Graphite One Drills 15m of 10.75% Cg at Graphite Creek, as China Slams the Door on Flake Graphite Exports

China is once again using its dominance in the mining and processing of critical minerals to bully end users and to raise prices.

In this case the material is graphite, required for the anode part of the lithium-ion battery manufactured for electric vehicles.

On Friday, Beijing said it will require export permits for some graphite products “to protect national security”. The real reason is retaliation against the United States for widened curbs on Chinese companies’ access to semiconductors, including stopping sales of more advanced artificial intelligence chips made by Nvidia; and the European Union for daring to impose tariffs on Chinese-made EVs the Europeans argue unfairly benefit from subsidies.

The Biden administration has released a raft of measures seeking to stop Beijing from using advanced US technologies to strengthen its military. The rules also restrict a broader swathe of advanced chips and chipmaking tools to a greater number of countries including Iran and Russia, and blacklist two Chinese chip designers, Reuters reported.

Readers of these pages understand China is the largest graphite producer and exporter, and refines almost all the world’s graphite into the material that is used in virtually all EV battery anodes.

Under the new graphite restrictions, which take effect Dec 1, exporters must apply for permits to ship two types of graphite: synthetic graphite, and natural flake graphite and its products.

While it’s unclear how much effect the ban will have in the short term, Bloomberg reported that, “With this new graphite export curb, South Korean firms which heavily rely on China for graphite imports would need to seek alternatives, such as mines from the United States or Australia, but it would likely increase the cost burden for many,” said Kang Dong-jin, an analyst at Hyundai Motor Securities.

Deficits are expected to kick in by 2025 as new graphite mines fail to keep up with surging demand from automakers.

Graphite importance

The lithium-ion battery cathode is where metals like lithium, nickel, manganese and cobalt are used, and depending on the battery chemistry, there are different options available to battery makers. Not so for graphite, an anode material for which there are no substitutes.

Due to its natural strength and stiffness, graphite is an excellent conductor of heat and electricity. It is also stable over a wide range of temperatures.

Graphite is thus found in a wide range of consumer devices, including smartphones, laptops, tablets and other wireless devices, earbuds and headsets. Besides being integral to electric car batteries, graphite is found in e-bikes and scooters.

Graphite has the largest component in batteries by weight, constituting 45% or more of the cell. Nearly four times more graphite feedstock is consumed in each battery cell than lithium and nine times more than cobalt.

Graphite is indispensable to the EV supply chain.

BloombergNEF expects graphite demand to quadruple by 2030 on the back of an EV battery boom transforming the transportation sector. It is not an exaggeration to say that electrification of the global transportation system doesn’t happen without graphite.

Déjà vu

Of course, it isn’t the first time that China has used a metal, or group of metals, to bash its Western adversaries over the head to make a point. Nor will it be the last.

In 2010, an international incident sent rare earth oxide prices into the stratosphere. A Japanese naval vessel interdicted a Chinese fishing boat near the Senkaku Islands, of which Japan and China both claim ownership, and detained the captain. In response, the Chinese decided to ban all rare earth exports to Japan, then China’s largest REE customer. The rare earths market panicked, and within months, all the rare earth oxides gained in price.

In 2019, it nearly happened again. As part of its trade war strategy, China raised the prospect of cutting exports of the commodities that are critical to America’s defense, energy electronics and auto sectors.

Suddenly, the once-remote possibility of using critical metals as pawns in the trade war became more likely.

But it is more than rare earths. The US is dependent on foreign countries for critical metals used in cell phones, electric vehicles, renewable energies and semiconductors.

On Aug. 1, China’s commerce department imposed new restrictions requiring exporters to seek a license to ship gallium and germanium compounds. Germanium is used in solar power and fiberoptics, along with military night-vision goggles. Gallium is used make radio frequency chips for mobile phones, satellite communications and semiconductors.

CNBC reports China shipped zero germanium and gallium in August compared to 13 tonnes total in July. The USGS says China was a leading global producer and exporter of germanium in 2022. Last year 98% of the world’s gallium was mined in China.

The curbs have pushed up prices outside of China.

In reaction to the tech wars between the US and China that started in 2020 over semiconductors, the United States has taken steps to decouple critical minerals supply chains from China. This includes Title III designations in the Defense Production Act, and subsequent funding of projects from the Department of Defense; and $2.8 billion from the Bipartisan Infrastructure Law, doled out by the Department of Energy to 21 projects involving battery materials processing and manufacturing.

One source notes that graphite projects expected to qualify for Inflation Reduction Act credits are Graphex’s pitch coating facility in Michigan, and Graphite One’s Graphite Creek project in Alaska.

Graphite One (TSXV:GPH, OTCQX:GPHOF)

The US Geological Survey has characterized Graphite Creek as America’s largest graphite resource, and one of the world’s biggest.

The US Department of Defense, the Alaska government and the Bering Straits Native Corporation (BSNC) have all committed to moving Graphite One’s vision of a US-based graphite materials supply chain forward.

Non-dilutive funding

In July, the DoD awarded GPH with a technology investment grant of $37.5 million under Title III of the Defense Production Act.

Graphite One Awarded $37.5 Million Department of Defense Grant Under the Defense Production Act

The company subsequently announced it had entered into a one-year $5 million loan agreement with Taiga Mining Company, its largest shareholder.

The proceeds will be used for infill drilling, as Graphite One moves towards its feasibility milestone. The company granted Taiga an option to purchase up to a 1% net smelter royalty (“NSR”) in increments of 0.25% for every $1.25 million advanced to the company on 133 claims owned or lease by the company, which was bought back for approximately $0.5 million on June 21, 2023. The option may be exercised at any time prior to maturity. If and when the option is exercised, the outstanding loan balance and accrued interest will be deemed consideration paid for the purchase of the NSR.

Neither the grant nor the loan is dilutive to shareholders.

In September, Graphite One closed a US$2 million strategic investment by way of a private placement from BSNC, with an option to invest a further US$6 million over the next 12 months to support the development of Graphite Creek.

The BSNC investment follows multiple community meetings with residents and company officials during 2023, Graphite One said.

It also bolsters Graphite One’s position and brings added credibility to the project. With the support of BSNC, the company can proceed with increased confidence as it strives to bring the Graphite Creek project to full-scale operations.

Also in September, Graphite One was awarded a $4.7 million contract from the Defense Logistics Agency (part of the US Department of Defense), to develop a graphite and graphene-based foam fire suppressant as an alternative to PFAS fire-suppressant materials, as required by US law.

Under a signed agreement, Vorbeck Materials Corp of Maryland is the primary sub-contractor on the DLA contract. Vorbeck is a global leader in graphene production and advanced graphene applications. Its graphene offering, VOR-X, can produce the material at large-scale levels and integrate it into numerous solutions.

2023 drilling — first assays

Graphite One plans to complete a total of 20,000 meters of drilling in 2023 and 2024 with the objective of increasing the annual concentrate production for the upcoming feasibility study (FS) compared to that assumed in the prefeasibility study (PFS).

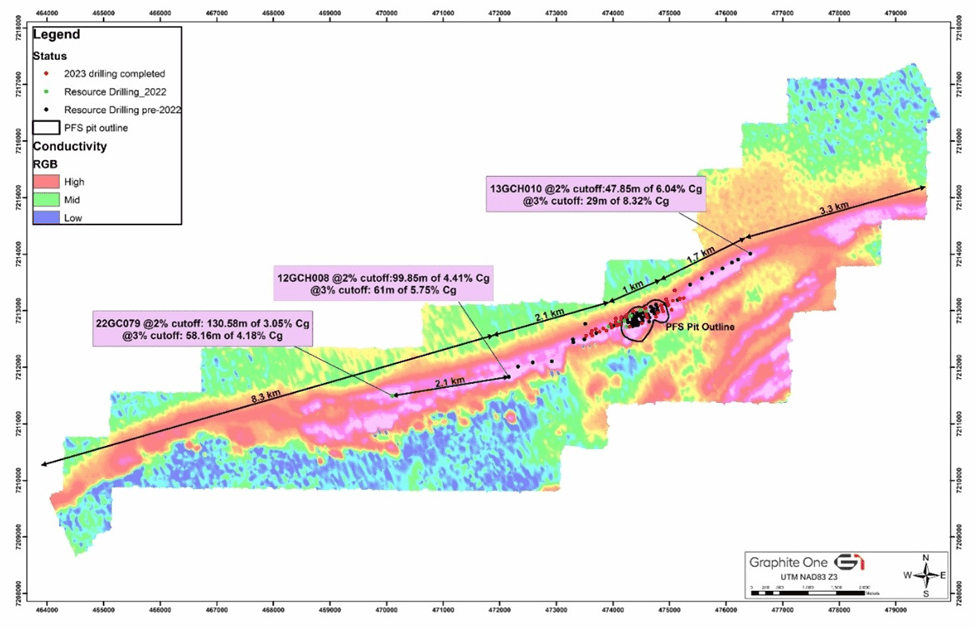

The 2023 drill program was designed to double the measured and indicated resources and increase the inferred resource by infill drilling along trend to hole 22GC079. The results of the program will feed into the company’s FS, which contemplates increasing production from 50,000 tonnes of graphite concentrate per year as estimated in the PFS to more than 150,000 tonnes of graphite concentrate.

This week Graphite One announced the completion of the 2023 drill program along with a selection of assay results. The program quadrupled the scope of 2022’s, with 57 holes completed for a total of 8,736 meters — the largest drill program in GPH’s history.

Five geotechnical holes were drilled for the purpose of evaluating construction sites or hydrology conditions. According to Graphite One, the remaining 52 holes all intersected visual graphite mineralization, and continued to demonstrate exceptional consistency of a shallow, high-grade graphite deposit that remains open both to the east and west of the existing mineral resource estimate.

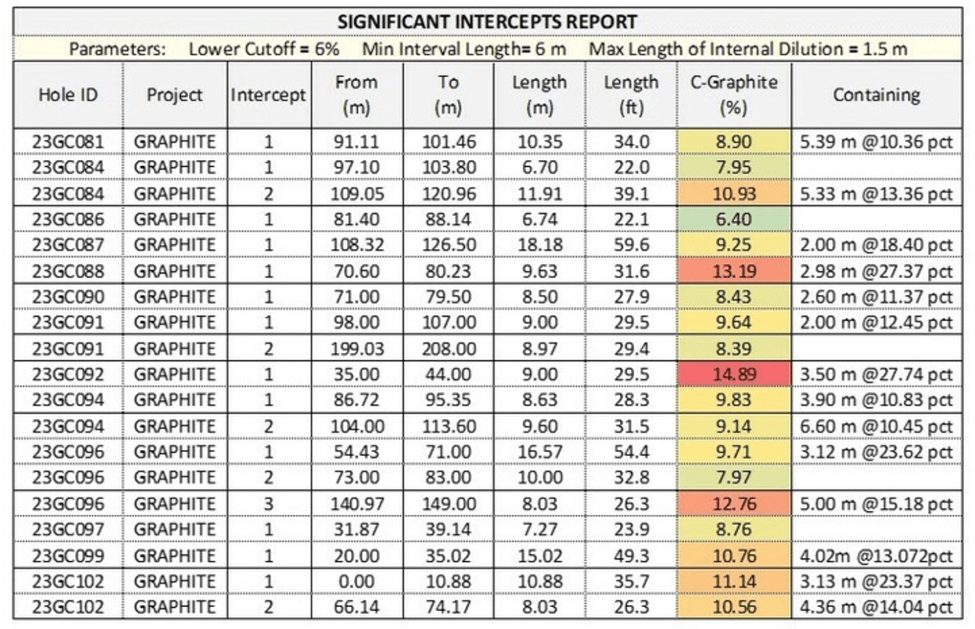

Notable intercepts include:

- 63m of 13.19% Cg from 70.60m

- 0m of 14.89% Cg from 35.0m

- 02m of 10.75% Cg from 20.0m

- 88m of 11.14% Cg from surface and 8.03m of 10.56%from 66.14m further down hole.

Summary of 2023 summer drill program results

Graphite Creek geophysical anomaly with resource drilling to date

“Our team’s impressive effort put us well on the way to completing the Feasibility Study as expeditiously as possible,” said Anthony Huston, founder and CEO of Graphite One. “The results — 52 graphite intercepts over 52 holes — confirm our confidence that Graphite Creek is truly a generational resource of strategic value to the United States, and we wish to thank the Alaskan Government, our funding partners, local stakeholders, and communities for their continued support in advancing this critical asset.”

The company anticipates that the remaining assays will be received by the end of the year and incorporated into the feasibility study, which is anticipated to be released in the fourth quarter of 2024.

“I commend the Graphite One staff and our contractors for their exceptional execution of what was by far G1’s most ambitious summer drilling program — in terms of drill holes and feet drilled — in the Company’s history,” said Mike Schaffner, Graphite One’s senior vice president of mining. “The conversion to a ground-based drilling program was very successful, resulting in much improved performance compared to past years by eliminating weather-related delays and reducing the reliance on helicopter support.”

“The leadership team at Bering Straits Native Corporation (BSNC) is pleased with the early returns from Graphite One’s busy drilling season. The impressive work of the Graphite One team, which includes local BSNC shareholders, reinforces our decision to support the project,” said BSNC director of external affairs and public relations Marleanna Hall. “As a BSNC shareholder originally from Nome myself, I am thrilled by what this project can do for our region.”

Conclusion

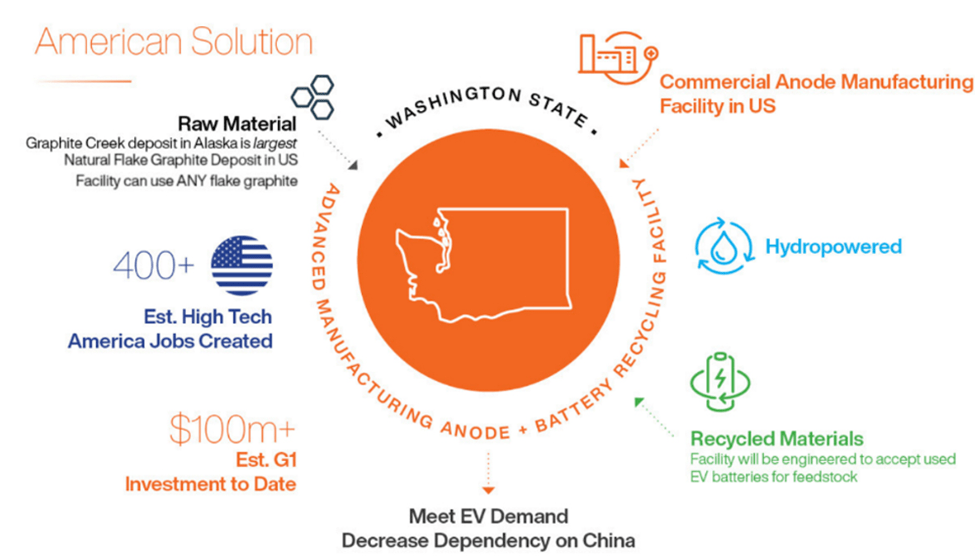

Given its significant graphite resource, which the USGS now places among the world’s largest, the deposit’s exploration upside, and its anticipated Washington State graphite product manufacturing facility, Graphite One is building the foundation for its goal of becoming the first vertically integrated producer to serve the US EV battery market.

To do that, the company entered an MOU in April 2022 with Sunrise (Guizhou) New Energy Material Company, a China-based lithium-ion battery anode material producer. The intent is to sign a technology licensing agreement, and to share expertise and technology for the design, construction, and operation of the proposed graphite material manufacturing facility in Washington State.

The Washington facility represents the second link in Graphite One’s advanced graphite materials supply chain. A planned recycling facility to reclaim graphite and other battery materials is to be co-located at the Washington plant, completing the third link.

The world simply needs more graphite, a key ingredient in EV batteries and energy storage systems for which there are no substitutes.

Analysts estimate that by 2030, it will take at least 5 million tonnes of graphite per year to fill battery demand. This is roughly four times the 1.3 million tonnes mined globally, according to the USGS’s Mineral Commodities Summaries 2023.

This is why the DOE, in its assessment, ranked graphite near the top of its list of minerals critical to America’s energy future. The US federal government’s critical minerals list also has graphite as one of five key battery minerals that are at risk of supply disruptions.

The only way to alleviate that risk is for the United States to find its own source of graphite production, and at AOTH we believe a project like Graphite One’s ticks all the boxes.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Graphite One Inc (TSXV:GPH). GPH is a paid advertiser on his site aheadoftheherd.com. This article is issued on behalf of GPH

MORE or "UNCATEGORIZED"

Bonterra Announces Closing of Upsized Brokered Private Placement for Proceeds of $10.5M

Bonterra Resources Inc. (TSX-V: BTR) (OTCQX: BONXF) (FSE: 9BR2) i... READ MORE

ESGold Expands Montauban Mine Building to 4,000 sq. ft. Ahead of Key Operational Milestones

Increased facility footprint reflects advanced construction progr... READ MORE

ARIS MINING COMPLETES INSTALLATION AND COMMISSIONING OF SECOND MILL AT SEGOVIA, ON TIME AND ON BUDGET

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces the... READ MORE

Zodiac Gold Expands Arthington Discovery with Broad Gold Intercepts

Zodiac Gold Inc. (TSXV: ZAU) a West-African gold exploration co... READ MORE

Appia Announces Final Closing of Its Non-Brokered Private Placement

Appia Rare Earths & Uranium Corp. (CSE: API) (OTCQB: APAAF) (... READ MORE