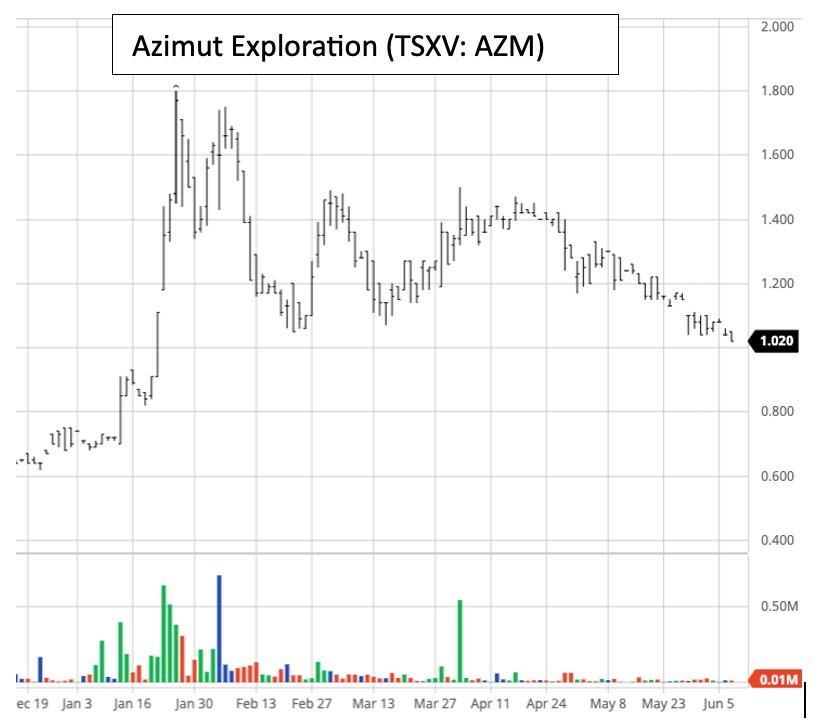

A share price ride like that attracts a lot of attention so it’s no surprise that other explorers have jumped in value when they announce Quebec projects with spodumene potential. We saw it happen with a Maven holding: Azimut Exploration (TSX-V: AZM) spiked from $0.70 to $1.75 when the market realized it has ground adjacent to Corvette with evidence of lithium.

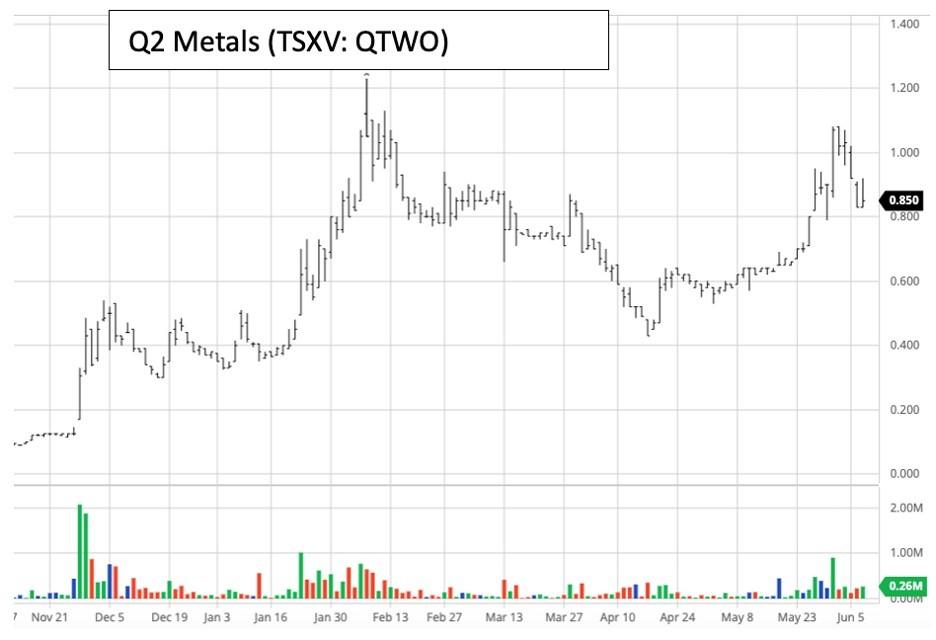

Q2 Metals is similar: its Mia project is a few hundred kilometres west of Corvette but has the same kind of rocks (a graphitic unit with pegmatite intrusions) and initial sampling returned some high lithium grades. The company will conduct its first drilling this summer. As for its share price: it jumped in November when Q2 acquired Mia, it ran in January when the company made its lithium focus clear (including rebranding away from gold), and it has been running again of late as field work gets underway. It’s currently valued at $61 million.

What really stands out here is that companies are jumping in value when the market sees the potential for their projects to host Corvette-like mineralization.

It’s been a while since I saw investors vie to get in ahead of discovery in gold or silver or copper. Fun times.

And so I was very excited to discover a company that I think could have a Q2 Metals-type move this summer.

Targa Exploration (CSE: TEX): The Next Quebec (+ Saskatchewan, Ontario, and Manitoba) Lithium Play

Targa Exploration set itself up to have a good chance to be the next standout Canadian lithium explorer. The company came to trade in September with a gold project but that was just to get listed. The plan was always to develop a portfolio of promising lithium projects and in the last eight months Targa has done precisely that.

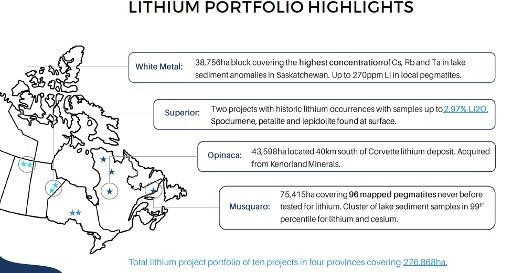

The portfolio now includes ten projects in Quebec, Manitoba, Saskatchewan, and Ontario. All offer potential by virtue of rock types, structures, known proximal lithium discoveries, and standout levels of lithium and lithium pathfinder elements in soil or sediments.

The projects came from sources I know and trust: Kenorland Minerals, a proven project generator; Steve Blower, a successful geologist with 17 years experience in Saskatchewan; and Shawn Ryan, the Yukon prospector famous for leading Kaminak to the Coffee discovery via geochemistry who has since shifted his astute prospecting focus to other provinces and metals.

And Targa comes from a group with strong technical capacity, deep access to capital, good marketing prowess, and demonstrated success making money for investors: Inventa Capital. Inventa is a dozen companies that work out of the same offices to share infrastructure and were generally borne of the same leaders. The standout success is Vizsla Silver (TSX-V: VZLA).

The team at Inventa saw an opportunity in lithium a year ago, as prices started to fall off despite strong long-term fundamentals. In looking for a good way to enter the space, they soon realized that it sat in their own backyard. Canada has been explored for many things but not for lithium, at least not until recently, yet large-scale government mapping and sampling programs show clear lithium potential if you know what to look for.

That list includes:

- Mapped pegmatite rocks

- Located on geologic sub-province boundaries

- Geochemistry with strong levels of lithium and lithium pathfinder elements

Lithium in Canada may be new but all the discoveries of the last few years came from those starting points. And even though juniors are rushing into Canadian lithium, there are still good projects to be had if you know what to look for, if you know the right people, and if those right people want to work with you.

Often, the people who stake new projects do not want to run a public explore-co. They want to sell their projects to a pubco with a good team, in exchange for cash and stock that keeps the prospector exposed to the property. It’s for that exposure, and because they want their ideas explored well, that prospectors want to work with good teams.

Targa presented as exactly that to Blower, Ryan, and Kenorland. The resulting portfolio is brimming with lithium discovery potential…that I don’t think the market has noticed yet.

The map above highlights four of Targa’s ten projects. I’ll give brief comments on all ten.

Before I do: yes, ten projects is a lot. But not only is it possible to advance that many projects; it’s a good idea when a portfolio is full of early projects that haven’t yet seen the groundwork to highlight the best targets. It helps when the market is keen enough on a commodity that it responds to positive sampling results, which is the first opportunity here.

This is Targa’s 2023 plan. They will not drill this summer but there’s still a good chance the stock does well because prospecting, mapping, and sampling at ten projects will likely define some strong lithium targets. After the success of Patriot Battery Metals, there are investors looking high and low for the next lithium discovery so a stock debuting strong targets should attract attention.

Opinaca Lithium Project

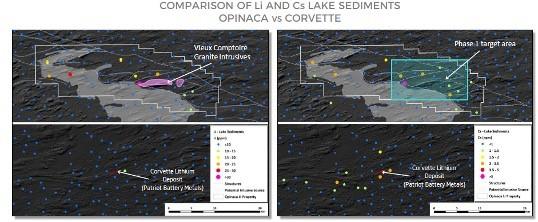

- James Bay region of Northern Quebec, 40 km south of PMET’s Corvette discovery

- Proximal to a major east-west structure, as indicated by highly magnetic rocks to the south and low mag rocks to the north (Corvette has similar setup)

Covers a cluster of lithium and cesium lake sediment geochem anomalies, which suggest the presence of lithium-bearing pegmatites. The maps below compare anomalies at Opinaca and Corvette.

Superior Project

- Northeast Manitoba; project in two parts (Red Cross Lake and Red Sucker Lake)

- Red Cross Lake is 70km NE along a major geologic sub province boundary from the God’s Lake lithium deposit (Vision Lithium), which hosts 9.4 million tonnes of pegmatite averaging 1.12% Li20.

- 17 parallel pegmatite dikes up to 3.7 metres wide within a 50-metre wide corridor

- Average of 1.25% Li2O from five dike samples in 1979. One dike returned 2.97% Li2O.

- Red Sucker Lake offers two kinds of lithium mineralization along a 5-km-long area: whole rock samples from pegmatite intrusions graded as high as 1.49% Li2O while spodumene (key lithium mineral) was mapped in pegmatite dikes.

Musquaro Project

- Eastern Quebec

- 96 mapped pegmatites around a lake that have never been analyzed for lithium.

- Lake sediments are highly anomalous for lithium, cesium, and rubidium (99th percentile of the provincial database)

Ungava Project

- Northern Quebec

- Staked to cover large group of anomalous lake sediment samples, including many lithium, cesium, and rubidium values in the 99th percentile

- Limited mapping has been done but five pegmatites identified and they correlate with strong lithium sediment values. Regional magnetics suggests favourable faulting environment for dike emplacement

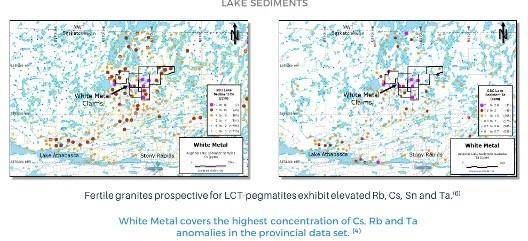

White Metal Project

Staked to cover pegmatites that returned lithium in historic sampling beside lake sediment samples with the highest concentrations of cesium, rubidium, and tantalum (lithium pathfinder elements) in the provincial dataset

Prince Albert Lake Project

- Located between ACME Lithium and ALX Resources lithium projects in northeast Saskatchewan

- Centered on cesium-rich lake sediment sample; located up-ice from high-grade lithium boulders; favourable rock types and interfaces

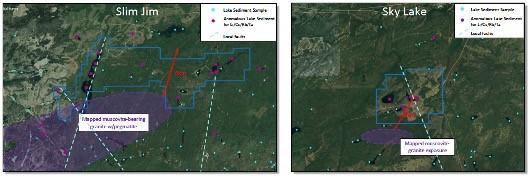

Slim Jim and Sky Lake Projects

- Northwest Ontario, where significant lithium exploration is underway following a few discoveries

Both offer exploration targets within 1 to 4 km of peraluminous granite intrusions, which is known as the ‘sweet zone’ for lithium-bearing pegmatite emplacement

The Opportunity

You will note that several of Targa’s projects have lake sediment samples with 99th percentile values, including all four of its Quebec projects. For what it’s worth, the lake sediment samples that led PMET to Corvette were only 68th percentile.

As exec chair Craig Parry pointed out, it’s also worth considering that it’s unlikely Corvette is the only or the best lithium-rich pegmatite in Quebec. More likely is that more lithium-focused exploration will uncover more Corvette-type deposits.

“Quebec could be the Saudi Arabia of lithium and we have some of the best ground,” says Parry. “There’s pegmatite mapped across each property. If one of those has significant spodumene this thing goes to the moon.”

He says it in a more promoter way than I would, but my thoughts are the same. The world needs more lithium discoveries and Canada – Quebec in particular – is the new frontier. Investors are all over lithium discoveries, because they’re bullish on lithium and because everyone wants to be invested in the next PMET. And PMET investors have all kinds of cash available, some of which many will likely want to put into the next PMET opportunity.

All these factors mean a new lithium discovery of good grade in Quebec would indeed send a stock soaring. Targa is not going to drill this summer so they won’t generate a full-on discovery but they could very well find spodumene (lithium mineral) of good grade in mapped pegmatites of scale. That would generate a response.

What kind of response? Targa currently has a market cap of $29 million. A reasonable comp is Q2 Metals, which acquired the Mia lithium project in November. The acquisition took QTWO’s share price from $0.12 to $0.40, giving it a market cap of $16 million, similar to Targa a few weeks ago before word about this financing started to get out.

In late December Q2 Metals announced sampling results that confirmed a large mapped pegmatite trend at Mia is lithium mineralized and the stock went from $0.40 as high as $1.10. QTWO then raised $10.2 million; after following the lithium price down and back up its share price has recently settled around $0.90, giving it a market cap today of $67 million.

Since this is such a recent example, I think it’s very reasonable to think that success showing good lithium mineralization on one (let alone more) of the pegmatite clusters/trends on its Quebec projects could send Targa’s valuation to similar levels. If that happened, it would be a quick double from current pricing.

There’s no point speculating beyond that. Of course success drilling out a well mineralized lithium discovery, in Quebec or Saskatchewan or Ontario or Manitoba (all good jurisdictions), could send Targa on a PMET path, but it’s too early in the game to think about that. For now, I like the odds of a quick double based on sampling this summer. If that works out, I will assess the results and decide whether to hold some or all for further gains. I imagine the potential for a PMET-style 170-bagger would incline me to! But that’s something only time and results will tell.

Courtesy of the Resource Maven

MORE or "UNCATEGORIZED"

Bonterra Announces Closing of Upsized Brokered Private Placement for Proceeds of $10.5M

Bonterra Resources Inc. (TSX-V: BTR) (OTCQX: BONXF) (FSE: 9BR2) i... READ MORE

ESGold Expands Montauban Mine Building to 4,000 sq. ft. Ahead of Key Operational Milestones

Increased facility footprint reflects advanced construction progr... READ MORE

ARIS MINING COMPLETES INSTALLATION AND COMMISSIONING OF SECOND MILL AT SEGOVIA, ON TIME AND ON BUDGET

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces the... READ MORE

Zodiac Gold Expands Arthington Discovery with Broad Gold Intercepts

Zodiac Gold Inc. (TSXV: ZAU) a West-African gold exploration co... READ MORE

Appia Announces Final Closing of Its Non-Brokered Private Placement

Appia Rare Earths & Uranium Corp. (CSE: API) (OTCQB: APAAF) (... READ MORE