Guanajuato Silver Completes Development to High Grade Santo Nino Vein at San Ignacio

Guanajuato Silver Company Ltd. (TSX-V:GSVR) (OTCQX:GSVRF) is providing an update on development and exploration progress at the Company’s wholly-owned San Ignacio mine located in Guanajuato, Mexico.

Chairman and CEO, James Anderson said, “We have identified a greater than two-metre wide mining block at Santo Nino consisting of significant tonnage and grade. Further exploration potential west of this new production area is highly prospective and will remain at the forefront of our exploration campaigns throughout 2025.”

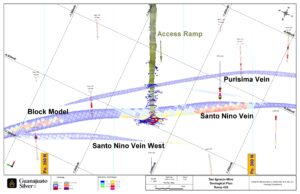

Image: San Ignacio project showing major mining areas; underground workings are highlighted in yellow.

After several months of development work, the 430 Ramp has reached the Purisima vein where mining activity has been initiated. The advance of the ramp then continued to the west approximately another 10 metres where the Santo Nino vein was contacted. The Santo Nino vein offers the Company access to an entirely new mining area with comparatively higher gold content.

Image: Longitudinal view of the Purisma and Santo Nino Veins showing underground workings.

Exploration at San Ignacio for 2025 will focus on infill drilling in the Melladito North area, exploring deeper extensions to the Nombre de Dios veins, and evaluating additional veins to the west of Santo Nino, supported by geophysics and geological surface mapping.

Image: Plan View

Mineralization at San Ignacio is related to the powerful and prolific La Luz structure, which runs parallel to the primary system in Guanajuato – the Veta Madre vein located approximately 10km to the east. The La Luz system has a known strike length of over 8km and consists of 18 identified veins, including Santo Nino. The La Luz mineralization was the first silver and gold mineralization identified by the Spanish in the Guanajuato area as early as the 1540’s.

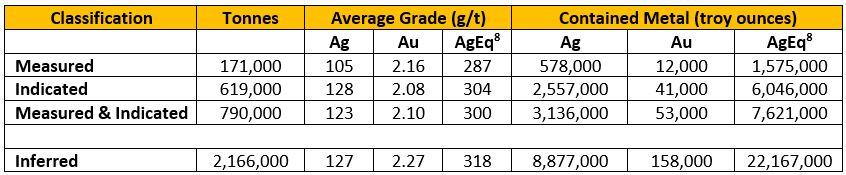

In September, 2023, the Company issued a mineral resource estimate for GSilver’s 100% owned San Ignacio mine. The 2023 MRE was prepared by APEX Geoscience Ltd., with an effective date of September 21, 2023.

The 2023 MRE comprises Measured and Indicated Mineral Resources of 7.621 million troy ounces AgEqii at 300 g/t AgEqii within 0.79M tonnes (t), and Inferred Resources of 22.167M oz AgEqii at 318 g/t AgEqii within 2.166M tonnes. These figures represent increases in contained metals of approximately 4.318M oz AgEqii in the Measured and Indicated category (130% increase), and 16.385M oz AgEqii in the Inferred category (283% increase) versus the previously reported historical resource estimatei. The 2023 MRE for the San Ignacio mine is presented in Table 1 below.

Table 1: 2023 San Ignacio Mineral Resource Estimate (effective date September 21, 2023)

Notes:

- The 2023 San Ignacio Mineral Resources were estimated and classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum “Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines” dated November 29th, 2019, and the CIM “Definition Standards for Mineral Resources and Mineral Reserves” dated May 10th, 2014.

- The 2023 MRE was prepared by Warren Black, M.Sc., P.Geo. and Tyler Acorn, M.Sc., of APEX Geoscience Ltd under the supervision of the Qualified Person, Michael Dufresne, M.Sc., P.Geo., President of APEX Geoscience Ltd.

- Mineral resources which are not mineral reserves do not have demonstrated economic viability. No mineral reserves have been calculated for San Ignacio. There is no guarantee that any part of mineral resources discussed herein will be converted to a mineral reserve in the future.

- The QPs are unaware of any environmental, permitting, legal, title, market, or other relevant factors that may materially affect the estimate of mineral resources.

- The quantity and grade of the reported Inferred Resources are uncertain in nature and there has not been sufficient work to define these Inferred Resources as Indicated or Measured Resources. It is reasonably expected that most of the Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- All figures are rounded to reflect the relative accuracy of the estimates. Totals may not sum due to rounding.

- Specific gravity of 2.64 is used for 2023 MRE.

- Metal prices are set at US$1,850/oz Au and US$22/oz Ag, with 87% recovery for both. This yields an Au:Ag ratio of 84.1:1 for the calculation of AgEq.

- Costs are US$40.0/t for mining, US$16.0/t for processing, and US$18/t for G&A, leading to a 120 g/t AgEQ reporting cutoff grade.

- Underground resources are confined to potentially minable shapes defined by a stope optimizer. The resulting stopes have a minimum horizontal width of 1 m and length and height dimensions of 20 m by 20 m, which can be sub-stoped to 10 m by 10 m. They must also contain a minimum grade of 120 g/t AgEQ.

For additional details on the 2023 MRE and San Igancio property please refer to the technical report dated March 7, 2024 (effective date December 31, 2023) titled “Technical Report on the San Ignacio Property, Guanajuato, Mexico” available on SEDAR+ at www.sedarplus.ca.

Qualified Person

William Gehlen, a Director of Guanajuato Silver, is a Certified Professional Geologist with the American Institute of Professional Geologists (No. 10626), and a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects.

Mr. Gehlen has reviewed and verified technical data disclosed in this news release and detected no significant QA/QC issues during review of the data and is not aware of any sampling, recovery or other factors that could materially affect the accuracy or reliability of the drilling data referred to herein. Verified data underlying the disclosed information includes reviewing compiled assay data; QA-QC performance of blank samples, duplicates and certified reference materials; and grade calculation formulas.

About Guanajuato Silver

GSilver is a precious metals producer engaged in reactivating past producing silver and gold mines in central Mexico. The Company produces silver and gold concentrates from the El Cubo Mine, Valenciana Mines Complex, and the San Ignacio mine; all three mines are located within the state of Guanajuato, which has an established 480-year mining history. Additionally, the Company produces silver, gold, lead, and zinc concentrates from the Topia mine in northwestern Durango. With four operating mines and three processing facilities, Guanajuato Silver is one of the fastest growing silver producers in Mexico.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE