Guanajuato Silver To Acquire Bolanitos Gold-Silver Mine in Mexico

GSilver continues determined consolidation of the Guanajuato Mining District.

Guanajuato Silver Company Ltd. (TSX-V:GSVR) (OTCQX:GSVRF), a growing Mexico-based precious metals producer, has entered into a definitive agreement dated November 21, 2025 to acquire the Bolanitos gold-silver mine located in Guanajuato, Mexico, from Endeavour Silver Corp. (TSX:EDR) for total consideration of up to US$50 million, consisting of (i) upfront consideration of US$40 million to be paid on closing and (ii) contingent consideration of US$10 million (see transaction details below); the Transaction is expected to close in January 2026.

Highlights

- Bolanitos will be Guanajuato Silver’s 5th producing precious metals mine in Mexico. Upon the completion of the Transaction, the Company will operate three primary silver mines (Topia, Valenciana, and El Cubo) and two primary gold mines (Bolanitos and San Ignacio).

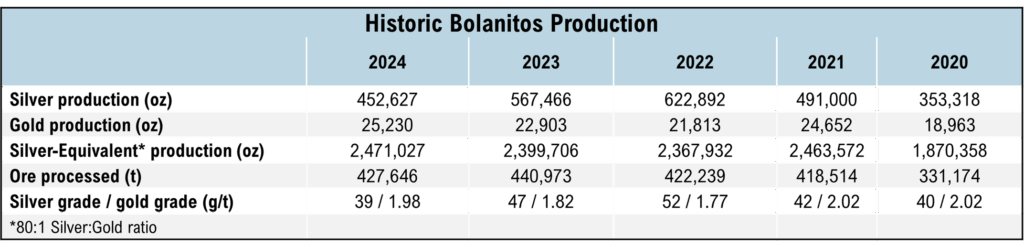

- 2024 Production at Bolanitos totaled 2,471,027 silver-equivalent ounces from 427,646 tonnes grading 39 g/t silver and 1.98 g/t gold for 452,627 ounces of silver and 25,230 ounces of gold. Silver and gold recoveries were 84.4% and 92.7% respectively. AgEq calculated at 80:1 silver to gold ratio (see Endeavour MD&A for the year ended December 31, 2024).

- The acquisition of Bolanitos significantly increases Guanajuato Silver’s resource base; see Bolanitos resource and reserve estimates below.

- The incorporation of the San Ignacio Mine into the Bolanitos Mines Complex is expected to rapidly generate improved economics and expanded mine life; mineralized material mined at San Ignacio will now be transported to the nearby 1,600 tonnes per day Bolanitos flotation plant; as Bolanitos and San Ignacio are contiguous to one another, this is expected to dramatically reduce transportation costs and increase utilization at the Bolanitos mill.

- The Transaction also includes the acquisition of the historic Cebada mine, which is located contiguous and to the north of theCompany’s Valenciana Mines Complex (VMC). The Company intends to reactivate Cebada, which is currently on care and maintenance, as an important exploration and development project.

James Anderson, Chairman and CEO said, “The numerous advantages of integrating our San Ignacio Mine into the Bolanitos Mines Complex are obvious; we have already begun preparations to ensure seamless integration of this asset into our production portfolio, allowing us to quickly realize the economic rewards from this acquisition. By expanding our production platform within the prolific Guanajuato Mining District we have taken another positive step towards building Mexico’s next mid-tier precious metals producer.”

Transaction Summary

Under the terms of the Agreement, Guanajuato Silver will acquire all of the outstanding shares of Minera Bolanitos S.A. de C.V., a subsidiary of Endeavour, that holds all the mining assets located in the Guanajuato district currently held by Endeavour. Bolanitos is being acquired for total upfront consideration at closing of US$40 million, which is comprised of US$30 million in cash and US$10 million of Guanajuato Silver common shares at a deemed price of US$0.2709413 (Cdn$0.3815) per share. In addition to the Upfront Consideration, Guanajuato Silver will make two contingent payments to Endeavour, each being US$5 million, upon achieving production of two million ounces of silver-equivalent and four million ounces of silver-equivalent, respectively. Each Contingent Payment will be satisfied 50% in cash and 50% in Guanajuato Shares, subject to the Maximum Percentage (as defined below).

The number of Contingent Shares issuable to Endeavour is subject to a maximum ownership percentage of 9.9%. If the issuance of Contingent Shares would result in Endeavour holding more than the Maximum Percentage, the value of any excess contingent payment amount (after issuing shares up to 9.9%) shall be payable in cash.

Any Contingent Shares shall be issued at a price equal to the greater of (i) the volume weighted average trading price of the shares on the TSX Venture Exchange for the 10 consecutive trading days immediately preceding the applicable milestone payment date, and (ii) the minimum price permitted by the TSXV (which is currently the “Discounted Market Price” as of the issuance of the news release regarding the applicable contingent payment, as defined in the TSXV Corporate Finance Manual), in each case converted to United States dollars using the average exchange rate posted by the Bank of Canada on the day preceding the applicable milestone payment date. If applicable, Guanajuato Silver will make a cash payment to Endeavour equal to any shortfall between the aggregate Contingent Share Issue Price and the Market Price, at the time of each Contingent Payment.

The Transaction is arm’s length and no finder’s fees are payable in connection with the Transaction.

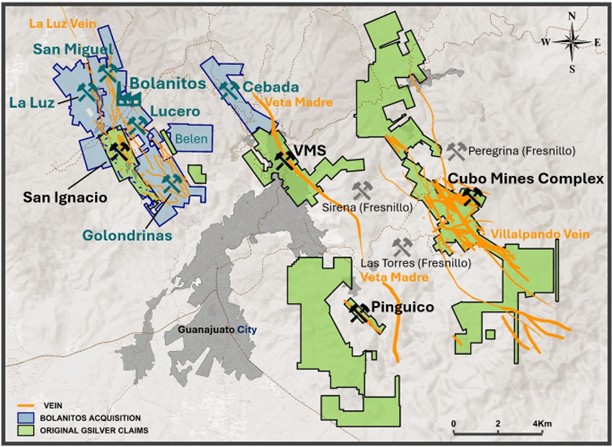

Figure 1: Map of the Guanajuato Mining District showing the main epithermal veins and other significant geological structures. Bolanitos is located along the La Luz Vein structure.

Bolanitos Operations

2024 production at Bolanitos totaled 2,471,027 silver-equivalent (AgEq) ounces from 427,646 tonnes grading 39 g/t silver and 1.98 g/t gold for 452,627 ounces of silver and 25,230 ounces of gold. Silver and gold recoveries were 84.4% and 92.7% respectively. AgEq was calculated at 80:1 silver to gold ratio (see Endeavour MD&A for the year ended December 31, 2024). Production at Bolanitos has been relatively consistent for several years and will add incrementally to Guanajuato Silver’s total annual production.

Table 1: Historic Bolanitos production from 2020-2024. Source: See Endeavour Management’s Discussion & Analysis for the Years Ended December 31, 2024, December 31, 2023, December 31, 2022, December 31, 2021 and December 31, 2020 filed by Endeavour on SEDAR+.

Figure 2: Bolanitos processing facility – 1,600 tonnes per day standard flotation plant.

Figure 3: Bolanitos processing facility – Bolanitos is a producing precious metals mining operation.

Figure 4: The Bolanitos mine was purchased by Endeavour Silver in 2007 from Penoles S.A. de C.V. The plant and ancillary infrastructure have been upgraded over the years.

Bolanitos consists of 26 mining concessions totaling 2,537 hectares. The land package, located 12km northwest of the city of Guanajuato, includes three producing mines: San Miguel, La Luz and Lucero. The past-producing Golondrinas mine, located in the southern portion of the Bolanitos concessions, is scheduled for production restart in 2026. The Bolanitos land package is contiguous with, and partially surrounds, GSilver’s San Ignacio concessions on three sides.

The mining method used at Bolanitos is primarily long-hole stoping and conventional cut and fill mining. Mineralized material is brought to surface for crushing and grinding. The 1,600 tonnes per day flotation processing facility produces a bulk gold-silver concentrate, and currently operates at approximately 75% capacity, allowing for processing of mined material from San Ignacio. Endeavour purchased the Bolanitos Mine from Penoles S.A. de C.V. in 2007 and has made incremental expansions and improvements since acquisition.

Figure 5: Bolanitos mill interior. The mill is currently operating at approximately 75% capacity; the Company expects to achieve increased capacity at Bolanitos through the addition of mineralized material from San Ignacio

Reserve and Resource Estimates

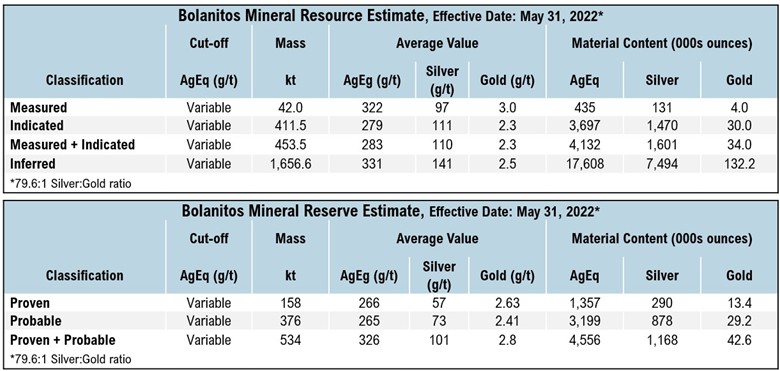

Table 2: Bolanitos Resource Estimate. Source: NI 43-101 Technical Report – Updated Mineral Resource and Reserve Estimates for the Bolanitos Project, Guanajuato State, Mexico, effective date: November 9, 2022.

- Mineral Resources are reported exclusive of Mineral Reserves.

- Mineral resources and mineral reserves have been reduced due to mining depletion from production at the property as set out in Endeavour’s continuous disclosure record. Refer to production table above.

Silver equivalent calculation (AgEq) for the Bolanitos Mineral Reserve and Mineral Resource estimate is based on a 79.6:1 silver to gold price ratio. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Except as otherwise specified herein, all scientific and technical information related to Bolanitos in this Press Release is based on a technical report entitled “NI 43-101 Technical Report: Updated Mineral Resource and Reserve Estimates for the Bolanitos Project, Guanajuato State, Mexico” with an effective date of November 9, 2022, filed on SEDAR+ by Endeavour on January 26, 2023 (the “Bolanitos Report“). To the best of the Company’s knowledge, information, and belief, the Bolanitos Report is considered current pursuant to National Instrument (“NI”) 43-101 and there is no new material scientific or technical information that would make the disclosure of the mineral resources, mineral reserves or results of the Bolanitos Report inaccurate or misleading. Furthermore, as required under applicable securities laws, the Company will file an updated technical report on Bolanitos, in accordance with NI 43-101, within 180 days of this press release.

For additional details on San Ignacio please refer to Guanajuato Silver’s technical report dated March 7, 2024 (effective date December 31, 2023) titled “Technical Report on the San Ignacio Property, Guanajuato, Mexico” available on SEDAR+ at www.sedarplus.ca.

Figure 6: Proximity of the primary stockpiles at Bolanitos and San Ignacio. The Bolanitos mill is located within two kilometres of the San Ignacio project; the two properties are contiguous and share the same geology.

Additional Exploration and Development Projects

The Transaction includes the past-producing Cebada mine, which is located on trend along the Veta Madre vein system, directly to the north of GSilver’s Valenciana Mines Complex. Additionally, the Bolanitos acquisition includes the Belen exploration project, which is located to the east of San Ignacio (see Figure 1 for location); Belen will also be a focus for future exploration drilling.

Bolanitos Geology

The Guanajuato mining district hosts three major mineralized fault systems, the La Luz, Veta Madre and Villalpando systems; Bolanitos is situated along the La Luz structure. Mineralized veins at Bolanitos consist of the classic banded and brecciated epithermal variety. Silver occurs primarily in dark sulfide-rich bands within the veins. Economic concentrations of precious metals are present as shoots that are distributed vertically and laterally between non-mineralized segments of the veins. Overall, the style of mineralization is pinch-and-swell with some flexures resulting in closures and others generating wide sigmoidal breccia zones.

Figure 7: Bolanitos is a primary gold mine centered on the epithermal vein structures of the La Luz fault system.

Additional Transaction Details

In connection with the Transaction, Endeavour and the Company will enter into an investor rights agreement at closing which will include, among other things, participation rights in favour of Endeavour. Pursuant to the Investor Rights Agreement, Endeavour has also agreed to vote its Guanajuato Shares in accordance with recommendations of the Company’s board of directors in respect of general matters for a period of 12 months and to certain restrictions on transfer on the Guanajuato Shares issuable pursuant to the Agreement as part of the Upfront Consideration. All Base Shares will be subject to voluntary restrictions on transfer for a period of 12 months, after which 50% of the Base Shares will be subject to restrictions for an additional two years.

Closing the Transaction is subject to customary conditions for a transaction of this nature, including the approval of the TSXV and the execution of the Investor Rights Agreement, and is expected to occur in January 2026. The Agreement provides for a reciprocal termination fee of US$2.5 million, payable by Endeavour or the Company in certain circumstances. The Termination Fee may be satisfied either (i) entirely in cash or, at the election of the applicable payor, (ii) by paying US$1 million in cash and settling the remaining US$1.5 million through the issuance of common shares of the payor, subject to stock exchange approval.

Any such shares will be issued at a deemed price per share equal to the greater of (i) the 10-day VWAP on the applicable exchange as of the termination date, and (ii) the minimum price permitted by the TSXV or Toronto Stock Exchange (as applicable) after giving effect to the maximum discount permitted thereby, in each case converted to U.S. dollars using the Bank of Canada’s average daily exchange rate on the business day immediately preceding the termination date. If applicable, the party paying the Termination Fee will make an additional cash payment to the other party equal to any aggregate shortfall in value between the Termination Share Market Price and the Termination Share Issue Price.

Management Transition

The Company also reports that COO Carlos Silva will retire as of December 31, 2025. The Company has greatly benefited from Mr. Silva’s hard work, commitment to discipline, and astute leadership; he was particularly successful at enhancing Guanajuato Silver’s social license to operate, having recently earned for the Company the Socially Responsible Company (ESR) distinction. Everyone at Guanajuato Silver wishes him well in his retirement – ¡Felicidades Carlos!

Rick Trotman will continue with the Company with the new title of Senior Vice President: Mining Operations. Since joining the Company in a full-time capacity, (See GSilver News Release dated July 29, 2025), Mr. Trotman has been invaluable in driving the Company toward sustained profitability. In his expanded role, he will be responsible for all mining, development, and exploration activities at all the Company’s assets; Rick will also lead the integration of Bolanitos into the Company’s operations.

Qualified Person

William Gehlen, a Director of Guanajuato Silver, is a Certified Professional Geologist with the American Institute of Professional Geologists (No. 10626), and a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects.

Mr. Gehlen has reviewed, approved and verified the technical data disclosed in this news release (including a review of the Bolanitos Technical Report on behalf of the Company) and has not detected any significant QA/QC issues during review of the data and is not aware of any sampling, recovery or other factors that could materially affect the accuracy or reliability of the drilling data referred to herein. The verification of data underlying the disclosed information includes reviewing compiled assay data; QA-QC performance of blank samples, duplicates and certified reference materials; and grade calculation formulas.

About Guanajuato Silver

GSilver is a precious metals producer engaged in reactivating past producing silver and gold mines in central Mexico. The Company produces silver and gold concentrates from the El Cubo Mine, Valenciana Mines Complex, and the San Ignacio Mine; all three mines are located within the state of Guanajuato, which has an established 480-year mining history. Additionally, the Company produces silver, gold, lead, and zinc concentrates from the Topia mine in northwestern Durango. With four operating mines and three processing facilities, Guanajuato Silver is one of the fastest growing silver producers in Mexico.

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE