GoldMining Drilling Intercepts Gold Mineralization at Depth, São Jorge Project Pará State, Brazil

GoldMining Inc. (TSX: GOLD) (NYSE American: GLDG) is pleased to report additional assay results from the 2025 drilling program at its 100% owned São Jorge Project in the Tapajós gold district, Pará State, Brazil. The results are from the previously announced diamond core drilling program consisting of 3,862 metres drilling designed to test below and along trend of the existing São Jorge mineral resource estimate area, and to further support the initial reverse circulation drilling results that previously identified exploration discoveries at four new gold prospects, including at the William South, William North, Ivonette and Dragon West prospects within a two kilometre radius of the existing Deposit (see news release October 20, 2025; January 6, 2026).

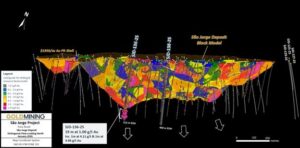

Figure 3 São Jorge Deposit diamond core drill results, as of January 26, 2026. (CNW Group/GoldMining Inc.)

Highlights:

- São Jorge Diamond Core Drilling Results:

- 19 m at 1.00 grams per tonne gold from 425 m depth (SJD-136-25).

- Within a broader zone of 73 m at 0.54 g/t Au from 422 m depth.

- SJD-136-25 was drilled beneath the existing mineral resource estimate constraining pit shell and represents one of the deepest drill intercepts at the project to date.

- 3 m at 1.10 g/t Au from 10 m depth and 1 m at 1.15 g/t Au from 45 m depth (SJD-133-25) at São Jorge Deposit ‘Northwest’ Extensionprospect.

- 19 m at 1.00 grams per tonne gold from 425 m depth (SJD-136-25).

- Processing of Induced Polarisation data collected in 2025 confirms a broad chargeability high anomaly at William South similar in scale to the known IP signature of the São Jorge Deposit.

- The IP anomaly extends more than 1km and is located approximately 2 km from the Deposit.

- Drilling over the highest chargeability core of the IP anomaly is planned in 2026.

- The Company has recently remobilized the geophysical survey team to continue expanding the IP survey to the east of the existing grid.

- Exploration results received to date support the broader potential for future extensions of the presently delineated São Jorge deposit through additional exploration work and delineation of potential new discoveries of gold mineralization across the 46,000 hectare 100% owned São Jorge Project.

Alastair Still, Chief Executive Officer of GoldMining, commented: “GoldMining is pleased with the results of the 2025 diamond core drilling program which has identified mineralization that may extend the known depth of the São Jorge gold deposit. We’re encouraged by the potential for additional systematic drilling to potentially extend the mineral resource deeper. Drilling also provided additional indications of a potential continuation of mineralization along strike of the Deposit to the northwest. Furthermore, the 2025 IP survey expansion over targets that contain some of the largest, highest tenor and most continuous gold-in-soil anomalies on the property, has discovered the William South IP Anomaly, a large, high tenor chargeability feature with scale similar to the IP signature of the Deposit itself. The systematic approach by the technical team to building up multiple lines of evidence points towards an exciting emerging target area at William South which has yet to be tested systematically by drilling. We look forward to announcing 2026 exploration plans in due course. The excellent infrastructure at the Project helps facilitate our exploration activities to potentially deliver significant growth on a highly prospective regional-scale property in the rapidly emerging Tapajós gold district.”

Project Overview

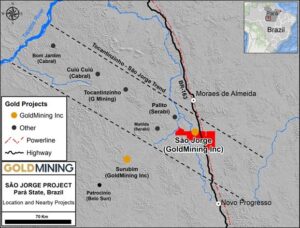

The São Jorge Gold Project is located in the Tapajós gold district (see Figure 1) in the south-central portion of the Amazon Craton. The São Jorge gold deposit is a granite-hosted, intrusion-related gold mineral system which is a similar style to the Tocantinzinho gold mine located approximately 80 km northwest of São Jorge. Exploration activities at the Project carried out by the Company over the past two years have successfully delineated several new exploration targets comprising gold ± copper ± molybdenum ± silver soil geochemical anomalies, which cumulatively outline a large mineral system (see news releases dated March 18 and April 14, 2025). The São Jorge mineral system is defined by a comprehensive exploration data set which the Company has developed over previous systematic exploration campaigns. Surrounding the currently delineated São Jorge deposit, which has a defined 1.4 km strike length, the broader mineral system comprises a zone of contiguous surface geochemical anomalies over an area of 12 km x 7 km, which the Company interprets to be the surface expression of a broad intrusion related gold system.

The 2025 São Jorge exploration program comprised a total of 9,533 m of drilling, which exceeded the total planned meterage of 9,000 m while remaining on–budget, including 3,862 m diamond core, 3,528 m RC and 2,143 m auger drilling.

2025 São Jorge Diamond Core Drilling Program

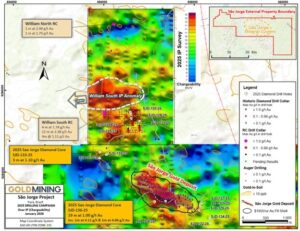

The objective of the 2025 diamond core drilling program was to test several target areas within 1-2 kilometres of the Deposit, including immediate wingspan extensions along strike and to depth, and an emerging target area at the William South Prospect, which is located 1.5 km north of the Deposit; see Figure 2.

Deposit Wingspan Expansion Drilling

Five diamond core holes were drilled on 2 x 200 metre step-out drill sections along trend to the southeast of the São Jorge Deposit. Drilling targeted the projected strike continuation of the Deposit and extended southwards across strike to test a broad deep IP chargeability anomaly. Drilling intersected intercalated syenogranite and volcanics in contact with monzogranite intrusives, with rare thin quartz veins and broad zones of 0.5 – 2% pyrite mineralization which is likely the source of the IP chargeability anomalism in bedrock. Assays indicated this zone of chargeability is weakly mineralized with respect to gold, with a best intercept of 1 m at 0.90g/t Au from 2m depth in colluvial cover, and 1 m at 0.24 g/t Au from 45 m depth in bedrock.

Three diamond core holes were drilled along trend to the northwest of the Deposit, located approximately 1 kilometre from the western limit of the currently delineated Deposit, to follow-up on 2024 core intercepts which returned 10 m at 0.66 g/t Au from 93 m depth (news release September 9, 2025). The 2025 diamond core drilling successfully intersected the monzogranite (host rock) – syenogranite contact, which is the focus of structural deformation and mineralization at the Deposit. The drilling returned encouraging intercepts of 3 m at 1.10 g/t Au from 10 m depth and 1 m at 1.15 g/t Au from 45 m depth (SJD-133-25). Additional drilling is warranted over the 1 kilometre of strike between the NW Extension and the Deposit, as well as further northwest along strike.

Two deep diamond core drill holes were drilled below the Deposit, testing the potential down-dip extension of mineralization below the depth of the current mineral resource estimate constraining pit shell (see Figure 3). Both holes were targeted to test pierce points on the plane of mineralization projected down plunge of discontinuous high-grade shoots evident in long section view.

SJD-136-25 drilled below a high grade zone of mineralization at the western end of the proposed pit shell, intersecting 19 m at 1.00 g/t Au from 425 m depth, within a broader zone of 73 m at 0.54 g/t Au from 422 m depth. Mineralization occurred within the expected down-dip projection of the mineralized plane, comprising quartz veins and sulphide mineralization within sheared and fractured monzogranite.

SJD-138-25 returned a best intercept of 1 m at 1.25 g/t Au from 175 m depth, which was above the targeted pierce point and hosted in syenogranite; whereas in the projected target zone deeper within the monzogranite host rock, drilling intersected quartz veining and sulphides with only low grade gold values. Gold grade distribution within the Deposit is interpreted to be a function of the intersection of cross-structures with the main WNW-ESE striking mineralized trend. Mineralization remains broadly open at depth below the currently delineated Deposit and therefore additional drilling is warranted to test for potential additional extensions of the mineral resource.

William South Prospect

The emerging William South target area was initially identified by gold-in-soil geochemistry sampling which returned high tenor results over a broad 2 km x 2 km area located approximately 2 kilometres north of the Deposit, with soil assays peaking at 2,163 ppb Au (2.163 g/t Au). Shallow auger drilling completed in 2024 returned encouraging intercepts including 1 m at 17.14g/t Au from 12 m depth, 1 m at 10.2 g/t Au from 14 m depth, 5 m at 2.78 g/t Au from 10 m depth and 3 m at 1.05 g/t Au from 12 m depth (news release November 11, 2024). The gold-in-auger intercepts were initially interpreted to be at the top of the saprolitic (weathered bedrock) horizon, but they could represent a colluvial layer at the base of the transported overburden as it is difficult to distinguish transported clay from in situweathered bedrock clay within the saprolitic weathering profile that is typical in the district.

Diamond core drilling intersected monzogranite with rare thin quartz veins and minor sulphide mineralization, returning a best result of 1 m at 0.75 g/t Au from 87 m (SJD-130-25). The drilling was completed prior to completion of the 2025 IP survey which extended the geophysical data set northward from the Deposit over the William South and North prospect areas. IP image processing is now completed which has revealed that the 2025 diamond core drilling at William South tested an area of moderate-high but discontinuous IP chargeability, which is located on the southern flank of a larger, higher tenor and more continuous IP chargeability anomaly – the ‘William South IP Anomaly’ (see Figure 2) – which is similar in scale to the chargeability signature associated with the Deposit. Recently released RC drill results (January 6, 2026) for 2025 drilling also located on the southern flank of the main IP chargeability anomaly returned encouraging drill intercepts including 12 m at 2.38 g/t Au from 13 m depth, 4 m at 1.11 g/t Au from 46 m depth and 1 m at 1.23 g/t Au from 16 m depth. The core of the main William South IP anomaly has not yet been drill tested and remains a high priority for 2026 exploration programs.

Table 1 São Jorge 2025 DDH results at William South prospect (as of January 26, 2026).

|

Prospect Name |

Drill Hole |

Interval |

Interval |

Sample |

Au Grade |

Ag Grade |

Cu Grade |

|

SE Extension |

SJD-125-25 |

28 |

29 |

1 |

0.14 |

0.11 |

81 |

|

178 |

179 |

1 |

0.16 |

0.09 |

45 |

||

|

244 |

247 |

3 |

0.10 |

0.22 |

130 |

||

|

272 |

273 |

1 |

0.10 |

0.48 |

269 |

||

|

William South |

SJD-126-25 |

2 |

9 |

7 |

0.20 |

1.22 |

30 |

|

including |

8 |

9 |

1 |

0.83 |

2.58 |

30 |

|

|

13 |

14 |

1 |

0.37 |

5.20 |

49 |

||

|

54 |

55 |

1 |

0.10 |

0.03 |

32 |

||

|

William South |

SJD-126B-25 |

8 |

9 |

1 |

0.17 |

0.83 |

18 |

|

20 |

21 |

1 |

0.20 |

0.63 |

18 |

||

|

73 |

77 |

4 |

0.14 |

0.04 |

3 |

||

|

including |

76 |

77 |

1 |

0.41 |

0.06 |

5 |

|

|

85 |

86 |

1 |

0.20 |

0.07 |

25 |

||

|

SE Extension |

SJD-127-25 |

NSR |

|||||

|

William South |

SJD-128-25 |

134 |

138 |

4 |

0.10 |

0.04 |

8 |

|

including |

134 |

135 |

1 |

0.25 |

0.06 |

10 |

|

|

146 |

151 |

5 |

0.11 |

0.05 |

6 |

||

|

including |

146 |

147 |

1 |

0.32 |

0.07 |

5 |

|

|

194 |

195 |

1 |

0.11 |

0.16 |

34 |

||

|

196 |

197 |

1 |

0.10 |

0.02 |

3 |

||

|

200 |

201 |

1 |

0.11 |

0.04 |

5 |

||

|

SE Extension |

SJD-129-25 |

2 |

3 |

1 |

0.90 |

0.85 |

11 |

|

7 |

8 |

1 |

0.15 |

3.64 |

66 |

||

|

45 |

46 |

1 |

0.24 |

0.13 |

99 |

||

|

William South |

SJD-130-25 |

49 |

50 |

1 |

0.34 |

0.04 |

2 |

|

62 |

65 |

3 |

0.18 |

0.08 |

142 |

||

|

including |

62 |

63 |

1 |

0.39 |

0.20 |

294 |

|

|

87 |

88 |

1 |

0.75 |

0.35 |

11 |

||

|

163 |

164 |

1 |

0.24 |

0.39 |

733 |

||

|

169 |

171 |

2 |

0.11 |

0.19 |

226 |

||

|

William South |

SJD-131-25 |

189 |

190 |

1 |

0.11 |

0.04 |

10 |

|

SE Extension |

SJD-132-25 |

NSR |

|||||

|

NW Extension |

SJD-133-25 |

0 |

1 |

1 |

0.22 |

0.25 |

36 |

|

3 |

4 |

1 |

0.11 |

0.06 |

33 |

||

|

10 |

13 |

3 |

1.10 |

0.11 |

34 |

||

|

including |

10 |

11 |

1 |

2.20 |

0.14 |

29 |

|

|

35 |

36 |

1 |

0.63 |

0.22 |

26 |

||

|

45 |

46 |

1 |

1.15 |

0.18 |

26 |

||

|

54 |

55 |

1 |

0.83 |

0.17 |

14 |

||

|

101 |

102 |

1 |

0.15 |

1.43 |

289 |

||

|

SE Extension |

SJD-134-25 |

13 |

14 |

1 |

0.16 |

2.56 |

30 |

|

NW Extension |

SJD-135-25 |

NSR |

|||||

|

Deposit Deeps |

SJD-136-25 |

53 |

54 |

1 |

0.21 |

— |

76 |

|

74 |

75 |

1 |

0.28 |

— |

530 |

||

|

164 |

165 |

1 |

0.14 |

0.17 |

10 |

||

|

167 |

168 |

1 |

0.22 |

0.25 |

4 |

||

|

173 |

174 |

1 |

0.11 |

0.07 |

53 |

||

|

246 |

255 |

9 |

0.12 |

0.07 |

66 |

||

|

including |

253 |

254 |

1 |

0.52 |

0.15 |

56 |

|

|

271 |

273 |

2 |

0.17 |

0.15 |

24 |

||

|

292 |

295 |

3 |

0.36 |

0.60 |

196 |

||

|

306 |

307 |

1 |

0.13 |

0.29 |

682 |

||

|

323 |

324 |

1 |

0.15 |

9.63 |

3,466 |

||

|

328 |

329 |

1 |

0.12 |

0.29 |

292 |

||

|

342 |

343 |

1 |

0.14 |

0.15 |

15 |

||

|

344 |

345 |

1 |

0.12 |

0.29 |

6 |

||

|

346 |

347 |

1 |

0.14 |

0.15 |

7 |

||

|

377 |

379 |

2 |

0.45 |

0.16 |

139 |

||

|

including |

377 |

378 |

1 |

0.81 |

0.22 |

83 |

|

|

390 |

412 |

22 |

0.36 |

0.21 |

36 |

||

|

including |

394 |

397 |

3 |

0.99 |

0.24 |

2 |

|

|

422 |

495 |

73 |

0.54 |

0.18 |

57 |

||

|

including |

425 |

444 |

19 |

1.00 |

0.22 |

1 |

|

|

including |

435 |

436 |

1 |

4.11 |

0.29 |

1 |

|

|

and |

454 |

455 |

1 |

2.26 |

0.13 |

1 |

|

|

and |

481 |

482 |

1 |

4.96 |

0.35 |

9 |

|

|

and |

492 |

493 |

1 |

0.22 |

0.57 |

2,330 |

|

|

NW Extension |

SJD-137-25 |

203 |

204 |

1 |

0.44 |

0.17 |

11 |

|

248 |

249 |

1 |

0.13 |

0.10 |

30 |

||

|

Deposit Deeps |

SJD-138-25 |

4 |

6 |

2 |

0.12 |

5.23 |

52 |

|

74 |

75 |

1 |

0.12 |

0.08 |

2 |

||

|

87 |

91 |

4 |

0.36 |

0.09 |

28 |

||

|

including |

88 |

89 |

1 |

0.97 |

0.17 |

32 |

|

|

103 |

107 |

4 |

0.80 |

0.35 |

222 |

||

|

120 |

121 |

1 |

0.15 |

0.06 |

14 |

||

|

132 |

137 |

5 |

0.17 |

0.17 |

179 |

||

|

including |

136 |

137 |

1 |

0.51 |

0.42 |

666 |

|

|

150 |

151 |

1 |

0.64 |

0.45 |

31 |

||

|

158 |

163 |

5 |

0.14 |

0.51 |

637 |

||

|

172 |

176 |

4 |

0.41 |

0.34 |

15 |

||

|

including |

175 |

176 |

1 |

1.25 |

0.51 |

13 |

|

|

240 |

241 |

1 |

0.16 |

0.07 |

27 |

||

|

251 |

252 |

1 |

0.38 |

0.25 |

240 |

||

|

264 |

265 |

1 |

0.13 |

0.28 |

5 |

||

|

268 |

269 |

1 |

0.27 |

0.20 |

6 |

||

|

278 |

282 |

4 |

0.16 |

0.23 |

2 |

||

|

304 |

305 |

1 |

0.10 |

0.26 |

103 |

||

|

306 |

307 |

1 |

0.12 |

0.23 |

305 |

||

|

390 |

392 |

2 |

0.23 |

0.30 |

4 |

||

|

411 |

412 |

1 |

0.18 |

0.12 |

7 |

||

|

420 |

422 |

2 |

0.19 |

0.12 |

14 |

||

|

437 |

443 |

6 |

0.19 |

0.15 |

9 |

||

|

including |

439 |

440 |

1 |

0.43 |

0.06 |

2 |

|

|

Notes: NSR: ‘No Significant Result’. True width of mineralization is estimated to be approximately two-thirds of downhole length, assuming primarily steeply dipping vein-hosted mineralization intersected by inclined (-60° dip) drill holes. Assays >1 g/t Au in bold; drill holes highlighted in this release are shaded.

|

Table 2 São Jorge 2025 DDH drill hole collar location coordinates (as of January 26, 2026).

|

Hole Number |

Easting |

Northing |

Elevation |

Dip |

Azimuth |

Depth (m) |

Status |

|

SJD-125-25 |

658134 |

9282526 |

211.43 |

60 |

180 |

399.63 |

Reached Target Depth |

|

SJD-126-25 |

656604 |

9284453 |

213.87 |

50 |

360 |

65.93 |

Hole failed – Collapsing |

|

SJD-126B-25 |

656605 |

9284456 |

213.85 |

50 |

360 |

167.67 |

Reached Target Depth |

|

SJD-127-25 |

658161 |

9282596 |

216.74 |

60 |

180 |

220.66 |

Reached Target Depth |

|

SJD-128-25 |

656601 |

9284550 |

211.60 |

50 |

360 |

201.23 |

Reached Target Depth |

|

SJD-129-25 |

658116 |

9282427 |

210.84 |

60 |

180 |

364.49 |

Reached Target Depth |

|

SJD-130-25 |

656584 |

9284596 |

210.50 |

50 |

010 |

201.05 |

Reached Target Depth |

|

SJD-131-25 |

656793 |

9284403 |

213.45 |

50 |

360 |

200.22 |

Reached Target Depth |

|

SJD-132-25 |

658352 |

9282153 |

226.46 |

60 |

360 |

204.29 |

Reached Target Depth |

|

SJD-133-25 |

655904 |

9283712 |

216.72 |

50 |

360 |

200.13 |

Reached Target Depth |

|

SJD-134-25 |

658345 |

9282247 |

221.63 |

60 |

360 |

201.69 |

Reached Target Depth |

|

SJD-135-25 |

656053 |

9283657 |

222.89 |

50 |

360 |

200.57 |

Reached Target Depth |

|

SJD-136-25 |

657128 |

9282624 |

255.31 |

60 |

360 |

511.79 |

Reached Target Depth |

|

SJD-137-25 |

655911 |

9283578 |

227.63 |

50 |

360 |

270.29 |

Reached Target Depth |

|

SJD-138-25 |

657365 |

9282632 |

226.90 |

70 |

360 |

449.81 |

Reached Target Depth |

Data Verification

For drill core sampling, samples were taken from the NQ/HQ core by sawing the drill core in half, with one-half sent to SGS Geosol Laboratórios Ltda. in Brazil for assaying, and the other half of the core retained at the site for future reference. Sample lengths downhole were uniformly 1.0 m. For the auger drilling program, samples were collected at 1 m sample intervals, with the material being dried, homogenized and split in the field to obtain a 1 kg representative sample which was sent to SGS for analysis. The remaining auger sample material is stored until the lab results are received, and a 1 kg sample duplicate is maintained in the archive. For the RC drilling program, samples were collected at 1 m sample intervals, generating approximately 25 kg samples, with the material being dried, homogenized and split in the field to obtain a 1 kg representative sample which was sent to SGS for analysis. The remaining RC sample material is stored until the lab results are received, and approximately 20 kg of the original samples are maintained in the archive.

SGS is a certified commercial laboratory located in Vespasiano, Minas Gerais, Brazil, and is independent of GoldMining. GoldMining has implemented a quality assurance and quality control program for the sampling and analysis of drill core and auger samples, including duplicates, mineralized standards and blank samples for each batch of 100 samples. The gold analyses are completed by FAA505 method (fire-assay with an atomic absorption finish on 50 grams of material).

About GoldMining Inc.

GoldMining Inc. is a public mineral exploration company focused on acquiring and developing gold assets in the Americas. Through its disciplined acquisition strategy, GoldMining now controls a diversified portfolio of resource-stage gold and gold-copper projects in Canada, the U.S.A., Brazil, Colombia, and Peru. The Company also owns approximately 21.5 million shares of Gold Royalty Corp. (NYSE American: GROY), 9.9 million shares of U.S. GoldMining Inc. (Nasdaq: USGO) and 19.1 million shares of NevGold Corp. (TSXV: NAU). See www.goldmining.com for additional information.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE