GreenLight Metals Intersects 22.24 meters of 3.02 g/t Gold and 2.03% Copper (5.27% Copper Equivalent) at the Bend VMS Deposit in Wisconsin

High-Grade Intercept in hole B25-004 includes Visible Gold at 290m; Results Confirm Strengthening Mineralization Down-Plunge

GreenLight Metals Inc. (TSX-V: GRL) is pleased to announce additional high-grade Copper and Gold results from its Phase 1 drilling program at the Bend Project in Wisconsin, further to its September 22, 2025 news release reporting results from holes B25-001 through B25-003. The six-hole diamond drilling program, totaling 2,037 meters, was completed from three sites along two sections entirely on the Company’s leased forty-acre tract of private minerals.

Highlights

- Phase 1 Program Complete: Six-hole drilling program successfully completed on schedule, targeting eastern extensions of the known Bend deposit. Drilling confirms mineralization extends eastward along a ~36-42° plunge and remains open at depth and along trend.

- B25-004: Increase in both grade and thickness of mineralization ~45 meters down dip of previously released hole B25-003 (12.85m of 3.74% CuEq)

- 34.25 meters (drilled thickness) averaging 2.22 g/t Au, 1.35% Cu, 15.62 g/t Ag and 193.22 g/t Tellurium (Te) (3.74% CuEq, not including Te) from 275.25m

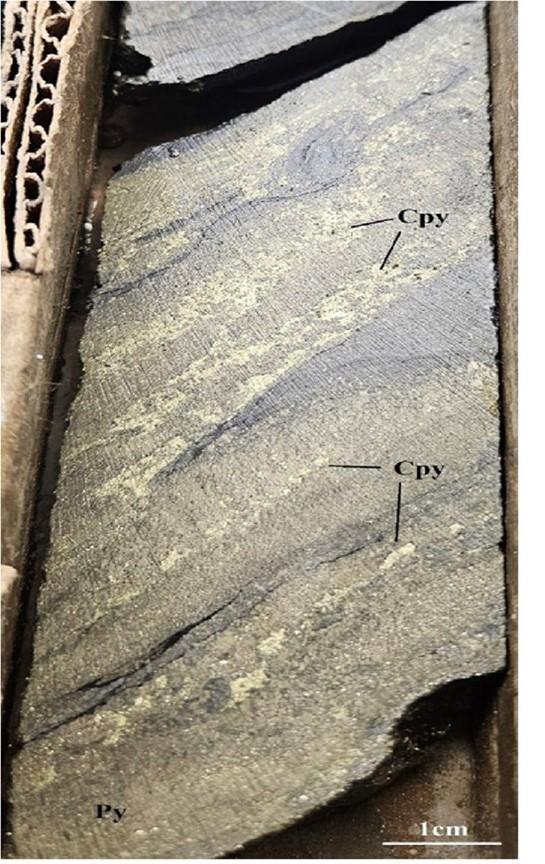

- Including 22.24 meters averaging 3.02 g/t Au, 2.03% Cu, 23.53 g/t Ag and 283.08 g/t Te within massive to semi-massive sulfide (5.27% CuEq) from 276.29m

- Localized high grade gold intersection within the main sulfide body over 6.10 meters averaging 7.41 g/t Au from 287.9 meters. Visible gold was identified at 290m

- 34.25 meters (drilled thickness) averaging 2.22 g/t Au, 1.35% Cu, 15.62 g/t Ag and 193.22 g/t Tellurium (Te) (3.74% CuEq, not including Te) from 275.25m

- B25-005: Extension of copper and gold mineralization eastward 57m down plunge of B25-003, 47m along strike of B25-004

- 19.32 meters (drilled thickness) averaging 2.03 g/t Au, 0.78% Cu, 10.12 g/t Ag, 153.73 g/t Te (2.95% CuEq) from 285.83m

- Including 8.79 meters averaging 1.93 g/t Au, 1.64% Cu, 20.31 g/t Ag, 273.48 g/t Te (3.74% CuEq) within massive to semi-massive sulfide zone from 285.83m

- Including 4.00 meters averaging 4.19 g/t Au, 0.1% Cu, 2.03 g/t Ag, 100.70 g/t Te (4.52% CuEq) within footwall crystal tuff from 300m

- B25-006 (assays pending):

- Visual results include 17.11m of semi-massive to massive sulfide from 328.52m and 5.42m of heavily mineralized footwall crystal tuff from 345.63m

- Strategic Advantage: Program executed entirely on private mineral lands with existing permits, demonstrating GreenLight’s ability to advance exploration efficiently while federal permit applications remain pending

Matt Filgate, President & CEO, commented: “The results from Holes 4 and 5 demonstrate increasing grade and thickness as mineralization continues down-dip and strengthens within the deposit core. We are highly encouraged by the presence of high-grade copper and gold-including visible gold at 290 meters-which underscores the project’s growth potential. The results of the Phase 1 drill program have confirmed substantial continuity of high-grade mineralization and established clear vectors for our upcoming 5,000-6,000 meter winter drill campaign.”

Table 1: Summary of Significant Intercepts – Holes B25-004 and B25-005

| DDH | From (m) | To (m) | Interval (m) | Cu (%) | Au (g/t) | Ag (g/t) | Te (g/t) | Cu Eq (%) |

| B25-004 | 275.25 | 309.5 | 34.25 | 1.35 | 2.22 | 15.62 | 193.2 | 3.74 |

| Including | 276.29 | 298.53 | 22.24 | 2.03 | 3.02 | 23.53 | 283.1 | 5.27 |

| Including | 287.9 | 294 | 6.10 | 2.20 | 7.41 | 27.01 | 346.3 | 10.08 |

| B25-005 | 285.83 | 305.15 | 19.32 | 0.78 | 2.03 | 10.12 | 153.7 | 2.95 |

| Including | 285.83 | 294.62 | 8.79 | 1.64 | 1.93 | 20.31 | 273.5 | 3.74 |

| and | 300.00 | 304.00 | 4.00 | 0.10 | 4.19 | 2.03 | 100.7 | 4.52 |

The composite grades of select intervals are calculated on a length-weighted basis and are reported as drilled thicknesses. True thicknesses of the intervals are estimated to be 75-85% of the drilled thickness.

CuEq is reported to express the aggregate in-situ value of copper, gold and silver as a percentage copper grade. CuEq incorporates assumed metallurgical recoveries and is not a proxy for, nor evidence of, economic value. Tellurium (Te) is reported separately and is not included in CuEq.

CuEq (%) = ((Cu grade (%) / 100 * 0.9 (recovery) * 2204.6 * $4.50) + (Au grade (g/t) * 0.9 (recovery) / 31.1035 * $3,600) + (Ag grade (g/t) * 0.9 (recovery) / 31.1035 * $40)) / (2204.6 * 0.01 * $4.50).

Assumptions: metal prices of $4.50/lb Cu, $3,600/oz Au, $40/oz Ag; recoveries of 90% for Cu, Au and Ag based on the Company’s preliminary assessment of analogous VMS deposits. No allowances have been made for smelting/refining charges, penalties or deleterious elements, or payability factors. No metallurgical test work has been completed at Bend; actual recoveries and payabilities are unknown and may differ materially.

Tellurium (Te) overlimit analyses for samples >500 g/t Te are currently pending for 7 samples in B25-004 and B25-005. The grade for these intercepts were calculated using 500 g/t Te for these samples.

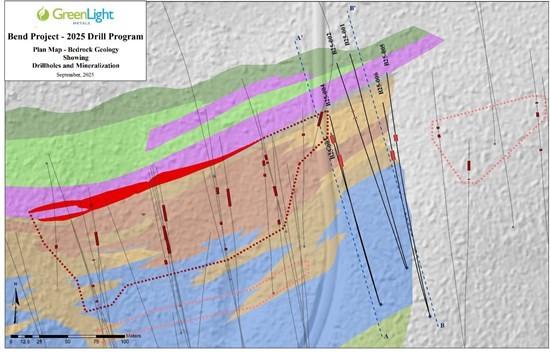

Figure 1: 2025 Drill Program Plan Map

Hole Details

- Details for holes B25-001 through B25-003 were provided in the Company’s September 22, 2025 news release.

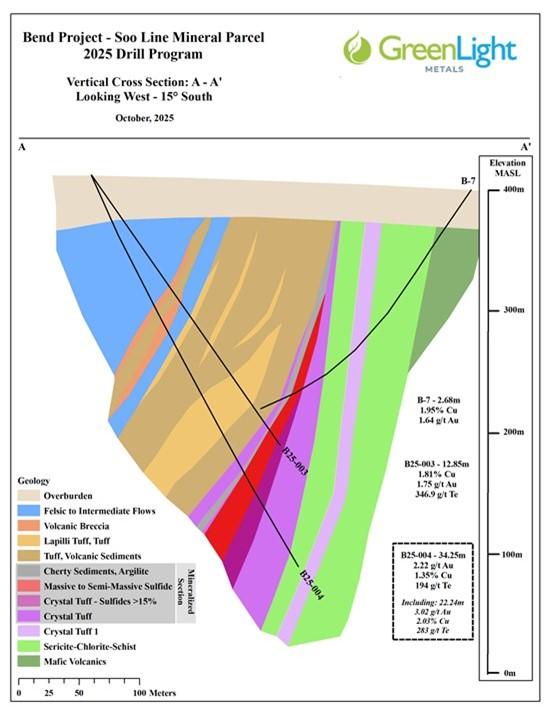

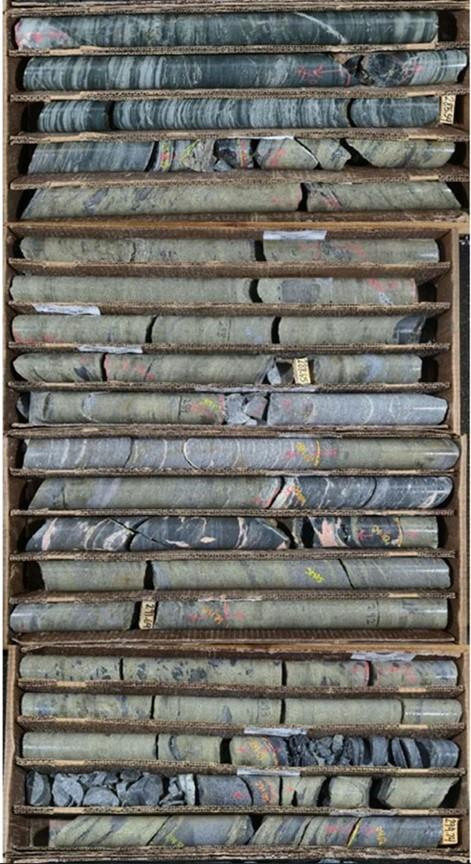

- B25-004: Collared on the same site as B25-003 and designed to test down-plunge continuity ~45m below B25-003 vertically, the mineralized horizon was intersected at 276.29m yielding 22.24m of semi-massive to massive pyrite-chalcopyrite sulfide. The 34.25-meter total mineralized interval represents a significant increase in both grade and thickness compared to B25-003 (12.85m), confirming that mineralization strengthens down-plunge. A localized high-grade gold zone averaging 7.41 g/t Au over 6.10 meters was intersected within the massive sulfide body, with visible gold identified at 290 meters. B25-004 also intersected 13.57m of pyrite in the footwall quartz- eye crystal tuff from 298.53m to 312.10m.

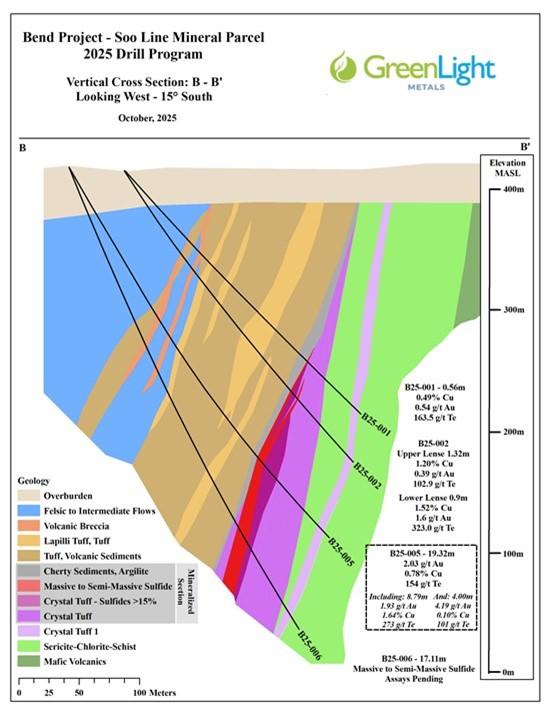

- B25-005: Collared as a 47m step back south on the same section as B25-001/002 to test down-plunge extent at 60m vertical depth below B25-002, the mineralized horizon was intersected at 285.83m with 8.79m of semi-massive to massive pyrite-chalcopyrite. This hole supported the hypothesis of a 36° to 42° plunge to the east. B25-005 also intersected 16.6m of strong pyrite mineralized footwall chloritized quartz-eye crystal tuff known for hosting gold mineralization from 294.62m to 311.22m.

- B25-006: Collared from the same site as B25-005 to test 60m down dip vertically, the mineralized horizon was intersected at 328.52m coring 17.11m of semi-massive to massive sulfides. Similar to overlying holes, a 5.42m thick pyritic-rich footwall zone within the quartz-eye crystal tuff was intersected from 345.63m to 351.05m.

Next Steps

- Pending assays: Results for the final Phase 1 hole, B25-006, are expected in the coming weeks and will be released once received and validated.

- Phase 2: Planning is currently underway for an expanded, winter drill program to follow up on the recent drilling success at the Bend project. Permitting efforts on both the federal properties (Prospecting Permit) as well as within the privately owned Soo Line Mineral Parcel are in progress to initiate a 5,000 – 6,000 meter drill program to further expand the deposit.

GreenLight Engages Bunt Capital for Investor Relations Services

The Company also announces it has entered into a six-month agreement with Bunt Capital Corporation, based in Toronto, Ontario, to provide investor relations services to the Company. Bunt is a full-service marketing and consulting services company focused on the junior metals and mining sector. Bunt will communicate directly with existing shareholders, analysts and prospective investors. Under the agreement, Bunt Capital will provide investor relations and capital-markets advisory services, including institutional and family-office outreach and coordination of non-deal roadshows.

The Company will pay Bunt Capital C$15,000 per month plus applicable taxes, invoiced monthly in arrears, from working capital, for a total of C$90,000 plus taxes over the six month term. Bunt may from time to time acquire or dispose of securities of the Company through the market, privately or otherwise, as circumstances or market conditions warrant. Bunt has also agreed to the Company’s insider trading policy and will observe the Company’s trading blackouts. Bunt and its affiliates are at arm’s length to the Company and has no other relationship with the Company, except pursuant to the engagement agreement. The engagement is subject to acceptance of the TSX Venture Exchange.

Table 2: Drill Collar Information

| Hole ID | Easting (m) | Northing (m) | Elevation (masl) | Azimuth | Dip | Total Depth (m) |

| B25-001 | 688514.058 | 5018602.251 | 412.855 | 344.0 | 48.0 | 279.81 |

| B25-002 | 688512.840 | 5018601.978 | 413.468 | 342.0 | 58.0 | 307.24 |

| B25-003 | 688490.294 | 5018569.989 | 412.868 | 344.0 | 55.5 | 276.61 |

| B25-004 | 688491.065 | 5018570.208 | 412.871 | 344.7 | 65.0 | 368.20 |

| B25-005 | 688533.987 | 5018560.256 | 415.502 | 345.0 | 59.0 | 376.43 |

| B25-006 | 688534.039 | 5018560.161 | 416.008 | 344.0 | 67.0 | 428.85 |

*Coordinates in NAD83 UTM Zone 15N

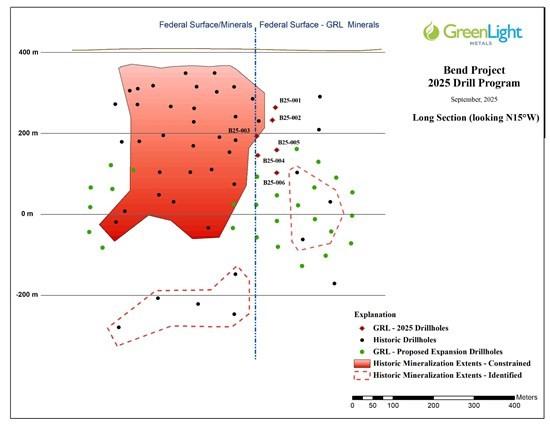

Figure 2: Long Section with DDH pierce points on plane of mineralization

Figure 3: Cross Section A-A’

Figure 4: Cross Section B-B’

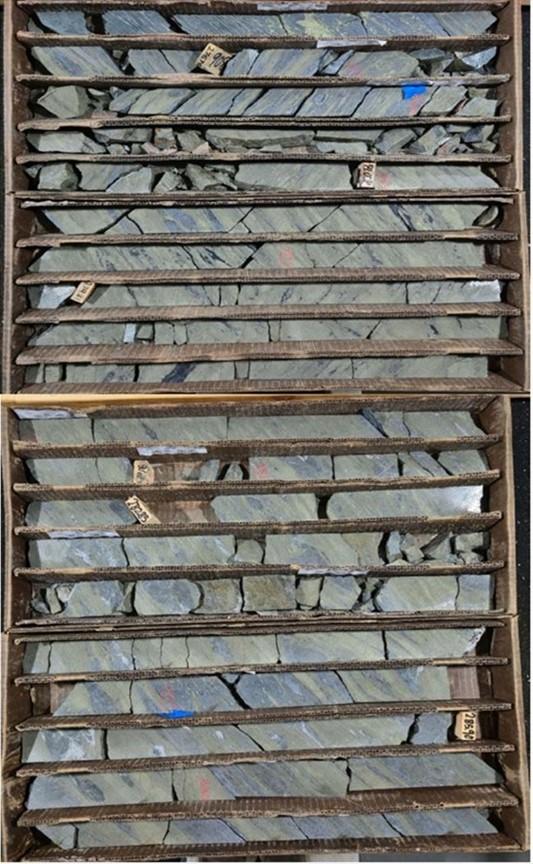

B25-004: 276.1m – 286.90m

B25-004: 286.90m – 298.20m

B25-005: 284.00m – 294.74m

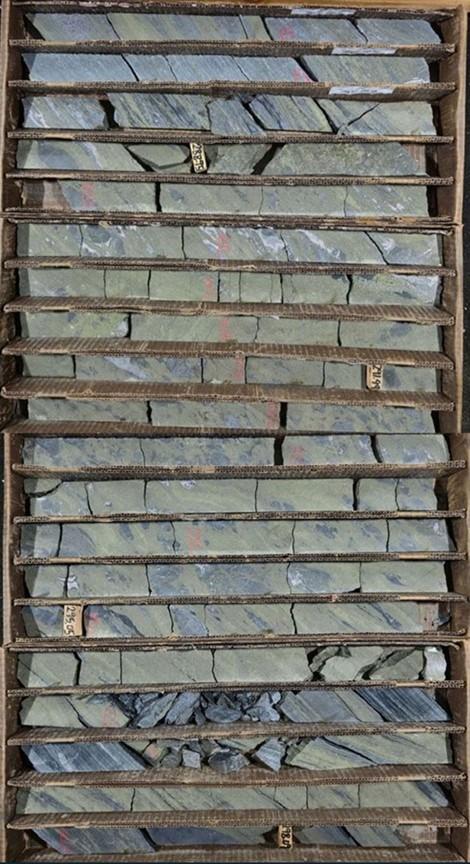

B25-004: 291.20m

B25-005: 286.10m

B25-004: 291.20m

B25-004: Visible Gold at 290m

About the Bend Project

The Bend VMS Project represents an advanced exploration opportunity. To date, over US$8 million has been invested in the project, including 59 diamond drill holes totaling 23,849 meters. Historical drilling highlights include 67.69 meters grading 1.01% Cu and 0.99 g/t Au, including 27.6 meters at 2.40% Cu and 1.43 g/t Au.

Sample Preparation and QA/QC

Samples from the 2025 Bend drill program followed strict chain of custody from collection, through processing and delivery to ALS Global’s laboratory in Twin Falls, Idaho. The drill core was delivered directly from the drill area to GreenLight’s core facility in Medford, WI. The drill core was inspected and sampled by GreenLight’s geologists who insert Certified Reference Materials (“CRMS”) and Blank material into the sampling stream and make up 10% of the total samples submitted to ALS. The drill core at the Bend project is drilled in NQ size (47.6mm) and is bifurcated by an electric masonry saw and placed in sentry sample bags sealed with zip-ties. Samples are shipped by ground directly to ALS via certified cartridge courier in rice bags secured on pallets. Samples are prepared using the ALS method PREP-31y which includes drying (if necessary) in an oven at a maximum temperature of 60°C, fine crushed of the sample to at least 70% passing less than 2mm and rotary split continuously through crushing via a Boyd RSD crusher-splitter. A 250g split sub-samples is then pulverized to 85% passing 75µm. Gold is analyzed by fire assay and inductively coupled plasma mass spectrometer (ICP-MS) if a 25g aliquot sample. (ALS Method Au-ICP21), while multi-element chemistry is analyzed by four acid digestion of a 0.25g pulverized sample split with detection by inductively coupled plasma mass spectrometer (ICP-MS) for 48 elements (Ag, Al, As, Ba, Be, Bi, Ca, Cd. Ce. Co, Cr, Cs, Cu, Fe, Ga, Ge, Hf, In, K, La, Li, Mg, Mn, Mo, Na, Nb, Ni, P, Pb, Rb, Re, S, Sb, Sc, Se, Sn, Sr, Ta, Te, Th, Ti, Tl, U, V, W,Y, Zn, Zr)(ALS method core ME-MS61). Gold assay method Au-ICP21 has an upper detection limit of 100ppm. Any sample that produced an over-limit gold value from ICP-MS is then sent for a gravimetric finish analysis. Samples that return copper assays greater than 1% Cu, the upper detection limit for ME-MS61 is sent for an “ore grade” analysis, in this case ALS method code Cu-OG46, which is a 0.4g aliquot pulverized sample with an ICP finish and an upper detection limit of 50% Cu.

Qualified Person Statement

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements as set out in NI 43-101 and reviewed and approved by Thomas Quigley, MSc, CPG-11962, Exploration Director of the Company, a Qualified Person as defined by NI 43-101.

About GreenLight Metals Inc.

GreenLight Metals is a Wisconsin-focused exploration company advancing copper-gold and gold projects across the Penokean Volcanic Belt-one of North America’s most prospective VMS districts-and the Kalium Canyon epithermal gold project in Nevada’s Walker Lane. In Wisconsin, our portfolio includes the Bend copper-gold deposit, the Reef high-grade gold project, and the Lobo and Lobo East massive sulfide targets. Guided by a team with deep roots in the state, we are building a modern minerals company for Wisconsin, by Wisconsin-committed to responsible exploration, transparent engagement, and creating durable local opportunities as we help supply the critical metals that power the energy transition.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE