GOLDEN SHIELD DRILLS 13.40M GRADING 12.24 G/T GOLD AND ANOTHER 13.40M GRADING 2.54 G/T GOLD FURTHER EXTENDING MINERALIZATION AT MAZOA HILL

Golden Shield Resources Inc. (CSE: GSRI) (FRA: 4LE0) (OTCQB: GSRFF) is pleased to announce assay results from three holes from the Company’s ongoing Phase III drill program at its 100% owned flagship, 5,457-hectare Marudi Mountain gold project located southwestern Guyana. The Phase III drill program comprises approximately 3,000m, with six holes designed to test the southern and depth extension of the Mazoa Hill Deposit and five drill holes dedicated to testing the July and Throne targets, as discussed in the Company’s news release dated September 13, 2022.

HIGHLIGHTS

- 13.40 m grading 12.24 g/t gold, 4.3 m grading 8.68 g/t gold and another 13.40 metres grading 2.54 g/t gold including 6.0 grading 4.93 g/t gold confirm continuation of high-grade mineralization at depth at Mazoa Hill

- 19.6 m at 1.06 g/t Au encountered in new, upper lens of mineralized host Quartz-Metachert Unit (QMC)

- The intersections in all three holes are outside the currently defined resource at Mazoa Hill and both zones remain open along strike and down-plunge. Results are awaited for three further holes on a further step out section to the SE with host rock QMC identified in all.

- Drilling commenced on the Throne and July Targets with holes targeting anomalous gold values and prospective lithologies identified from surface sampling and trenching programmes.

Hilbert Shields, CEO of Golden Shield commented: “The results of these first three holes at Mazoa Hill continues the extension of the known mineralized zone and finding new lenses of additional mineralization is always a welcome surprise. We eagerly await results from the remaining three holes drilled at Mazoa Hill, and the ongoing initial test drilling of the Throne and July Prospects. Furthermore, we look forward to the outcome of the IP Survey and the comprehensive integration of the multiple layers of historical geological, as well as new data, being gathered by contractors currently on site.”

MAZOA DRILL RESULTS

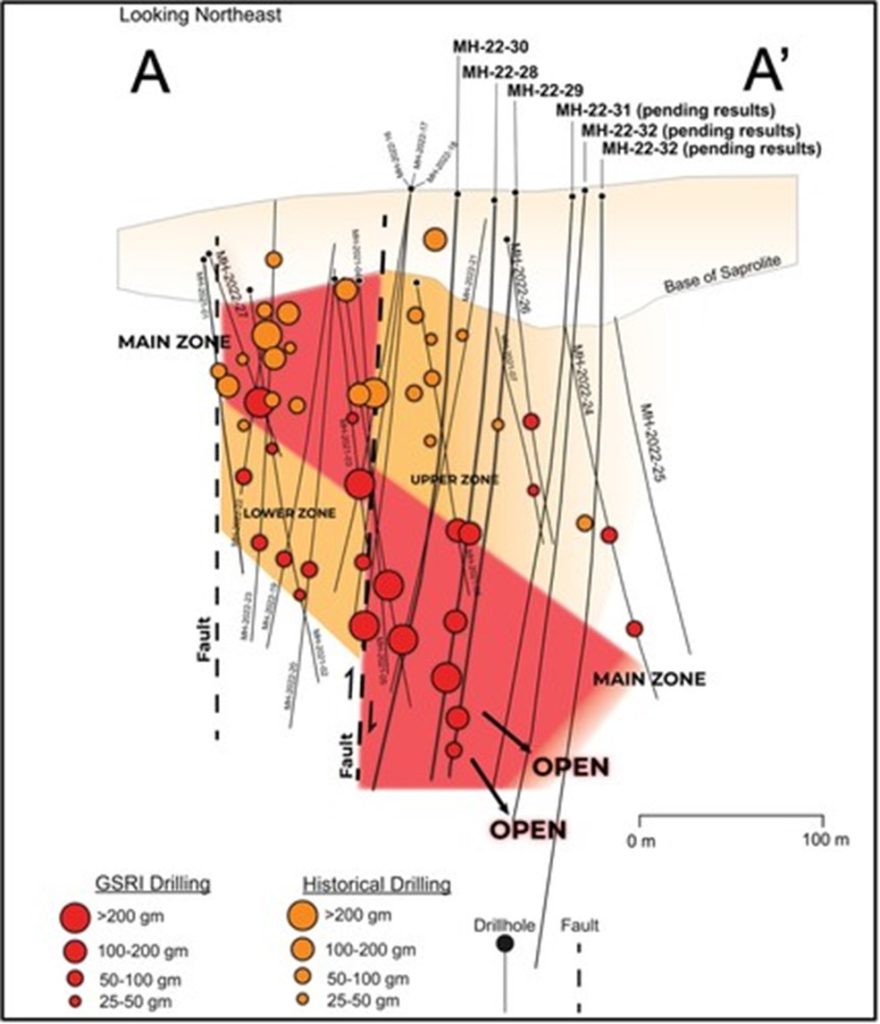

The six recently completed diamond drill holes at Mazoa Hill targeted strike and down-plunge extensions of a high-grade zone or “shoot” identified by Golden Shield’s Phase I and II drilling. Historical drilling did not recognize the strike or vertical extent of this shoot. The high-grade shoot is hosted in a broader envelope of “quartzite-metachert” (QMC) which is interpreted as a strongly silicified shear zone along the contact between amphibolite schist and mica schist.

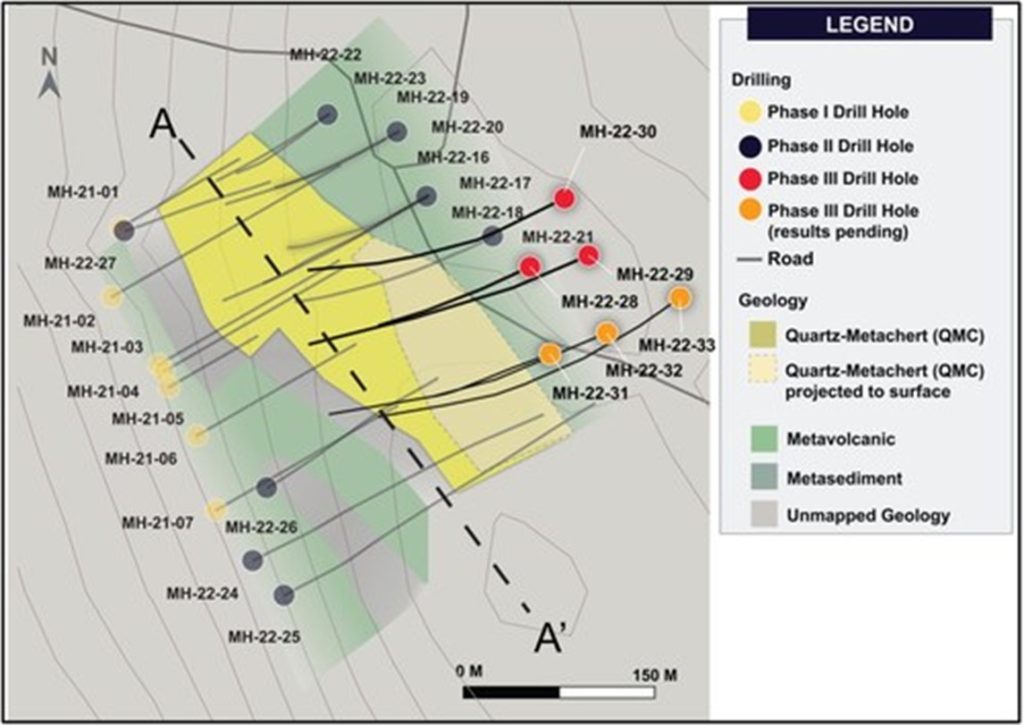

Drill holes MH-22-28, MH-22-29 are approximately 50m apart on section and were drilled to test the down-plunge extension of the high-grade shoot at Mazoa Hill. The two holes stepped out 50m to the southeast of hole MH22-21 which intersected 31m grading 7.58 g/t gold (see the Company’s news release dated May 31, 2022).

Hole MH-22-28 intersected three zones:

- 13.40m grading 12.24 g/t gold from 285.00m at the lower contact of the QMC unit.

- 3.00m grading 4.23 g/t gold from 259.80m also at the lower contact of the QMC unit and,

- 19.60m grading 1.06 g/t gold from 194.00m in a newly identified zone above the main QMC unit

Hole MH-22-29 intersected three zones within the main QMC unit:

- 9.00m grading 2.01 g/t gold from 194.00m at the upper QMC contact.

- 13.40m grading 2.54 g/t gold from 315.70m including 6.00m grading 4.93 g/t gold from 315.70m.

- 4.30m grading 8.68 g/t gold from 337.40m at the lower contact of the QMC unit

All intercepted zones remain open at depth and along strike, to the southeast.

MH-22-30 was designed to test the depth extension of mineralization approximately 50 meters vertically below hole MH-22-21, in the central part of the deposit. The hole intersected approximately 50 meters of QMC host lithology, but did not return significant grades from this area, perhaps suggesting a base to, or fault offset, to the high-grade zone, closing off the mineralized lens at depth on this section.

The Mazoa Zone intersected by Holes MH-22-28 and MH-22-29 remain open to depth and along strike to the south and will be a focus of our next drill campaign.

Table 1. Drillhole Intersections.

| Hole / Depth | Azimuth and Inclination |

Interval | From | To | Width | Au (g/t) |

| MH-22-28 /

351m |

240 /-60 | 1 | 194.00 | 213.60 | 19.60 | 1.06 |

| Including | 207.40 | 213.50 | 6.10 | 2.89 | ||

| 2 | 259.80 | 262.80 | 3.00 | 4.23 | ||

| 3 | 285.00 | 298.40 | 13.40 | 12.24 | ||

| MH-22-29/

354m |

240 /-60 | 1 | 259.40 | 260.50 | 1.10 | 2.03 |

| 2 | 284.70 | 293.70 | 9.00 | 2.01 | ||

| 3 | 315.70 | 321.10 | 13.40 | 2.54 | ||

| Including | 315.70 | 321.70 | 6.00 | 4.93 | ||

| 4 | 327.60 | 329.10 | 1.50 | 2.65 | ||

| 5 | 337.40 | 341.70 | 4.30 | 8.68 | ||

| MH-22-30/

348m |

240 /-60 | 1 | 79.75 | 86.25 | 6.50 | 1.30 |

| Including | 79.75 | 81.25 | 1.50 | 4.08 | ||

| *Lengths are drill indicated core length, as insufficient drilling has been undertaken to determine true widths at this time. The highest assay used for weighted average grade is 50.90/t gold and top-cutting is not deemed to be necessary. Average widths are calculated using a 0.50 g/t gold cut-off grade with < 4 m of internal dilution below cut-off grade. Sample lengths are 1m unless reduced below this to respect geological contact. | ||||||

NEXT STEPS – MAZOA HILL TREND AND PROPERTY-WIDE EXPLORATION

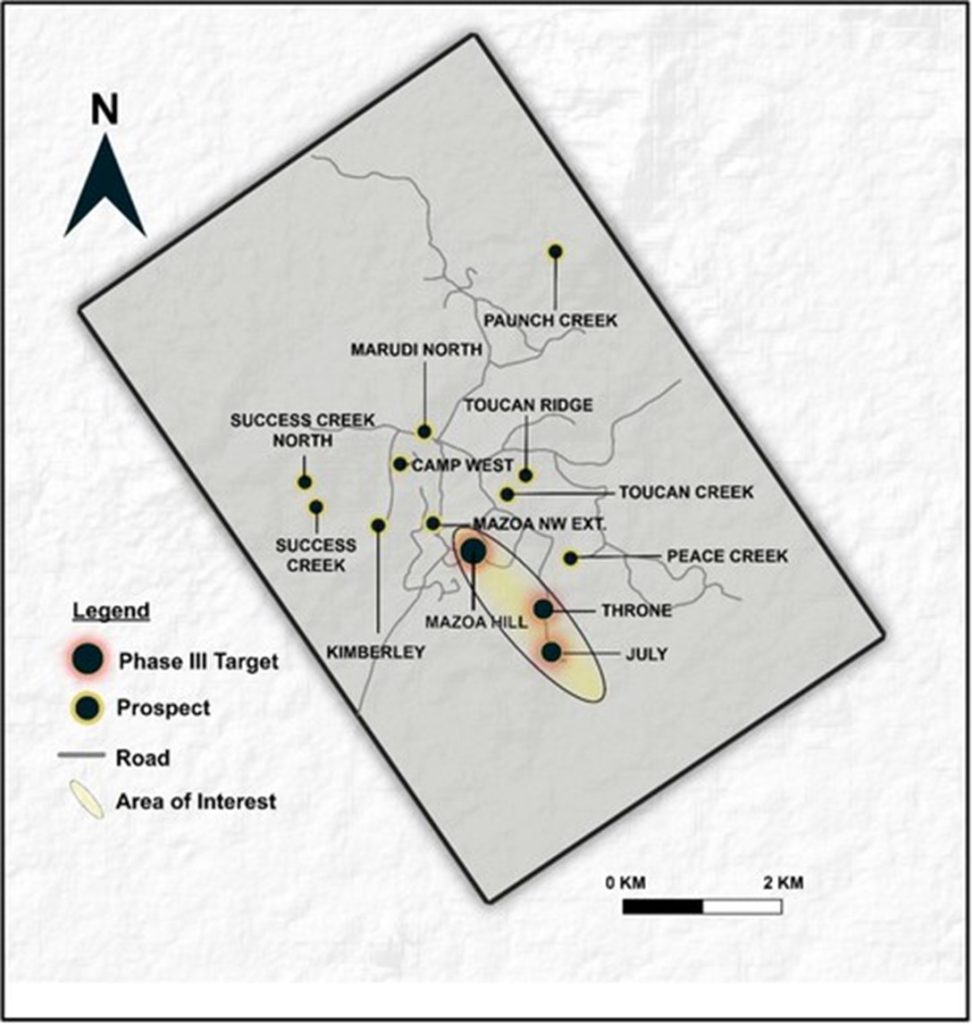

With results from the first three of six holes at Mazoa Hill now complete, assays from three remaining holes drilled at Mazoa Hill, MH-22-31, MH-22-32 and MH-22-33 remain to be received. Drilling is currently focused on July and Throne Prospects (see the Company’s news release dated September 13, 2022). Both the July and Throne prospects display the same QMC host-rock that hosts gold mineralization at Mazoa Hill and occur along strike to the south of the Mazoa Hill deposit, forming a 1.8 kilometre long trend (see Figure 1).

Property exploration is ongoing at the Marudi Mountain property. Auger sampling work that has been ongoing for months, in, addition to Induced Polarization (IP) Survey is being implemented across approximately 25 square kilometres covering the Mazoa-Throne-July trend. Furthermore, Specialized Geological Mapping has been contracted to assist with geological modelling and generation of additional drill targets with a geologist on site for most of November.

DTC ELIGIBILITY

The Company has also received The Depository Trust Company full-service eligibility in the United States, making the Company’s stock more accessible to U.S. retail and institutional investors.

The DTC is the largest securities depository in the world and facilitates electronic settlement of stock certificate transfers in the United States. The shares of the Company, trading under the symbol “GSRFF” in the United States, are now eligible to be electronically cleared and settled through the DTC and are therefore considered “DTC eligible”. This electronic method of clearing securities offers a more efficient, lower-cost settlement process for investors and brokers.

Quality Assurance

All Golden Shield sample assay results have been independently monitored through a quality control / quality assurance protocol which includes the insertion of blind standards, blanks as well as pulp and reject duplicate samples. Logging and sampling are completed at Golden Shield’s core handling facility located at the Marudi property. Drill core is diamond sawn on site and half drill-core samples are securely transported to Actlabs Guyana Inc (“Actlabs”) sample preparation and analysis facility in Georgetown, Guyana. Samples are crushed and pulverised and a 50 gram charge is analysed by Fire Assay with gravimetric finish. Golden Shield is not aware of any drilling, sampling, recovery or other factors that could materially affect the accuracy or reliability of the data referred to herein. ACTLABS Laboratories is independent of Golden Shield.

Qualified Person

Leo Hathaway, P. Geo, Executive Chair of Golden Shield, anxd a Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed, verified, and approved the scientific and technical information in this news release and has verified the data underlying that scientific and technical information.

About Golden Shield

Golden Shield Resources was founded by experienced professionals who are convinced that there are many more gold mines yet to be found in Guyana. The Company is well-financed and has three wholly controlled gold projects: Marudi Mountain, Arakaka and Fish Creek. Golden Shield continues to evaluate other gold opportunities in Guyana.

Figure 1. Overview of the Marudi Mountain Property showing location of the Mazoa Hill Deposit and additional prospects. The area of focus for Phase III drilling is highlighted. (CNW Group/Golden Shield Resources)

Figure 2. Drill locations of 2021 (Phase I) and 2022 (Phase II + Phase III) drilling. (CNW Group/Golden Shield Resources)

Figure 3. Vertical Long Section of the Mazoa Hill Deposit located at A-A’ on Figure 2., showing downdip extension of mineralization in Holes MH-22-28 and MH-22-29. Circles plot mid-point drill intercepts, and circle size corresponds to gold grade (g/t) x length of drill intercept (m). (CNW Group/Golden Shield Resources)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE