GOLD ROYALTY TO ACQUIRE PRODUCING PEDRA BRANCA GOLD AND COPPER ROYALTY

Gold Royalty Corp. (NYSE: GROY) is pleased to announce that it has entered into an agreement to acquire an existing royalty on the Pedra Branca mine, from BlackRock World Mining Trust plc for $70 million in cash. Pedra Branca is an operating copper and gold mine located in Brazil and currently owned and operated by a subsidiary of BHP Group Limited. In August 2025, BHP announced the sale of the Pedra Branca mine and other assets in the Carajás region to CoreX Holding BV, which is expected to complete upon the satisfaction of customary closing conditions. All amounts are expressed in U.S. dollars unless otherwise noted.

David Garofalo, Chairman and CEO of Gold Royalty, commented: “We are pleased to announce another significant addition to our portfolio. The acquisition of the Pedra Branca royalty represents an immediate and material addition to our cash flows. On completion, our portfolio of high-quality assets will include eight cash flowing assets and a deep pipeline of over 250 royalty and streaming interests.”

Transaction Highlights:

- Materially accretive to Gold Royalty cash flows: For the 12 months ended June 30, 2025, the Royalty expense recorded to the prior royalty holder was approximately $7.9 million, equivalent to approximately 2,800 gold equivalent ounces* at an average gold price of $2,811 per ounce. The Royalty is expected to add significant and meaningful cash flow to Gold Royalty after completion of the acquisition, including as a result of the current gold pricing climate.

- Enhances leverage to gold and copper: The Royalty’s terms include a 25% net smelter return royalty on gold and 2% NSR on copper produced from Pedra Branca. This further enhances Gold Royalty’s already strong gold exposure from both a revenue and asset value perspective. Gold Royalty believes the enhanced copper exposure is timely, given the currently strong long-term fundamentals for the metal based on demand projections to support the coming global transition to renewable energy.

- Attractive royalty structure: The Royalty has full coverage over the Pedra Branca East and Pedra Branca West deposits. The Royalty does not include any step-down options so it provides full exposure to longer term optionality of the asset.

- Exposure to top quality asset: The Pedra Branca East underground copper and gold mine achieved first production in 2020 and had an approximate 800 ktpa mining rate operated by OZ Minerals. BHP acquired Pedra Branca when it acquired OZ Minerals in 2023 and has continued to extend the mine life and reported increases in Pedra Branca’s Mineral Resources and Ore Reserves, as reported in the BHP Annual Report for the year ended June 2025.

- World-class operators: The mine was constructed by OZ Minerals and is currently operated by BHP. On August 18, 2025, BHP announced that a wholly-owned subsidiary of CoreX Holding BV had agreed to acquire Pedra Branca, along with BHP’s other Carajás copper assets in Brazil.

- Top-tier jurisdiction: Pedra Branca is located in the Carajás region in Brazil’s Pará state, a prolific mining region which is home to world-class iron ore deposits as well as copper, gold, manganese, copper, tin, and aluminum.

* GEOs is a non-IFRS measures and do not have a standardized meaning under IFRS. See “Non-IFRS Measures” for further information.

The Transaction and Royalty

Pursuant to the transaction, Gold Royalty will acquire the Royalty in exchange for $70 million in cash, payable to Blackrock at closing. The Company has available resources and commitments to fund the purchase price. Completion of the acquisition is subject to customary closing conditions.

Pursuant to the agreement, after closing, Gold Royalty will receive all payments relating to production from the Royalty for periods ending after December 31, 2025.

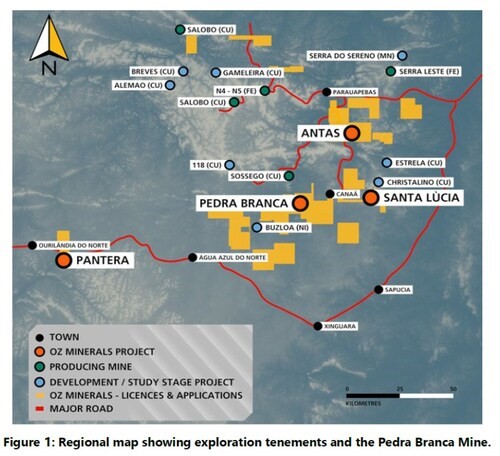

The Royalty consists of a 25% NSR on gold and a 2% NSR on copper and other products produced from the Pedra Branca mine, comprising the Pedra Branca West and Pedra Branca East areas, and the former Antas North mine which has been fully depleted as depicted on the map in Figure 1 below.

Pedra Branca

The Pedra Branca mine is located in Água Azul do Norte, which is approximately 160 km from Marabá and 900 km from Belém in the state of Pará, Brazil. Electricity is supplied to the mine via a 5 MW transmission line. Material is transported from Pedra Branca and is processed at the Antas North Plant, located in the municipality of Curionópolis, Brazil. The plant has been operating and depositing tailings into a nearby exhausted open pit.

The mine consists of an iron oxide copper gold deposit. High-grade zones of semi-massive and breccia mineralization with dominant chalcopyrite as the key copper-bearing mineral.

Pedra Branca was acquired by OZ Minerals in 2018 when OZ Minerals purchased Avanco Resources including its projects in the Carajás Copper Region and the Gurupi Greenstone Belt. OZ Minerals commenced mine construction in 2019; the mine was ramped up to full production in 2022. Subsequently, BHP acquired OZ Minerals in 2023.

In its annual report for the year ended June 30, 2025, BHP disclosed JORC-based estimated measured mineral resources of 2.4 Mt at 1.68% copper and 0.47 g/t gold and indicated mineral resources of 12 Mt at 1.41% copper and 0.40 g/t gold, utilizing a cut-off based on an NSR value of $78.73/t. It also disclosed estimated proven mineral reserves at Pedra Branca of 1.3 Mt at 1.8% copper and 0.48 g/t gold and probable mineral reserves of 2.5 Mt at 1.85% copper and 0.49 g/t gold, utilizing cut-offs based on NSR values of $78.73/t above mining level 810 and $84.20/t below the 810 mining level.

On August 18, 2025, BHP announced that a wholly-owned subsidiary of CoreX Holding BV had agreed to acquire Pedra Branca, along with BHP’s other Carajás copper assets in Brazil. CoreX Holding is a global, highly diversified industrial conglomerate established in 2024. It operates across a wide range of industries including metals and mining, ports and terminals, green energy, shipping and logistics, and other sectors. The company operates in over 55 countries with a workforce exceeding 20,000 employees. CoreX Metals & Mining, the metals and mining subsidiary of CoreX Holding, is one of the world’s largest chromite and ferrochrome producers and also has operations in nickel, copper, and gold.

About Gold Royalty Corp.

Gold Royalty Corp. is a gold-focused royalty company offering creative financing solutions to the metals and mining industry. Its mission is to invest in high-quality, sustainable, and responsible mining operations to build a diversified portfolio of precious metals royalty and streaming interests that generate superior long-term returns for our shareholders. Gold Royalty’s diversified portfolio currently consists primarily of net smelter return royalties on gold properties located in the Americas.

Qualified Person

Alastair Still, P.Geo., Director of Technical Services of the Company, is a “qualified person” as such term is defined under Canadian National Instrument 43-101 (“NI 43-101“) and has reviewed and approved the technical information disclosed in this news release.

Notice to Investors

Except where otherwise stated, the disclosure in this news release relating to the Pedra Branca mine has been derived from BHP’s annual report for the year ended June 30, 2025, a copy of which is available on its website at www.bhp.com, its other disclosures identified herein and other public information disclosed by it. Such information has not been independently verified by the Company. Specifically, Gold Royalty has limited, if any, access to the property subject to the Royalty. Although Gold Royalty does not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate.

Unless otherwise indicated, the technical and scientific disclosure contained or referenced in this news release, including any references to mineral resources or mineral reserves, was prepared by the BHP under the 2012 Edition of the Australasian Code for Reporting of Exploration Results, which differs from the requirements under NI 43-101 and those of the U.S. Securities and Exchange Commission, including under subpart 1300 of Regulation S-K under the Securities Exchange Act of 1934. Accordingly, the scientific and technical information contained or referenced in this news release may not be comparable to similar information prepared by entities under NI 43-101 or SK 1300.

In addition, the disclosure herein includes information regarding resource and reserve estimates and other exploration information prepared and disclosed by BHP, which has been included by the Company pursuant to Item 1304 of SK1300 as such information was prepared and disclosed by BHP prior to the Company’s acquisition of an interest in the Royalty. The Company is not treating such information as a current estimate of mineral resources or mineral reserves under SK1300 and notes that a qualified person of the Company has not done sufficient work to classify the estimate as such under SK1300.

Figure 1: Regional map showing exploration tenements and the Pedra Branca Mine. Source: Pedra Branca Mineral Resource and Ore Reserve Statement and Explanatory Notes as at 30 June 2022, published by OZ Minerals. (CNW Group/Gold Royalty Corp.)

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE