The Prospector News

GoldMining Inc. Confirms Additional Significant Gold-Antimony Results in Historic Drilling, Including 4.01 g/t AuEq over 56 metres (2.06 g/t Au & 0.55% Sb) and 2.54 g/t AuEq over 107 metres (1.44 g/t Au & 0.31% Sb), at its Crucero Project, Peru

You have opened a direct link to the current edition PDF

Open PDF CloseGoldMining Inc. Confirms Additional Significant Gold-Antimony Results in Historic Drilling, Including 4.01 g/t AuEq over 56 metres (2.06 g/t Au & 0.55% Sb) and 2.54 g/t AuEq over 107 metres (1.44 g/t Au & 0.31% Sb), at its Crucero Project, Peru

GoldMining Inc. (TSX: GOLD) (NYSE American: GLDG) is pleased to report additional strong historic drill intercepts from its 100% owned Crucero Project in Peru. These results are reported as part of the Company’s previously announced ongoing review and validation of historic assay results, which has continued to show significant antimony mineralization, in conjunction with the known gold mineralization, expanding the project’s potential for multi-metal value creation.

Drill Intercept Highlights:

- CPC 10-1: 2.03 g/t gold equivalent* (1.58 g/t Au & 0.13% Sb) over 133.1 metres from 4 metres depth;

- CPC 10-3: 2.25 g/t AuEq (1.54 g/t Au & 0.20% Sb) over 88 metres, from 72 metres depth;

- DDH-07: 30.41 g/t AuEq (3.72 g/t Au & 7.58% Sb) over 2 metres, from 49 metres depth;

- DDH-24: 2.54 g/t AuEq (1.44 g/t Au & 0.31% Sb) over 107 metres, from 108 metres depth;

- DDH-27: 4.01 g/t AuEq (2.06 g/t Au & 0.55% Sb) over 56 metres, from 133 metres depth; and,

- DDH-34: 6.25 g/t AuEq (1.88 g/t Au & 1.24% Sb) over 20 metres, from 385 metres depth.

|

*AuEq is calculated using the formula AuEq (g/t) = Au grade (g/t) + 3.52 * Sb grade (%). Au price of $2,200/oz and Sb price of $35,600/tonne (both approximately 35% below current spot price). Reports gold recovery at 100% and uses a notional antimony recovery of 70%. |

“These results strengthen our confidence in Crucero’s potential as a dual gold-antimony system,” said Alastair Still, CEO of GoldMining. “With antimony price near record highs and gold mineralization already confirmed, we are working to uncover new value in a project that has been underexplored for critical metals potential. Antimony, primarily occurring as the mineral stibnite, co-exists with gold mineralization at the Project. We believe that thorough continued analysis of the historic gold and antimony results within the existing assay database there is an opportunity to enhance the economic value for the 100% owned Crucero Project.”

Further to the Company’s April 23, 2025, news release, which presented assay intercepts for historic drillholes DDH-01 to -04, the Company has continued to systematically compile Sb assay results within the Project drill database. This work has included the validation of historic assays against original independent laboratory certificates. Presented herein are assays for a further 20 drill holes that have been validated by the Company to date.

The updated and revised Crucero database now contains assay data for 79 drill holes as well as 657 trench assays including over 17,000 assay records, 13,296 of which have independent laboratory certificates available. The Company is working with the laboratories to locate additional archived assay certificates, in order to build a comprehensive database and undertake further analysis of the distribution and grade of antimony throughout the Project.

Crucero Project

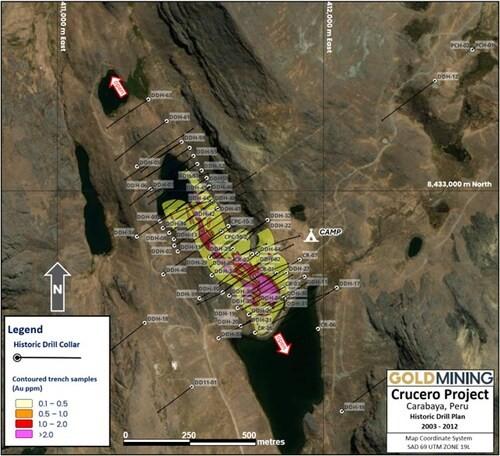

The Crucero Project (see Figure 1) is located in the Andes mountain range in Carabaya Province, in southeastern Peru. The village of Caserio de Oscoroque is located approximately 10 km to the west of the Project by road, and the nearest major community is the city of Juliaca, about 150 km to the south-southwest, which has an airport that provides domestic flights that connect throughout Peru.

The Project contains orogenic gold mineralization that is associated with pyrite, pyrrhotite, arsenopyrite and stibnite mineralization. The mineralization is contained within altered meta-sedimentary rocks belonging to the Ananea Formation of Lower Paleozoic age.

Exploration programs from 1996 to 2012 by previous operators included geological mapping, soil and rock geochemistry, trenching, surface geophysical surveys, diamond drilling and metallurgical testwork. Drilling across the Project totals 79 core holes for 24,705 metres completed from 2003 to 2012.

To date, exploration of the Project has concentrated on the A1 Zone which dips vertically to steeply to the east, is approximately 750 metres along strike by 100 metres in width and is traced to a vertical depth of approximately 400 metres. The A1 Zone is hosted within meta-sediments (mudstones and siltstones) of the Ananea Group. Pyrite is the most abundant sulphide mineral and typically occurs as blebs, the distribution of which commonly appears to be along foliation or bedding. Quartz veins are uncommon and are not necessarily gold-bearing, although the highest-grade gold found to date is within quartz veins with stibnite.

Prior geological studies have interpreted that the A1 Zone has been subjected to two phases of gold mineralization of which the major gold-mineralizing event formed during isoclinal folding, is largely conformable with bedding and is associated primarily with pyrite and pyrrhotite. The second phase of gold mineralization is associated with later deformation characterized by brittle deformation that resulted in the development of faulting and remobilization of gold that is associated with arsenopyrite and antimony mineralization. This later phase of gold mineralization is volumetrically minor compared to the first phase; however, it is more significant because the higher gold and antimony grades occur with this later phase.

For further information regarding the Crucero Project, please refer to the technical report summary titled “43-101 Technical Report, Crucero Property, Carabaya Province, Peru” with an effective date of December 20, 2017, (the “Technical Report”), available under the Company’s profile at www.sedarplus.ca.

Table 1 – Crucero Project historical drill assay intercepts. Bold intervals correspond with those reported in the ‘highlights’ section above.

| Hole Number | Interval From (m) |

Interval To (m) |

Core Length (m) |

Gold Grade (g/t) |

Antimony Grade (%) |

AuEq (g/t)* |

| CPC 10-1 | 4.00 | 137.10 | 133.10 | 1.58 | 0.13 | 2.03 |

| including | 49.00 | 73.00 | 24.00 | 2.27 | 0.56 | 4.23 |

| CPC 10-2 | 27.50 | 97.50 | 70.00 | 0.86 | 0.03 | 0.96 |

| CPC 10-3 | 72.00 | 160.00 | 88.00 | 1.54 | 0.20 | 2.25 |

| including | 110.00 | 120.00 | 10.00 | 2.75 | 0.54 | 4.65 |

| DDH-06 | 52.00 | 54.00 | 2.00 | 4.21 | 0.00 | 4.21 |

| DDH-07 | 49.00 | 51.00 | 2.00 | 3.72 | 7.58 | 30.41 |

| including | 50.00 | 50.40 | 0.40 | 14.90 | 30.90 | 123.67 |

| Also | 124.00 | 162.00 | 38.00 | 0.74 | 0.08 | 1.03 |

| DDH-08 | 134.00 | 151.46 | 17.46 | 5.11 | 0.00 | 5.11 |

| including | 139.00 | 141.00 | 2.00 | 34.50 | 0.01 | 34.53 |

| Also | 160.00 | 202.00 | 42.00 | 0.82 | 0.31 | 1.91 |

| including | 174.00 | 190.00 | 16.00 | 1.39 | 0.80 | 4.19 |

| Also | 214.00 | 298.00 | 84.00 | 0.38 | 0.14 | 0.88 |

| including | 218.00 | 243.00 | 25.00 | 0.18 | 0.46 | 1.80 |

| DDH-09 | 109.00 | 141.00 | 32.00 | 1.54 | 0.01 | 1.56 |

| Also | 152.90 | 206.00 | 53.10 | 1.42 | 0.51 | 3.21 |

| DDH-18 | No Significant Intercept | |||||

| DDH-19 | 143.00 | 179.00 | 36.00 | 1.55 | 0.03 | 1.66 |

| Also | 199.00 | 275.00 | 76.00 | 1.58 | 0.09 | 1.90 |

| including | 202.00 | 250.00 | 48.00 | 2.09 | 0.14 | 2.60 |

| including | 232.00 | 233.00 | 1.00 | 13.38 | 2.51 | 22.22 |

| Also | 356.00 | 378.00 | 22.00 | 0.77 | 0.12 | 1.18 |

| Also | 408.00 | 460.00 | 52.00 | 0.68 | 0.25 | 1.56 |

| including | 414.00 | 427.00 | 13.00 | 0.50 | 0.97 | 3.93 |

| DDH-20 | 63.00 | 70.00 | 7.00 | 4.34 | 0.01 | 4.37 |

| Also | 78.00 | 86.00 | 8.00 | 1.15 | 0.06 | 1.34 |

| Also | 146.00 | 155.00 | 9.00 | 1.32 | 0.12 | 1.73 |

| Also | 163.00 | 180.00 | 17.00 | 1.71 | 0.01 | 1.75 |

| Also | 190.00 | 201.00 | 11.00 | 2.86 | 0.37 | 4.14 |

| Also | 318.00 | 352.00 | 34.00 | 0.76 | 0.01 | 0.79 |

| Also | 363.00 | 392.00 | 29.00 | 0.80 | 0.03 | 0.91 |

| DDH-21 | 80.00 | 102.80 | 22.80 | 1.58 | 0.18 | 2.21 |

| Also | 114.00 | 207.00 | 93.00 | 1.25 | 0.02 | 1.32 |

| Also | 235.00 | 288.00 | 53.00 | 0.61 | 0.04 | 0.75 |

| Also | 323.00 | 338.05 | 15.05 | 1.39 | 0.00 | 1.39 |

| DDH-23 | 49.00 | 86.00 | 37.00 | 1.07 | 0.04 | 1.20 |

| DDH-24 | 108.00 | 215.00 | 107.00 | 1.44 | 0.31 | 2.54 |

| including | 132.00 | 141.00 | 9.00 | 1.46 | 0.95 | 4.80 |

| including | 189.00 | 209.00 | 20.00 | 0.98 | 0.98 | 4.43 |

| DDH-26 | 119.00 | 159.00 | 40.00 | 1.77 | 0.10 | 2.12 |

| and | 185.00 | 206.00 | 21.00 | 1.21 | 0.01 | 1.23 |

| DDH-27 | 133.00 | 189.00 | 56.00 | 2.06 | 0.55 | 4.01 |

| including | 139.00 | 144.00 | 5.00 | 1.97 | 1.55 | 7.43 |

| including | 150.00 | 162.00 | 12.00 | 2.47 | 1.61 | 8.14 |

| Also | 202.00 | 237.00 | 35.00 | 1.02 | 0.01 | 1.04 |

| DDH-31 | 3.55 | 70.00 | 66.45 | 1.32 | 0.16 | 1.88 |

| including | 4.00 | 33.00 | 29.00 | 1.67 | 0.36 | 2.93 |

| DDH-32 | No Significant Intercept | |||||

| DDH-33 | 223.00 | 233.00 | 10.00 | 0.99 | 0.04 | 1.14 |

| Also | 248.00 | 275.00 | 27.00 | 0.87 | 0.01 | 0.90 |

| Also | 413.00 | 448.00 | 35.00 | 0.82 | 0.01 | 0.86 |

| DDH-34 | 385.00 | 405.00 | 20.00 | 1.88 | 1.24 | 6.25 |

| including | 393.00 | 404.00 | 11.00 | 2.65 | 2.13 | 10.15 |

| DDH-35 | 35.00 | 43.00 | 8.00 | 0.93 | 0.10 | 1.27 |

| Also | 94.00 | 110.00 | 16.00 | 1.27 | 0.00 | 1.27 |

| Also | 136.00 | 188.00 | 52.00 | 1.62 | 0.33 | 2.78 |

| including | 142.00 | 179.00 | 37.00 | 1.84 | 0.45 | 3.43 |

|

Notes: |

||||||

| Mineralized intercepts are estimated to be approximately two-thirds of true width. | ||||||

| *AuEq is calculated using the formula AuEq (g/t) = Au grade (g/t) + 3.52 * Sb grade (%), Uses – Au price of $2,200/oz and Sb price of $35,600/tonne (both approximately 35% below current spot). Reports gold recovery at 100% but uses a notional recovery of the Antimony of 70%. | ||||||

Table 2 – Crucero Project drill hole collar location coordinates for historical drill hole intercepts detailed in Table 1.

| Hole Number |

Easting

Metres |

Northing

Metres |

Elevation (m above sea level) |

Depth (m) |

Azi° | Dip° | Year Drilled |

| CPC 10-1 | 411013 | 8432920 | 4452.1 | 137.1 | 236 | -45 | 2010 |

| CPC 10-2 | 410769 | 8433177 | 4457.2 | 101.1 | 233 | -45 | 2010 |

| CPC 10-3 | 410799 | 8433199 | 4454.0 | 182.9 | 234 | -60 | 2010 |

| DDH-06 | 410513 | 8433320 | 4407.1 | 134.5 | 231 | -45 | 2009 |

| DDH-07 | 410510 | 8433320 | 4407.1 | 315 | 75 | -45 | 2009 |

| DDH-08 | 410583 | 8433156 | 4401.9 | 361.6 | 56 | -45 | 2009 |

| DDH-09 | 410771 | 8432933 | 4468.5 | 312.4 | 52 | -45 | 2009 |

| DDH-18 | 410480 | 8432832 | 4475.5 | 313.9 | 233 | -45 | 2011 |

| DDH-19 | 410829 | 8432889 | 4453.8 | 480.4 | 238 | -45 | 2012 |

| DDH-20 | 410841 | 8432818 | 4450.0 | 470 | 72 | -44 | 2012 |

| DDH-21 | 410870 | 8432865 | 4451.5 | 338 | 63 | -46 | 2011 |

| DDH-23 | 410810 | 8433100 | 4487.2 | 155 | 235 | -45 | 2010 |

| DDH-24 | 410733 | 8433011 | 4467.3 | 250 | 56 | -45 | 2011 |

| DDH-26 | 410879 | 8432867 | 4451.0 | 300 | 60 | -60 | 2010 |

| DDH-27 | 411031 | 8433011 | 4465.3 | 260 | 240 | -45 | 2010 |

| DDH-31 | 411013 | 8432920 | 4451.6 | 92.1 | 180 | -60 | 2011 |

| DDH-32 | 410942 | 8433220 | 4487.3 | 400 | 238 | -75 | 2011 |

| DDH-33 | 410766 | 8432774 | 4448.0 | 586.8 | 67 | -45 | 2012 |

| DDH-34 | 410452 | 8433156 | 4398.0 | 551 | 56 | -56 | 2012 |

| DDH-35 | 410797 | 8432935 | 4459.9 | 256 | 63 | -45 | 2011 |

Data Verification

The Technical Report and the Company’s historic exploration database, including verification of laboratory certificates, were used to verify the reported assay intercepts. As detailed in the Technical Report, Crucero Project drill core sampling program comprised the following procedure: prior to processing, core was photographed and measured for core loss, then logged geologically and marked for sampling. Sample lengths downhole were generally 1.0 metres within visually mineralized core, to 2.0 metres outside mineralized zones, except where samples were taken to honor geological contacts. Samples were obtained by sawing the core in half; half was placed in a numbered sample bag and the other half stored in the core box for reference. Normal security measures were taken throughout the sampling and shipping processes. All drill programs used standards, duplicates and blanks that were introduced into the sample stream on the Property during the sample preparation process, and/or introduced by the independent laboratory during the analysis. The sampled half-core was then sent for assay to either ALS Peru S.A. (“ALS”), or SGS del Peru S.A.C. (“SGS”), each an independent assay laboratory.

SGS completed sample analysis in Lima, Peru, for drill holes DDH-19, DDH-20, DDH-32, DDH-33, DDH-34 (this release). Analysis utilized four standard SGS analytical procedures: 1) gold was analyzed by fire assay of a 50-gram aliquot with an atomic absorption finish (FAA515); 2) if the sample contained more than 500 ppb gold the sample was re-analyzed using fire assay and a gravimetric finish (FAG505); 3) samples were also analyzed for a 33-element package using four-acid digestion and inductively coupled plasma (ICP) with an atomic emission spectroscopy (AES) finish (ICP40B); and 4) if the sample contained more than 10,000 ppb arsenic or antimony, these elements were analyzed using atomic absorption (AAS41b).

ALS Global completed sample preparation and analysis in Lima, Peru, for drill holes CPC 10-1, CPC 10-2, CPC10-3, DDH-05, DDH-06, DDH-07, DDH-08, DDH-09, DDH-10, DDH-18, DDH-21, DDH-23, DDH-24, DDH-26, DDH-27, DDH-31, DDH-35 (this release). Analysis utilized four standard ALS analytical procedures: 1) gold analyses were completed by fire assay fusion with AAS finish (Au-AA24 method) on 50 grams test weight; 2) if the sample contained more than 10,000 ppb gold the sample was re-analyzed using fire assay and a gravimetric finish (Au-GRA21); 3) antimony and other multi element analyses (total suite of 35 elements) were assayed by aqua regia digestion and ICP-MS analysis (ME-ICP41 method) on 0.25 grams test weight; and 4) antimony which assayed at the upper level of detection of 10,000 ppm, was generally re-assayed to percent level analysis via atomic absorption spectrometry (Sb-AA08 method).

Qualified Person

Tim Smith, P. Geo., Vice President Exploration of GoldMining, has supervised the preparation of, and verified and approved, all other scientific and technical information herein this news release. Mr. Smith is also a qualified person as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About GoldMining Inc.

GoldMining Inc. is a public mineral exploration company focused on acquiring and developing gold assets in the Americas. Through its disciplined acquisition strategy, GoldMining now controls a diversified portfolio of resource-stage gold and gold-copper projects in Canada, the U.S.A., Brazil, Colombia, and Peru. The Company also owns approximately 21.5 million shares of Gold Royalty Corp. (NYSE American: GROY), 9.9 million shares of U.S. GoldMining Inc. (Nasdaq: USGO) and 26 million shares of NevGold Corp. (TSXV: NAU).

Figure 1 – Crucero Project, Department of Puno, Province of Carabaya, Peru. (CNW Group/GoldMining Inc.)

Figure 2 – Crucero plan map showing location of drill holes and an outline of mineralization exposed at surface within the A1 Zone. (CNW Group/GoldMining Inc.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE