Goldshore Discovers New Mineralized Shear Zones as Part of Superion Exploration Drilling at the Moss Deposit with 17.7m of 1.52 g/t Au

Goldshore Resources Inc. (TSX-V: GSHR) (OTCQB: GSHRF) (FSE: 8X00) is pleased to announce its latest assay results from its recently completed 20,000-meter drill program targeting new mineralized shear zones to the north of the QES zone as part of the follow up drilling from the discovery of the Superion zone at the Moss Gold Project in Northwest Ontario, Canada.

Michael Henrichsen, CEO of Goldshore commented, “Additional drilling to the west of the Superion discovery continues to deliver new mineralized shear zones on the northern side of the QES Zone within or near the conceptual open pit. We believe the definition of these new mineralized zones clearly demonstrates the emerging nature of the deposit as we continue to expand mineralization. In addition, the higher-than-average resource grades that have been encountered thus far on the northern side of the pit are very encouraging and will be a focus for additional drilling in the future, as we look to define a near surface high-grade zone that could be accretive to the economic performance of the deposit.”

Highlights:

- Results from a series of holes testing an undrilled area between and on the northern flank of the QES and Main zones have intercepted multiple new mineralized shears within the existing conceptual pit. Best intercepts include:

- 10.35m of 0.59 g/t Au from 109.0m in MQD-25-178 and

- 6.0m of 1.14 g/t Au from 138.0m, including

- 3.0m of 1.73 g/t Au from 138.0m, and

- 15.4m of 0.64 g/t Au from 239.6m, including

- 4.0m of 1.44 g/t Au from 246.0m

- 17.7m of 1.52 g/t Au from 333.0m in MQD-25-179, including

- 2.3m of 8.24 g/t Au from 334.0m and

- 4.0m of 1.27 g/t Au from 346.0m, and

- 6.85m of 3.01 g/t Au from 436.0m including

- 2.0m of 9.76 g/t Au from 436.0m

- 22.0m of 0.48 g/t Au from 185.0m in MQD-25-180, and

- 18.4m of 1.36 g/t Au from 285.6m, including

- 10.75m of 2.01 g/t Au from 293.5m

- Results from the most northern step back hole, MQD-25-179, intersected the Superion mineralized trend extending the strike length to 380m with an intercept of:

- 13m of 0.84 g/t Au from 35m in MQD-25-179, including

- 2.00m of 3.84 g/t Au from 44.0m

Technical Overview

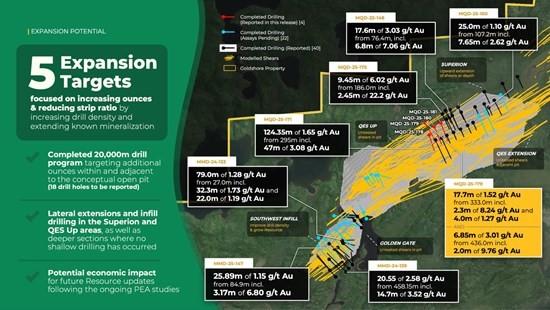

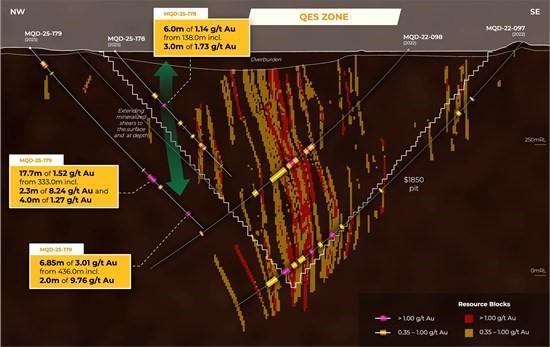

Figure 1 illustrates the location of the drill holes being reported in relation to the planned winter drill program. Figure 2 shows a cross-section through drill holes MQD-25-178 and MQD-25-179. Tables 1 and 2 provide summaries of significant intercepts and drill hole locations, respectively.

Figure 1: Summarizes the winter 2025 drill program targeting resource expansion within the conceptual open pit outlined in grey. Drill holes being reported are highlighted in red.

Figure 2: Cross section through MQD-25-178 and MQD-25-179 illustrating additional mineralized shears near the pit shell edge on the northern side of the QES Zone

Drill results reported herein are from the Superion exploration drill program, targeting a significant and largely untested area beneath swampy terrain on the north side of known mineralized shears within or near the conceptual open pit defining the Moss deposit.

MQD-25-178 was drilled approximately 300m west of the newly discovered Superion Zone. The hole collared into a porphyritic diorite before transitioning into a multi-phase diorite complex like that of the Main Zone host rock. The diorites are variably altered, changing between chlorite-epidote to sericite-silica-hematite to sericite-chlorite dominated assemblages, all of which contain 2-3% disseminated pyrite. Shear zones are altered with sericite-silica-hematite and sericite-chlorite assemblages and mineralization locally increasing to 3-5% pyrite. They yield intercepts of 10.35m of 0.59 g/t Au from 109.0m, 6.0m of 1.14 g/t Au from 137.0m including 3.0m of 1.73 g/t Au, and 15.4m of 0.64 g/t Au from 239.6m including 4.0m of 1.44 g/t Au from 246.0m.

MQD-25-179 was drilled as a 160m step back behind MQD-25-178. The hole collared into andesitic volcanics and transitioned to dacite volcanics at 39.0m where the contact is strongly sheared with Superion-style sericite-silica alteration containing highly deformed quartz-carbonate veining and 3-5% disseminated pyrite-chalcopyrite mineralization, which yielded an intercept of 13.0m of 0.84 g/t Au from 35.0m, including 2.0m of 3.84 g/t Au from 44.0m. Two shearing fabrics were measured in the area, an east-west-striking fabric, in line with the Superion mineralization trend, and a northeast-southwest-striking fabric following the main deposit trend. It is unclear at this point which trend is controlling mineralization. The hole continued in dacitic volcanics until 263.0m intersecting the same multi-phase diorite complex as described in MQD-25-178. Shear zones are altered with sericite-silica-hematite and sericite-chlorite alteration packages hosting 3-5% disseminated pyrite-chalcopyrite mineralization; and yielding multiple intercepts including 17.7m of 1.52 g/t Au from 333.0m including 2.3m of 8.24 g/t Au from 334.0m and 4.0m of 1.27 g/t Au from 346.0m, 6.1m of 0.66 g/t Au from 362.0m, and 6.85m of 3.01 g/t Au from 436.0m including 2.0m of 9.76 g/t Au from 436.0m.

Figure 3: Sericite-chlorite altered and pyrite-chalcopyrite bearing shears in MQD-25-179 returning 17.7m of 1.52 g/t Au from 333.0m as part of the Superion program between the Main and QES zone and 300m west of the Superion zone.

MQD-25-180 was drilled as a 200m step out and MQD-25-181 as a 100m step out to the west of the Superion mineralization along the deposit strike. Both holes collared into a dacitic volcanic package which contained frequent 5-10m scale diorite dykes before intersecting the multi-phase diorite package at 150m and 135m, respectively. Both holes encountered similar alteration assemblages and sheared mineralization, as described in MQD-25-178 and MQD-25-179. Sericite-silica-hematite altered shears occur as 10-20m wide intersections in MQD-25-180 yielding intercepts of 22.0m of 0.48 g/t Au from 185.0m, 1.0m of 9.23 g/t Au from 253.65, and 18.4m of 1.36 g/t Au from 285.6m, including 10.75m of 2.01 g/t Au; while the shear widths reduced to 1-5m in MQD-25-181 yielding intercepts of 4.85m of 0.73 g/t Au from 116.0m, 0.9m of 10.4 g/t Au from 149.0m, and 3.0m of 2.23 g/t Au from 275.0m. Minimal gold intercepts were encountered along strike to the east suggesting the zone has begun to pinch out.

An additional 200m area to the west remains untested between the new intercepts and the previously defined Main Zone mineralized shears. Additional drill holes in this area will be planned for later in the year.

Table 1: Significant intercepts

| HOLE ID | FROM | TO | LENGTH (m) | TRUE WIDTH (m) | CUT GRADE (g/t Au) |

UNCUT GRADE (g/t Au) |

| MQD-25-178 | 57.00 | 62.85 | 5.85 | 3.9 | 0.31 | 0.31 |

| 109.00 | 119.35 | 10.35 | 7.0 | 0.59 | 0.59 | |

| 137.00 | 143.00 | 6.00 | 4.1 | 1.14 | 1.14 | |

| incl | 138.00 | 141.00 | 3.00 | 2.0 | 1.73 | 1.73 |

| 182.00 | 189.00 | 7.00 | 4.8 | 0.61 | 0.61 | |

| 196.00 | 198.00 | 2.00 | 1.4 | 1.70 | 1.70 | |

| 217.35 | 223.00 | 5.65 | 3.9 | 0.52 | 0.52 | |

| 239.60 | 255.00 | 15.40 | 10.7 | 0.64 | 0.64 | |

| incl | 246.00 | 250.00 | 4.00 | 2.8 | 1.44 | 1.44 |

| 298.00 | 300.00 | 2.00 | 1.4 | 0.65 | 0.65 | |

| MQD-25-179 | 26.00 | 28.00 | 2.00 | 1.3 | 0.31 | 0.31 |

| 35.00 | 48.00 | 13.00 | 8.5 | 0.84 | 0.84 | |

| incl | 44.00 | 46.00 | 2.00 | 1.3 | 3.84 | 3.84 |

| 63.00 | 65.00 | 2.00 | 1.3 | 0.69 | 0.69 | |

| 317.90 | 320.00 | 2.10 | 1.5 | 0.42 | 0.42 | |

| 333.00 | 350.70 | 17.70 | 12.6 | 1.52 | 1.52 | |

| incl | 334.00 | 336.30 | 2.30 | 1.6 | 8.24 | 8.24 |

| and | 346.00 | 350.00 | 4.00 | 2.8 | 1.27 | 1.27 |

| 362.00 | 368.10 | 6.10 | 4.4 | 0.66 | 0.66 | |

| 436.00 | 442.85 | 6.85 | 5.0 | 3.01 | 3.01 | |

| incl | 436.00 | 438.00 | 2.00 | 1.4 | 9.76 | 9.76 |

| incl | 436.00 | 437.00 | 1.00 | 0.7 | 17.5 | 17.5 |

| MQD-25-180 | 175.00 | 178.05 | 3.05 | 2.2 | 0.73 | 0.73 |

| 185.00 | 207.00 | 22.00 | 15.6 | 0.48 | 0.48 | |

| 237.00 | 244.50 | 7.50 | 5.4 | 0.32 | 0.32 | |

| 253.65 | 254.65 | 1.00 | 0.7 | 9.23 | 9.23 | |

| 265.20 | 275.00 | 9.80 | 7.0 | 0.33 | 0.33 | |

| 285.60 | 304.00 | 18.40 | 13.2 | 1.36 | 1.36 | |

| incl | 293.25 | 304.00 | 10.75 | 7.7 | 2.01 | 2.01 |

| incl | 299.00 | 300.00 | 1.00 | 0.7 | 5.29 | 5.29 |

| 328.00 | 330.00 | 2.00 | 1.4 | 0.73 | 0.73 | |

| 335.30 | 341.00 | 5.70 | 4.1 | 0.72 | 0.72 | |

| 354.50 | 359.55 | 5.05 | 3.7 | 0.41 | 0.41 | |

| MQD-25-181 | 102.00 | 108.00 | 6.00 | 3.9 | 0.41 | 0.41 |

| 116.00 | 120.85 | 4.85 | 3.2 | 0.73 | 0.73 | |

| 149.00 | 149.90 | 0.90 | 0.6 | 10.4 | 10.4 | |

| 160.00 | 169.00 | 9.00 | 6.0 | 0.32 | 0.32 | |

| 216.00 | 220.25 | 4.25 | 2.8 | 0.54 | 0.54 | |

| 266.60 | 269.00 | 2.40 | 1.6 | 0.62 | 0.62 | |

| 275.00 | 278.00 | 3.00 | 2.0 | 2.23 | 2.23 | |

| 313.00 | 315.00 | 2.00 | 1.4 | 1.21 | 1.21 | |

|

Intersections calculated above a 0.3 g/t Au cut off with a top cut of 30 g/t Au and a maximum internal waste interval of 5 metres. Shaded intervals are intersections calculated above a 1.0 g/t Au cut off. Intervals in bold are those with a grade thickness factor exceeding 20 gram x metres / tonne gold. True widths are approximate and assume a subvertical body. |

||||||

Table 2: Drill Collars

| HOLE | EAST | NORTH | RL | AZIMUTH | DIP | EOH |

| MQD-25-178 | 669,639 | 5,379,690 | 428 | 161.2 | -49.6 | 327.00 |

| MQD-25-179 | 669,588 | 5,379,845 | 435 | 150.0 | -49.7 | 480.00 |

| MQD-25-180 | 669,706 | 5,379,798 | 428 | 157.5 | -50.1 | 381.00 |

| MQD-25-181 | 669,791 | 5,379,844 | 428 | 158.3 | -48.6 | 379.35 |

Analytical and QA/QC Procedures

The HQ diameter drill core has been oriented using ACTIII or equivalent tools and validated in the core shack. All core has been sawed in half cut just off the core orientation line (bottom of hole) with the right half (looking down hole) of the core bagged and sent a third-party analytical laboratory. The left half of the core was returned to core boxes and is stored at Goldshore’s Kashabowie core yard facility.

All samples were sent to ALS Geochemistry in Thunder Bay for preparation and analysis was performed in the ALS Vancouver analytical facility. ALS is accredited by the Standards Council of Canada (SCC) for the Accreditation of Mineral Analysis Testing Laboratories and CAN-P-4E ISO/IEC 17025. Samples were analysed for gold via fire assay with an AA finish and 48 pathfinder elements via ICP-MS after four-acid digestion. Samples that assayed over 10 ppm Au were re-run via fire assay with a gravimetric finish.

In addition to ALS quality assurance / quality control protocols, Goldshore has implemented a quality control program for all samples collected through the drilling program. The quality control program was designed by a qualified and independent third party, with a focus on the quality of analytical results for gold. Analytical results are received, imported to our secure on-line database and evaluated to meet our established guidelines to ensure that all sample batches pass industry best practice for analytical quality control. Certified reference materials are considered acceptable if values returned are within three standard deviations of the certified value reported by the manufacture of the material. In addition to the certified reference material, certified blank material is included in the sample stream to monitor contamination during sample preparation. Blank material results are assessed based on the returned gold result being less than ten times the quoted lower detection limit of the analytical method. The results of the on-going analytical quality control program are evaluated and reported to Goldshore by Orix Geoscience Inc.

Qualified Person

Peter Flindell, PGeo, MAusIMM, MAIG, Vice-President, Exploration, of the Company, and a qualified person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has approved the scientific and technical information contained in this news release.

Mr. Flindell has verified the data disclosed. To verify the information related to the winter drill program at the Moss Gold Project, Mr. Flindell has visited the property several times; discussed and reviewed logging, sampling, bulk density, core cutting and sample shipping processes with responsible site staff; discussed and reviewed assay and QA/QC results with responsible personnel; and reviewed supporting documentation, including drill hole location and orientation and significant assay interval calculations. He has also overseen the Company’s health and safety policies in the field to ensure full compliance, and consulted with the Project’s host indigenous communities on the planning and implementation of the drill program, particularly with respect to its impact on the environment and the Company’s remediation protocols.

About Goldshore

Goldshore is a growth-oriented gold company focused on delivering long-term shareholder and stakeholder value through the acquisition and advancement of primary gold assets in tier-one jurisdictions. It is led by the ex-global head of structural geology for the world’s largest gold company and backed by one of Canada’s pre-eminent private equity firms. The Company’s current focus is the advanced stage 100% owned Moss Gold Project which is positioned in Ontario, Canada, with direct access from the Trans-Canada Highway, hydroelectric power near site, supportive local communities and skilled workforce. The Company has invested over $75 million of new capital and completed approximately 100,000 meters of drilling on the Moss Gold Project, which, in aggregate, has had over 255,000 meters of drilling. The 2024 updated NI 43-101 mineral resource estimate has expanded to 1.54 million ounces of Indicated gold resources at 1.23 g/t Au and 5.20 million ounces of Inferred gold resources at 1.11 g/t Au. The MRE only encompasses 3.6 kilometers of the 35+ kilometer mineralized trend, remains open at depth and along strike and is one of the few remaining major Canadian gold deposits positioned for development in this cycle. Please see NI 43-101 technical report titled: “Technical Report and Updated Mineral Resource Estimate for the Moss Gold Project, Ontario, Canada,” dated March 20, 2024 with an effective date of January 31, 2024 available under the Company’s SEDAR+ profile at www.sedarplus.ca.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE