Gianni Kovacevic – “TiempoDeActuar?”

The COP 25 Climate Change Conference is taking place December 3 -10 in Santiago, Chile, … I mean, Madrid, Spain.

My favourite catch-phrase from the cognoscenti that attend these global get-togethers is the all-time classic, “it’s time to act!” UN Secretary-General, Antonio Guterres (pictured above), used it and a greatest hits of one-liners in his opening speech.

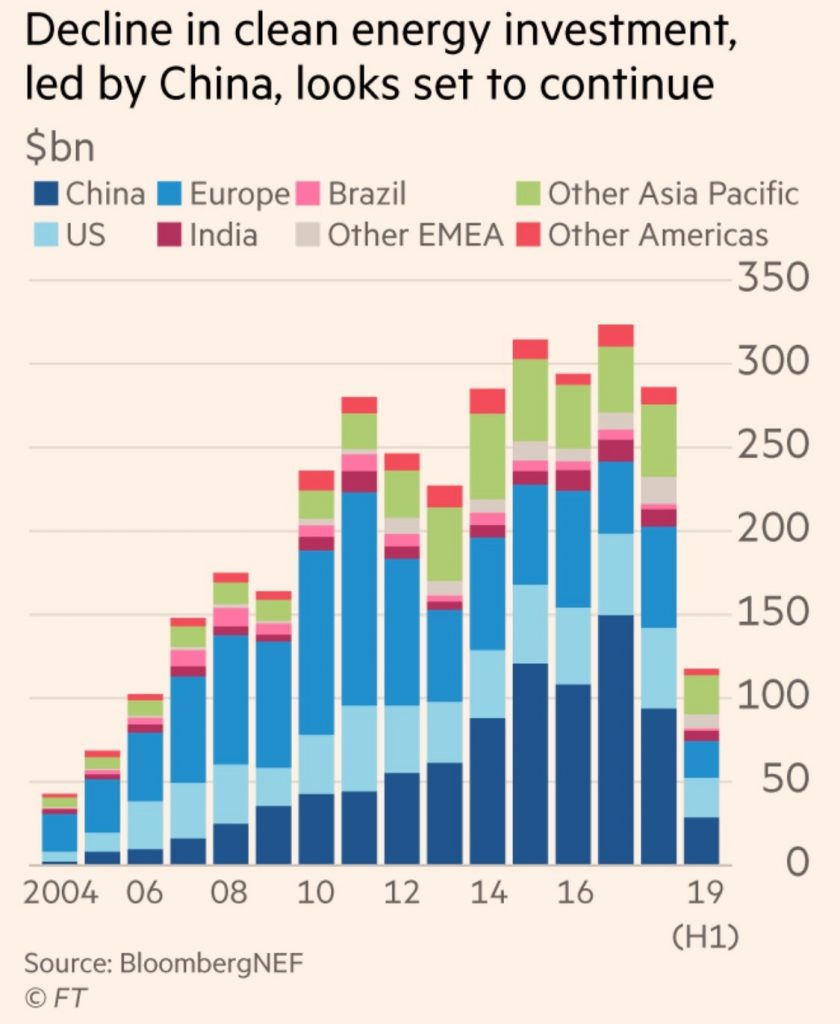

Below, is a telling graphic from a recent article on falling investment for clean energy in 2018 and thus far into 2019. If one seriously follows global energy, one shouldn’t loose too much sleep that this down trend will continue.

Irrespective of politician jibber-jabber, in the coming years, likely before 2025, many energy experts forecast annual investment for all green energy schemes/plans to top $1Trillion! Annually! Obviously, this includes some re-tooling of the global automobile manufacturing system.

Remember Fukushima?

It is becoming a 600 MW wind and solar power hub. In most jurisdictions, nuclear power now costs well in excess of $10 Million /MW to construct. Conventional thermal generation – coal and natural gas – has traditionally been ~$2 Million /MW. What happens when the COP25 crowd starts to tax the living daylights out of stand-alone thermal power, ie. non-peaker power? Ask any Big Power CEO what direction their plans are going… the Davos 2019 battle between Francesco Starace and Vicki Hollub comes to mind.

Meanwhile, many wind and solar mega-projects are being priced around the same figure as conventional thermal power, or LOWER, in the case of solar. What intermittency? Net/net in some cases it now costs less than $4 Million /MW for commercial scale solar even if a natural gas (LNG) power plant is thrown in for back-up.

Mayday, Mayday, What Enables Green Energy Ambitions?

On December 3rd Glencore hosted its annual Investor Day. This is important, not due to the fact it was the same day as COP25 starting, rather, because anyone who knows anything about energy, knows that emission-free energy generation or utilization really means electrification, and electrification is enabled by Copper. The irony of Chile’s missed opportunity to showcase Copper to the world – sigh!

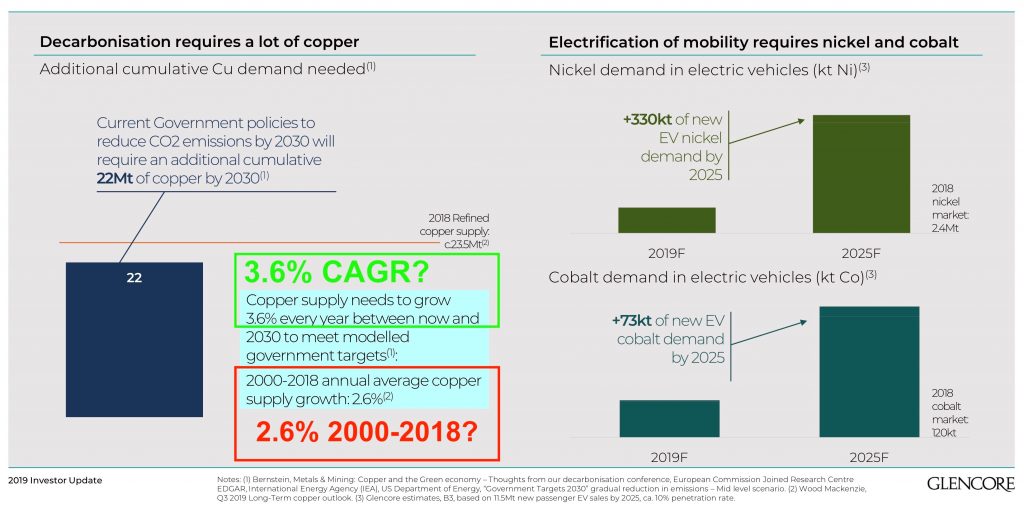

The graphic below is from Ivan Glasenberg’s portion of the Investor Day presentation. Carefully view the small print on the bottom of the page (it’s high rez if you download it) regarding notes and sources.

When all these opinions and forecasts (many from the COP 25 crowd) are consolidated and then reconciled to the impact they will have on Copper demand, it correlates to Copper supply needing to grow by ~3.6% every year between now and 2030 to meet modelled government targets. Good luck! The annual Copper supply growth from 2000 to 2018 during the China Super-Cycle was only 2.6%!

Few Citizens Actually Know Where Copper Comes From.

It truly is a shame that Chile was unable to host the COP 25 gathering due to the recent protests. I have travelled to the World’s #1 producer of Copper numerous times the past few years sharing ideas with my many friends in industry and government alike.

That said, here are a few factoids I am willing to wager few of the glitterati in Madrid are contemplating:

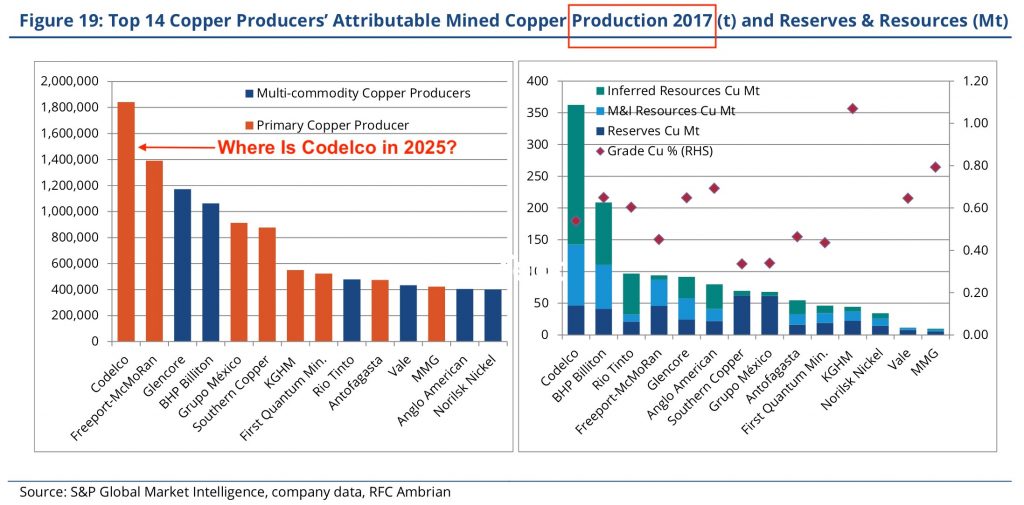

Codelco, Chile’s State owned mining company, is the largest Copper producer in the world. Sadly, it is not likely to remain so. Last week Codelco provided January to September financials and important operational data. In a nutshell, Codelco is cancelling some $8 Billion of funding for capital projects. The industry will the impact of this through the 2020s.

In 2017, Codelco produced 1.8Mts of Copper with previous assumptions anticipating this number could climb over 2.0Mts in the mid-2020s. With the recently announced capital cut-back, this annual production number should/could fall to ~1.35Mts, and, Codelco falling out of number 1 Producer spot. Ed note, it takes 4 to 5 years to build a new Copper mine. For your accelerated review, here is a table of the 14 largest Copper producers in 2017.

Why Should The State Of Copper Miners Be Important To COP25?

Can any of the above mentioned Copper producers achieve the 3.6% CAGR supply growth needed over the next 10 years to make the COP25 dreams feasible? Can any of them do that in the next 2, 3, 4 years?

How many Copper companies can convert resources into reserves at current Copper prices? Almost none. In fact, BHP, the world’s largest integrated miner, suggest the inducement price for new production is ~$3.50 /lb.

Conclusion:

- It will be industry, consumer behaviour and… maybe… governmental pressure that accelerates the pivot to electrification.

2.As the energy pivot begins in earnest – and it is rounding the corner of hyper-adoption in real time – better than average demand growth will occur for Copper.

3. Unless… the price ratio between Copper and Aluminium goes totally out of whack (3 : 1 ???) That said, aluminium is not a substitutable substitute as many think. Surely price does matters, but so does science and the implementation of high amperage, large diameter, extremely flexible, lower man hours to install Copper cable mandatory in AC/DC systems. Oh, and ultra-high efficient electrical products – important in Japan, Germany etc, and less so in Saudi Arabia and Russia – aluminium need not apply for the task at hand.

4. Investors are so worried about demand growth. Don’t be! If CAGR growth does not end up being 3.6%, it still won’t matter because there will inevitably be a lack of supply growth. …unless lower grade resources can be converted into reserves, no where near possible at sub-$4.00 /lb Copper prices.

Happy Investing,

Gianni Kovacevic

MORE or "UNCATEGORIZED"

NEW GOLD COMPLETES US$173 MILLION BOUGHT DEAL FINANCING

New Gold Inc. (TSX: NGD) (NYSE American: NGD) is pleased to annou... READ MORE

SILVER VIPER CLOSES LIFE OFFERING

Silver Viper Minerals Corp. (TSX-V: VIPR) (OTC: VIPRF) announces... READ MORE

MAX Power Closes $1.9 Million Private Placement

MAX Power Mining Corp. (CSE: MAXX) (OTC: MAXXF) (FRANKFURT: 89N) ... READ MORE

McEwen Copper Announces Completion of the Feasibility Drilling Program

70,000 meters completed, highlights include: 349.0 m of 0.77... READ MORE

Rupert Resources Reports Results From Project Drilling Including 120m at 6.2g/t Gold

Rupert Resources Ltd. (TSX:RUP) reports assay results from projec... READ MORE